Q3 2024 Housing Market Update: Minimal Signs of Recovery Despite Declining Mortgage Rates

The housing market continues to exhibit significant weakness, as reflected in the residential component of GDP, which detracted from growth in Q3 2024.

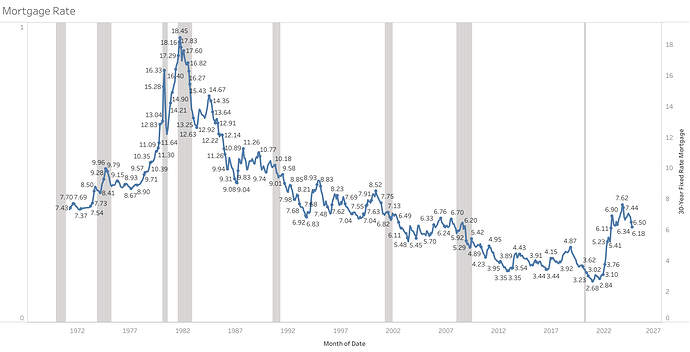

The ‘lock-in effect’—where homeowners hold historically low mortgage rates from the 2010-2019 period—combined with severe affordability challenges, suggests that a meaningful rebound in activity is unlikely until mortgage rates decrease substantially or home prices see a notable correction, or until we see significant fiscal stimulus again.

Given these factors, I still expect the residential sector to remain subdued through the remainder of the year and into 2025

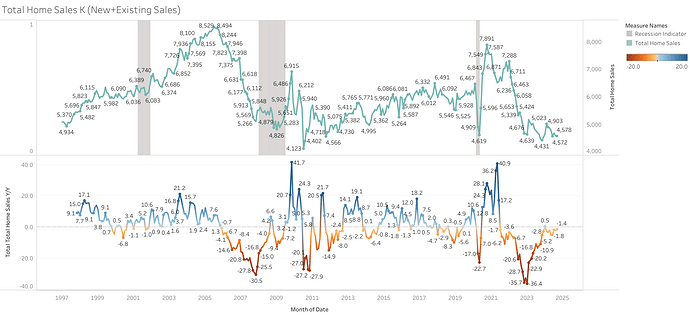

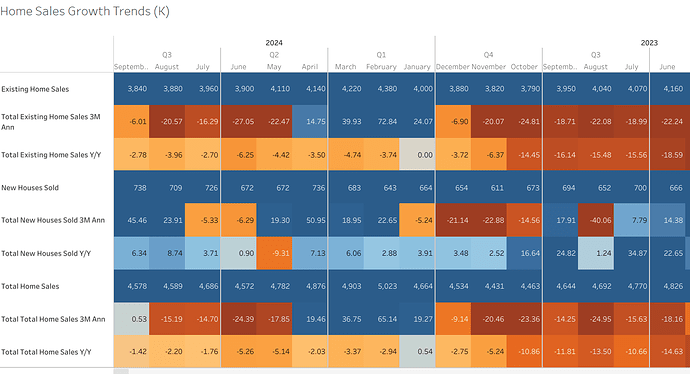

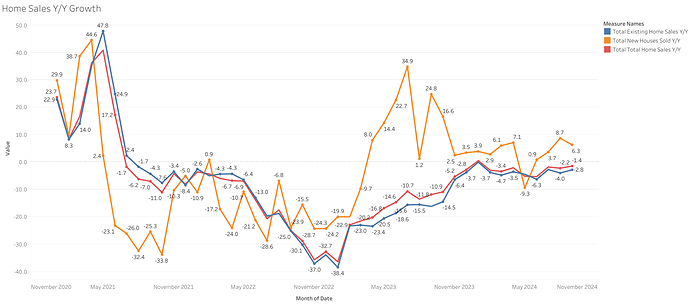

Demand Remains Well Below Historical Levels, but Growth Rates Show Signs of Stabilization at these low levels

- Existing home sales were -2.78% y/y as of September 2024

- New Home sales were 6.34% y/y as of September 2024

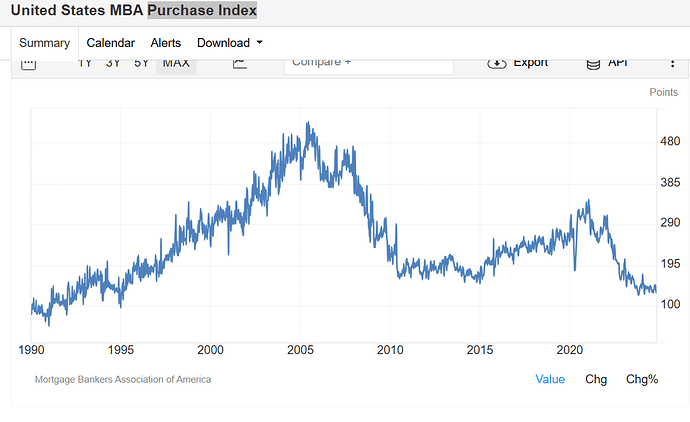

- Mortgage purchase index is still at levels last seen since the 1990s

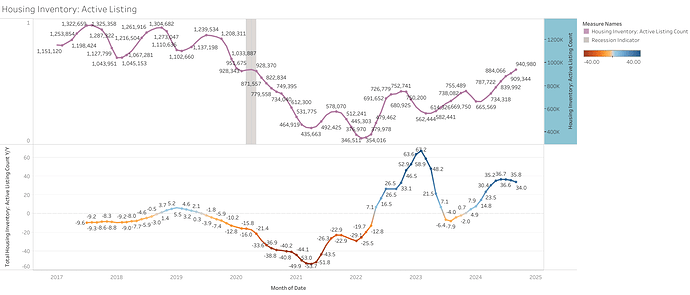

In Contrast, Supply Has Increased in 2024 but Remains Below 2019 Levels

To provide context, a balanced housing market typically has a months’ supply (available inventory divided by monthly sales pace) of around 5-6 months. Currently, existing homes are nearing this balance but remain somewhat undersupplied, though inventory is rising swiftly. In contrast, new homes have already entered an oversupply phase.

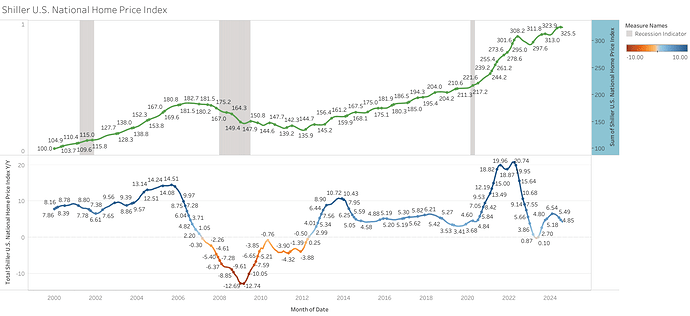

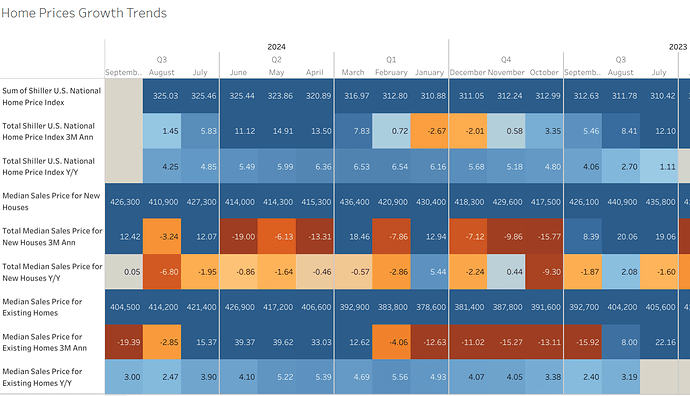

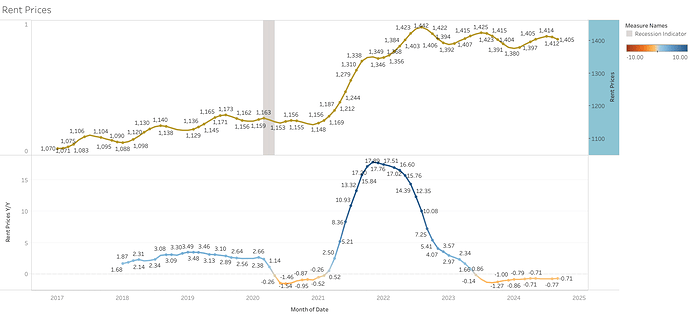

As a result of this demand-supply dynamic, home price growth has been moderating during Q3 2024. Rent prices, meanwhile, remain slightly negative year-over-year, but stable.

- Shiller price index at 4.85% y/y in August, from 5.5% in June 2024

- Median home prices of new homes increased $12300 in Q3 2024, flat y/y.

- Median home prices of existing homes declined $22400 in Q3 2024, still 3% y/y.

- Rent prices are essentially flat during the quarter and annually.

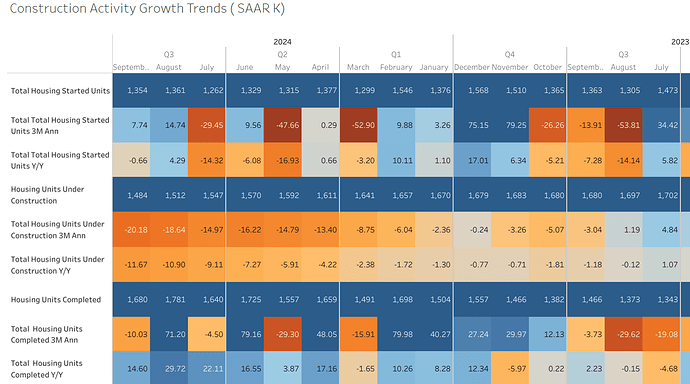

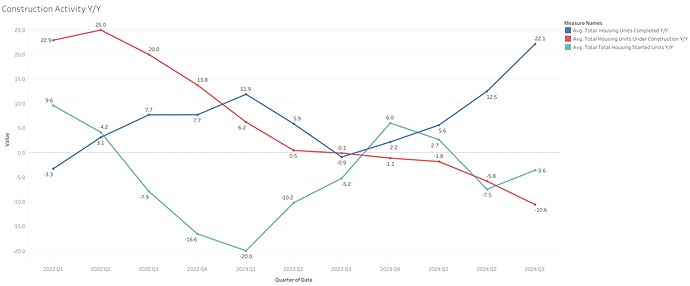

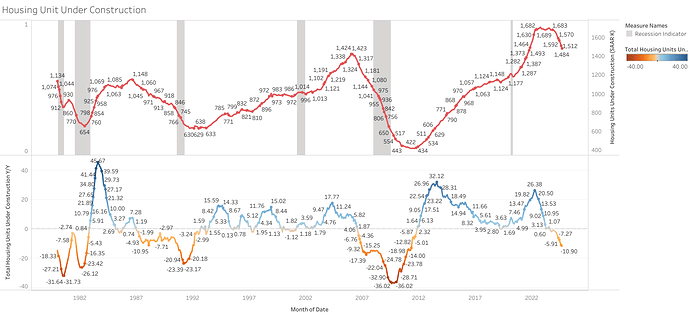

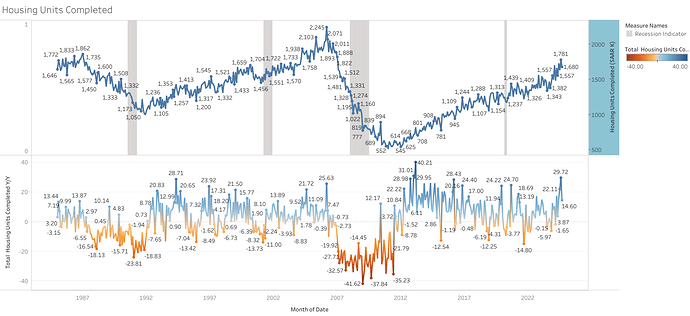

The backlog in the residential construction sector is slowly diminishing, which could place downward pressure on employment in the sector moving forward.

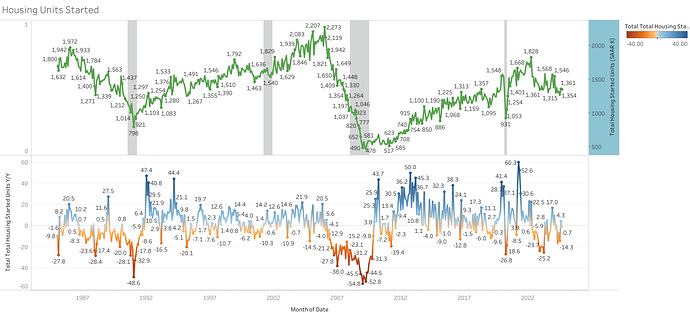

The current pace of housing starts is unable to keep up with the rate of housing completions.

- Housing Units Started at 1,324 Thousand SAAR in Q3 2024 from 1,340 In Q2. It remained negative -4% y/y.

- Housing Units Under Construction at 1,514 Thousand SAAR in Q3 2024 from 1,591 In Q2. It is -10.6% y/y.

- Housing Units Completed at 1,700 Thousand SAAR in Q3 2024 from 1,647 in Q2. It is up a significant 22% y/y.

Mortgage rates saw a substantial decline in Q3 2024 by expectations of rate cuts; however, they have risen again in Q4 2024 as some of those expectations have been adjusted in the market.

Sources:

Tableau

Google Sheets