December 2024 FED Meeting Assessment

The Federal Reserve delivered a hawkish message in its latest meeting, signaling not only a reduction in the anticipated number of rate cuts but also a significant upward revision to inflation forecasts, along with an acknowledgment of upside risks to inflation.

The FED is once again shifting its focus to inflation from unemployment.

While I remain skeptical about the accuracy of the Fed’s projections (given their poor track record), my concerns are around:

- The Fed’s credibility is once again under pressure. The rapid flip-flopping in policy signals and focus over just a few meetings has eroded confidence. The reliance on a highly data-dependent approach, without a clear proactive plan, underscores the lack of forward-thinking in their planning.

- The Fed’s inconsistent signaling is only amplifying uncertainty and volatility in financial markets. Currently, there is not a clear trajectory, and each pivot by the Fed now triggers overreactions in either direction.

- The decision to aggressively cut rates in September may have been a mistake. They conditioned themselves to further easing when the economy maybe did not need it yet. A more measured approach waiting to thoroughly assess whether unemployment was genuinely set to rise might have avoided it.

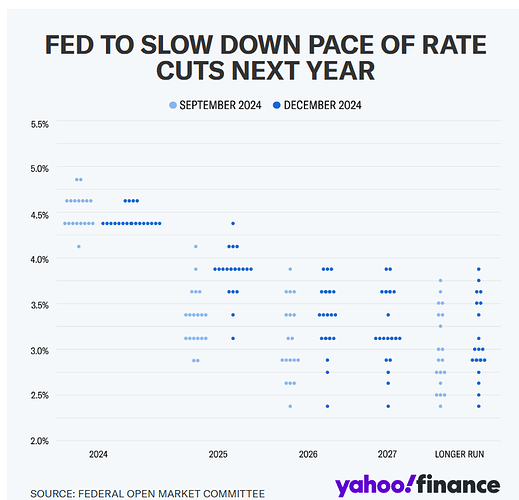

Currently, markets are pricing in only one rate cut for 2025. The positive takeaway here is that expectations are already set at a very low bar for rate cut surprises, should economic data fail to come in as hot as anticipated.

This doesn’t necessarily require a recession, just a modest economic slowdown or softer data in what many are expecting to be a very strong 2025 could be enough to shift expectations toward additional easing. This would be bullish for the markets.

In my view, the Federal Reserve appears to be positioning for an extended pause. If we do see a rate cut, it is unlikely before May or June, given inflation’s historical pattern to run hotter during the first half of the year.

While I have previously noted the increased inflationary risks following the Trump election, it is still too early to have definitive conclusions about the impact of his policies.

While the potential for upward inflationary pressure exists, there is insufficient evidence at this stage to assert that inflation will accelerate meaningfully in the near term, but is in my view that we will continue to see stickiness in its developments.

FED Decision and New Projections

- The FED cut 25bps in the December meeting. But there was 1 dissent, and 3 other non members also dissented. Indicating further rate cuts will ve more difficult to get.

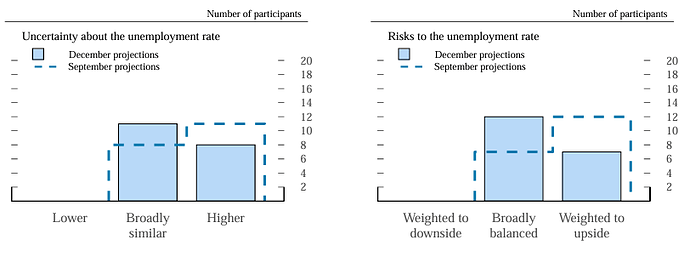

- Only 2 more cuts are projected for 2025. They removed 2 from the forecasts, which was in line with expectations.

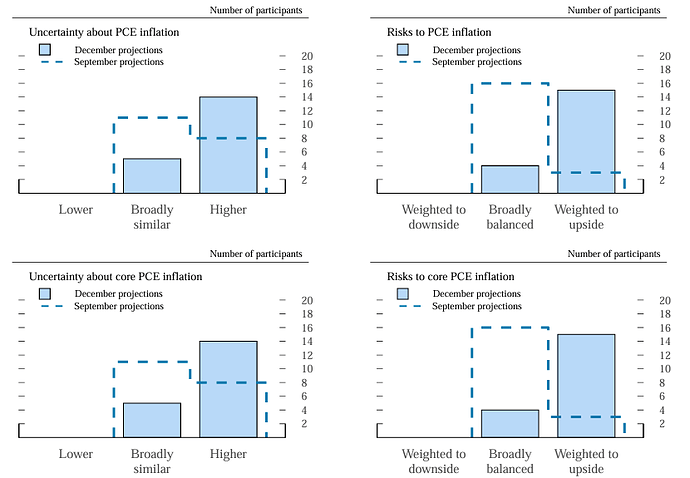

- 15 or 19 judged the risks around the inflation forecast (which were raised) were weighted to the upside. (only 3 in September). The Fed is now sifthing its focus to inflation risks.

- The dot plot is significantly more hawkish. The longer run rate continues to slowly increase

Powell conference notes:

- The decision to cut rates was appropriate, they need to balance risk on both sides.

- Labor market risks have diminished, but the market has loosened. Further loosening is not needed to achieve the inflation target.

- Some Fed members factored fiscal policy uncertainty into their outlook, raising concerns about upside inflation risks in 2024.

- Today’s decision was a closer call. Further cuts will depend on notable progress in reducing inflation or additional labor market loosening.

- The decision for fewer cuts due to stronger growth, fewer unemployment

risks, closer alignment with the neutral rate, and greater uncertainty around inflation. - A more cautious approach is now deemed appropriate, monetary policy still remains restrictive, but they are now closer to neutral rate.

- Chair Powell sees Core PCE inflation at 2.5% by 2025 as significant progress. Inflation is not expected to reach the 2% target until 2027.

- The FED will not settle for inflation above 2%.

- Inflation is moderating more slowly than anticipated, largely due to the slow adjustment in housing prices.

- Long-term rates are responding to a robust U.S. economy compared to global peers.

- A rate hike is unlikely but cannot be ruled out in today’s uncertain environment.