Bitcoin Correlation with Global Liquidity is very strong on both magnitud and direction

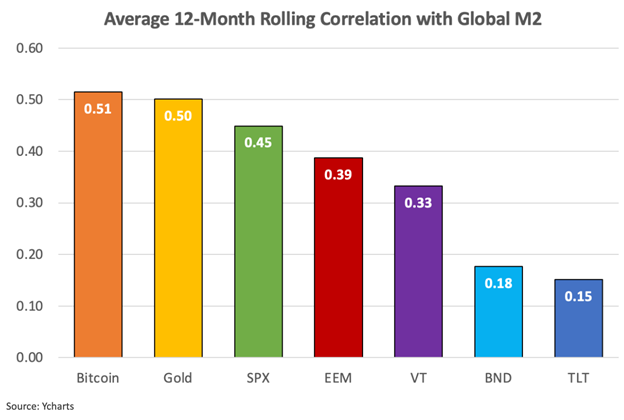

- Over 2013–2024, Bitcoin’s correlation with global liquidity was 0.94, though it weakens over shorter time frames. (0.51 on 12 months, 0.36 on 6 months)

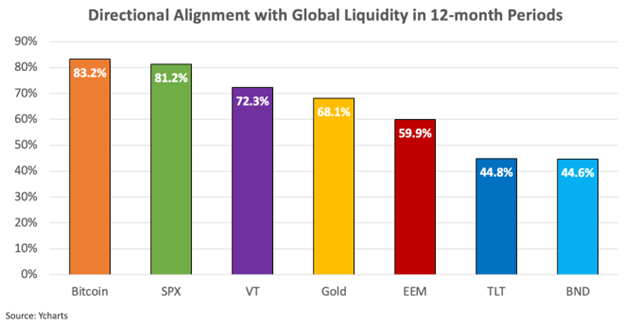

- Bitcoin moved in the same direction as global liquidity in 83% of 12-month periods and 74% of 6-month periods.

- Unlike stocks or bonds, Bitcoin’s price is driven purely by liquidity and supply-demand dynamics, because it has no dividends, earnings, or structured institutional flows like pension funds.

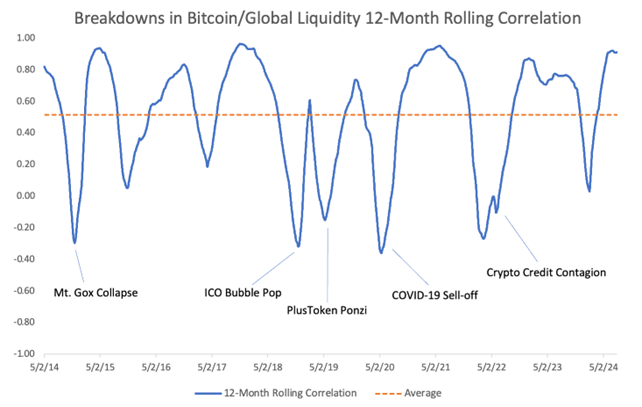

- Short-term price movements are more likely to be influenced by factors specific to Bitcoin rather than liquidity:

- Industry-specific shocks

- At extreme valuation levels, Bitcoin’s price action tends to be more driven by market sentiment and supply-side dynamics

Notion Document: Notion – The all-in-one workspace for your notes, tasks, wikis, and databases.