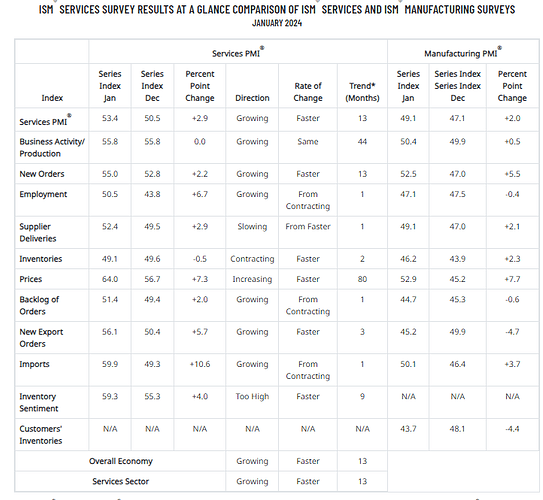

Both the manufacturing and services sector PMI showed some improving dynamics in the economy for January, but the negative that comes with this is that prices in both surveys had a significant jump in both sectors too.

Is early to know, but if this continues, at the very least we could see very little improvement in inflation going forward.

Still not at the level seen in 2022.

Manufacturing

Demand remains soft but shows signs of improvement, and production execution is stable compared to December, as panelists’ companies continue to manage outputs, material inputs and labor costs. Sixty-two percent of manufacturing gross domestic product (GDP) contracted in January, down from 84 percent in December.

Twenty percent of companies reported higher prices, compared to 14 percent in December,” says Fiore. A price index above 52.8 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) Producer Price Index for Intermediate Materials.

Services

The overall growth rate increase in January is attributable to faster growth of the New Orders, Employment, and Supplier Deliveries indexes. The majority of respondents indicate that business is steady. They are optimistic about the economy due to the potential impact of interest rate cuts; however, they are cautious due to inflation, associated cost pressures and ongoing geopolitical conflicts

Prices paid by services organizations for materials and services increased in January for the 80th consecutive month. The Prices Index registered 64 percent, 7.3 percentage points higher than the seasonally adjusted 56.7 percent registered in December. This month-over-month increase is the largest since August 2012 (9.3 percentage points).

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/january/