This topic discusses the upcoming Q3 2023 Upwork earnings. It will include our final assessment and decision before the earnings release. We will also summarize the results here. You can find our earnings preparation and full summary of the results in the Wiki:

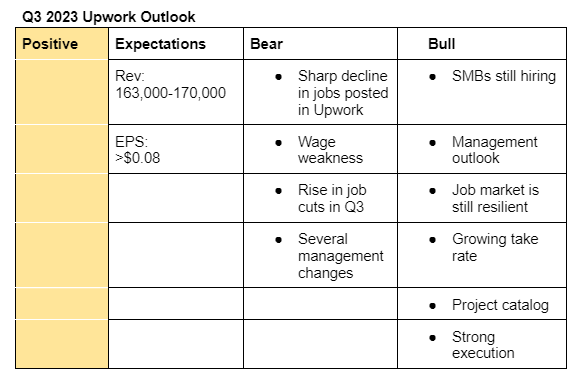

I am positive on Upwork earnings. My guestimates are based on the fact that it has beaten upper revenue guidance in the last three quarters by an average of 1.41% and management outlook that doesn’t account for macro improvements. However, I am also a bit cautious due to month-over-month decline in the number of jobs posted in Upwork and softening wages in the U.S. Here are my bullish and bearish sentiments;

Bullish;

- "SMB sentiments remains very low. However job openings and hiring plans were stable, or even increased a bit during the quarter. According to ADP data, SMBs continue to add jobs during the quarter, but at a lower rate than Q2, " @Magaly notes.

- The management outlook doesn’t depend on macro improving from here eg seasonal trends. That means the earnings risk is mainly not on the downside.

- Take rate will likely continue improving due to the price change as well as surge in the number of connects needed to apply for a job. Upwork said connects monetizations in Q2 contributed to revenue growth.

- Job openings in the United States are still stable.

- Upwork execution strength could continue to improve. Its new GM of enterprise has received praises lately from the CEO and CFO on how she’s restructuring the department. Upwork is also advancing well in product developments.

Bearish;

- The average number of jobs posted in Upwork as well as number of hours are declining sequentially. Upwork CFO said in the Canaccord cconference that part of the reasons they posted good results in Q2 was growth in average hours per contract.

- Wage growth is slowing down in U.S and job cuts rose in Q3 y/y.

- I still don’t have a positive picture on the performance of newly-hired senior executives.

- Upwork has a $350 loan repayment in 2026 and currently has $500 million in cash. Any large cash burnt with no significant growth in revenue may cause liquidity problems.

My take on Upworks Q3 is more optimistic, given that we had an overall economically strong Q3 with slightly increased job openings, stable small businesses, and an overall resilient labor market.

That said the recent weakening in payrolls might finally signal the start of an easing job market and cause Upwork’s Q4 and 2024 outlook to be cautious or negative.

It’s important to note that we still do not have established correlations regarding Upwork.

As an example, we continue to track open Jobs on the Upwork but am unaware if there is a correlation between it and Upwork performance. After all, it’s not mainly new open jobs that are important for Upworks GSV but how stable the established contract base is and which amount of money is flowing through it.

Similarly, we are unaware of the exact effects of higher unemployment and a weaker broader economy on Upwork as layoffs in industries like construction, transportation, and manufacturing are not likely going to have a strong direct effect on Upwork and digital industries like VC funded startups that are related to Upwork already entered into their “recession period” more than one year ago. It is therefore possible that Upwork will stay stable or grow even if the broader economy enters into a contraction.

Fundamentally the most important and uncertain factor when it comes to Upwork lies in its execution. Recent new product developments are a step in the right direction but we need to keep a close eye on Upwork’s internal developments.

SI=+20%, I=10

- Upwork posted impressive Q3 results; revenue of $175.7 million (+11% y/y) exceeded management upper guidance ($165 million-$170 million or 4%-7% y/y), adjusted EBITDA and EPS of $31.2 million and $0.12 also topped management upper guidance of $14 million-$17 million and $0.09-$0.11, respectively.

- Upworks profit margin rose to 9% from -16% a year ago while net cash from operating activities rose to $37 million from $10 million in Q3 2022.

- However, Upwork’s GSV of $1,030 million was flat Q/Q and Y/Y due to “lapping” of strong quarters.

- Upwork raised their full-year 2023 revenue guidance and adjusted EBITDA to $680 million-$685 million and $67 million-$71 million from $665 million-$675 million and $50 million-$55 million, respectively.

- The company is guiding Q4 2023 revenue of $175million-$180 million and non-GAAP EPS of $0.16-$0.18 versus analysts estimates of $172.7 million (+7% y/y) and $0.16, respectively.

https://investors.upwork.com/static-files/e7a891f7-011d-44a9-b5e0-817069a0f814

In the earnings call;

- CFO Erica Gessert said they haven’t seen any material improvement in macro environment in Q3, and macro trends continue to be uneven and difficult to predict, sometimes changing month over month though hours per contract are up slightly Q/Q and up 10% year-over two-year trends.

- They expect EBITDA margin to fall to 15% in Q4 from 18% in Q3 due to reduction in long-term investments in favour of short-term projects such as AI in Q4.

- They have a small number of team members in Middle East and don’t anticipate the conflict to have any noticeable impact to the business since GSV from the region is negligible.

- CEO Hayden Brown said small business clients are the ones leading the pack in terms of

performance. - CFO Erica Gessert said they expect additional growth from price structure to happen in first half of 2023 but they are not breaking out the exact dynamics.

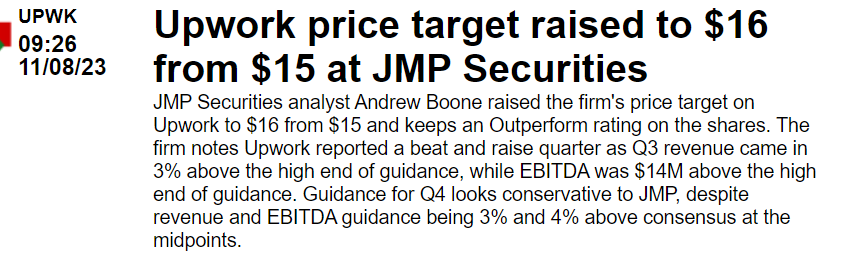

- Buy, $15->$16: JMP securities is conservative on Upwork’s Q4 guidance.

- Buy, $15->$18: Needham is positive on Upwork’s Q3 results and outlook.

I=7

-

Fiverr also reported good third-quarter results; revenue grew 12% y/y to $92.5 million, in-line with upper management guidance ($89.5 - $92.5 million), active buyers fell 2% y/y to 4.2 million while spend per buyer grew 4% y/y to $271.

-

It raised lower guidance of its FY23 revenue to $358 million from $355 million but maintained the upper guidance of $365 million.

-

However, Fiverr is guiding Q4 revenue of $88.1 - $95.1 million (6% - 14% y/y), mid-point being below analysts estimate of 93.33 million (+12.3% y/y).

“Our Q4’23 outlook and updated full year 2023 guidance reflects the volatility we experienced in our marketplace following the onset of the war in our region and the potential for increased volatility through the remainder of the year,” its shareholder letter reads.

https://investors.fiverr.com/static-files/c2681296-81e7-4ba3-9692-84f12b0e4f97