Assessment Retail Sales February 2025

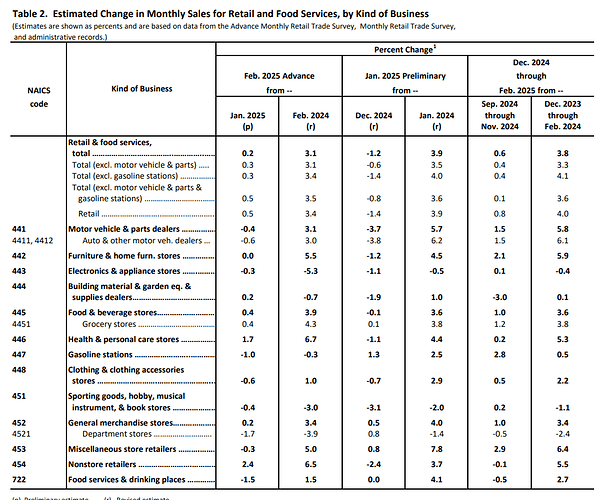

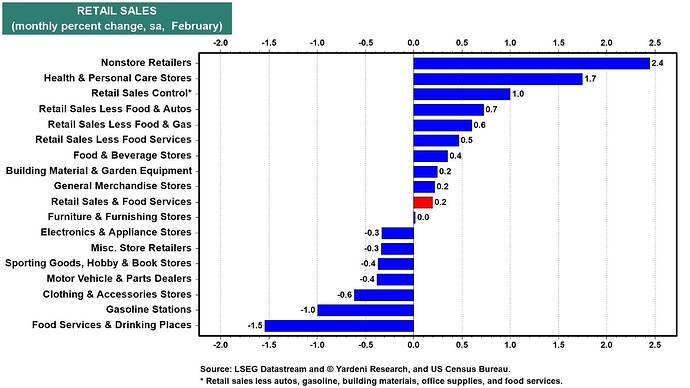

Overall, a mixed report (downward Revisions to last month and barely a recovery this month), with some nice underlying strength in many areas (online sales continue to be very strong despite last month decline), but as expected it looks like there’s going to be some tariff front-running overhang, and some concern around the bars/restaurants since discretionary spending could be slowing, in line with trave demand slowing according to airlines guidance.

Year over year growth seems resilience still, though slowing in recent months (and below historical averages), and accounting for inflation is almost flat growth.

Despite the monthly improvement, this report caused the Atlanta Fed’s GDPNow model to lower Q1’s real GDP growth from -1.6% to -2.1%, led by a decline in the growth of consumer spending from 1.1% to 0.4%. (Model is not reflecting the gold imports adjustment, which they will do on March 26)

So, low or even flat spending is still expected for Q1 2025.

This is mostly goods-related spending (only about 35% of PCE), for services spending, will have to wait for the PCE report, and see Atlanta GDP adjustment for additional data.