Airlines Q3 3023 results summary:

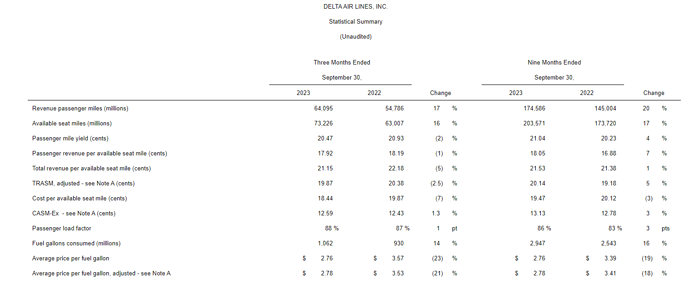

Delta Airlines

Says they continue to see strong demand, especially in the transatlantic segment. While demand is strong, revenue per available seat mile and passenger yield are down y/y and q/q in Q3.

They mentioned their is some discounting happening in the industry, but their fares are holding up well due to the premium segment.

Robust demand for travel on Delta is continuing into the December quarter where we expect total revenue growth of 9 percent to 12 percent compared to the December quarter 2022 with total unit revenue (TRASM) expected to decline 2.5 percent to 4.5 percent. Within this outlook, Domestic and Transatlantic trends are consistent with the September quarter on a year-over-year basis, while unit revenue trends in the Pacific and Latin America are expected to modestly decelerate given capacity growth related to China re-opening and investment in our LATAM JV

Business travel continues to see increased growth

Our recent corporate survey indicates continued growth in business demand with a significant majority of companies expecting their travel to stay the same or increase as we move into 4Q and into '24. SME and hybrid travelers are producing margins in line with corporate travelers and demand from these travel remains well above 2019 levels.

Domestic demand expected to moderate

Domestic demand remains steady and initial bookings for the peak holiday periods are strong. The ongoing UAW and actor strikes are having a modest impact and we have incorporated those into our outlook. As we move through the fourth quarter, our Domestic capacity growth moderates and, in the first quarter of 2024, we expect domestic capacity to be flat to slightly down year-over-year.

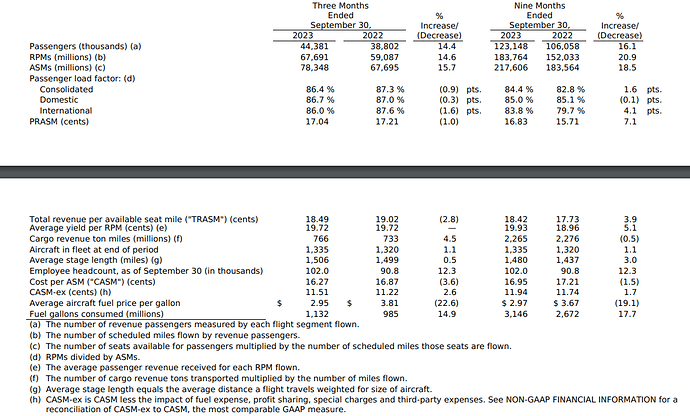

United Airlines

Very similar history to Delta Airlines.

Total third-quarter top line revenue was up 12.5% year-over-year, a record revenue quarter and near the high end of guidance. United experienced a strong and steady domestic demand environment in the quarter, with 9% revenue growth year-over-year, outpacing second quarter results. The company saw strength in close-in bookings in August and September with both months well ahead of year-over-year demand.

In the international space, profits were at record highs in both the Atlantic and Pacific regions. Revenue in the Atlantic region was up 15% versus the same quarter in 2022, and 70% versus the same quarter in 2019. Pacific revenue exceeded third-quarter 2019 levels despite capacity remaining 24% below third-quarter 2019. Domestic revenues in the quarter were second highest all-time and the domestic system remains solidly profitable.

Q4 still expected to have healthy growth.

Turning to our outlook for the fourth quarter. We expect total revenue to be up approximately 10.5% on approximately 15.5% more capacity. This implies TRASM will be down around 4.5% year-over-year. United’s Q4 unit revenue expectations are consistent with Q3 adjusted for stage.

Demand for the Atlantic and the Pacific was truly outstanding, and we see that trend continuing into the fourth quarter. Third-quarter domestic PRASM results were consistent with our year-over-year performance in the second quarter down 2.1 points. In other words, we saw no real change in our domestic trends in the quarter-over-quarter review. Our focus on prudent gauge growth centered in our hubs resulted in strong positive marginal revenue on our incremental capacity.

https://www.united.com/en/us/newsroom/announcements/cision-125299

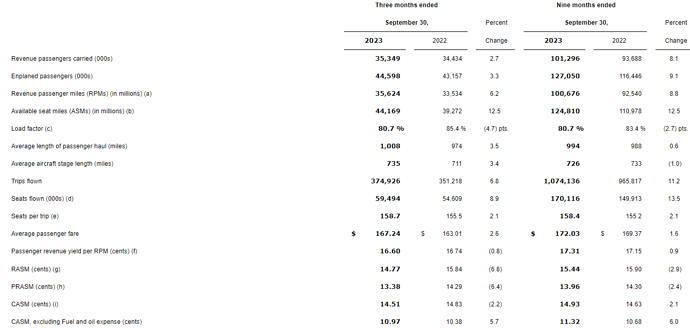

Southwest Airlines

Soutwest also mentioned healthy demand, they have a bit more weakness but mentioned this is because they need to have a adjustmnent to match the network to demand trends better, as demand patterns will moderate back to prepandemic.

They do mentioned their promotional activity as being slightly more than normal, but fares still holding ok.

The Company’s third quarter 2023 revenue performance was a third quarter record due to strong leisure demand. While the Company experienced lower-than-expected close-in bookings in both August and September, impacted by seasonal trends, overall demand remained stable throughout the quarter. Third quarter 2023 managed business revenues performed largely as expected, as the Company continued to gain business travel market share.

Outlook

Moving to the fourth quarter, we are seeing a continuation of healthy leisure booking demand and stable business travel patterns. As a result, we expect a nominal sequential increase in operating revenue, resulting in record fourth quarter revenue and passengers which would bring us to three consecutive quarters of record operating revenue. October performance has been strong to date and bookings for the holidays as a whole are also strong.

RASM however continues to be impacted by higher than seasonally normal capacity, driven by our network restoration plan, a larger than normal investment in development markets, and business travel that while improving is still below historical levels.

They point out the RASM ( revenue per available seat mile) weakness is not about demand, but a mismatch in networks and demand trends.

it’s not about there is a demand problem. So again, Southwest, we’re seeing, again, record operating revenues, record passengers, record Rapid Rewards participation on revenues, record retail spend on our card, record new members, on and on and on, and we’re expecting record operating revenues and passengers again in the fourth quarter.

So it’s not as if we’re not generating demand. Southwest is generating a strong demand. It’s about getting that aligned more precisely with the new travel patterns

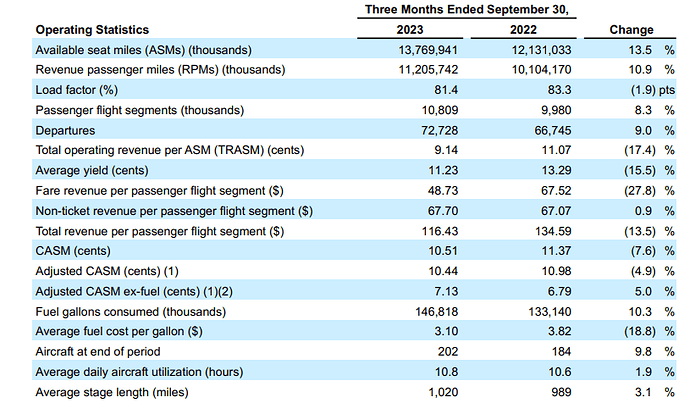

Spirit

Spirit very different story, a lot of weaknesses in most of its metrics.

Softer demand for our product and discounted fares in our markets led to a disappointing outcome for thethird quarter 2023. We continue to see discounted fares for travel booked through the pre-Thanksgiving period. And, unfortunately, we have not seen the anticipated return to a normal demand and pricing environment for the peak holiday periods. Given these continued trends, we are evaluating our growth profile and our competitive position.

In addition to a softer-than-expected demand environment, we continue to be challenged by higher fuelprices and NEO engine availability issues and are expecting our margins in the fourth quarter will be lowerthan we reported for the third quarter 2023.