Moody’s Research:

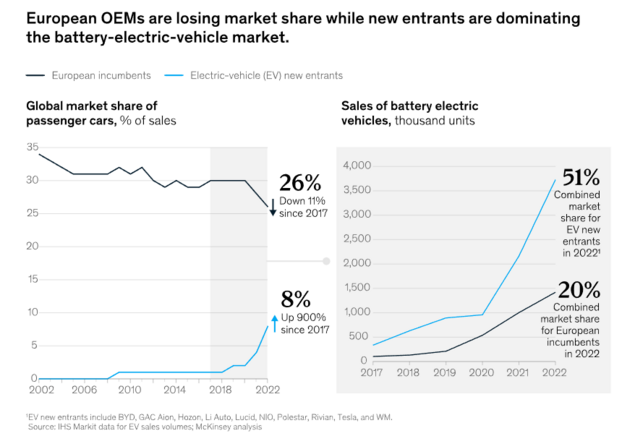

According to Moody’s, EU auto industry is becoming less competitive, especially since the introduction of EVs, and has been losing market share to new entrants, especially from China.

They said current research shows that successful automakers are developing cars defined by software. This will disrupt the old supply chain for the need for a completely new one.

They point out that despite current initiatives being a positive step, the projected supply and capacity are still insufficient to meet the region’s anticipated demand by 2030.

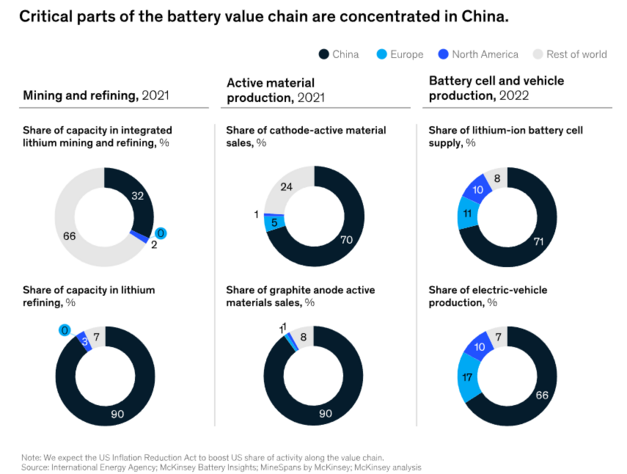

Is especially important that the current battery value chain is largely controlled by Chinese companies, in an environment where decoupling and deglobalization efforts are being talked and planned.

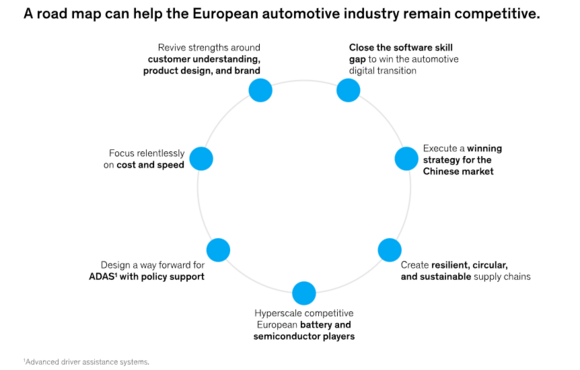

Some of the most important changes needed according to them:

- Reduce cost by adopting structural product design, vertically integrating battery production, scaling EV production, and improving productivity.

- To maintain market share in China, they need to produce vehicles more appealing and tailored to Chinese consumers’ needs and preferences, as Chinese brands are doing.

- To cover European battery demand locally, an additional 20 gigafactories, a €35 billion investment, would be needed. The continent would also need 37 new semiconductor fabs to cover local demand, requiring a €190 billion investment.

- Only 15 to 20 percent of current R&D workers at European incumbents have software skills, compared with almost 45 percent at new entrants.To shrink the gap, industry stakeholders would need to find holistic solutions

- The industry will need a cumulative €300 billion worth of infrastructure investments in electricity generation, the electricity grid, EV chargers, and hydrogen refueling systems through 2030.

https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/a-road-map-for-europes-automotive-industry#/