This topic is to discuss CPI data releases and developments during the month that could give us an indication about the CPI direction in coming months

@moritz I have finished May 2023 article, big decline for sure in may and even more expected in June, and positive that the majority of the contribution is coming from shelter and used cars. But I think is still early to have certainty it will reach 2% anytime soon Consumer Price Index:Historical Releases/2023 May - InvestmentWiki

Good overview.

The outlook component in your assessment is very interesting. What do you think about adding an outlook section to our cpi articles?

I‘d be very interested to get more color of what economist are expecting for June or even beyond (if available) esp. on core , super core and different components.

If I have a clear picture of where things are heading I can factor that in when thinking about interest rates and companies that are especially sensible to overall macroeconomic conditions like Upwork, Volkswagen etc.

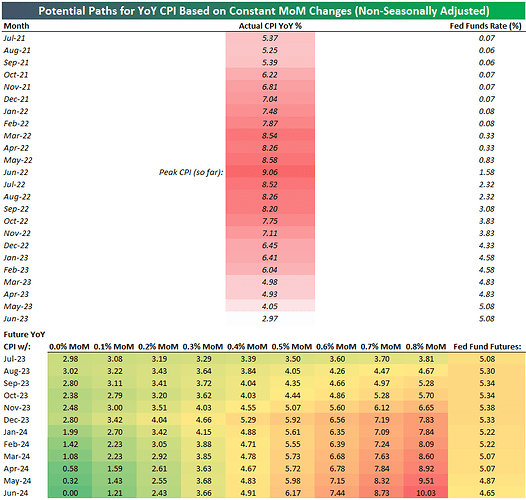

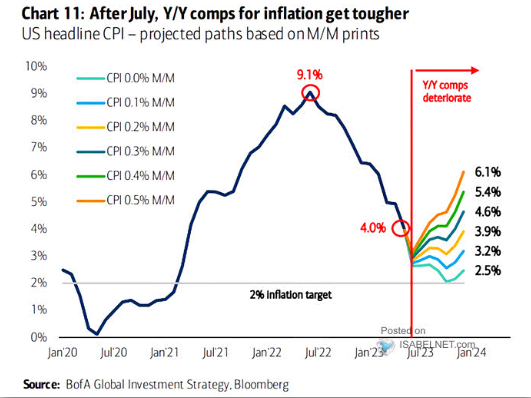

We can try but is not always going to be as easy as this month to know the outlook for the next one. Actually, after July, there is a lot of uncertainty/not consensus among analysts, it will be more dependent on coming data, since comps start to normalize, and the outlook of the economy too. But I will share everything that I encounter.

3 months of increases in housing prices, this is concerning for inflation. We could see some declines in shelter CPI since Y/Y is negative now, but if housing prices don’t decline more and momentum picks up, it will be definitely very slow process, and very volatile.

- Before seasonal adjustment, the U.S. National Index posted a 1.3% month-over-month increase in April, while the 10-City and 20-City Composites both posted increases of 1.7%.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.5%, while the 10-City Composite gained 1.0% and 20-City Composites posted an increase of 0.9%.

S&P Corelogic Case-Shiller Index Continued Gains in April - Index Announcements | S&P Dow Jones Indices

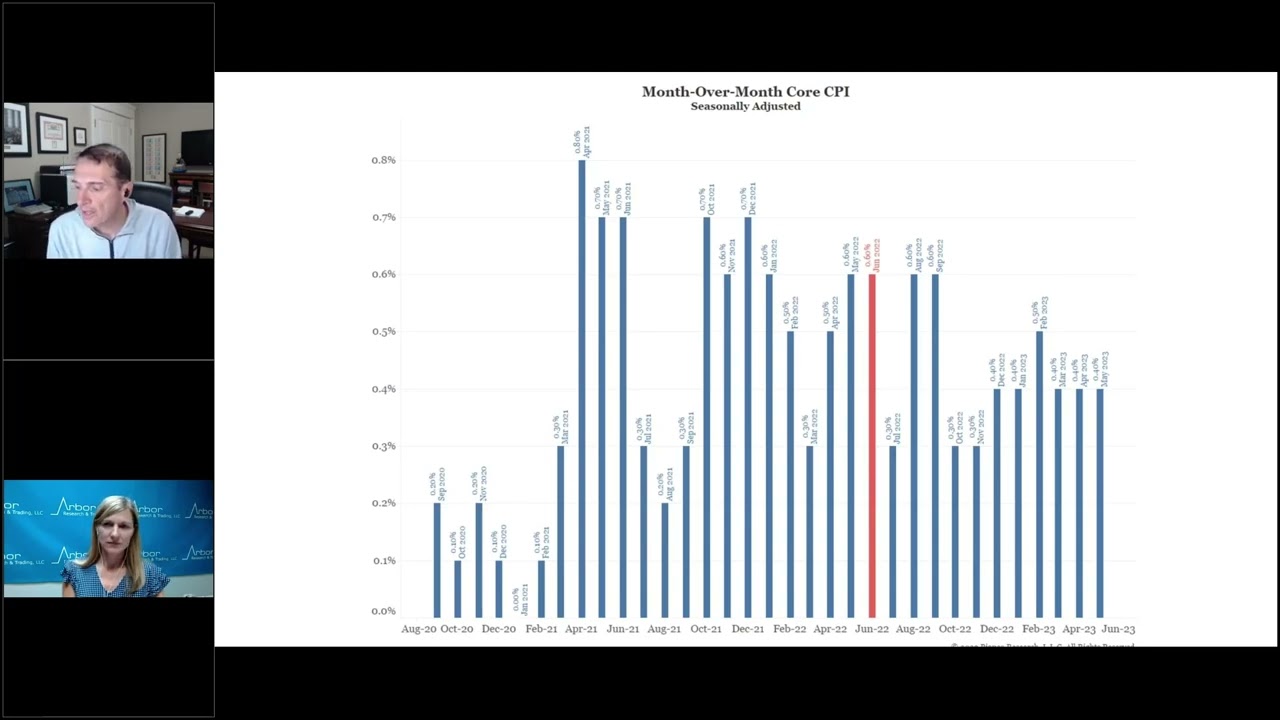

Very good video from Jim Bianco explaining with charts why inflation could bottom in July due to the base effects. He is not taking into account any external shocks

7 posts were merged into an existing topic: FED Independence

Interesting chart by BofA, comps will make it difficult after June. Average m/m increase in 2023 has been 0.30%

CPI Estimates for tomorrow @moritz Consumer Price Index:Historical Releases/2023 June - InvestmentWiki

Big decline in CPI, but will be mostly due to base effects, since m/m is still expected at 0.3%. Things that stand out for me:

- Housing prices increasing for 3 consecutive months, this is apparently due to low existing home supply (owners locked in their homes due to higher rates). Not so great for inflation if it continues.

- Huge decline in used car prices in June, which will be reflected in CPI in the coming months

- Energy seems to be in a range, I think a shock in supply/demand could be significant for CPI, now that comps will be lower.

My assessment of June CPI in the article: Consumer Price Index:Historical Releases/2023 June - InvestmentWiki

I will continue to search for additional forecasts of July and 2023, I have not seen much yet.

Unless we see deflation in July and August m/m, inflation will not be coming down in those two prints.

https://twitter.com/bespokeinvest/status/1679176798695727104/photo/1

Good article.

Here is my take: Data looks very promising as

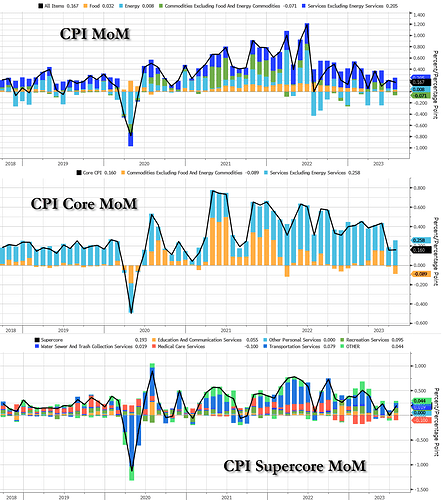

- Supercore Inflation stands at 0% m/m, and Core goods inflation is at -0.1% m/m as we see inflation coming down in almost all sectors of the economy.

- Inflation increases are largely caused by the contribution of shelter which is expected to be temporary. Taking shelter out of the picture we almost saw a 0% inflation m/m change.

If we have reason to believe that current trends largely continue, annualized m/m inflation growth rates are way more important than y/y growth rates. (Obvs. there will be some headwinds from the likes of energy but of minor importance?)

Headline inflation numbers might increase again as the BofA “CPI Different Scenarios” graphic suggests that there has been already 2.5% inflation since the beginning of the year. This can obviously not be reverted but inflation developments in the second part of 2023 will be way more important than the fact that there has already been inflation at the start of the year for the further fed trajectory, so I don’t worry about headline inflation rising again to 4% or if it’s a temporary impact not even 5%.

Fed funds futures price now a probability of max. 15% of a second rate hike. (Was this significantly higher at one point?)

In my unqualified opinion, it seems very unlikely at first impression that the Fed would hike 2 times if m/m inflation growth rates stay so subdued. Even one rate hike - which the market is certain will happen- looks aggressive to me and might be only taken by the fed in order to assure the job is finished and due to worries that this month could be an outlier?

On the Flipside less inflation will hurt business profitability esp. if wage price growth continues.(Once we have a forum topic about the labor market we should link it here as well)

What is your take on this @Magaly? Do you think i am missing something relevant?

I do agree with most of what you said, but I am not sure yet about the FED path as maybe you are?

I agree they probably don’t even need 1 more hike, but I think they will definitely do the July one at this point. And a second one I am not sure we can discard it yet. The FED has been so determined about not making another mistake and everyone always accuses them of being behind the curve, that unfortunately, I think their psychology can play against them, and hike again if they see headline increasing. I also think they prefer to overtighten that to let inflation increase again, especially is the economy seems to be holding, and the stock market is soaring.

And same as they haven’t cared until now about the known lags in CPI, I don’t think they will care if annualized says another thing completely. We will have to wait for more data probably to be sure what they will do.

Either hike or not, we should probably not expect rate cuts anytime soon, unless something happens with the economy too.

![]() Haha, I actually did my best trying to highlight my uncertainty by combining several uncertainty-increasing words in one sentence like “unqualified”, “seems”, and “first impression”.

Haha, I actually did my best trying to highlight my uncertainty by combining several uncertainty-increasing words in one sentence like “unqualified”, “seems”, and “first impression”.

Overall I am as well not sure at all about the Feds path as I am not totally aware of how they take decisions and I have certainly knowledge gaps and missing data points I am not taking into account as of now which they are considering.

From my take of the situation with weakening demand signals appearing

and inflation and production dropping

I now start to see a situation in which financial conditions are more than accurately tight to slow down the economy and there is a risk appearing that the Fed might overdo it, especially considering risks to regional banks etc.

One of the last obvs. remaining hawkish factor which the Fed and we need to watch evermore closely is the labor market. If I had to guess I would assume that the first signs of easing should finally appear towards the end of the year.

If the labor market does not ease it could put the Fed into a difficult position, but if it does I have some level of trust in the Fed that it would mainly consider m/m changes and the real situation on the ground and will change it’s stance on “ignoring lag effects”. (which might have been an excuse to hike more)

I completely agree that the Fed wants to keep rates high as long as possible to eliminate any remaining inflation dangers. We should not completely rule out one or multiple emergency cuts at one point though.

I think is just that you have more faith in the FED that I do probably haha follow them for some years, I think they are much more reactionary than they are proactive in their decisions. But it would be nice if for once, they start to behave differently.

The Fed already has unemployment at 4.1% in its projections for 2023. More than the accuracy, for me this means that even with unemployment rising to this level, they are ok with 2 more hikes, no cuts, and QT for 2023. So I think we would probably need to see a number way above 4.1% unemployment for the FED to change its path, or get to 4.1% way before they are projecting.

I completely agree they could do emergency cuts at some point, especially if they overtighten, but this would only be imo if something breaks or gets bad, which is not completely bullish either, unless they react as they did in 2020, with excessive liquidity too.

But excessive liquidity could reignite inflation. So I think is a difficult situation already either way. Even more, if we take into account those huge fiscal deficits that no one knows who is going to finance them, if not for the FED

-

Treasury secretary Janet Yellen said cooling labor market, subsiding rent, declining prices of used cars and improving supply chain in autos are helping bring down inflation.

-

She,however, cautioned against reading too much into June CPI data terming it as a “one-month” numbers.

Housing prices continue to increase m/m, near the peak again, a headwind for inflation down the road, as we know the lags are very large.

If they will continue lower at some point, I think will be dependent if there is recession or not, and rates.

" The S&P CoreLogic Case-Shiller 20-city home price index in the US increased 1.5% month-over-month in May 2023, marking a fourth straight month of increases"

CPI July article: Consumer Price Index:Historical Releases/2023 July - InvestmentWiki

Headline CPI is expected to see a y/y increase compared to June, while the core is expected to remain unchanged or even decline a bit. While m/m increases seem manageable for now.

The big jump in oil prices in July is expected to hit gasoline prices in August, especially. So, the August forecasts are not looking pretty either for headline CPI.

For me, it’s also concerning to see housing prices increasing once again due to limited supply. And obviously, the fact the wages continue to be very sticky.

It will be interesting to see what will the FED says now that headline CPI is most likely going to increase, but the core will continue most likely in its trend down, with shelter CPI cooling. I continue to think they could use it as an excuse to hike 1 more time, but we will probably have to see how the markets price it, since I don’t think the FED will deliver any surprise. For now, the markets are expecting a pause for the rest of the year.

SI=2-3%, I=9

- U.S consumer price index(CPI) rose 0.2% in July, in-line with the estimate.

- Year-over-year, CPI rose 3.2% versus 3.3% estimate.

- Core CPI rose 0.2% in June, also in-line with the estimate.

- Year-over-year, core CPI grew by 4.7% versus 4.8% estimate.

- More than 90% of the monthly increase in CPI came from shelter which rose 0.4%, same as in June.

- Both food and energy indexes rose 0.2% in July versus a rise of 0.2% and 0.4%, respectively in June.

- Used cars and new cars prices decline 1.3% and 0.1%, respectively.

I have finished Today’s article: Consumer Price Index:Historical Releases/2023 July - InvestmentWiki

I would say this is a very mixed report with some negative and positive developments. But probably balancing to more positive, since shelter is now over 90% which we know will moderate a bit more, and monthly increases still very modest.

The majority of the positive effect this month is coming from goods, specifically used/new car prices. Super core went up as most services had an increase during the month, and shelter remains mostly unchanged. Stickiness in services is reflected still.

Food also increased during the month, and as expected the majority of the increase in oil was not reflected in this print, which will be until next month if oil prices don’t decline.

Airlines fares have a very low contribution but is interesting to see they are -18% yoy and -8.1% mom.