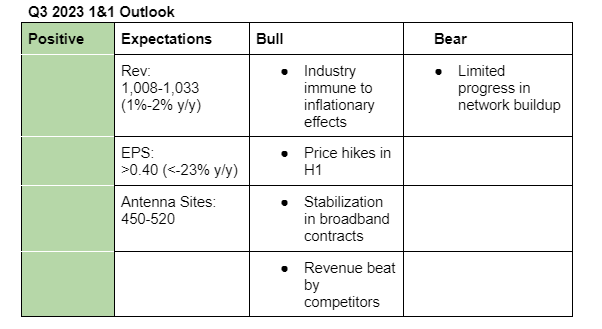

This topic discusses the upcoming Q3 2023 1&1 earnings. It will include our final assessment and decision before the earnings release. We will also summarize the results here. You can find our earnings preparation and full summary of the results in the Wiki: 1&1:Quarterly Results/2023 Q3 - InvestmentWiki

I am positive on 1&1 Q3 earnings. My expectations are guestimates based on its past performance and projected industry growth rate in Germany. I expect EPS to be down year-over-year due to network delays. This is not overly bad as network costs meant for prior periods are likely to be reflected in second-half EPS.

I expect that insights from its MVNO agreement with Vodafone will carry more weight and could cause more volatility in the stock than the earnings results since the market would likely want to see a slowdown in the buildout of the network.

Here is the description of the bullish and bearish sentiments.

Bullish

- 1&1 expects the price increases implemented in the first-half to have an impact in the second half.

- Loss of broadband customer contracts is expected to stabilize as the year comes to an end.

- Telecommunications industry is immune to inflationary risks since mobile communications are a necessity to most people.

- Revenues of Telefonica Deutscheland and Deutsche Telecom in Q3 slightly beat analysts estimates.

Bearish

- 1&1 continues to lag behind its targets when it comes to network buildup. Any negative comments regarding the network expansion during the earnings release may not please the market. BNetza is also expected to make a decision regarding whether to extend the MVNO agreement. Any delays on this decision will push the date of the network launch further.

SI=-3%, I=10

Here is a summary of the third-quarter results;

-

Revenue was up 4.07% to 1.039 billion (analysts estimate: 1.013 billion or +1.5% y/y), service revenue grew 3.7% y/y to 834.3 million (estimate: 821.8 million or +2.1% y/y)- an improvement from Q1 and Q2 which saw flat growths, EBITDA fell by 12% y/y to 159.1 million (analyst estimate: 164 million or -9.3%) as a result of increased network startup costs, while EPS came in 0.42 vs analysts estimate of 0.44.

-

1&1 reported 503 antenna sites versus 500 guided by the management, and maintained that they expect to close the year with 1,000 antenna sites and start growing the number of antenna sites by 2,000 annually starting from 2024.

“Despite further delivery failures at our main partner, deployment of radio masts are improving overall – the ramp-up gained momentum in the second half of the year as announced,” the report reads.

-

Access contracts grew 2.9% y/y to 16.11 million (estimate: 16.09 million or +2.8% y/y); mobile contracts were up 5.0% y/y to 12.10 million (estimate: 12.07 million or +4.7% y/y) and broadband contracts fell 2.9% y/y to 4.01 million (estimate: 4.03 million or -2.5% y/y).

-

1&1 confirmed its guidance for 2023.

In the earnings call;

- CEO Ralph Dommermuth said the agreement already reached with Vodafone is binding and that no party can leave ongoing detailed discussions, but in case of disagreements, the Network Agency will act as the arbitrator.

- Dommermuth said that if the parallel MVNO operation is not authorized, they will have to migrate existing 5G customers to their own network, which has a small 5G footprint, but he doesn’t expect any major implications because although its competitors use 3.6GHz, some of their customers have weak 5G displayed on their devices due to the use of old antennas.

- He said that they are not thinking about consolidation since they see good business opportunities but they are open to collaborating with other operators in handling grey spots, especially in rural areas.

- Regarding the position statement by the Federal Cartel Office, Dommermuth said there is a lot of truth in it but they are open to any decision that will provide them with low-band frequency in the right capacity.

- He said that they have clear plans to add 2,000 antenna sites in 2024, though they target 3,000 antenna sites.