Understanding macro correlations is crucial for crypto investors, especially as digital assets become more intertwined with broader financial markets

Bitcoin Correlation with Global Liquidity is very strong on both magnitud and direction

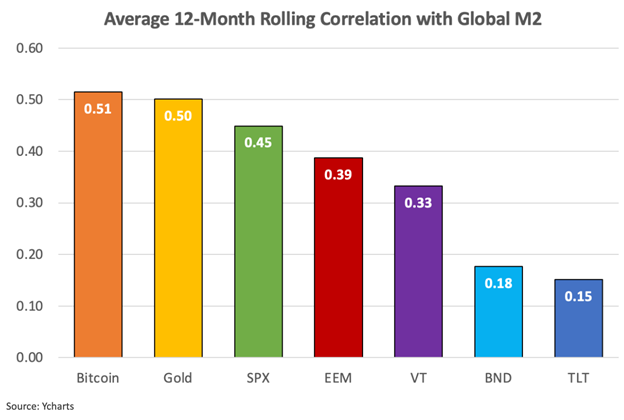

- Over 2013–2024, Bitcoin’s correlation with global liquidity was 0.94, though it weakens over shorter time frames. (0.51 on 12 months, 0.36 on 6 months)

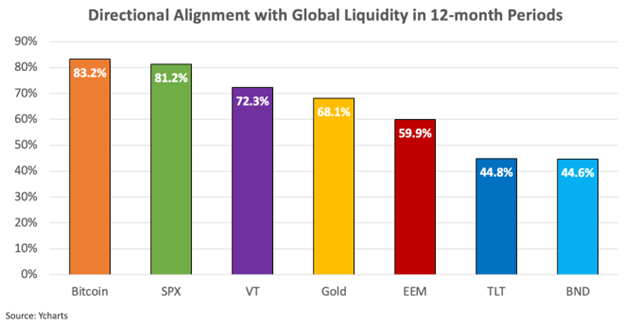

- Bitcoin moved in the same direction as global liquidity in 83% of 12-month periods and 74% of 6-month periods.

- Unlike stocks or bonds, Bitcoin’s price is driven purely by liquidity and supply-demand dynamics, because it has no dividends, earnings, or structured institutional flows like pension funds.

- Short-term price movements are more likely to be influenced by factors specific to Bitcoin rather than liquidity:

- Industry-specific shocks

- At extreme valuation levels, Bitcoin’s price action tends to be more driven by market sentiment and supply-side dynamics

Notion Document: Notion

Cointelegrah: Global M2 liquidity showing strong upward momentum, will Bitcoin follow?

Bitcoin has indeed followed (with a 3 month lag) the decline in global liquidity since September 2024, and as my previous post summarizes, the correlation of Bitcoin with global liquidity has been historically very high, not only recently.

This could signal that the bottom could be close, but obviously, lag and correlation are not perfect indicators, so it could be more or less, or break, especially with so much uncertainty. But in the medium term it seems at least a bounce could have a higher probability.

I am always super sceptical when i see people on X or elsewhere draw correlations because people often just choose data or “correlations” which is supporting their narrative that they like to push. (select timeframes, adjust scales etc.)

Therefore I don’t like us to repeat claims of others too much without deeper supporting research. For example in this case I don’t even know what global M2 is and don’t find it plausible that Bitcoin would drop more than 20% if global M2 drops 1%.

If we taking this measurement of global M2. (I did not verify if the website is good and credible) it stands out to me that BTC did not move a lot between Oct22-Jan23 while global M2 surged but it surged between Oct23-Mar24 while global M2 roughly stayed the same.

This indicates that other factors like the BTC ETF that was announced and launched in this time are way more important than global M2.

I have already worked on this topic more in depth, I even linked the research in the post (which comes from Lyn Alden) which is above this other post.

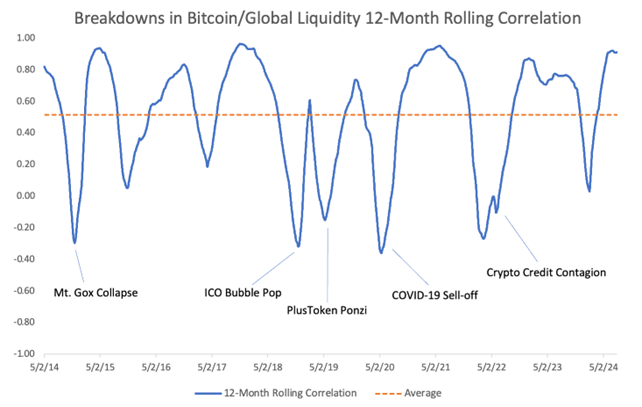

It is well researched that Bitcoin correlation with global liquidity is high. It’s not perfect, it does breaks due to idiosyncratics events, and that there is a lag between liquidity and price.

I saw that you referenced some research of Lyn Alden there but we don’t have any deep research on this topic ourselves incl. not even establishing what M2 is.

To me it is absolutely ridiculous to draw correlations from times when BTC was at 100$ because at the time bitcoins marketcap was so low that global liquidity did not matter at all. (and using those crazy scales) Instead it is a technology adoption story.

Don’t forget that people have vested interests and Alden might have as well. So people who are pushing BTC certainly like to establish a connection with growing liquidity to point out that BTC will always rise (as liquidity will rise)

I think in general you know my super critical take of considering correlations we don’t understand fundamentally well. (because then we don’t have orientation what is signal and what is noise) We can establish a database to prioritize and work on them but i think this here and right now is low priority

It will be very difficult to leverage other peoples research as you have been telling us to do, if you don’t or can’t never accept or even read or consider their conclusions.

We will never been be able to scale any of us research this way, and we will be stuck trying to prove everything ourselfts with all the details that something like this needs.

My vision is that we will have deep efforts to determine the quality of the research of others (which we already regard highly) e.g. the planned project of doing it with Yardeni. (It does not have to be as deep for everyone. There will be multiple levels how deep our understanding/assessment of another analysts will be. From some first good impressions to very deep understanding)

My vision is that you help me to filter things out so that the analysts you are referring are top class in terms of methodology and a variety of other factors. The less bogus elements i spot in their analysis like questionable correlations the better.

I have been reading Lyn Alden for years, she is not only highly regarded from me, but most of the crypto and macro industry.

You are here dismissing a research that you havent even read or consider yourself if it’s makes sense a bit (there are some fundamental reasons), or even researched it yourself at all.

I can for sure explore more the topic eventually (because she is not the only analyst that have this “opinion” or research done), but I highly dislike when you dismiss something you haven’t even work on yourself at all. This has happened before, and let to me to stop pushing things at some point because it stopped making sense for me to do it.

Imo you also have to trust that I have learned all this year’s to assess better who is pure bullshit or not from your guide actually (I have become way more critical than before, and have even stop following people I did before). If not, I will never be able to be autonomous in my area as you desire, and you will always need even more prove to follow any of the assessments, and you will be stuck that our research is not even useful to you because you can’t never really trust it.

What is extremely important to me in everything that we are doing is a very high level of granularity. This is the source of research excellence in my opinion and applies to everything from our assessments of analysts to our assessment of individual arguments.

This means I will never see anyone or any analysis as black or white but always consider details.

Obviously, sometimes we don’t have the time to go into detail in every question, so we need to be heuristic sometimes and believability-weight arguments given by others. In those cases it is important to have an established an opinion of someone so we can believability-weight their opinions a bit higher.

Example: We see Ed Yardeni explain a thesis on an complicated area that is less important and we have established a very high opinion of him → We will consider it more.

This is only the case though for less important questions for which we don’t want to dig deeper e.g. with chatgpt deep research. (In many cases a quick gpt deep research can be good given that it does not costs us a lot of time and we capture knowledge into Notion)

In addition we always need to be critical when listening to people or reading their arguments and spot any arguments which are bullshit. Obvs. the more low quality arguments we spot of a certain person the lower our opinion will be (& opposite with high quality arguments) but importantly spotting a low quality argument does not mean I will dismiss a person altogether immediately esp. if I don’t know her or him (Unless the argument is extremely bad and we instantly see someone has no clue).

Instead, I believe that people are certainly more sophisticated in one area than in others, and they can have good arguments, but might also miss some points sometimes or assess other areas completely wrong. (And everyone has their vested interest e.g. trying to establish themselves as an expert in a certain area etc. etc. So if someone is highly regarded in crypto it might be more difficult for them to take a very critical stance)

This principle of being critical with every argument is true even if we regard someone highly as no one will ever be perfect. (Therefore we believability-weight their arguments a bit higher like described above in case we have no idea at all but not fully accept them)

In the concrete example of the latest messages we also need to be very granular when assessing what I actually tried to say.

1)I rejected the chart of cointelegraph which looked quite strange to me. I did this because we did not double check the sources used. If we use M2 like established here (the first source I gave is behind a paywall now) it does not look like both are actually moving in parallel but liquidity rose first in July and August before BTC rose. In addition, I think that a publication like cointelegraph might be biased and tries to support an argument and not every person writing articles for a media outlet is always sophisticated. In my opinion BTC rose because of the Trump election not because of liquidity…

2)I tried to establish the concept of being more critical if we look at correlations by naming examples when BTC and M2 have not been correlated and highlighted that I strongly believe that liquidity conditions did not play an important role in the early stages of BTC as it was more a technology adoption play and most people did not even knew BTC regardless of the fact if more money was in the system or not.

3)I never said that I don’t think liquidity is not important for risk assets. Quite on the opposite I think I told you often that I moved more into crypto in 2020 after I saw how much money was printed by central banks. (I also believe that in case monetary policy gets easier e.g. because there is recession and QT stops etc. that could be good for crypto)

On the question of trust this is something which develops over time in accordance with how sophisticated I see you. Overall it improved a lot and I start to rely on you on a lot of topics but this does not mean we are fully aligned yet and I feel I can blindly rely on it. I see it similar to the description above how to assess analysts. The more you provide me with very strong and granular arguments and things that turn out to be the most important and right the higher my trust will be and if I feel there are weaknesses in your argumentation or in sources you consider or you do not spot some bad arguments or there is no clear understanding what is important and what not the lower it will be. (I expect you to work on different topics to establish how important they are, so having a variety of work in the forum and notion is not bad but then for you to realize what we really need to focus on and point me to that)