Yeah, it could have been an initial push in sentiment after rate cut expectations increased. It just remains to be seen if it will hold up the same after revisions, but markets/fed will react based on these for now.

The report is not aligned with anecdotal data, both PMI from ISM and SP Global1 2 showed weaker/contracting employment trends in September.

In other cases, I would say trusting the government data is better, but I am not so sure anymore.

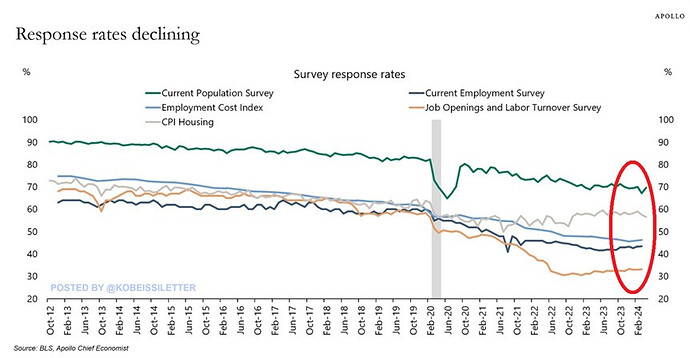

The response rate of government labor surveys is also very low currently, and it could be playing a role in the quality of data.

I don’t have specific expectations about immediate changes in jobs, but my best guess is that we’re unlikely to see significant weakness in the near term, probably still above 100k a month.

A negative payroll print doesn’t seem imminent either.

While I do anticipate a gradual increase in unemployment, especially considering that employment data appears weaker compared than the payroll numbers, but it’s likely to rise more slowly than in other periods.

The US has added on average 88k per month in the labor force since 2010, so it does not need negative payroll growth either to see unemployment increasing significantly.