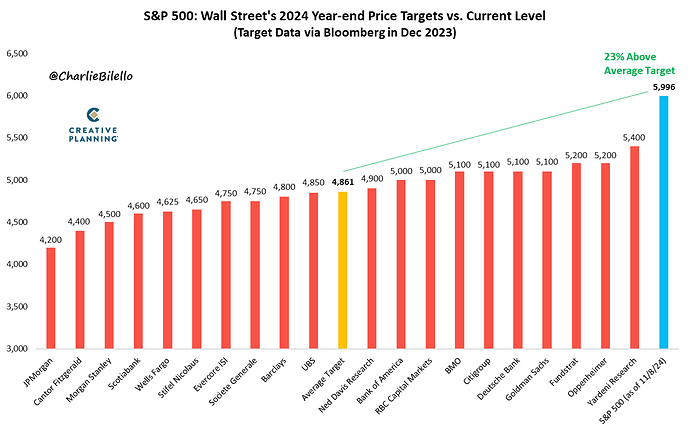

Yardeni current targets are 5,400 by 2024, 6,000 by 2025 and 6,500 by 2026.

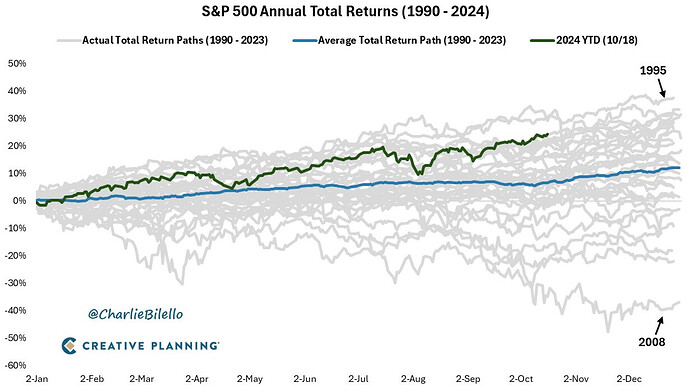

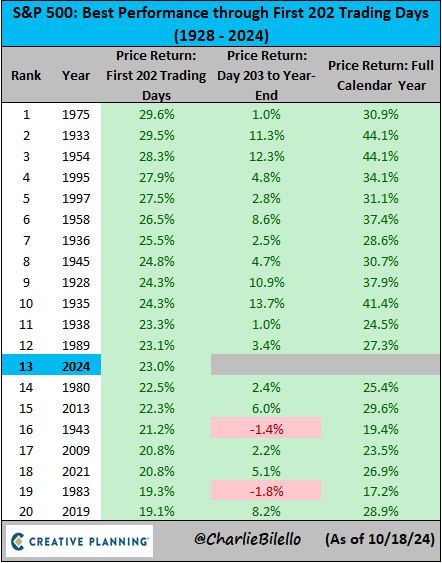

The S&P500 is on track to have one of its best years since 1990 at 24% currently, and the 13th best ever.

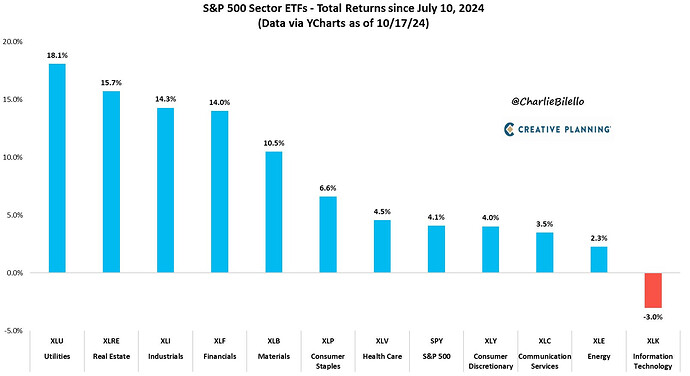

Interesting the rotation that has happened since July after rate cuts became clear

SP500 is now above every single major institution target at the beginning of the year, an incredible year for the markets

It also tells a lot about the forecasting abilities of analysts and the difficulty of doing this, especially for the market.

5 posts were merged into an existing topic: Retail Investors Market Sentiment and Positioning

“Smart money” is reducing long exposure to US equities

- Leveraged funds and asset managers net S&P 500 futures positions tumbled by nearly $80 BILLION despite a small pick-up last week.

3 posts were merged into an existing topic: CTAs Market Positioning

SP500 Price Targets Revised Down but Still Expected to be up 25% in 2025

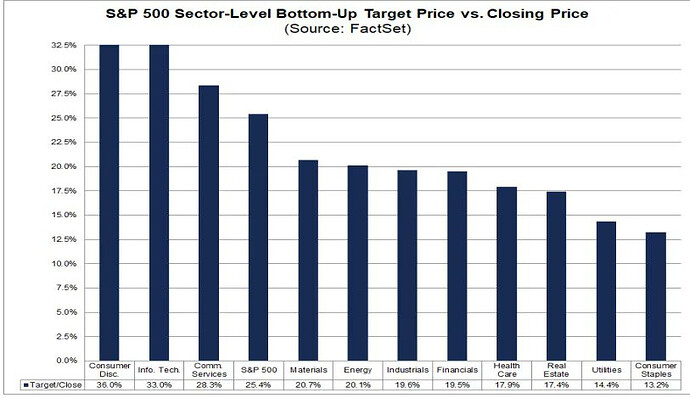

Factset’s analysis of analyst bottom-up SPX price targets for the next 12 months as of Thursday saw the first softening in as long as I can remember falling -17pts w/w to 6,926 (but which would still be +25.4% from Thursday’s close), and still up ~1,993 points over the past 48 weeks.

Consumer Discr (+36.0% (up from +24.7% two weeks ago) flip flops again with Tech (+33.0% (up from +24.8% two weeks ago)) as the sector with the largest upside seen by analysts (the other megacap growth sector, Comm Services is third at +28.3%), while Consumer Staples remains as the sector expected to see the smallest price increase (+13.2% but up from +7.4% last week).

As a reminder the last 20 yrs they have been on avg +6.3% too high from where they start the year (which was 6,755), but note they underestimated it five of the past six years (including 2024).

https://x.com/neilksethi/status/1901650985434648646

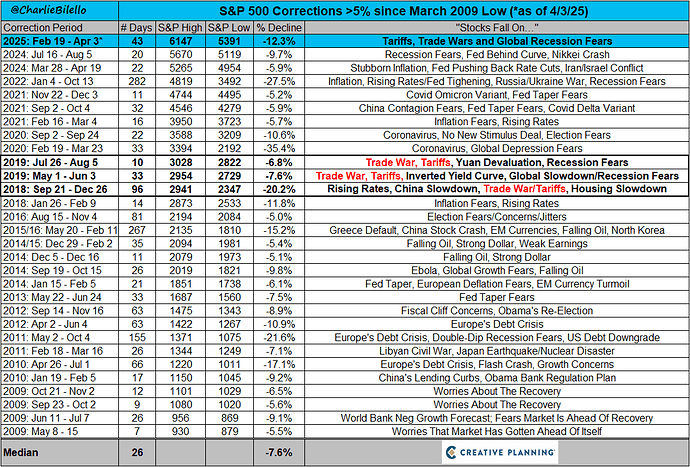

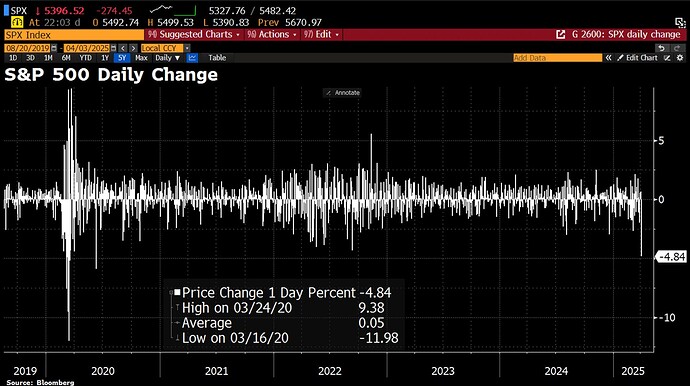

The S&P 500 fell 4.8% today, its biggest 1-day decline since June 2020.

- The S&P 500 is now down over 12% from its peak on February 19, the biggest drawdown since 2022. This is the 30th correction >5% and 10th correction >10% since the March 2009 low

- The Magnificent 7 Index is now down over -30% from its all time high seen on December 18th.

I=7

S&P 500 futures rose 0.4% while Nasdaq 100 futures gained 0.3% after Trump said he won’t use force to acquire Greenland

“We never asked for anything, and we never got anything. We probably won’t get anything unless I decide to use excessive strength and force, where we would be, frankly, unstoppable. But I won’t do that. Okay? Now everyone’s saying, Oh, good. That’s probably the biggest statement I made, because people thought I would use force. I don’t have to use force. I don’t want to use force. I won’t use force.”

He, however, said he is seeking immediate negotiations to discuss acquisition of Greenland by United States.

I=8

S&P 500 shed 1.1% while Nasdaq composite lost over 1.5% as concerns that AI will impact margins of a number of businesses grow

Futures shed more than 1% as concerns that AI will disrupt business models of whole industries and raise unemployment grows.

The rout extended to financial stocks and real estate sector from software companies.

I=7

Nasdaq Composite sheds 1%+ while S&P 500 futures is down 0.7% as AI fears on software stocks return

I=7

Stock futures shed more than 1% in rection to Trump’s tariffs

I=8

S&P 500 futures is down 1.2% while Nasdaq Composite is down 1.9%, driven by Nvidia which failed to impress investors

I=8

Nasdaq 100 and DAX sheds more than 2% as the war against Iran by U.S. and Israel continues

- Nasdaq 100 and DAX futures are down more than 2% as the war against Iran by U.S. and Israel continues.

- Meanwhile, oil futures are up more than 8.8%.

I=7

S&P 500 +0.6%, Nasdaq +1.2% as ADP beats expectations and Iran’s reported outreach on ending conflict

Stocks rose after ADP jobs report beat expectations and on reports that Iran indirectly reached out to the U.S. to discuss the terms for ending the war.

I=7

Stock futures shed more than 1% as concerns over the Iran conflict continue to mount

S&P 500 and Nasdaq Composite shed more than 1% as concerns over the Iran conflict flared up again and oil prices top $79 per barrel, the highest since June 2025.

I=7

Stock futures fall more than 1.5% as oil prices rise more than 13% amidst oil output cuts by some Middle East counties as the Iran conflict continues

S&P 500 and Nasdaq 100 futures lost more than 1.5% while DAX sheds 2.5% on concerns over oil distruption in the Strait of Hormuz and potential escalation of Iran conflict following the naming of Mojtaba Khamenei as new Supreme Leader.