Magaly Assessment Latest Developments with Tariffs as of April 9, 2025.

This was made very fast to have an initial assessment of the situation, it could change with additional data or analyst insights of things I could be missing

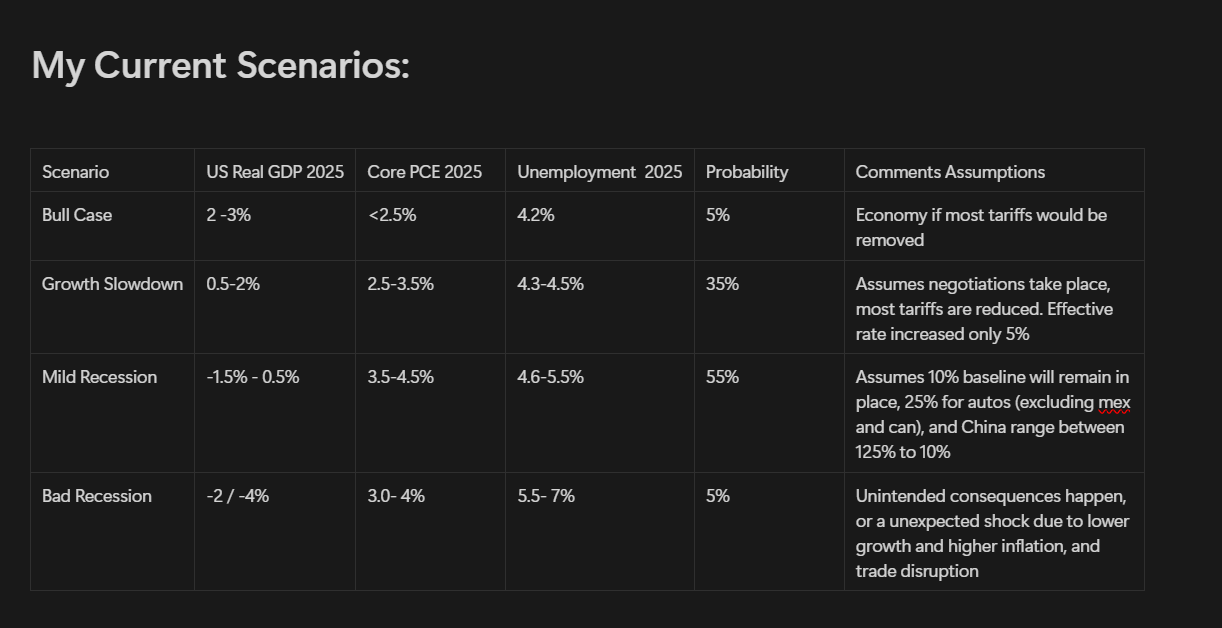

While the 90-day pause on reciprocal tariffs seemed good at first, the escalation with China is making the outlook still challenging for the economy, and on top of that there is also still a 10% tariff on all other imports, Hence I am maintaining a mild recession is still the most likely outcome with these conditions, and have actually increased the probability to 55% from 40%.

Model Scenarios: I am about 70% confident about these ranges and probabilities. My lower confidence is that I am still researching what could be the consequences beyond trade from this, but the fact escalation is only with China (for now) lowers the probability for this to turn into something catastrophic.

My arguments and modeling process (which is very simplified, just to get a rough estimate):

125% tariffs on China, 10% rest of the world, and 25% autos and part (excluding mex and can), means a headwind/cost increase of $926 B (22.5% additional effective rate). This is larger than the $650 before. (This is assuming full impact from 2024 levels)

-

There will be for sure declines in imports from China and Autos, assuming China imports fall by 50% in 2024, autos fall by 25%, and other imports increase by 2.5% (there will be some rerouting from China to other countries, and yuan could devaluate to offset tariffs as it has been happening). It would mean a headwind of $645 B (15.75% additional effective rate)

-

However, I am assuming that the economy has a total cost headwind $741 B (80% of the total, as a worst case). Because even if China’s imports decline, consumers/businesses will have to substitute (domestic/international) at higher prices in most cases, and in some cases, there will be supply constraints in some products due to the US/other countries not having the capacity.

→ This means a total headwind of ~2.5% to GDP, 3.74% of spending, and 21.5% of profits. I have modeled this to be roughly ~ -1.5% real GDP in 2025. -

It seems for now that the 10% baseline for all countries is not negotiable. So I think the likelihood this could be the floor is high (until I found new information than signal otherwise)

-

In a scenario where there is a deal with China and their tariffs also come down to 10% (which seems unlikely to be this low imo). The headwind could still be between $400 and 421 Billion (1.37 - 1.5% of GDP) → a much milder, but still, a recession is likely

-

In any case, even if tariffs only increased by 5% in total, it would still mean a headwind of $205 B (-0.7% of GDP, 1% spending), which is reflected in the growth slowdown scenario.

-

This analysis is for 2025, but in reality, this could extend to 2026, it depends on supply chains and initial inventory from firms (demand has been pulled in some cases) that could mean relatively good data still for some months