Labor Report Assessment for November 2024

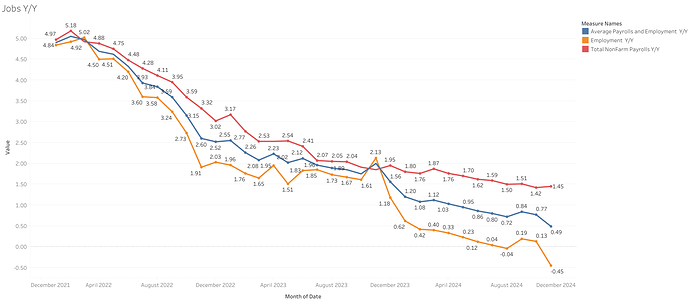

Although this month’s payroll rebound reflects a recovery from last month’s weather-induced weakness, my assessment remains that the labor market is continuing its gradual and protracted slowdown.

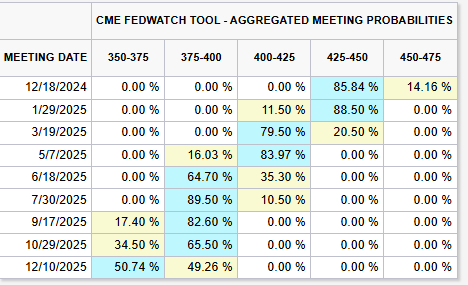

This dynamic, coupled with the rise in the unemployment rate, has bolstered market confidence that the Federal Reserve will cut rates by 25 basis points in its upcoming meeting. However, expectations for additional rate cuts in 2025 remain modest

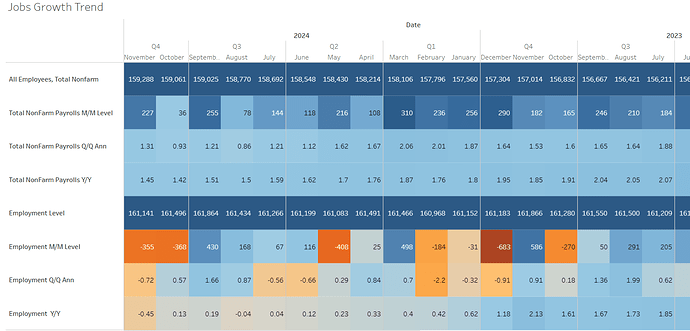

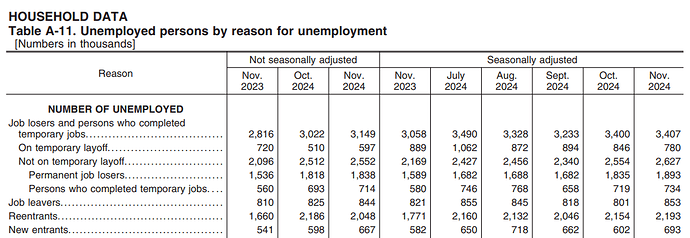

Payroll growth remained stable this month, while employment continues to weaken more

- Payrolls grew by 227k, 1.45% y/y

- Employment declined by -355k, -0.45% y/y

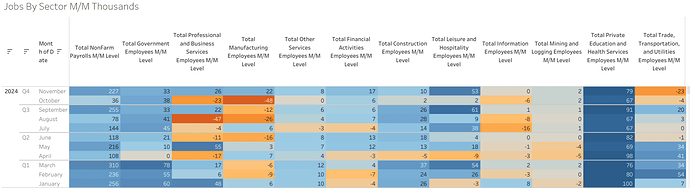

All Job categories saw a rebound from last month

- Industries such as manufacturing, information, business services, financial activities, and trade and transportation are experiencing stagnant or declining job growth rates.

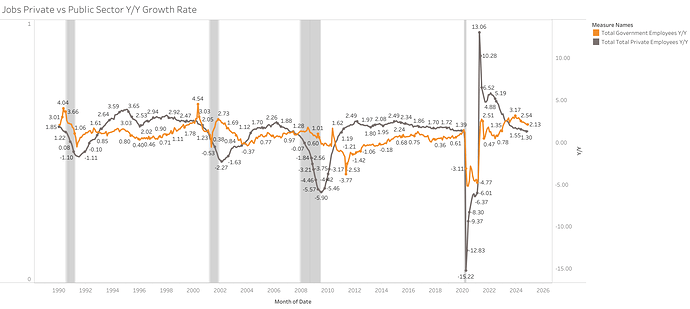

- Job growth within the government sector continues to outpace that of the private sector significantly.

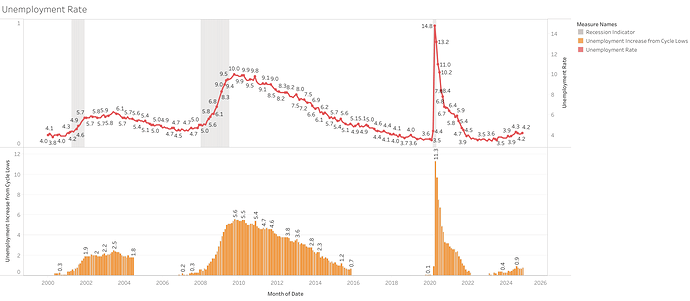

Unemployment rate increased to 4.245%. Unemployment data is still on a weaker path.

- The number of unemployed individuals rose by 161,000, reflecting a 14.1% year-over-year increase (+883,000).

- The labor force declined by 193,000, with the participation rate remaining below 2019 levels, despite a rise in immigration.

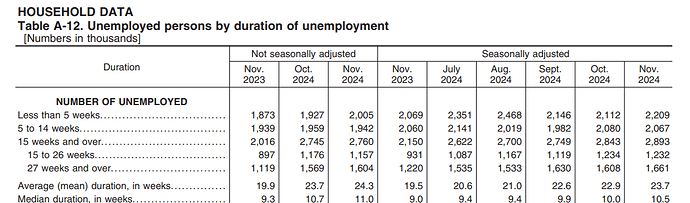

- The duration of unemployment is lengthening, indicating that the labor market is taking more time to absorb newly unemployed individuals.

- The U6 unemployment rate climbed to 7.8%.

- The increase in unemployment was broad-based across reasons, except for temporary layoffs, likely influenced by weather-related effects last month.

- Permanent job losers increased by 58k, and is 19% y/y

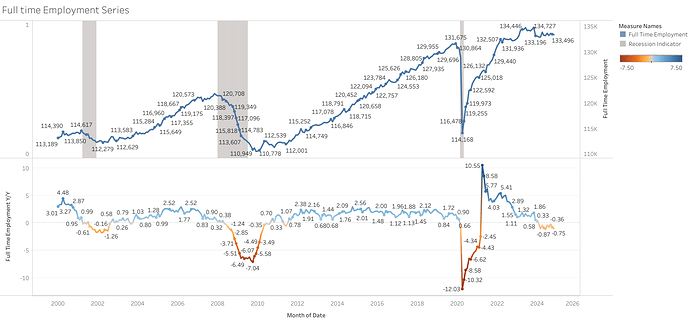

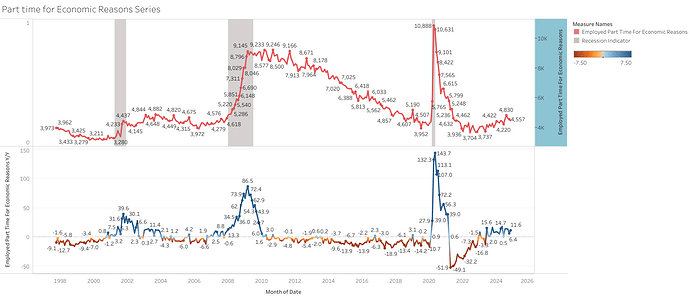

Full time employment continues to be weak, while part time for economic reason high y/y.

- Full-time employment declined by -111k, and is still negative -1% y/y

- Part-time for economic reasons declined by 100k, but is still up by 11.59% y/y