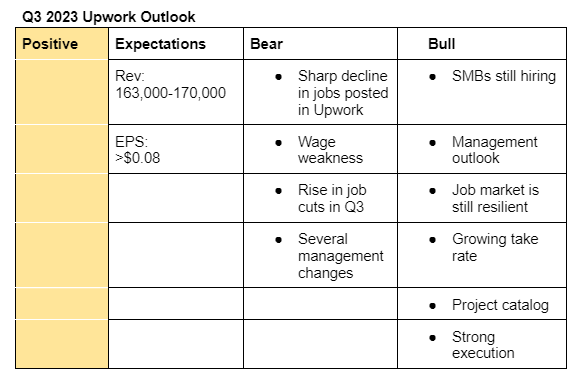

I am positive on Upwork earnings. My guestimates are based on the fact that it has beaten upper revenue guidance in the last three quarters by an average of 1.41% and management outlook that doesn’t account for macro improvements. However, I am also a bit cautious due to month-over-month decline in the number of jobs posted in Upwork and softening wages in the U.S. Here are my bullish and bearish sentiments;

Bullish;

- "SMB sentiments remains very low. However job openings and hiring plans were stable, or even increased a bit during the quarter. According to ADP data, SMBs continue to add jobs during the quarter, but at a lower rate than Q2, " @Magaly notes.

- The management outlook doesn’t depend on macro improving from here eg seasonal trends. That means the earnings risk is mainly not on the downside.

- Take rate will likely continue improving due to the price change as well as surge in the number of connects needed to apply for a job. Upwork said connects monetizations in Q2 contributed to revenue growth.

- Job openings in the United States are still stable.

- Upwork execution strength could continue to improve. Its new GM of enterprise has received praises lately from the CEO and CFO on how she’s restructuring the department. Upwork is also advancing well in product developments.

Bearish;

- The average number of jobs posted in Upwork as well as number of hours are declining sequentially. Upwork CFO said in the Canaccord cconference that part of the reasons they posted good results in Q2 was growth in average hours per contract.

- Wage growth is slowing down in U.S and job cuts rose in Q3 y/y.

- I still don’t have a positive picture on the performance of newly-hired senior executives.

- Upwork has a $350 loan repayment in 2026 and currently has $500 million in cash. Any large cash burnt with no significant growth in revenue may cause liquidity problems.