That’s correct. But I won’t use the term 'sell" since that will mean Vonovia will lose control of Dt. Wohnen hence no consolidation of its results. Technically, Vonovia can transfer (without selling) its direct stake to the JV and will still retain majority control indirectly. However, it will now be the majority shareholder in the JV. We don’t know if the Apollo structure allows that (my guess is that it doesn’t). Through the JV, it can squeeze-out Dt. Wohnen minority shareholders.

@moritz I agree with your assessment here that a one-off charge is unlikely to impact the valuations. However, even when we exclude the 26 million debt impairment, the adjusted EBT would still be down 14.6% in Q3 while that of Vonovia was up 0.5%. If the trend continues as a result of underperformance in the development business, the exchange ratio could rise further.

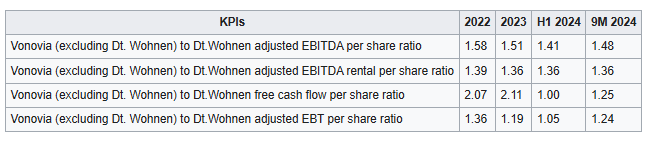

I still think that using adjusted EBITDA rental instead of adjusted EBT is unlikely since that wouldn’t provide a conclusive picture of the business. Even if that would be the case, Dt. Wohnen minority shareholders will be at a disadvantage position as shown in the table below. However, operating free cash flow ratio points towards the same direction as that of adjusted EBT. Given that free cash flow is an important metric in the DCF model, I think operating cash flow ratio is insightful.

It’s always great if you continue to discuss topics, especially if you have new ideas what should be included, you feel there are new important developments or I might be missing or misjudging elements.

How relevant is it in your opinion that Dt. Wohnen is down in just one quarter? I continue to believe that the profitability of the development business is volatile and should not be used to determine the value of a business. (esp. not one quarter)

Which timeframes are going to be used in the appraisal process?

I went back to the numbers again and found out that the €26 million interest impairment loss was just a small portion of the total impairment loss of €153.2 booked during the quarter. As it can be seen from the results here, this was the main driver of the adjusted EBT underperformance. If the impairment loss was flat y/y, the adjusted EBT could have grown 60% y/y to €244 million, enabling the exchange ratio to stay stable compared to H1.

Both Dt. Wohnen and Vonovia have development businesses. Hence my thinking is that divergence in performance of these businesses comes down to how Vonovia and Dt. Wohnen are managing them. Similarly, appraisal of Dt. Wohnen and GSW in 2014 didn’t exclude the development businesses. Financial results of the past three years and projections for the next several years were considered in the valuations (from page 152).

I=10

Vonovia offers an exchange ratio of 0.7947 and gross annual fixed payment of 1.22, sdk satisfied with the offer price and not the annual compensation

-

Vonova is offering 0.7947 Vonovia shares for each Deutsche Wohnen share.

-

Minority shareholders who don’t exchange their shares will receive a fixed annual payment of EUR 1.22 per share (EUR 1.03 net)

-

The shareholders of Deutsche Wohnen and Vonovia will approve or reject the offer on January 23 and 24 respectively.

-

Daniel Bauer, chairman of the Association for the Protection of Capital Investors (SdK), said they are satisfied with only the offer price and not the fixed annual payment.

“At first glance, the exchange ratio appears to be in line with expectations,” he told Handelsblatt. “The compensation payment of 1.22 gross per share, however, is below the SdK’s expectations and appears to be a little too low at first glance.”

-

He, however, pointed out that they can’t provide a final assessment since many details are still missing.

“A final assessment is not really possible at this point in time.” The reports will be looked at, and only once the planning assumptions are known can a serious statement be made. “But that will certainly take about two weeks after the report is published.”

Assessment

The exchange ratio is below our expectations of 1:1. However, the annual net dividend rate of 4.22% based Dt. Wohnen’s closing price on Friday this week doesn’t look bad. @moritz based on comments from sdk, there’s a high chance that they will not dispute the offer price, hence I think we should sell the recent 20% stake. But again, given that the exchange ratio will result in an offer price of EUR 24.67 (based on Vonovia’s share closing price of EUR 31.04 on Friday), I don’t see any much harm in waiting for further details on the offer price and comments from the likes of Elliot Investment before taking an action?

Hmm this is certainly below what we hoped for. I don’t see the yield as attractive given the low seniority of the dominated shareholders.

If the position should be sold or not really depends on our assessment that a higher compensation will be offered (due to minority shareholder opposition). If we think the probability is only in the single digit % range I think I would much rather sell because I don’t like the risk of being dependent on the stock price of Vonovia

Goldman Sachs believe that the compensation to Deutsche Wohnen shareholders is somewhat higher than originally planned.