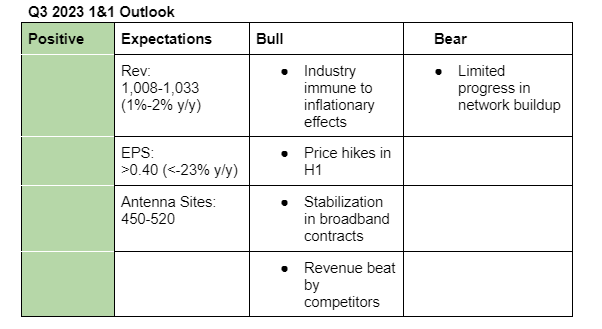

I am positive on 1&1 Q3 earnings. My expectations are guestimates based on its past performance and projected industry growth rate in Germany. I expect EPS to be down year-over-year due to network delays. This is not overly bad as network costs meant for prior periods are likely to be reflected in second-half EPS.

I expect that insights from its MVNO agreement with Vodafone will carry more weight and could cause more volatility in the stock than the earnings results since the market would likely want to see a slowdown in the buildout of the network.

Here is the description of the bullish and bearish sentiments.

Bullish

- 1&1 expects the price increases implemented in the first-half to have an impact in the second half.

- Loss of broadband customer contracts is expected to stabilize as the year comes to an end.

- Telecommunications industry is immune to inflationary risks since mobile communications are a necessity to most people.

- Revenues of Telefonica Deutscheland and Deutsche Telecom in Q3 slightly beat analysts estimates.

Bearish

- 1&1 continues to lag behind its targets when it comes to network buildup. Any negative comments regarding the network expansion during the earnings release may not please the market. BNetza is also expected to make a decision regarding whether to extend the MVNO agreement. Any delays on this decision will push the date of the network launch further.