This topic discusses Spotify’s Q3 2024 earnings. A summary of the Q3 2024 earnings expectations will be published here. Here is a full article on the same:

I am positive on Spotify’s Q3 2024 earnings. My estimates takes into account the price changes during the quarter, competitive positioning, cost efficiencies and quality of its products among others. Here is a description of my bullish points:

- Price increases: On June 2024, Spotify increased monthly subscriptions by an average of 8.5%. In the Q2 2024 earnings call, CFO Ben Kung said this price increase will contribute 100 to 200 basis points to the average revenue per user (ARPU) growth in Q3. As such, I expect the price increase to be the primary contributor to revenue growth in Q3.

- More pricing options: On June 2024, Spotify introduced a basic plan tier in the U.S. priced at $10.99 per month. This came three months after Spotify introduced an audiobooks tier in the U.S. priced at $9.99 per month. This additional options enables them to convert free users who are only interested in either music streaming or audiobooks at a lower price compared to the standard premium option. Deutsche Bank expects the audiobooks tier to contribute 80 basis points to the quarter-over-quarter growth in premium gross margins in Q3.

- Great product offering: According to analysts, Spotify has the best-in-class product offering. This can be seen from the great reception of its new products such as AI Playlist and Spotify Daylist. Spotify’s great products help the company to negotiate reduced payments to labels and to incur less churn when it increases prices.

- Competitive position remains solid: An August survey by Evercore established that Spotify continue to lead the music streaming industry in the U.S and U.K and that this lead keeps growing. The lower pricing of its monthly plans enables Spotify to remain competitive against the likes of YouTube. For instance, Jefferies estimates that Spotify’s pricing is significantly less than that of YouTube in 15 key markets.

- Bundling of subscriptions: In March 2024, Spotify announced that it was going to to reclassify its Premium Individual, Duo, and Family subscription plans as Bundled Subscription Offerings because they now have audiobooks. This enabled Spotify to cut costs in Q2 by $35 million. As Spotify bundles the subscription in other regions, the cost-savings increases. Mechanical Licensing Collective (The MLC) filed a legal suit against Spotify for doing this. However, I believe that Spotify will win the case since their 2022 legal settlement gives Spotify the right to do this.

- Focus on profitability: Since last year, Spotify has been focusing on profitability. This means that operating costs are not expected to rise significantly in the near-term.

- Netflix Q3 2024 results: Netflix Q3 2024 results topped analysts estimates indicating that consumers are still spending on entertainment despite the macro headwinds.

Headwinds during the quarter include:

- Social charges and currency fluctuations: Social charges is the main headwind that could impact Spotify’s operating income during the quarter. For instance, the management guided operating income of $405 million at a time when Spotify’s share price was trading at $313.79. Spotify’s shares ended Q3 2024 at $375. In Q2, the company reported social charges that were $47 million higher than expected (page 3) after the stock appreciated by $50 million during the quarter. As such, I expect the Q3 social charges to be around €45 million higher than the guided €15 million. Currency fluctuations could also impact the results during the quarter.

- Missed MAU guidance in the last three quarters: Spotify has missed its MAU guidance in the last three quarters by an average of 3 million. This may suggest that the churn associated with price increase last year may have come in higher than expected by the management. The same thing could happen when Spotify reports its Q3 results.

- Top-funnel spending remains volatile: Spotify said in its Q2 earnings call that ad spending in the upper funnel remains volatile. It also said that they are swiftly converting higher-engaged users to premium subscription. As such, I don’t expect ouperformance in its ad business in the near term.

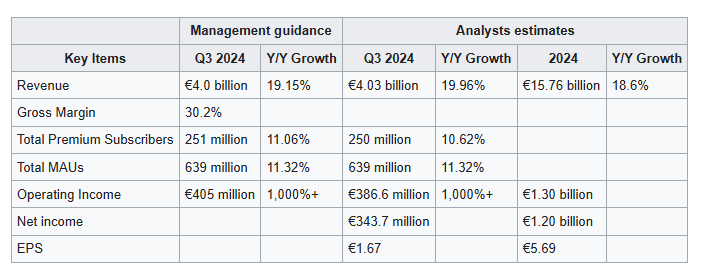

Here are the analysts and management expectations:

My estimates for 2024 include revenue of €15.74 billion (+18.9%), net income of €1.27 billion, and EPS of €5.70.

Hi Aron, thank you for your overview.

I have been playing around with numbers here and came to the conclusion that even in a very positive scenario with margin expansion and slight price growth an investment in Spotify would most likely not provide enough margin of safety to jump in rushed before earnings.

What do you think about my numbers in the valuation model? Do you think I am missing important points and are there assumptions that you think are too conservative? (For example should ARPU be higher etc.)

I am still a little bit unsure how we can work best with the models but maybe it’s a good idea if you fill in your assumption here (+ copy in the missing quarters) so that I can immediately see for which items your take is different than mine and then discuss your take in this topic.

You may also want to adjust subscriber growth numbers in your model. I did not adjust them yet in the main model but was surprised that both premium sub and total mau growth came in below our original expectations.

I have also found two mistakes in my valuation model scenario calculations. (For example not calculating ad-supported revenue correctly here)

Going forward we need to put way more emphasis on work with valuation models and it would become one of our most important workflows to spot mistakes in the valuation model of each other.

I largely agree with you assessment and projections for pricing. However, if the super-premium plan materializes by the end of 2025, then 2026’s premium ARPU will be significantly higher than your estimate. CEO Daniel EK said the plan will cost around $5 higher than the current plan. I estimate that the super-premium plan could contribute $1.2 to the ARPU. I think I will also lower your gross margin estimates significantly since tailwinds associated with it in 2024 should decline in 2025. For example, according to Digital Music News estimate, bundling of services in U.S. is now 97% complete. Similarly, cost-efficiencies in fee payments and traffic costs should decelerate as we move forward. Nevertheless, Spotify is targeting a gross margin of 35% over the long-term (probably by 2027-2030). I have also reduced total MAUs estimate but maintained the premium subscribers estimates for 2025-2028 (which has an effect on ad-supported users). If we consider this, Spotify would be trading at a multiple of 15.67 2028 earnings per share (N/B: I have updated the share price).

Yes, our MAU and premium users have been significantly higher than the actuals. The other mistake which we made is subtracting premium subscribers from total MAUs to arrive at the number of ad-supported users. This is wrong since some regions don’t have ads in the free plan. For instance, ad-supported plan was introduced recently in South Korea. As such, our formula deviated from the actuals by around 13 million. Adding back this 13 million will bring us closer to the actual.

Edit: Upon reflection, I noticed that my estimate for super-premium ARPU contribution was wrong since it assumed that super-premium users won’t be part of the premium subscribers. My new estimate is ARPU contribution of around 400 basis points and takes the 2028 multiple to 19.67 from 15.67.

Spotify’s Q3 2024 revenue was in line with management guidance while subscriber numbers exceeded both analysts and management’s expectations

- Spotify’s Q3 2024 revenue rose 19% y/y to €3,988 million, in line with management guidance and slightly below analysts estimate of €4,003 million while EPS of €1.45 was below analysts estimate of €1.67.

- Revenue was impacted by currency headwinds of 270 basis points versus management guidance of 100 basis points.

- Gross margin came in at 31.1%, above management guidance of 30.2% while operating income of €454 million exceeded management guidance of €405 million.

- Total monthly active users (MAUs) came in at 640 million, above analysts estimate of 639 million while premium subscribers were 252 million (analysts estimate: 250 million).

- Spotify is guiding Q4 revenue of €4.1 billion (my estimate: €4.27 billion at the midpoint), total MAUs of 665 million (my estimate: 663 million at the midpoint), premium subscribers of 260 million (my estimate: 258 million at the midpoint), gross margin of 31.8% (my estimate: 32.0% at the midpoint) and operating income of €481 million (my estimate: €455 million at the midpoint).

- The stock is up 7% after-market.

https://investors.spotify.com/files/doc_financials/2024/q3/Q3-2024-Shareholder-Deck-FINAL.pdf

Looking at the numbers here, it’s apparent that Q3 revenue was weighed down by ad business revenue which was below my expectations. I suppose that is due to currency headwinds. Average revenue per user (ARPU) was also slightly lower than I expected at the premium segment and ad segment. Overall, I would say the results were good, especially the gross margin and operating income.