Assestment of Potential Trump policies on inflation as of December 2024

Donald Trump has proposed several policies that, in theory, could contribute to higher inflation. These include:

- Imposing tariffs on imported goods may raise consumer prices domestically.

- Immigration reductions and mass deportations could reduce labor supply

- Tax cuts could lead to wider fiscal deficits, potentially boosting aggregate demand and creating upward pressure on prices

- Efforts to influence the Federal Reserve’s decision-making, though very unlikely, could undermine its ability to manage inflation effectively.

Additional tariffs are the most concerning and the most likely policy to impact inflation in the near term

Trump has proposed universal tariffs of 10% to 20% on all imports, a targeted 60% tariff on Chinese goods. However, recently only pledged 25% tariffs on imports from Canada and Mexico, along with 10% on additional Chinese goods.

- According to analysts, a 10% universal tariff would mean approximately a 1% increase in inflation.

- According to research from New York Fed, in 2018 is estimated that tariffs on approximately $283 billion of U.S. imports, with rates ranging from 10% to 50%, contributed to a 0.3% increase in inflation. Today, a significantly larger volume of goods could be affected ($1.3 trillion only from China, Mexico and Canada. $3.8 Trillion for total imports)

And unlike in 2018, the current economic environment is already tilted toward higher inflationary expectations, amplifying potential price pressures.

It seems unlikely that Trump will implement a universal 10% tariff. Instead, he is more likely to target specific countries, such as China, Europe, and Mexico. This approach appears to be strategic, using tariffs as a bargaining tool for negotiations on broader issues. As a result, the actual tariffs imposed will likely be lower than the initially proposed levels.

But since he will need tariff revenues to offset some of the tax cut initiatives, is most likely that some levels of tariffs will indeed happen.

Even if tariffs were to affect only 25% of all imports (almost 1 trillion), the impact would still most likely result in a range of 0.25-075% price increase in inflation. ( However, the analysis is probably more complex than simply applying a proportional increase to the affected goods based on the 2 research above)

This would be a one-time effect, with the effects likely materializing within a year of their implementation.

These are some of the conditions that could offset these inflationary impacts:

- A stronger U.S. dollar could offset some of the price increases by reducing the relative cost of imports.

- Tariffs may slow economic growth by reducing purchasing power, productivity, and trade volumes, leading to layoffs and lower investment in affected industries. This reduced demand could offset some or all of the inflationary effects.

With core PCE currently at 2.8%, tariffs alone could keep inflation high between 2.5% and 3%, or even push it above 3% in 2025/2026 depending on the scale and severity of the tariffs imposed, and the reaction on inflation expectations

An increase in fiscal deficits will also have an inflationary impact but be more moderate than tariffs

Trump’s proposals, particularly his tax cuts, could significantly increase debt and fiscal deficits while also stimulating the economy by leaving more income and profits in the hands of households and businesses.

Most of these proposals will require congressional approval. With Republicans controlling both chambers, their chances of success are higher. However, implementation is likely to take time, and even within the Republican party, there may be resistance to policies that significantly worsen the fiscal situation.

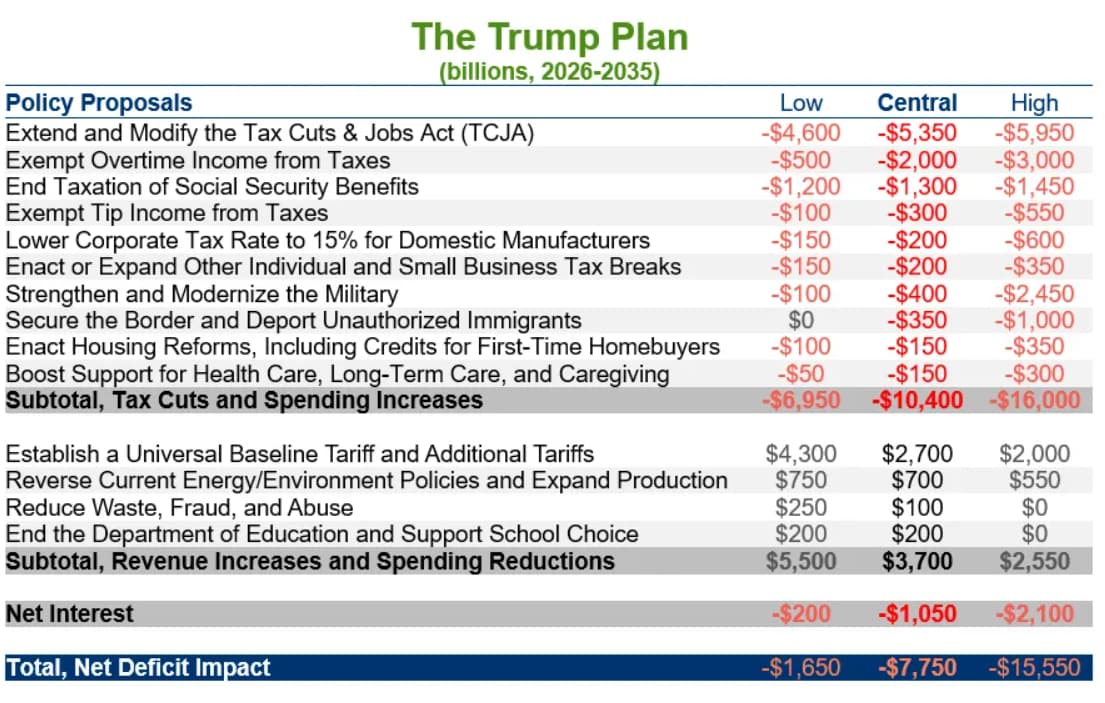

According to The Committee for a Responsible Federal Budget, Trump’s policy plans could:

- Increase federal debt by $7.75 trillion over the FY 2026–2035 period under a central scenario.

- Drive deficits to 9.7% of GDP by 2035, with estimates ranging from 7.7% to 12.2% of GDP depending on the scenario (levels not seen outside of wartime or major recessions)

Research from the Bank for International Settlements shows that the inflationary impact of a fiscal deficit depends on the policy environment:

- In regimes with strong central bank independence and prudent fiscal discipline, a 1% point increase in the fiscal deficit raises inflation by just 0.10% points.

- In fiscally-led regimes with weak fiscal discipline and limited central bank independence, the same increase leads to an average 0.50% point rise in inflation.

Given that the U.S. operates with a mix of these characteristics, the inflationary impact likely falls in the middle, around 0.30% for each 1% increase in deficits.

With deficits projected to rise from 6.5% of GDP currently to between 7.7% and 12.2%, this could translate to an inflation increase of 0.3% to 1.8%.

The advantage is that the inflationary effects of rising fiscal deficits are likely to unfold gradually over several years, rather than creating an immediate, all at the same time impact. However, this would add to the inflationary pressures already introduced by tariffs.

Furthermore, higher fiscal deficits in a rapidly growing economy could exacerbate economic overheating, particularly since some policies involve tax cuts also directly boost disposable income and spending.

Immigration policies are the most uncertain, and the effects to be mostly mixed

Trump has proposed a range of immigration policies, including mass deportations, stricter border controls, and the elimination of certain humanitarian programs. However, the feasibility of implementing these measures remains highly uncertain due to logistical and legal challenges, as well as questions about their overall effectiveness if implemented.

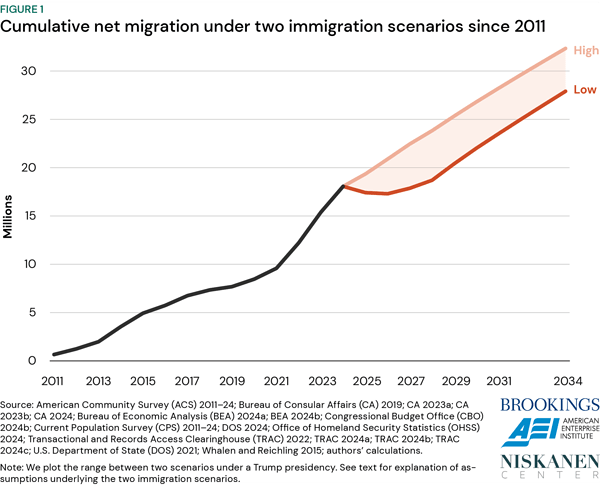

According to the Brookings Institute, projections for net migration vary significantly, reflecting the uncertainty:

- High Scenario: Net migration reaches 1.3 million in 2025 (CBO projecting 2.6 million), with a cumulative total of 5.8 million over four years.

- Low Scenario: Net migration turns negative, at -650,000 in 2025 and -120,000 in 2026, before becoming positive. Cumulative net migration over four years is around 630,000.

As a reference net immigrations has been in the range of 3 million annually since 2022.

The impact of these policies on inflation is uncertain, as they could have opposing effects:

- Immigration has supported labor supply growth and helped alleviate wage pressures since 2021. However, with the labor market cooling and labor shortages becoming less acute, the pressure of reduced immigration on wages in this context is unclear, but most likely less significant than the 2021/2022 period.

- Immigration is critical for economic growth in the future, as highlighted by Dallas Fed research. A decline in immigration could negatively impact spending and overall growth, potentially offsetting any inflationary pressures from a reduced labor supply.

- Other important sector like housing, could also see less pressure on prices due to less demand.

Overall, while the inflationary impact of these policies seem less concerning compared to other due to the opposing effects, it also remains one of the most uncertain.

What could this mean for rates?

I have the opinion currently that as long as core inflation remains within the 2.5%-3% range (tariffs, deficits and immigration pressure would have to be very light), the Federal Reserve is likely to maintain its current approach of gradual easing or, at the worst case scenario pause rate cuts indefinitely.

However, with core inflation levels above 3% in a sustained manner, the likelihood of a rate hike increases significantly. Such a development would likely trigger a strong negative reaction in financial markets.

Anything below 2.5% would mean more cuts than currently forecasted, which would be bullish for the markets.

Conclusion: There are significant uncertainties surrounding this issue, making it difficult to form a definitive or very certain opinion at this stage. It remains unclear how, when, or which policies will ultimately be implemented, and whether they will be introduced all at once or phased in over time. Even Trump true intentions.

I could see scenarios where the impact could be very light ~0.5% impact, and other where impact is way more significant with over 1.5% effect.

There could even be scenarios where the impact is negative if tariffs and immigrations policies affect growth very significantly.

My current best guess is effects to be in the 0.5-1% range in the 2025/2026 period. Keeping core inflation above target and in levels uncomfortable for the FED

That said, in my opinion, the concern/uncertainty the the market is reacting currently is real, particularly regarding tariffs, the fact inflation is already behaving very sticky, with some upward pressure in recent months, and this combined with the amount of uncertainty about monetary policy too, warrants a more cautious approach moving forward.

With both the Federal Reserve and markets closely focused again on this, any new information or policy action could provoke substantial market reactions in either direction.

- Economists have already raised their core PCE inflation forecasts for 2025 to 2.5%, up from 2.3%, largely due to concerns over tariffs.

Of course, other factors will also influence inflation, including geopolitical tensions, energy prices, housing trends, labor market dynamics, and other fiscal deflationary policies as DOGE. These forces, combined with the potential effects of these proposals, contribute to an increasingly complex and uncertain inflation outlook.