This topic discusses the forthcoming Q3 2023 Sixt earnings. It will include our final assessment and decision before the earnings release. We will also summarize the results here. Our earnings preparation and full summary of the results can be found in the Wiki:

Here are the main insights for Sixt from Hertz third-quarter earnings;

-

Demand is still strong. Fleet utilization was up 300 basis points y/y to 83% while volume was up 16% y/y.

"I would say in our Hertz brand, which plays to a more premium product both by way of service, offering loyalty and the like, we continue to see strength in leisure both in North America and in Europe, " CEO Scherr answered an analyst who asked about the state of demand while citing that some airlines are seeing softening in demand.

-

Pricing declined 7% y/y but was stable sequentially (+2%), and is expected to improve in the current quarter.

“We believe that various inflationary factors will continue to support tighter fleets and more elevated rates versus those historically experienced in the industry, all consistent with our ROA focus,” Scherr said.

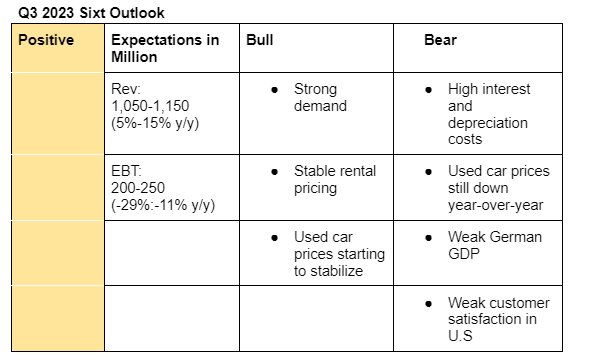

I am positive on Sixt Q3 earnings. My expectations are guestimates based on the current demand and pricing trends as well the fact that Q3 is usually a strong quarter for Sixt. However, I am also a bit cautious due to the current high interest and depreciation costs.

Here are my bullish and bearish arguements;

Bullish;

- Its competitor, Hertz, reported strong demand and stable rental pricing during the quarter.

- Airline companies also witnessed strong demand during the quarter.

- Almost half of Sixt’s annual earnings is usually generated in the third-quarter.

Bearish;

- High interest rates impacts its fleet growth while high depreciation costs lower its vehicle resale value.

- Used car prices in U.S and Europe are still down year-over-year but starting to stabilize.

- German economy is still weak.

- Weak customer satisfaction in U.S may affect demand for Sixt’s rental vehicles.

Sixt mentions that to mitigate the market risks of the used car market, they try as much as they can to create buy-back agreements with manufacturers or dealers. However, they are not able to do it for all their fleet, especially in the US, where these agreements are less common.

Also, it could happen that dealers are not able to comply with that agreement, and in this case they will need to sell the vehicles in the open market.

Around 72% of all vehicles added to the rental fleet in the financial year were secured by means of buy-back agreements in the case of purchased vehicles or under operating lease agreements. At the end of the year, the balance sheet value of the vehicles without buy-back agreement was EUR 1.8 billion. Sixt continuously monitors the development of market values by a Residual Value Committee.

They say that the US market poses more risks, and the fact that dealers can stop complying with the agreement.

By reducing the resale risk, Sixt is to a large extent independent of the situation on the used car markets. However, market-specific aspects, especially in the US high-growth market, and a possibly necessary adjustment of the purchasing strategy due to supply bottlenecks could lead to repurchase agreements not being enforceable to the desired extent. This is particularly true for the US growth market, where buy-back agreements are less common than in Europe.

In this context, however, it cannot be completely ruled out that contractual partners may not be able to comply with the buyback agreements and that Sixt is thus forced to market the vehicles itself. In this connection, as for all freely marketed vehicles, there is a risk that Sixt could generate lower incomes than expected due to economic risks or a possible deterioration of the used car markets

For this reason, Sixt regularly assesses the creditworthiness of its contractual partners on the basis of strict standards. This is especially important when the automobile trading markets are tense. In the case of a contractual partner defaulting, Sixt would be obliged to market the vehicles on the used car market at its own economic risk.

And this is how they show it in their financial statements

As in the previous year, rental fleet vehicles were sold predominantly under buy-back agreements concluded with manufacturers and dealers, and therefore only partially directly on the used car market. To better reflect this fact, proceeds from the sale of used vehicles are not recognised. Instead, the selling expenses carried under fleet expenses are reduced by the corresponding amounts. Any remaining balance is allocated to the item depreciation and amortisation expense including impairments.

2022 Annual report (pg76)

Great to know. In my opinion, that makes this specific risk manageable. Even if there is a 30% sudden and non-expected crash across the entire unsecured fleet of €1.8 billion, the effect of 540m would wipe out one year’s profit but would not fundamentally threaten the company.

SI=4%, I=10

-

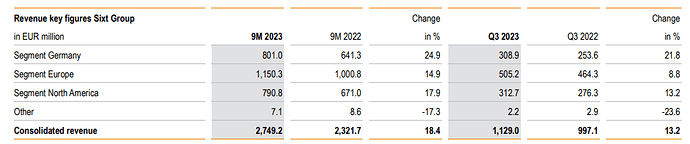

Revenue in Q3 grew by 13.2% y/y to EUR 1.13 billion, in-line with analysts estimate while EBT was EUR 246.9 million (-12.8% y/y) versus analysts estimate of EUR 239 million (-15.6% y/y).

-

In the 9 months 2023, fleet value was EUR 4.70 billion (+22.7% y/y) but Sixt said they will act with utmost discipline in their fleet planning in 2024.

"We expect to have tight levels of fleet, which will ensure high-capacity utilisation and a sustained positive price level, " CFO Kai Andrejewski wrote.

-

Sixt raised its 2023 lower EBT guidance to EUR 460 million (-16% y/y) from EUR 430 million (-21% y/y) but lowered the upper guidance to EUR 500 million (-9% y/y) from EUR 550 million (flat growth y/y).

-

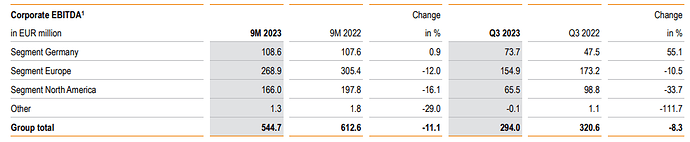

Germany was their strong revenue and EBITDA growth segment.

-

During the quarter, Sixt launched new TV brand campaigns in Germany, Belgium and France, which look good.