Magaly Assessment Earnings Expectations as of April 9, 2025

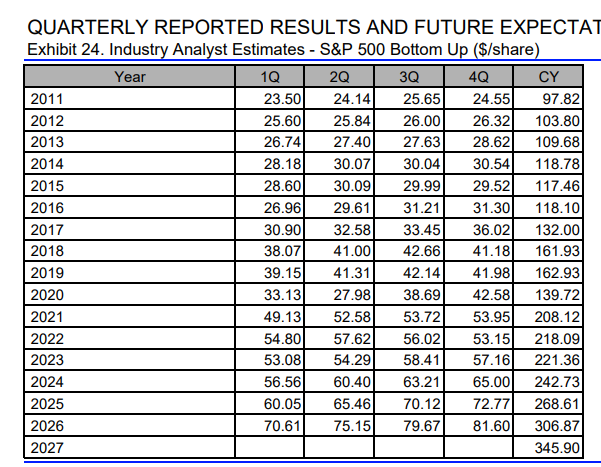

Analysts are still expecting 2025 EPS for $268%, a 10.66% increase over the previous year (even higher than last year 9.65%, where growth was exceptional)

Analysts have barely revised these expectations since 1 month ago, when I posted the first update even with all this market turmoil, they were expecting 270 back then to 268 now.

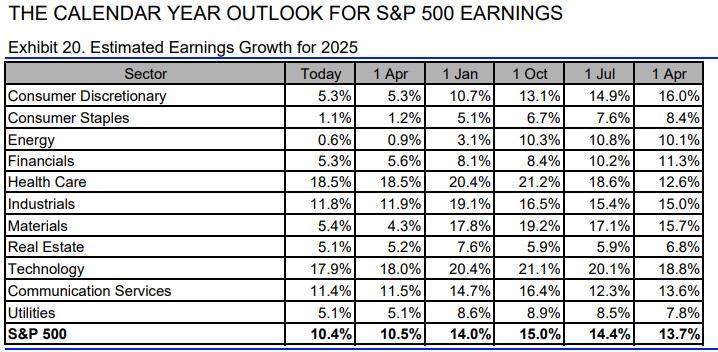

Given rising recession risks, or at the very least, a significant slowdown from 2024’s growth pace, such bullish earnings estimates now seem overly optimistic, and this expectation no longer makes sense to me both 2025 and 2026. Therefore, I believe there’s a high probability we’ll see meaningful downward earnings revisions after the next quarter’s (Q1, Q2, etc) earnings reports, potentially triggering further market sell-offs

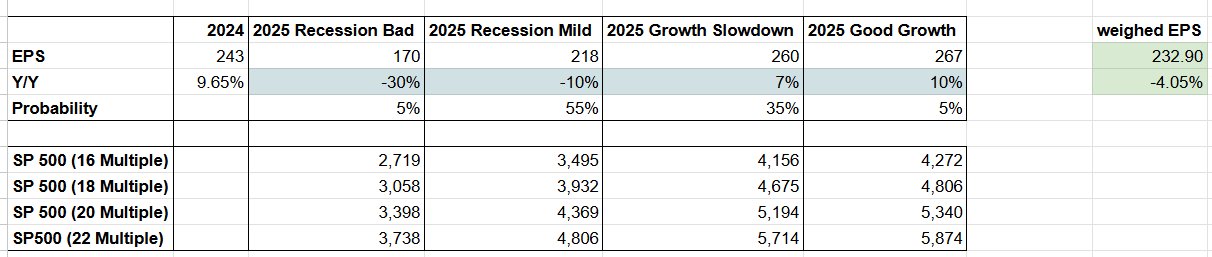

Historically, earnings decline by 20–30% during recessions, so I quickly calculated scenarios for earnings based on my recession scenarios, and I think the current risks for the market continue to be to the downside (especially after today’s rally).

Analyst Expectations