This topic discusses the current state of electric vehicles market(EVs), its outlook, main players, and current developments. According to the International Energy Agency(IEA), EV sales exceeded 10 million in 2022, accounting for 14% of all new car sales, up from around 9% in 2021 and less than 10% in 2022. Goldman Sachs expects the number of EV sales to grow from 2 million in 2020 to 73 million units by 2040.

@Aron good article and overview.

Any idea if there are Chinese manufacturers besides BYD, Patrick Hummel from UBS is concerned about?

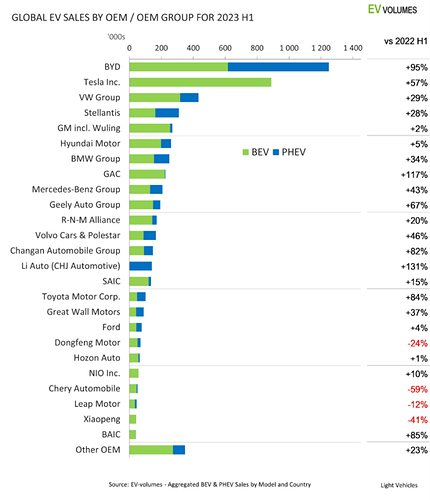

There is Geely and Changan with an EV market share of 5.2% and 4.5%, respectively in 2022. BYD had an EV market share of 29.7% in 2022.

SI=2%, I=8

-

The European commission has started an anti-subsidy investigation into electric vehicles coming from China as European Union gets frightened over the ability of its automotive industry to compete.

“Their price is kept artificially low by huge state subsidies. This is distorting our market,” European Commission President Ursula von der Leyen said.

“This is distorting our market. And as we do not accept this distortion from the inside in our market, we do not accept this from the outside,” She pointed out.

“Europe is open to competition but not to a race to the bottom. We must defend ourselves against unfair practices,” She said.

Justified worry as imports from China exploded in 2021

And Chinese brands planing to enter even more the market

Yeah. China may retaliate though, which won’t be good for European automakers with heavy presence in China. But Volkswagen may withstand it due to its Chinese partnerships.

-

Cui Dongshu, secretary-general of the China Passenger Car Association opposes EU commission probe and urges that the commission should be objective.

“China’s new energy vehicles exports are seeing stronger volumes not due to huge state subsidies, but because of the highly competitive China industrial supply chain from strong market competition domestically,” he said in a WeChat comment.

“Personally, I firmly oppose the EU’s assessment on China’s new energy vehicles,” he said.

“The EU should view the development of China’s electric vehicle industry objectively, rather than arbitrarily employing unilateral economic and trade tools to restrict the development or increase operating costs of China’s electric vehicle products in Europe,” he added.

-

He pointed out that Chinese vehicles sold in the mainland are retailing at twice the price of exports to Europe.

- According to KPMG, the average price of Chinese EV sold in Europe in 2022 was $30,000, lower than Tesla’s cheapest model 3 which was selling at more than $45,000.

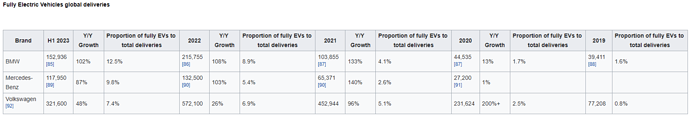

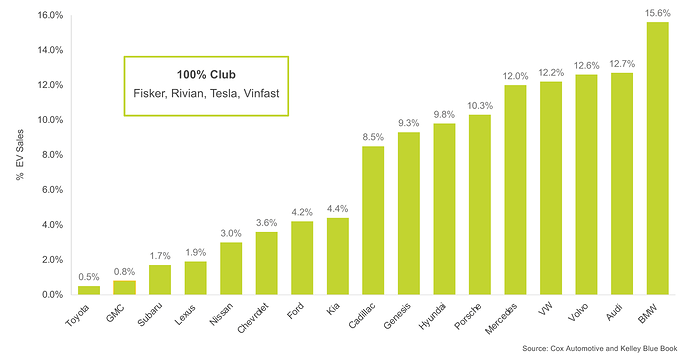

BMW and Mercedes-Benz seem to be doing well in the electric front. In the past two and half years, they have been doubling the percentage of BEVs to total deliveries. Also, during the 2023 IAA mobility conference, BMW and Mercedes-Benz showcased their upcoming EV models that will likely “close a large portion of the gap with Tesla and Chinese players,” said Daniel Roeska, senior research analyst at Bernstein Research. On the other hand, Volkswagen showed up empty-handed with regards to new EV models that will go into production in the near term.

I will rank BMW higher though due to the following:

- Among the three brands, BMW is moving faster when it comes to transition to EVs.

- BMW won the title “company car of the year” in six out of 18 categories during the IAA conference where 213 models competed.

- BMW ranks second in China when it comes to tech features in its cars, followed by Xpeng, Tesla and VW, according to a consumer survey by AlixPartners.

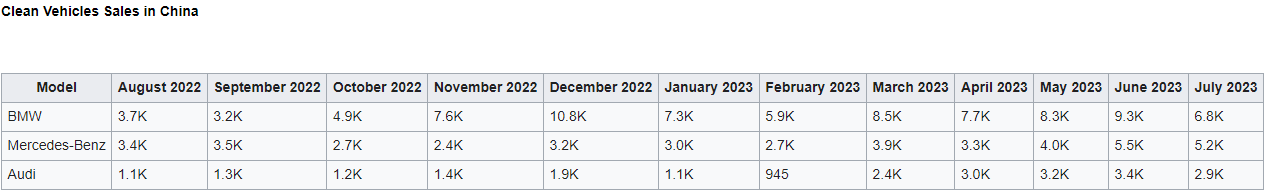

- BMW is selling almost twice as many clean vehicles as Mercedes-Benz in China.

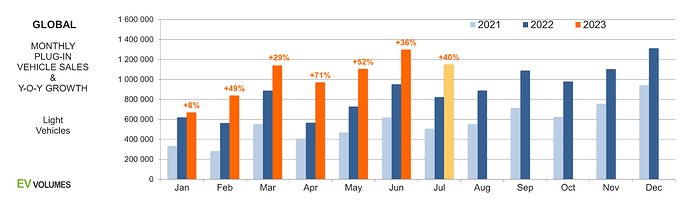

A total of 6 million new Battery Electric Vehicles (BEV) and Plug-in Hybrids (PHEV) were delivered during the first half of 2023, an increase of +40 %. 4,27 million were pure electric BEVs and 1,76 million were PHEVs

- BEVs (10 %) and PHEVs (4,1 %) stood for 14,1 % of global light vehicle sales at the close of H1, compared to 11,3 % in 2022 H1.

- China EV sales increased by +37 % in 2023 H1 y/y, compared to +82 % in 2022 vs 2021

- Sales in Western and Central Europe were up +28 % in H1 compared to just +15 % growth in 2022

- EV sales in USA and Canada are +50 % higher YTD to June than last year.

- For the full year of 2023, expect sales of 14 million EVs, growth of +33 % over 2022, with BEVs reaching 10 million units and PHEVs 4 million units.

https://www.ev-volumes.com/

EV exports by Chinese automakers grew 107% y/y in September to 91,000, data compiled by Bloomberg from China Passenger Car Association (PCA) shows.

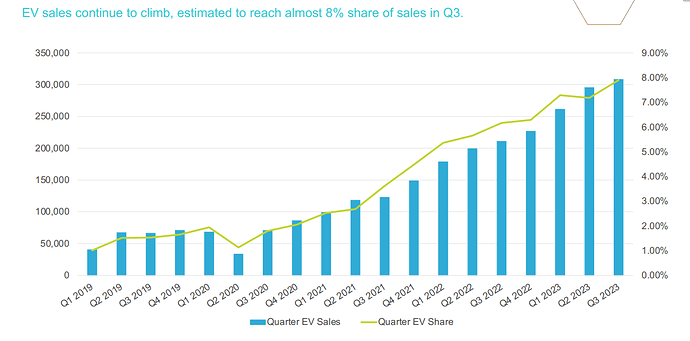

Electric vehicle (EV) sales volumes set another record in Q3, as total sales of battery-powered vehicles jumped past 300,000 for the first time in the U.S. market.

- Total EV sales in Q3 hit 313,086, a 49.8% y/y and an increase from the 298,039 sold in Q2.

- Year-to-date EV sales through September reached just over 873,000. The milestone of 1 million will likely be achieved in November.

- Electric vehicle sales accounted for 7.9% of total industry sales in Q3, a record and up from 6.1% a year ago and 7.2% in Q2

- The German luxury makes – Audi, BMW, and Mercedes – continue to rapidly increase sales of EV models. In Q3, BMW and Mercedes EV sales more than triple year-ago levels, while Audi posted an EV sales gain of 94%.

https://www.coxautoinc.com/wp-content/uploads/2023/10/Q3-2023-Kelley-Blue-Book-Electric-Vehicle-Sales-Report.pdf

Another Quarter, Another Record: EV Sales in the U.S. Surpass 300,000 in Q3, as Tesla Share of EV Segment Tumbles to 50% - Cox Automotive Inc.

I=4

Electrified vehicles accounted for 47.6% of all new car registrations in the EU between January to November 2023, up from 43% in the same period last year, data from the European Automobile Manufacturers Association (ACEA compiled by Reuters showed.

I=3

The China Passenger Car Association projects that deliveries of battery-electric and plug-in hybrid vehicles to dealers will increase by 25% to 11 million units in 2024, a slowdown from 36% growth in 2023 and a 96% rise in 2022.

I=4

- Tesla cuts prices of its EVs again as competition grows and demand weakens.

- In Germany, prices of its two Model Y versions were slashed by 5,000 euros.

- In China, price of Model 3 was reduced by 5.9% to 245,900 yuan while the starting price of Model Y was lowered to CNY258,900 from CNY266,400.

I=5

- According to PWC, German automakers have picked up in China with respect to electric vehicles.

- EV sales of German car makers increased by 49% y/y in 2023, hence they grew twice as fast as the overall market.

- In Q4 2023, their sales rose 63% y/y, hence they grew three times as fast as the overall market.

- Their market share rose by 1% to 5% in 2023.

I=4

- Tesla introduces fresh discounts and price cuts in China and U.S.

- In China, Tesla is reducing prices of Tesla Model Y and Model 3 by $5,000 through March.

- In U.S, it is offering 5,000 miles of free use of its Superchargers but eliminating its February discount on Model Y.

I=6, March 5, 2024

- The European Commission said it has evidence that the Chinese government is subsidising EVs exported to Europe through “direct cash transfers” and other means.

- Their probe is expected to end in November though they could impose provisional tariffs as soon as July.

https://europe.autonews.com/automakers/europe-weighs-retroactive-tariffs-chinese-ev-imports

Those tariffs could play an important role in alleviating the Chinese challenge in Europe’s transition to EVs.

Additionally, recent data shows a slowdown in pure BEV growth in Europe, which is seemingly a response to customer preferences. I think you reported about various OEMs scaling back @Aron?

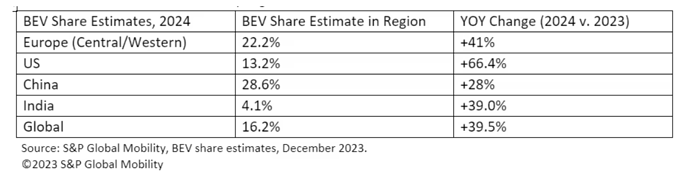

Do we have a current estimated growth trajectory for EVs in various regions?

If the slowdown persists, it could provide some breather for established OEMs although not being good for the world.

Yeah, automakers are either scaling down or delaying their EV plans.

But global EV sales is still expected to see growth. S&P Global forecasts that global EV sales will rise by 38.5% in 2024 to 13.3 milion units, with all regions seeing growth in EV share of total sales.

Recently, Goldman Sachs lowered their outlooks for EV share of new light vehicles in Europe from 2026 and beyond and in U.S from 2024 and beyond.

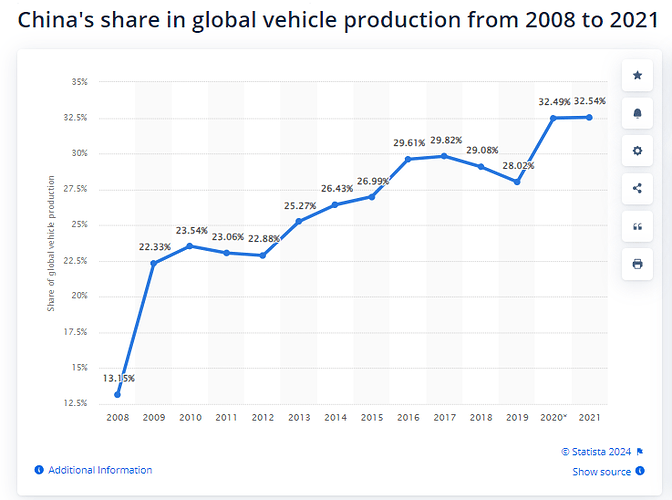

If the US and Europe regions decide to scale back in EV investments, couldn’t this mean China OEMs will take even more market share in the long term if they instead decide to maintain the investments during this period?

Especially if they start to offer cheaper options. I would not expect the decline in demand to last for a very long time, low affordability is imo 1 of biggest problems, and Chinese cars would offer a solution for this.

China was very clever imo in 2009 to take advantage of the weakness in the US and Europe with aggressive stimulus. And after COVID shortages, it was similar to a lesser extent their market share gain.

Thus, I would not be surprised if they applied similar tactics with EVs, though this time their economy is also weak, but they are already giving them subsidies.

If Europe impose tariffs to China Imports, wouldn’t the Chinese government retalied with Europe manufactures in China?. They could end up losing more if not careful.

BYD is already planning to build plants in Mexico and Hungary to avoid these tariffs too.