Q3 2024 Household Debt Rose Modestly. Delinquency Rates Remain Elevated

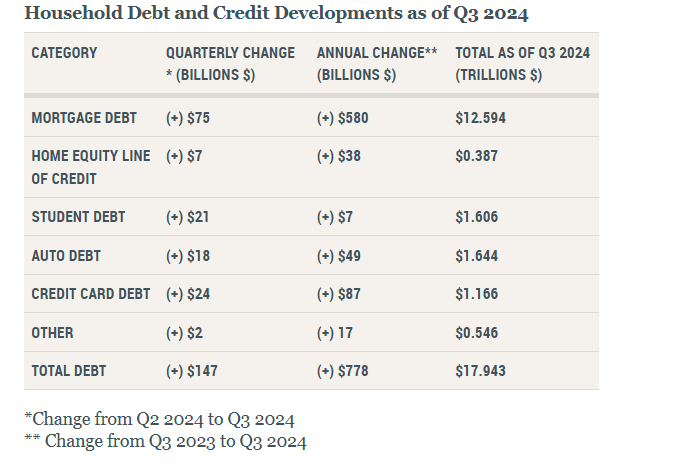

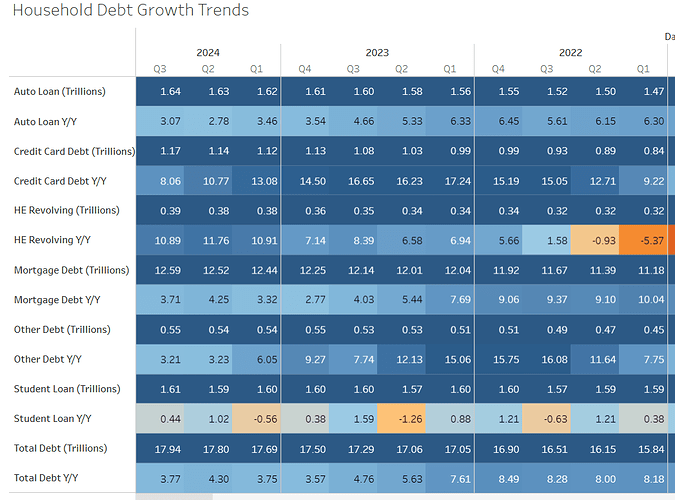

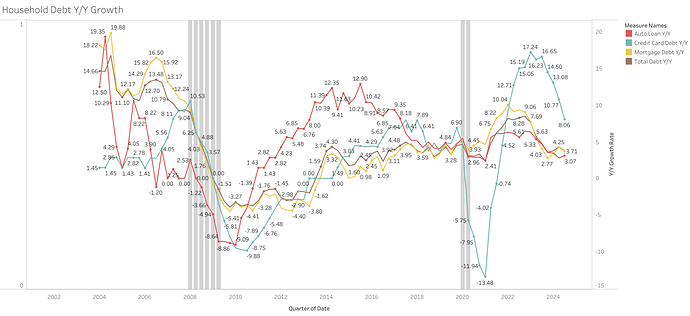

Total household debt increased by $147 billion (0.8%) in Q3 2024, to $17.94 trillion.

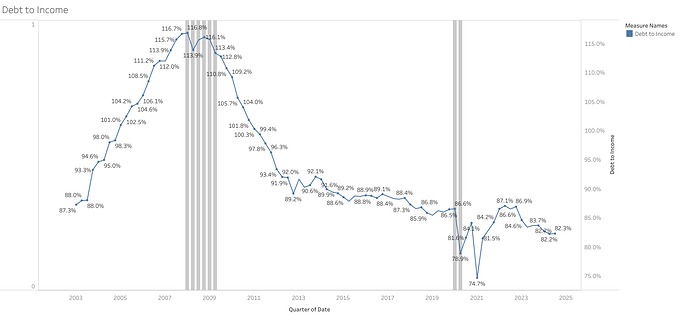

Debt to Income ratio remained essentially flat in Q3 2024 at 82.3%.

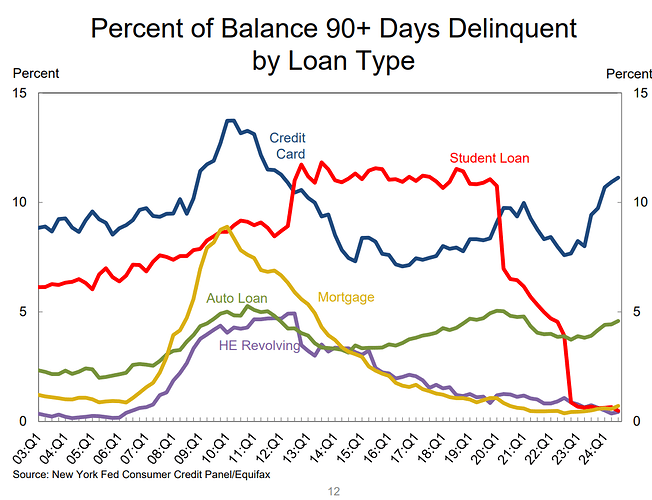

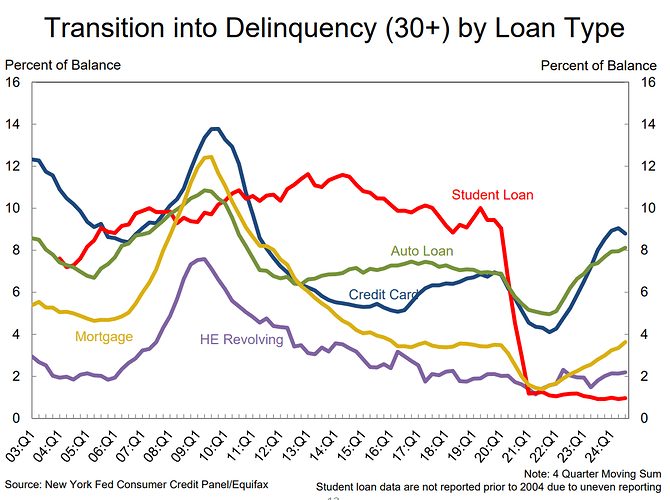

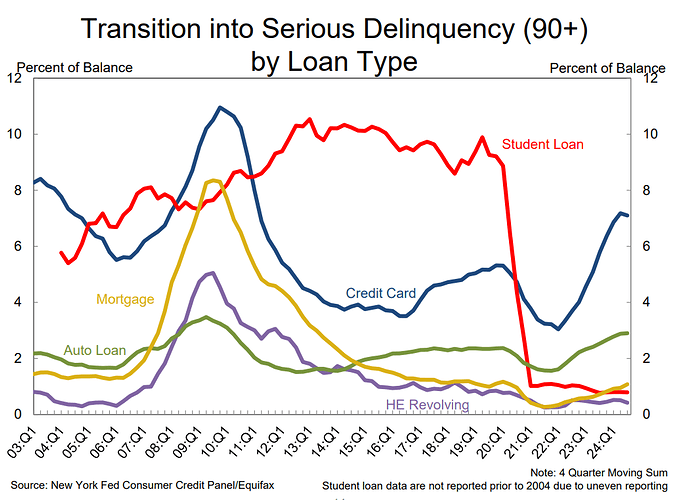

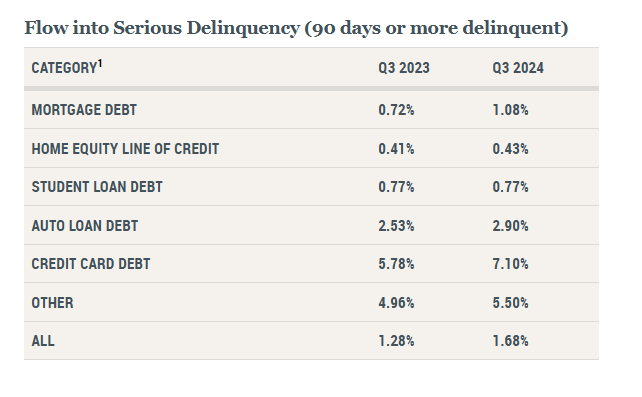

Aggregate delinquency rates edged up from the previous quarter, with 3.5% of outstanding debt in some stage of delinquency, from 3.2% in Q2 2024 and 3.0% in Q3 2023.

- Credit card delinquency rates improved, with 8.8% of balances transitioning to delinquency compared to 9.1% in the previous quarter.

- Early delinquency transitions for auto loans and mortgages worsened slightly, rising by 0.2 and 0.3 percentage points respectively.

- bout 126,000 consumers had a bankruptcy notation added to their credit reports this quarter, a small decline from the previous quarter.

https://www.newyorkfed.org/newsevents/news/research/2024/20241113

https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2024Q3