This topic is centered around Vonovia and our investment in it.

Discussion about Vonovia in archived discord channel

Original posts in archived discord channel

I just doubled the Vonovia position which is now approx. 40% of the Deutsche Wohnen position given interest rates came down by a lot and further rate hikes are now less certain than before. (1) https://finanzmarktwelt.de/ezb-unter-druck-zinsschritt-von-05-prozentpunkten-nicht-sicher-264121/

EZB unter Druck: Zinsschritt von 0,5 Prozentpunkten nicht sicher

Vor wenigen Tagen galt eine Zinserhöhung der EZB am Donnerstag noch als sicher. Doch die Banken-Krise in den USA hat die Zinserwartungen…

- [9:18 PM]

price 20.38€

March 16, 2023

Aron~Bluesky — 03/16/2023 8:27 PM

SI=-4%, I=10 -Vonovia 2022 revenue grew by 19.9% to 6.26 billion euros, putting its revenue at the lower end of the guidance given by the management during Q3 2022 earnings. The management had forecasted revenue to come in between 6.2 and 6.4 billion euros(+21% at the midpoint). -Adjusted EBITDA was 2.76 billion euros(+23%). Also at the lower end of the guidance, which was 2.75-2.85 billion euros(+24% at the midpoint) -Group FFO grew 20.1% in 2022 to 2.04 billion euros(2021: 1.69 billion euros) in-line with management guidance of 2.0-2.1 billion euros (+21% at the midpoint). -Vonovia said it will propose a dividend of 0.85 euros per share(2021: 1.66 euros per share). -It said it expects revenue in 2023 to be between 6.4 billion and 7.2 billion euros(+8.6% at the midpoint). -It also said it expects adjusted EBITDA to be between 2.6 and 2.85 billion euros(-1.3% at the midpoint). -Group FFO is being guided to be between 1.75 and 1.95 billion euros(-9.3%). -CEO Rolf Buch said,

“The consequences of Russia’s war of aggression meant that central banks across the globe had to raise interest rates at an unprecedented speed. In a regulated market, our business model, which is stable in the long run, reacts to changes like these with a time delay. This also has an impact on some of our key figures.” “The demand for housing will continue to rise this year, but the market environment will remain challenging.” He added

Presentations - Vonovia - Investor Relations (edited)

Vonovia - Investor Relations

Presentations - Vonovia - Investor Relations

All relevant information on the latest presentations of Vonovia SE.

1

March 22, 2023

Aron~Bluesky — 03/22/2023 10:24 AM

SI=-3%, I=6 -Morgan Stanley lowered Vonovia’s rating to “underweight” from “equal-weight” while also cutting its price target to 19 euros from 30 euros. -Analyst Bart Gysens said that for continental European real estate companies yields are too low yet rental income risks are high. -He noted that Vonovia’s measures to strengthen its balance sheet is looming after it failed to eliminate dividends completely. Morgan Stanley downgrades Vonovia to 'Underweight' - Target 19 euros -March 22, 2023 at 04:05 am EDT | MarketScreener

Morgan Stanley downgrades Vonovia to ‘Underweight’ - Target 19 euro…

U.S. investment bank Morgan Stanley downgraded Vonovia to underweight from equal-weight and cut its price target to 19 euros from 30 euros. In continental European real estate companies, yields are… | March 22, 2023

March 27, 2023

@Aron~Bluesky

@Aron~Bluesky

SI=-3%, I=6 -Morgan Stanley lowered Vonovia’s rating to “underweight” from “equal-weight” while also cutting its price target to 19 euros from 30 euros. -Analyst Bart Gysens said that for continental European real estate companies yields are too low yet rental income risks are high. -He noted that Vonovia’s measures to strengthen its balance sheet is looming after it failed to eliminate dividends completely. Morgan Stanley downgrades Vonovia to 'Underweight' - Target 19 euros -March 22, 2023 at 04:05 am EDT | MarketScreener

Pirate Captain — 03/27/2023 10:01 AM

I don’t like the fact they did not eliminate their dividends. What i could imagine is that funds have a requirement for dividends but from a company perspective it is not wise to distribute cash to investors at this time (edited)

2

@Pirate Captain

@Pirate Captain

I don’t like the fact they did not eliminate their dividends. What i could imagine is that funds have a requirement for dividends but from a company perspective it is not wise to distribute cash to investors at this time (edited)

Aron~Bluesky — 03/27/2023 5:38 PM

-It plans to dispose assets valued at €2bn during FY2023. -Its €2.2bn of unsecured bonds will mature in 2023. Vonovia/German property: stately pile of debt needs underpinning

Subscribe to read | Financial Times

News, analysis and comment from the Financial Times, the worldʼs leading global business publication

April 26, 2023

Aron~Bluesky — 04/26/2023 9:37 AM

SI=4%, I=8 -Vonovia to sell its Suedewo residential portfolio to U.S. investor Apollo for 1 billion euros ($1.10 billion). -Suedewo portfolio is currently valued at 3.3 billion euros, a 5% discount to its fair value in December 31. -Vonovia targets to generate 2 billion euros free cash flow from its portfolio sales. -In summer, it earmarked properties worth 13 billion euros for sale. 12ft

1

May 4, 2023

Aron~Bluesky — 05/04/2023 9:29 AM

SI=-3%, I=8 -Vonovia Q1 2023 revenue declined 12.2% to € 1.43 billion. -EBITDA declined 10% y/y to €728.7 million. -Rental revenue grew 2.6% y/y to €800.2 million. -Group FFO per share declined 17.8% to €0.73.

“The housing market was tense in the first three months of the year. Our core business - residential property management - is healthy and developed positively even in this difficult environment. The sales business declined as expected,” CEO Rolf Buch said.

-Market value of its real estate portfolio declined 3.7% Q/Q to €91.2 billion from €94.7 billion.

“Our valuation certainly offers the greatest possible transparency with regard to the challenging situation in Q1 2023. However, this valuation is a snapshot. Especially since we are seeing larger transactions again for the first time in the second quarter. Furthermore, the following applies unreservedly: The current market environment with increased capital and construction costs accelerates the megatrends that we are using as the basis of our business,” says Buch.

-Vonovia sold today five real estate portfolios( 1,350 residential units in Frankfurt, Berlin and Munich) to CBRE Investment Management for around €560 million. -The company is now able to cover 2023’s refinancing needs in full as well as two-third of the refinancing due in 2024.

“Amounting to a total of more than €1.5 billion, we already have almost reached our sales target for this year. Furthermore, we assess the results of our negotiations as a positive signal for the entire business: after a very difficult first quarter 2023 with little movement, the market is cautiously opening. Buyers and sellers can come to an agreement again. This in itself is a cause for optimism,” Buch said

-Vonovia maintained its 2023 revenue, EBITDA and Group FFO. – Company Announcement - FT.com Presentations - Vonovia - Investor Relations (edited)

EQS-News: Vonovia makes a solid start into the new financial year w…

The latest company information, including net asset values, performance, holding & sectors weighting, changes in voting rights, and directors and dealings.

Vonovia - Investor Relations

Presentations - Vonovia - Investor Relations

All relevant information on the latest presentations of Vonovia SE.

ThreadQ1/23 Vonovia results2 Messages ›

There are no recent messages in this thread.

- Pirate Captain started a thread: Q1/23 Vonovia results. See all threads. — 05/04/2023 11:04 AM

May 10, 2023

Aron~Bluesky — 05/10/2023 3:52 PM

SI=0%, I=7 -Vonovia offered a series of sweeteners to have Apollo purchase its 30% of portfolio. -Apollo will get around 70% of the dividends and will not pay asset-management fees. -This will take the discount to 30% of the book value, way above the 5% discount announced by the company when closing the deal. -The revelation casts a shadow on the deal that suggested that pricing was firming and confidence was returning to the German property market. -Chief Executive Officer Rolf Buch said during the earnings call that Apollo was getting higher dividends from the portfolio because it “has no minority protection rights in the deal.” -He added that the sale included a call option that will allow Vonovia to buy the assets back at a price that caps the private equity firm’s return, meaning it could claw the properties back at a discount in future. -Vonovia also sold properties to CBRE Investment Management for €535 million after taxes and transaction costs, reflecting a discount of 11%. Vonovia Offered Hidden Sweeteners to Get €1 Billion Apollo Deal - Bloomberg (edited)

1

May 12, 2023

@Aron~Bluesky

@Aron~Bluesky

SI=0%, I=7 -Vonovia offered a series of sweeteners to have Apollo purchase its 30% of portfolio. -Apollo will get around 70% of the dividends and will not pay asset-management fees. -This will take the discount to 30% of the book value, way above the 5% discount announced by the company when closing the deal. -The revelation casts a shadow on the deal that suggested that pricing was firming and confidence was returning to the German property market. -Chief Executive Officer Rolf Buch said during the earnings call that Apollo was getting higher dividends from the portfolio because it “has no minority protection rights in the deal.” -He added that the sale included a call option that will allow Vonovia to buy the assets back at a price that caps the private equity firm’s return, meaning it could claw the properties back at a discount in future. -Vonovia also sold properties to CBRE Investment Management for €535 million after taxes and transaction costs, reflecting a discount of 11%. Vonovia Offered Hidden Sweeteners to Get €1 Billion Apollo Deal - Bloomberg (edited)

Pirate Captain — 05/12/2023 9:44 PM

oh that’s bad. I’d say it’s a 8 or 9 in terms of importance as those are news that significantly deviate from what was communicated before

1

May 18, 2023

Aron~Bluesky — 05/18/2023 11:46 AM

SI=0%, I=7 Yesterday, Vonovia held its 2023 annual general meeting. Here is a summary of what happened during the meeting; -Shareholders approved the €0.85 per share dividend. -Shareholders elected a new chairperson of Supervisory board. -Union Investment, one of the major shareholders heavily critised the company on matters to do with communication and capital position. -CFO Philip Grosse defended the company’s capital position. -CEO Rolf Buch said they are ready to sell apartments to avoid further capital increase. Read more here: Vonovia: Anual General Meeting /2023 - InvestmentWiki (edited)

InvestmentWiki

May 24, 2023

Pirate Captain — 05/24/2023 2:24 PM

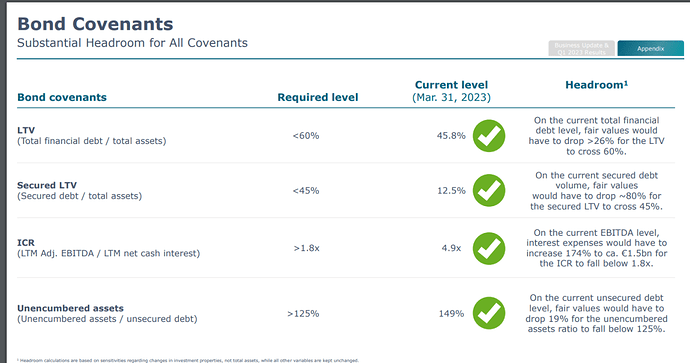

Cool summary @Aron~Bluesky. Can you find out at which LTV % Bond Covenants trigger for Vonovia? My guess would be 60%

1

Aron~Bluesky — 05/24/2023 3:33 PM

SI=-1%, I=5 -Warburg Research lowered price target on Vonovia from 40 euros to 38.60 euros but left the rating on Buy. -The company is making progress on real estate disposals aimed at improving its balance sheet and liquidity, analyst Simon Stippig wrote. ANALYSE-FLASH: Warburg Research senkt Ziel für Vonovia auf 38,60 Euro - 'Buy' | 24.05.23 | finanzen.at

@Pirate Captain

@Pirate Captain

Cool summary @Aron~Bluesky. Can you find out at which LTV % Bond Covenants trigger for Vonovia? My guess would be 60%

Aron~Bluesky — 05/24/2023 3:52 PM

yeah, 60% https://static.seekingalpha.com/uploads/sa_presentations/360/93360/original.pdf (page 39)

Aron~Bluesky — 06/12/2023 12:13 PM

SI=-1-2%, I=5 -Goldman Sachs lowers Vonovia price target to 38.20 euros from 35.40 euros but maintained the buy rating. -The price target adjustment reflects a higher cost of capital. -He noted that the real estate industry correlates negatively with rising bond yields. -He added that debt concerns in the real estate sector also weighs in. GOLDMAN SACHS stuft Vonovia auf 'Buy' - 12.06.2023