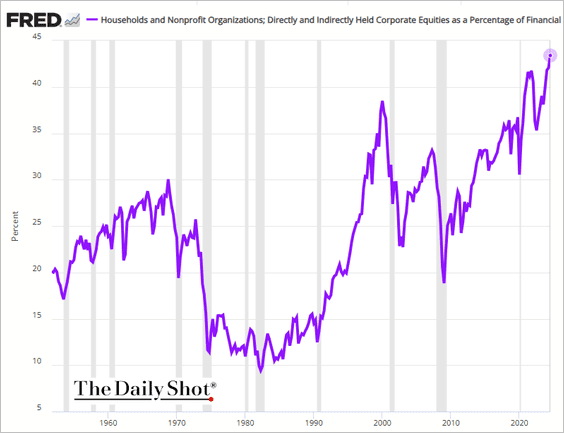

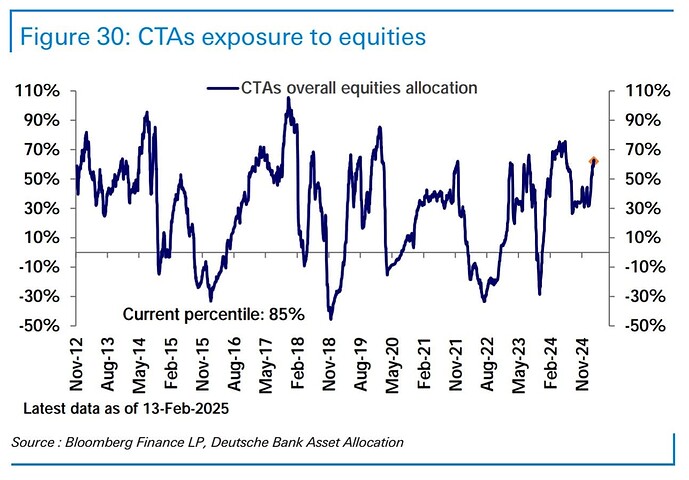

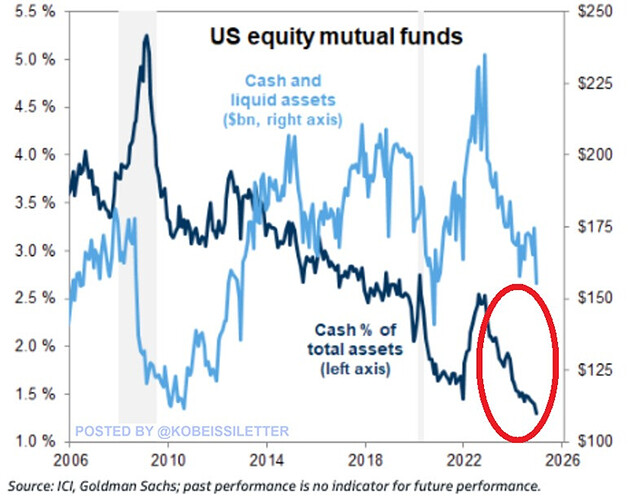

Equity Positioning was extreme in CTAs, Equity Mutual Funds and Households

Due to this I think if bad sentiment continues with upcoming data we could see a singificant market correction.

Overall I feel we need to be more up to date on positioning of different actors, and implied market pricing for growth and inflation. Because extreme sentiment accompanied with some unexpected news could create a significant headwind/tailwind,despite the economic conditions still seemingly relativily ok (with some risk on the hirizong like Trump policies).

The downside if that this type of data is not free, and only shared once in a while in news or X.

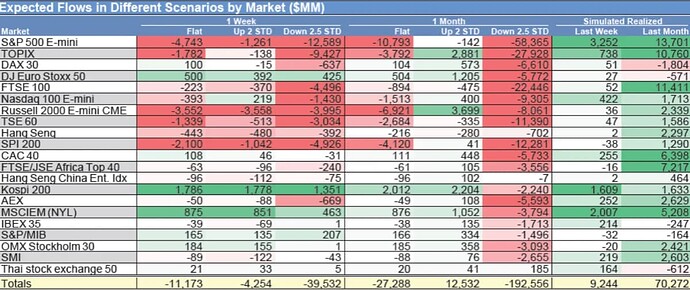

According to Cullen Morgan of Goldman Sachs Group, after a global buy of 9 billion dollars’ worth of stocks last week, the size of CTA’s Global Equity long positions reached 158 billion dollars (90th percentile). Now they have started to sell. They will be sellers in most scenarios next month.

In the next month:

- Flat: Sold 27 billion dollars (including Sell 11 billion dollars of S&P 500 Index)

- Up: Buy 12.5 billion dollars (Sell 0.142 billion dollars of S&P 500 Index)

- Down: Sold 193 billion dollars (including Sell 58 billion dollars of S&P 500 Index)