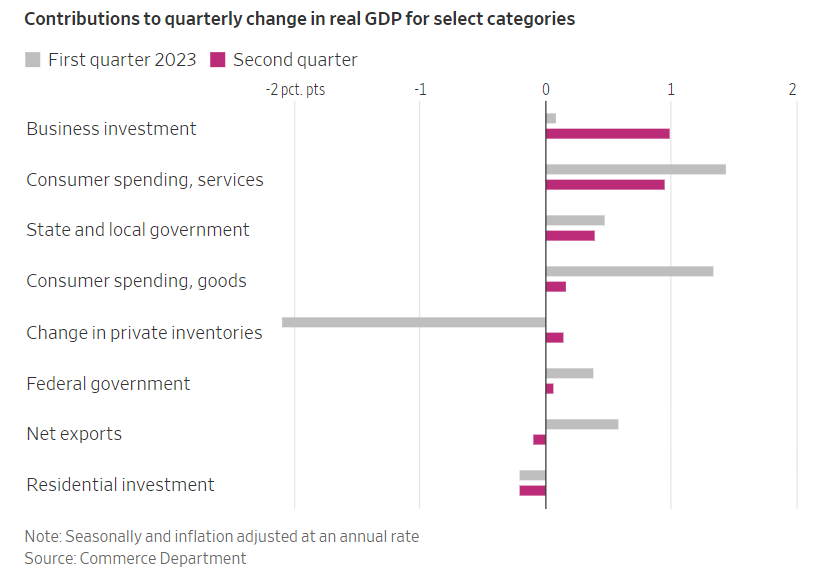

Q2 2023 GDP came better than expected at 2.4%, expectations were at 1.8%. The growth was mainly supported by an increase in business investments and a stabilization in inventory. The question is if this investment can continue to support growth going forward because consumer spending, gov spending, and trade had a clear decline in their growth rate during the quarter.

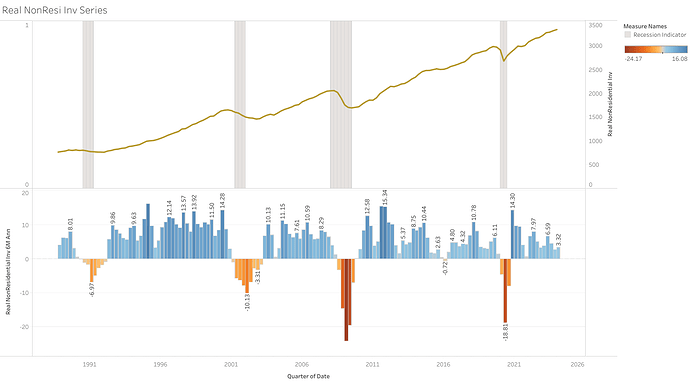

Business spending on equipment bounced back in the second quarter, largely because of investments in aircraft and vehicles as supply-chain snarls unravel. As that process unwinds, equipment and machinery spending will likely weaken again, said Richard F. Moody, chief economist at Regions Financial, in a note.

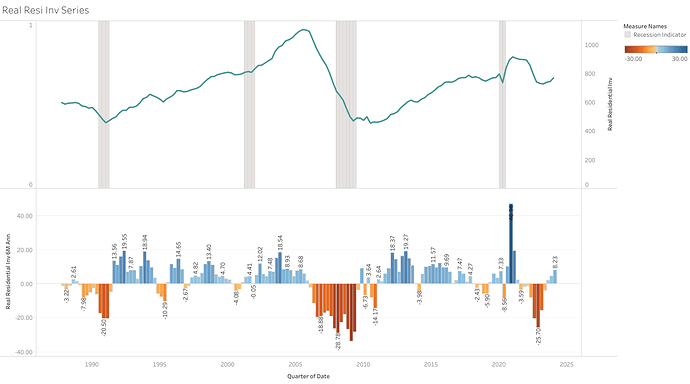

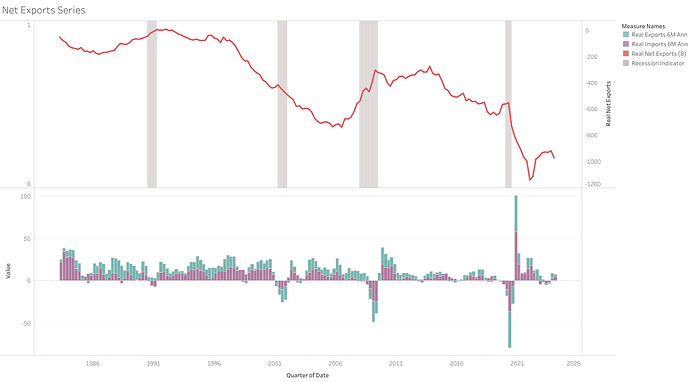

Net trade slightly subtracted from second-quarter growth, reflecting a sluggish global economy. Residential investment declined for the ninth consecutive quarter. Recent declines in residential investment reflect housing-market strains amid higher mortgage rates.

https://www.wsj.com/articles/us-gdp-report-economic-growth-92482437

https://www.bea.gov/sites/default/files/2023-07/gdp2q23_adv.pdf

U.S GDP for Q2 revised down to 2.1% from 2.4%, still above the 2% recorded in Q1 but lower than the 2.4% estimate.

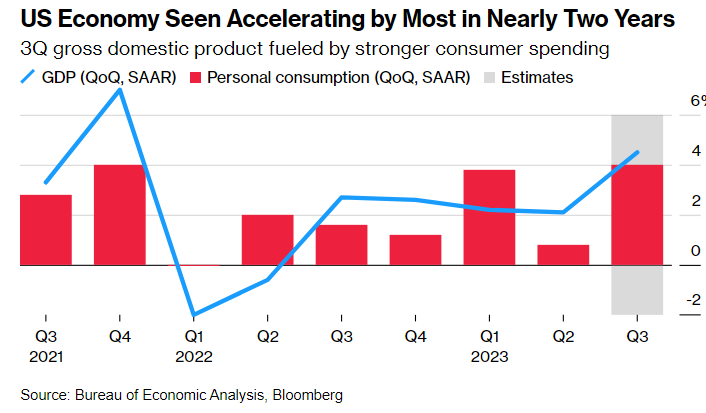

GDP for Q3 is expected to come by 4%+ tomorrow. I don’t think the FED will hike in November even with this hot print, but if persistent could change that opinion that we are at restrictive levels already.

Forecast for Q4 2023 is 0.7%.

Gross domestic product is projected to have grown at an annual rate of 4.5% last quarter, more than double the pace in the prior period, according to a Bloomberg survey of economists ahead of the release of government data on Thursday.

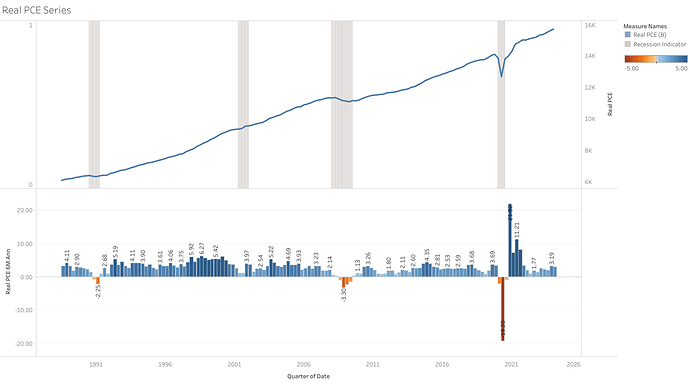

Consumers went on a spending spree from July through September as solid wage gains and ebbing inflation left them with more money to pay for goods and services. A record surge in household wealth coming into this year — courtesy of advances in home and equity prices — probably also played a part in encouraging consumption.

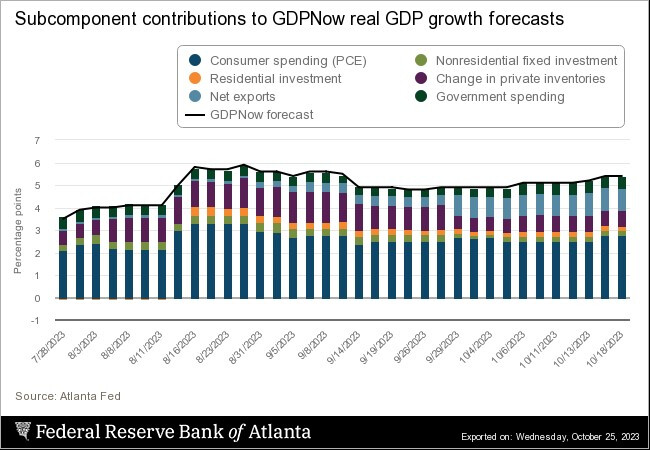

GDPNow from Atlanta FED even has it at 5.4%. With all components contributing positively to the number, but especially spending.

I=8

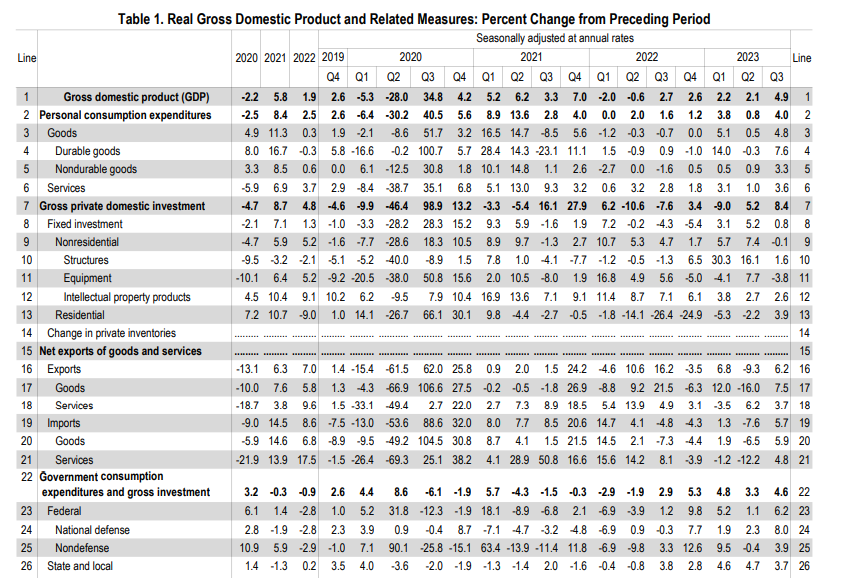

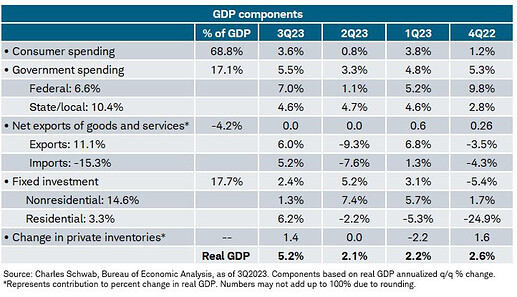

- U.S GDP rose 4.9% in Q3, up from 2.1% in Q2, and beating expectations for a 4.5% increase.

- Personal consumption rose 4%, in-line with estimate and above 0.8% rise in Q2.

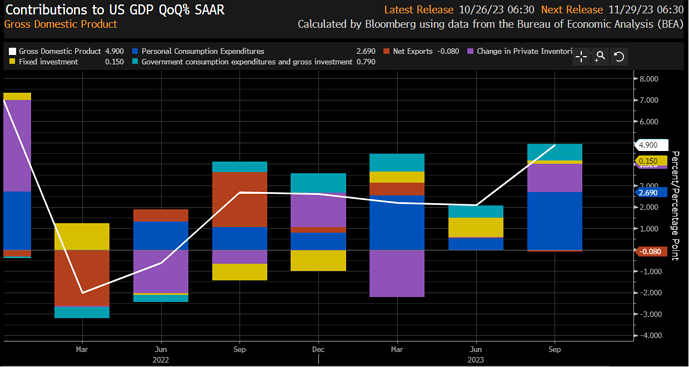

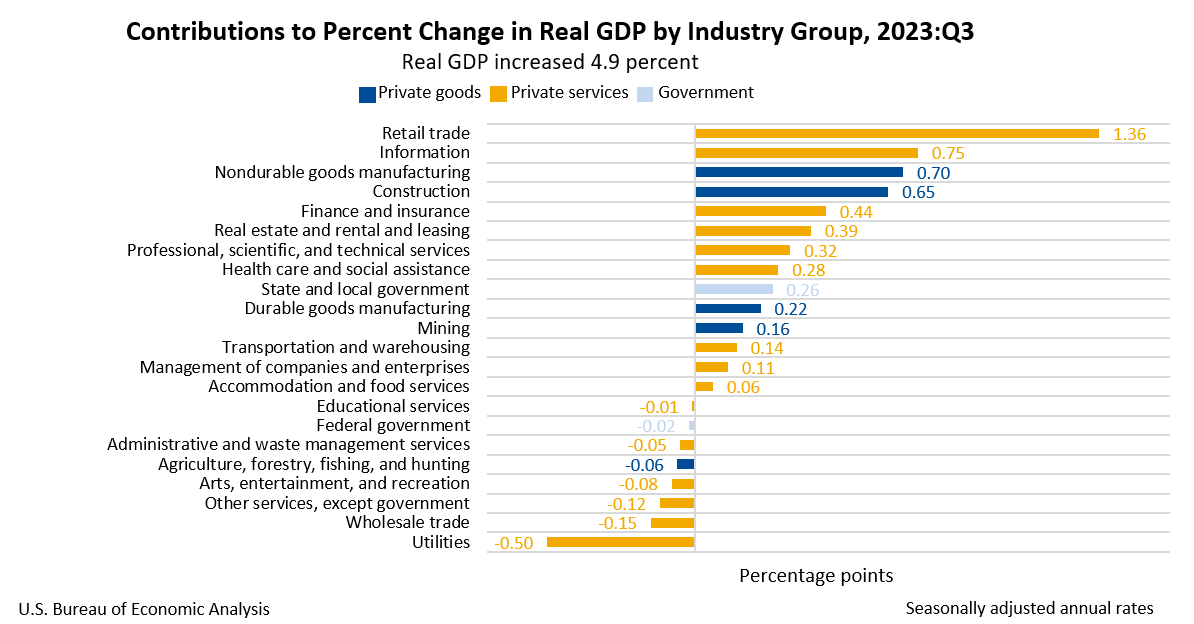

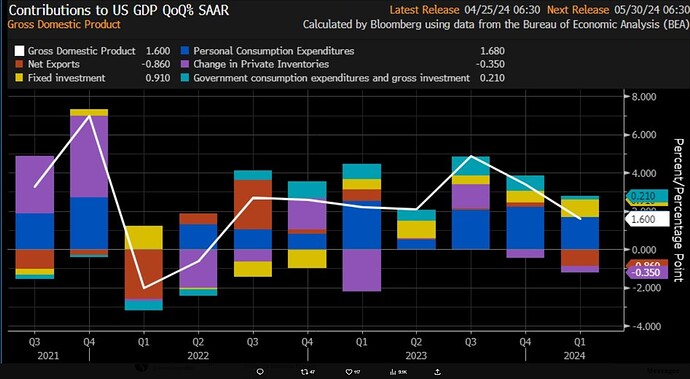

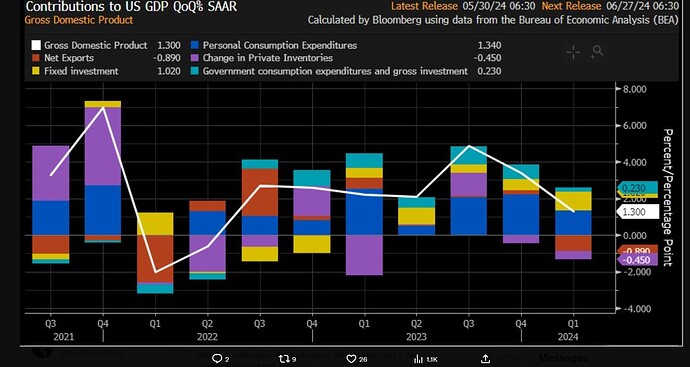

Contributions to GDP.

- Change in inventories was a big contributor, which may not last, as it is very volatile q/q.

- Consumer Spending is still very strong.

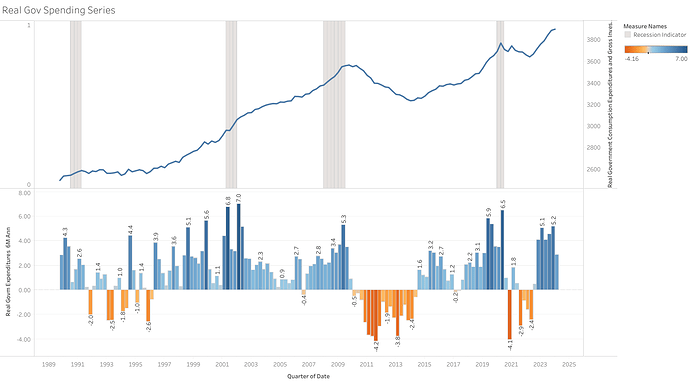

- Government spending is still very significant, difficult to see a big deceleration if this continues.

- While residential investment was positive this quarter, I don’t think it will last that much, since housing data is coming in soft again. And IMO the softness is more likely than not to continue.

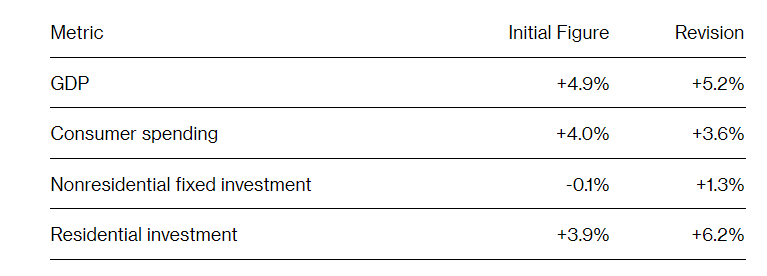

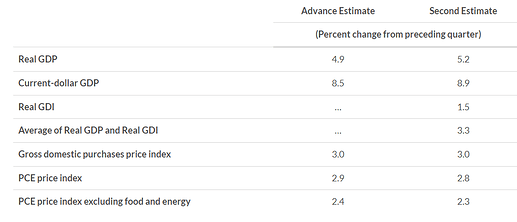

GDP was revised even higher to 5.2% in Q3.

Consumer spending was revised lower, but other components offseted that revision.

The personal consumption expenditures price index was also revised down to a 2.8% annual rate in the third quarter. Excluding food and energy, the gauge was also marked lower to 2.3%.

GDI which is supposedly to be the same as GDP, only rose 1.5%, a significant disconnect between the two currently.

https://www.bloomberg.com/news/articles/2023-11-29/us-economy-grew-5-2-in-third-quarter-more-than-first-estimated

https://twitter.com/LizAnnSonders/status/1729869812426547246/photo/1

I=7

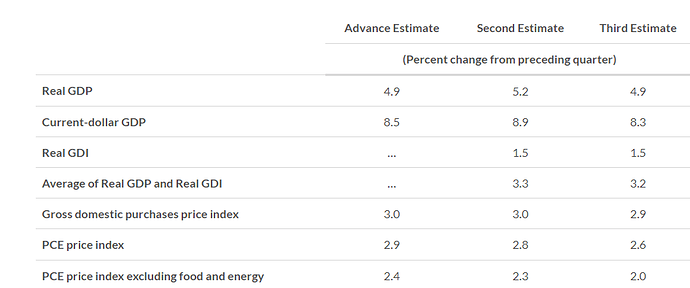

- According to third estimate by the Bureau of Economic Analysis, Q3 GDP grew by 4.9% lower than second estimate of 5.2% and lower than economists’ estimate of 5.1%.

- PCE Price Index was revised down to 2.6% from 2.8% while core PCE was revised down from 2.3% to 2.0%.

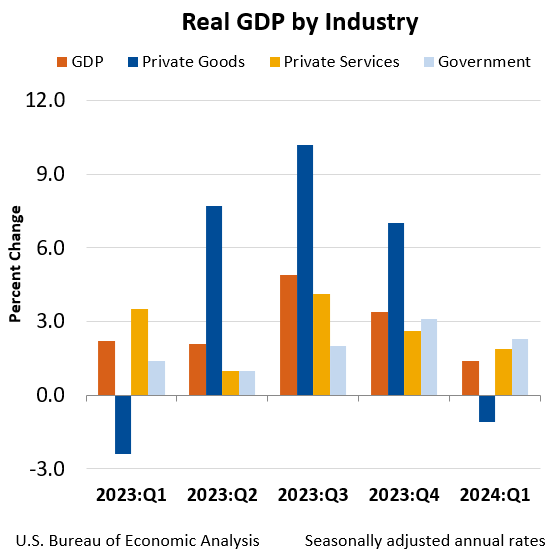

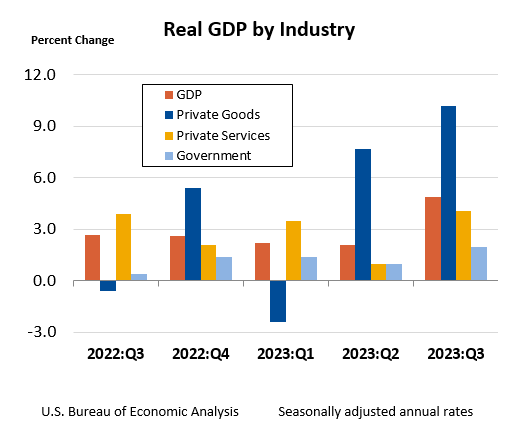

Q3 Real GDP By Industry

https://www.bea.gov/news/2023/gross-domestic-product-third-estimate-corporate-profits-revised-estimate-and-gdp-0

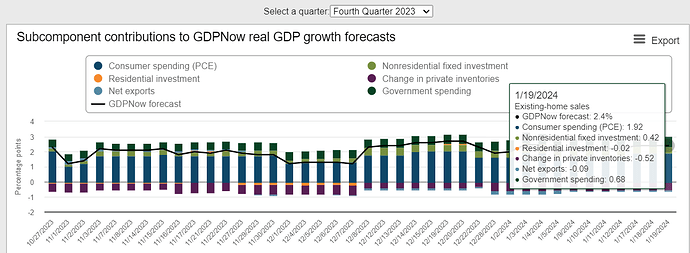

The consensus estimate for Real GDP is 2%. Atlanta GDPNow is forecasting 2.4%.

This is a significant deceleration from Q3 2023, but still healthy growth.

The biggest contributions are expected from consumer spending 0.92%, government spending 0.68% and nonresidential investment 0.42%.

The biggest drag on growth will be inventories.

I=8

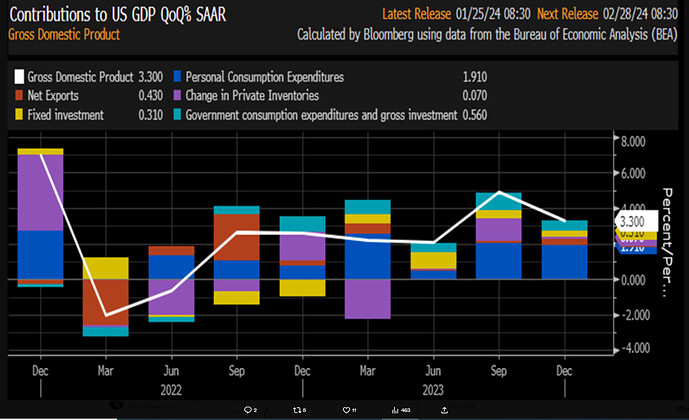

- U.S GDP grew by 3.3% in Q4, down from 4.9% in Q3 and beating estimates for a 2% increase.

- Stock futures were up slightly following the report- S&P 500 futures and Nasdaq Composite gained 0.4% while Dow Jones Industrial Average rose 0.2%.

- Consumer spending (1.91% vs 0.92% estimate) was the main contributor of growth.

Interesting how wrong estimates and the models were.

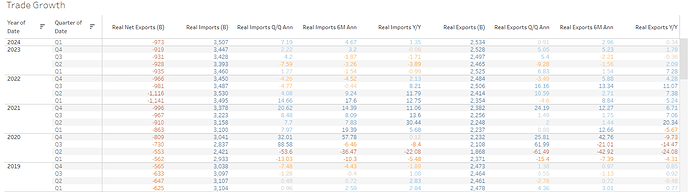

The change in inventories, and net exports not having a negative contribution is what they got very wrong.

Annual growth moved up from 1.9% in 2022 to 2.5% in 2023.

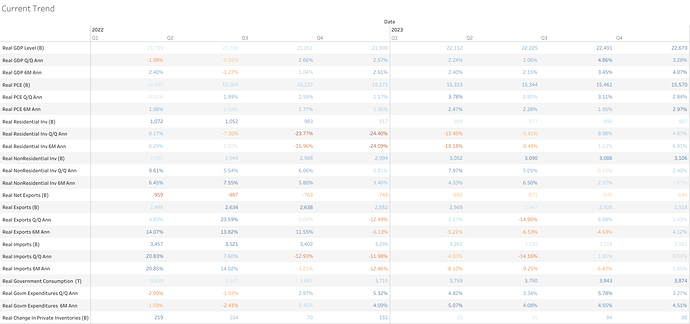

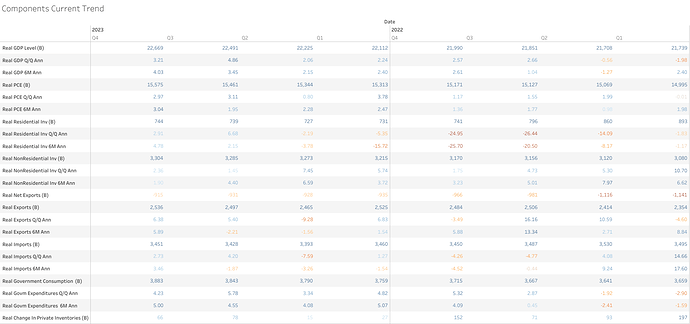

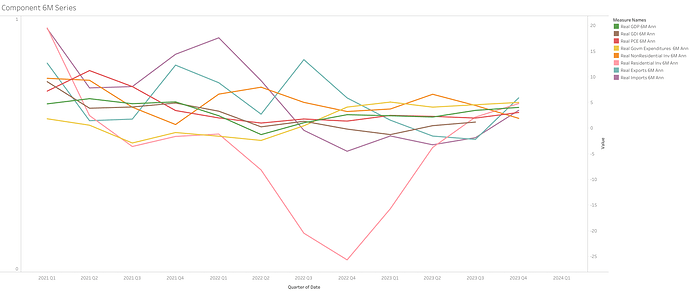

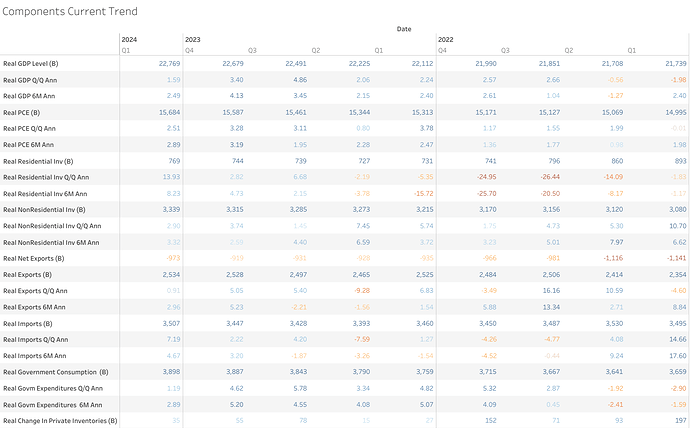

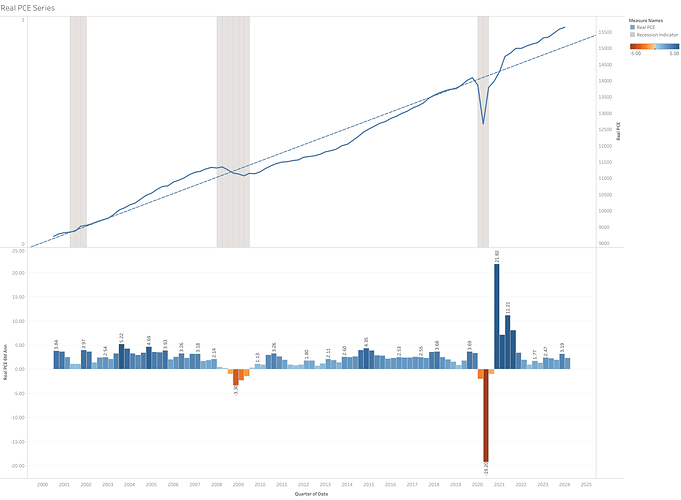

This is the current trend of the real components, some are seeing an acceleration again after being weak in 2022/2023, which is good for the growth outlook and momentum short term.

But always taking into account that this is already past data, and it could change at any time going forward.

I have a Tableau workbook for GDP(Still in progress): https://public.tableau.com/views/GDP2_17062087332110/RealGDPAvg?:language=en-US&:display_count=n&:origin=viz_share_link

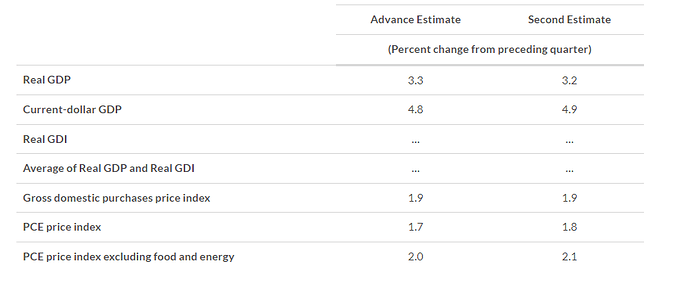

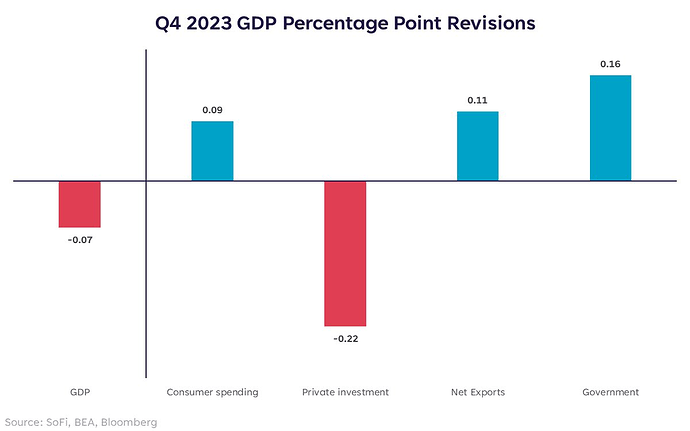

Q3 GDP had a slight revision down from 3.3% to 3.2%

PCE prices on the contrary were revised up.

This how components ended up after revision

https://twitter.com/LizYoungStrat/status/1762840498547360208/photo/1

https://twitter.com/LizYoungStrat/status/1762840498547360208/photo/1

I=9

-

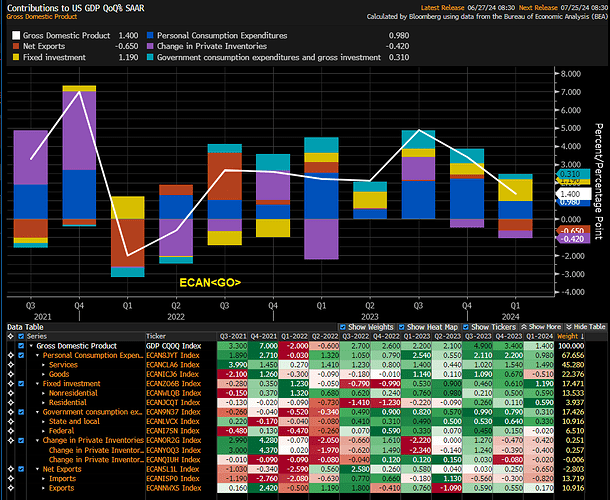

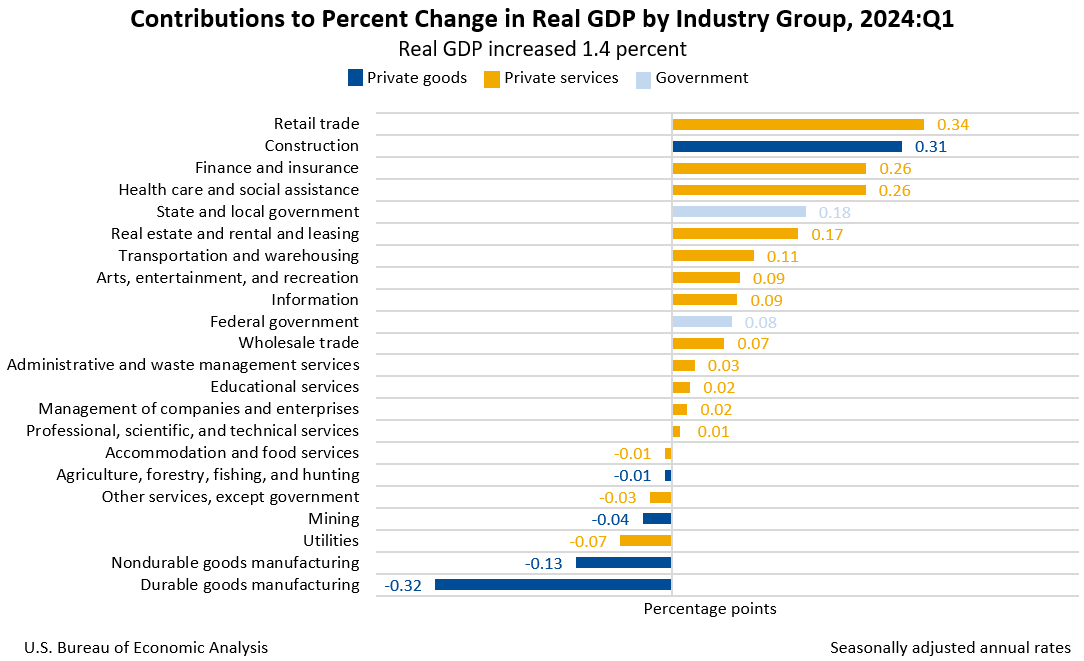

The U.S. GDP grew at a 1.6% annualized rate in Q1 2024 (Q4 2023: 3.4%), lower than 2.4% estimate.

-

Consumer spending increased by 2.5% in the period, lower than 3.3% in Q4 and 3% estimate.

-

The main contributors to the quarter over quarter decline was a drop in inventories and net exports.

Economy still growing, but not near the above 3% reported in the last 2 quarters, even below the growth seem throughout all of 2023.

However I would still characterized the report as mixed, some of the deceleration came from sectors, as government spending and inventories, that I don’t think will be prolonged for long. And on the other side, some cyclical components (residential investments and equipment) are still picking up in growth for now.

So, I think is still premature to know with confidence the trajectory going forward.

But if the economy start to move more towards stagflation than a very strong economy, it would certainly be concerning.

Low growth with higher inflation is not particularly good for companies. Contrary to just having a strong economy producing inflation. Hence it requires a more cautious perspective imo from now on, at least until clearer confirmation.

Significant deceleration in growth from government spending in Q1 2024 (1.2% Q/Q Ann), the economy was not able to sustain the past quarter’s high growth rate without the government contribution, but still the government reaction after this remains uncertain, I am doubtful low spending will continue.

- 2.89% 6M ann vs 5.2% in Q4 2023.

- 3.72% Y/Y vs 4.64% in q4 2023.

- Decreased in spending was mostly due to a decline in government investments, both at the state and federal levels.

Consumer spending continues to be relatively good (2.5% Q/Q Ann), but also showing a deceleration in the growth rates from past quarters.

- 2.89% 6M ann vs 3.19% in Q4 2023.

- 2.42% Y/Y vs 2.74% in q4 2023.

- Consumer spending came all from the service sector (4% Q/Q Ann), since goods spending was down during the quarter (-0.4%Q/Q Ann) mostly due to motor vehicles and auto parts decline (-9 Q/Q Ann).

Residential Investing continued with its recovery during Q1 2024 (14% Q/Q Ann).

- 8.23% 6M ann vs 4.73% in Q4 2023

- 5.15% Y/Y vs 0.39% in Q4 2023.

Nonresidential investing is also still growing at a relatively good pace (2.9% Q/Q Ann). Growth has also been decelerating, but not as clear yet.

- 3.32% 6M ann vs 2.59 in Q4 2023

- 3.86% Y/Y vs 4.57% in Q4 2023.

- Deceleration during the quarter came from investments in structures since growth in equipment and intellectual property accelerated.

The biggest negative contribution to GDP during the quarter was from net exports. There was a less-than-ideal combination of higher imports (7.19% Q/Q Ann) with a deceleration in exports (0.91% Q/Q Ann)

https://www.bea.gov/sites/default/files/2024-04/gdp1q24-adv.pdf

I=7

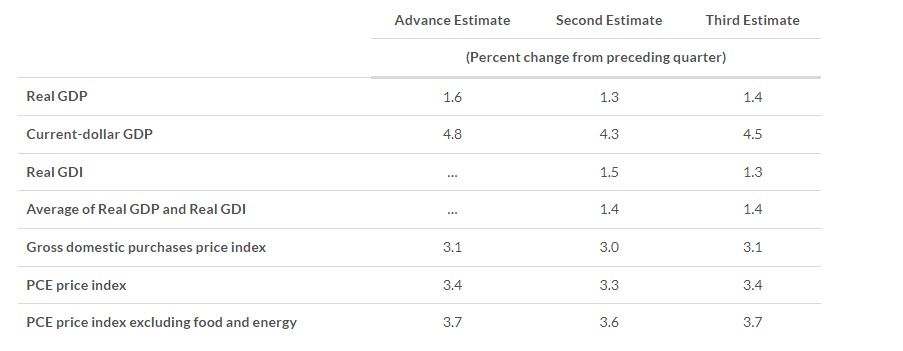

- Q1 GDP second estimate was revised down to 1.3% from 1.6%, but still above 1.2% Dow Jones estimate.

- Net exports and private inventories were lower but PCE and fixed investment remained healthy.

Q1 GDP Final Numbers

Final Q1 2024 US GDP increased at a slightly upwardly revised 1.4 per cent annualised rate for the last quarter Growth was previously estimated at a 1.3 per cent pace.

The economy grew at a 3.4 per cent rate in the fourth quarter.

Contributions

Consumer spending grew by only 1.5 percent Q/Q Ann, a reduction from the initial estimate of 2 percent.

Private goods-producing industries decreased 1.1 percent, private services-producing industries increased 1.9 percent, and government increased 2.3 percent

Sources:

Data

Tableau

News Release

Good overview. How are you progressing with the overall GDP model and our understanding of most important components, correlations etc?

I haven’t worked on it for the past 2 weeks since I was focused on Europe and the industries, but I have already set up the model and started working on it.

Maybe this week I can progress a bit with it.

I haven’t worked on Correlations that much, I am still stuck or unsure how to go around it other than from a logical perspective, this will probably be more of a long-term effort since I will have to learn it and test it first.

So my first estimates will only be for reference on what I am thinking, but I don’t expect to have a lot of confidence or accuracy yet.

I=8

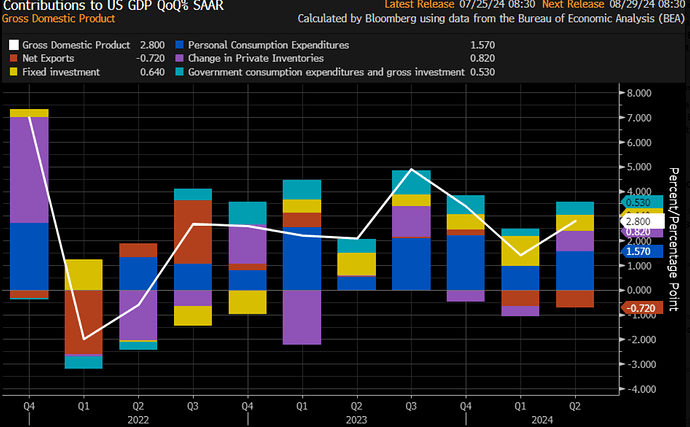

U.S GDP grew at a 2.8% annualized pace, much more than forecasted

- U.S GDP grew at a 2.8% annualized pace in Q2 2024 (Q1 2024: 1.4%), exceeding 2.0% estimate- with personal consumption expenditures being the main driver at 1.57%.

- Personal consumption expenditure price index increased by 2.6% in Q2, down from 3.4% in Q1.

- Core PCE was up 2.9% in Q2, down from 3.7% in Q1.