Topic to discuss developments in corporate debt, maturities, defaults, and all important news related to the financial health of the corporate sector.

Main Article: https://www.investmentwiki.org/wiki/Corporate_Debt

Topic to discuss developments in corporate debt, maturities, defaults, and all important news related to the financial health of the corporate sector.

Main Article: https://www.investmentwiki.org/wiki/Corporate_Debt

Sometimes I wonder if the market is really hoping for super-low rates again, so these companies can refinance easily, and not become a real problem at some point. As I don’t see this being talked about that much or at all, and credit spreads remain very tigh.

Fathom Consulting is a London research firm, that classifies all quoted US companies by their Altman Z-scores — a measure promulgated by the New York University professor Edward Altman to estimate how close they were to bankruptcy. It combines concepts such as account profitability, leverage, liquidity, solvency, and activity ratios.

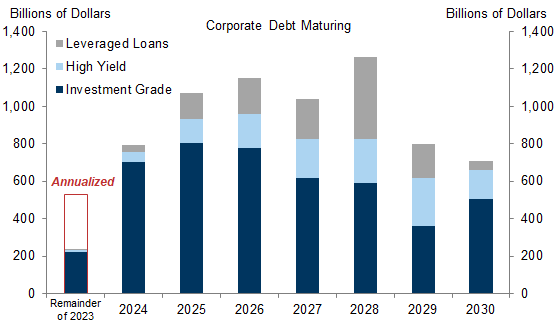

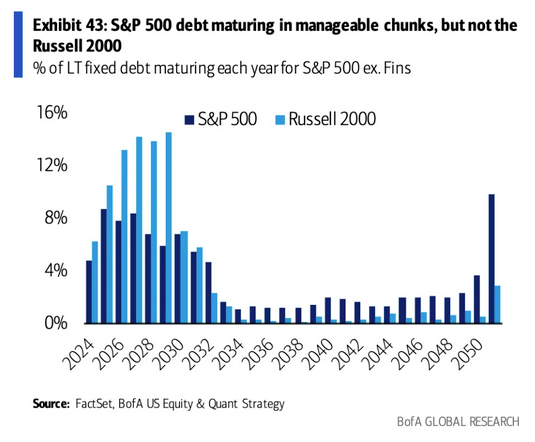

Significant maturities coming in next 2/3 years:

Markets are already thinking of ways to avoid problems with the significant maturities coming from 2024 onwards.

This can probably help in the short term, but not sure is the best for the long-term to leverage even more those companies.

I still think is healthy and a normal part of the business cycle to let unproductive firms fail even if it comes with short-term pain, but they probably will continue to do everything they can to avoid it.

Investment banks including JPMorgan Chase & Co. are attempting to bring so-called payment-in-kind debt to the leveraged loan market. The so-called PIK option would be used in amend and extend deals, which allow firms to push back the maturities on their debt to avoid refinancing in a higher interest rate environment.

The structure would theoretically work like this: around 20% to 25% of the interest expense on the amended loan would be switched into PIK, with the remainder paid in cash, the people said. The PIK interest accrues, and is only paid off when the borrower refinances, or pays the loan down.