This topic centers on Volkswagen Q2 2023 earnings expectations and results

SI=-2%, I=7

-

Porsche warned that supply chain problems are impacting its EV production.

“There is no week where we have no supply chain issue,” Chief Executive Oliver Blume said in the earnings call.

-

Porsche return on sales in the first half of 2023 was 18.9%(prior year:19.4%). The decline was due to higher costs.

-

Blume said that the luxury market is more resilient than the mass market and as such, maintained their 2023 outlook.

-

The company pointed to slower growth in Europe and China.

Overall solid results with revenue being up 14% Y/Y to €20.43 billion and operating profit rising 10.7% to €3.85 billion. Importantly returns on sales have been 19.5% just looking at Q2 2023.

It’s interesting though that Porsche is warning explicitly about a situation of worsening economic conditions and supply chain problems and just maintains its outlook on the basis that both of those do not worsen significantly.

EV’s make 12-14% of Porsches sales.

@Aron i’ve gone through your Q2 2023 Volkswagen article.

To me the following points stood out:

- IFO index points to strong situation, but negative expectations.

- expected uncertainties in h2 esp. due to weakness in Europe and China.

- EV problems with increased competition from Tesla and China, and potential supply chain problems.

- Tesla is willing to reduce prices further if necessary.

This matches well with @Magaly data which is seeing a strong situation of increasing sales in the united states but a worsening situation with credit.

My overall assessment based on this data for Volkswagens Q2 2023 is neutral, as I expect results to largely mirror those trends. Depending on how forceful the warning for H2 2023 is going to be and how strong the results are I could see the stock being slightly down but I do not expect any drastic moves. Even with some risks on the horizon, I do not expect any drastic adjustment to FY 23 guidance.

Are there any important additional points to add that I might be missing?

I was just about to add that Avg transaction prices for VW Group at least for the US increased in Q2 mostly in June, but Y/Y increases are obviously trending down now. These are prices seen at dealers.

*June prices could be revised, they usually do revisions the next month.

| Volkswagen Group | Transaction Price (Avg)* |

M/M | Y/Y |

|---|---|---|---|

| Jun-23 | $58,769 | 4.5% | 3.70% |

| May-23 | $56,250 | 0.8% | 1.50% |

| Apr-23 | $55,820 | -1.8% | -1.80% |

| Mar-23 | $56,858 | -0.6% | 5.40% |

| Feb-23 | $57,217 | -1.8% | 7.28% |

| Jan-23 | $58,266 | -1.3% | 12.40% |

| Average New-Vehicle Transaction Price June 2023 | Kelley Blue Book B2B | |||

| https://www.coxautoinc.com/wp-content/uploads/2023/07/June-2023-Kelley-Blue-Book-Average-Transaction-Price-data-tables.pdf |

Why neutral yet the insights point to a weak second half and stable Q2? Even deliveries were strong during the quarter and with management’s decision to focus on value instead of volume, I don’t expect any significant discounts during the quarter. I agree though that FY23 guidance may be slightly adjusted to reflect the current situation.

Very good point to mention strong deliveries in this context as well. Delivery numbers should be a central part of any quarterly automotive expectation summary.

Neutral in this context would simply point to mixed signals and its color would be orange. (Similar to this example)

The reason for not making it green is that markets are going to react based on the numbers of the quarter but will also take the outlook into account.

Overall I think even though there are signs of weakness, it is a slight weakness in a strong environment, so our rating could be greenish as well, but this would require a bit more confidence on our side that the signs of weakness would indeed not turn into a problem at one point down the line.

Over time we could also iterate on our expectation format and as an example, we could use different colors for the current state and the outlook.

-

Q2 revenue grew by 15.2% y/y to 80.059 billion euros versus analysts estimate of 80.25 billion euros(+15.4% y/y).

-

Unadjusted operating margin for H1 was 8.9%, above the guidance range of 7.5-8.5%.

-

Operating margin for Q2 which includes a -2.5 billion non-cash commodity hedging effect, was 7% versus 7.3% estimate.

-

Operating profit for Q2 was 5.6 billion euros below analysts estimate of 5.9 billion euros.

-

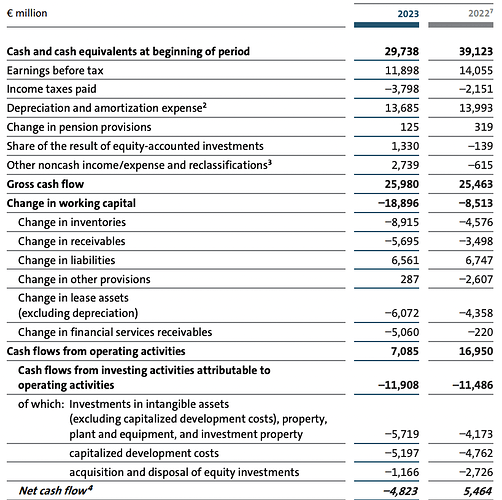

Volkswagen’s net cash flow declined by 72% y/y to 226 million euros during the quarter. In H1, net cash flow declined by 8% to 2.5 billion euros due to continuing bottlenecks in the logistics chains.

-

Volkswagen maintained its revenue and operating margin outlook for 2023. It expects revenue to grow by 10% to 15% y/y in 2023 and operating margin to be 7.5%-8.5%.

-

The group expects full-year net cash flow of EUR 6-8 billion “and has taken decisive measures to ensure that the lower end of this range is met.”

-

However, Volkswagen adapted its deliveries outlook for 2023 from around 9.5 million to 9 to 9.5 million. It said it will compensate for this with higher pricing and increase in production efficiency in H2.

-

Volkswagen noted that there were notable signs of recovery in China deliveries towards the end of the reporting period and that the group continues to see soid demand in general.

“We have strategically realigned and restructured the Volkswagen Group, with a clear plan and measurable milestones. In the first half of the year, the Volkswagen Group delivered reliably with very solid results. Sales in North America are picking up, we are strengthening our position in China through technological partnerships and on top of that the trend for fully electric vehicles is moving in the right direction. What is important to us is long-term, sustainable growth, with a focus on value over volume,” CEO Oliver Blume said.

"The focus for the second half is now on strengthening net cash flow. With the launch of performance programs at all brands and our strategic decisions in China, we will improve the competitive position of the Volkswagen Group even further,” CFO Arno Antlitz said.

“As anticipated, supply chain disruptions have continued to ease in H1 2023, with pressure shifting from semiconductor shortages to transportation and logistics delays. H2 should be supported by lower raw material costs and gradually easing logistical bottlenecks,” the press statement stated.

My take:

I think the results are sub-par. Investors may not like the results given that its European competitors reported better results/raised guidance. Mercedez raised its profit outlook while Stellantis and Renault posted better-than expected margins.

Source Volkswagen H1 2023 p. 44

Looking at the cash flow situation we can see an increase in inventories and receivables which is in line with the described bottlenecks in logistic chains.

We also see a very large increase in financial services receivables and an increase in lease assets.

This later point looks concerning as it means that Volkswagen is either financing its sales by granting customers more loans and leasing out more vehicles or potentially that some of the loans are starting to see payment delays. (I am not sure how this is accounted for)

We need to watch carefully for commentary about the cash-flow situation in the investor call and keep an eye on new half-year releases of Volkswagens financial services companies.

Great point on those competitor results. I think we should create an Automotive Industry Players Wiki article, which contains a table that features key numbers of competitors like their revenue, margins, net profits, cash flows, and market caps.

The goal of that table is to obtain a better overview of the industry and the developments of major players in it, so we know as an example more easily if one company is under or overperforming in the market, and then we can focus on what might be wrong if it’s a portfolio company.

This overview can also be very useful for us and the community to determine the relative value between different investment options within one industry.

(Note: I am not currently not looking to sell Volkswagen for one of the competitors though, as I have a level of faith in their brand portfolio that I do not have with a lot of competitors like e.g. Stellantis)

When it comes to competitor results we can indeed see that while Stellantis revenue did not increase more than the revenue of Volkswagen, their profits are significantly up and their cash-flows are very strong. So one could wonder why Volkswagen has those supply chain problems and if other companies manage their procurement better. (Or if they are simply less conservative and less hedged)

Renault is also upgrading its guidance and have strong cash flows

Mercedes-Benz gains look less impressive

I concur. Those insights can come in handy during decision making.

I am still in the process of making up my mind if I want to increase the Volkswagen position at the current stage by around 20-25%.

Please help by adding relevant information and arguments (including links to supporting data if available) to this mindmap. (I did not work on it yet)

What did they say about the cash flows?

Problem with car logistics of getting cars to customers. No questions or mention of the financial services receivables. Continuously very low credit losses. Given that no one put any emphasis on it and credit losses are low I am assuming that it is not a large problem as of now and maybe simply more loans have been given. (I or you could search if we find more details in the half-year report about that)

In any case, we should continue monitoring it closely going forward.

Here is the summary of the earnings call:

-

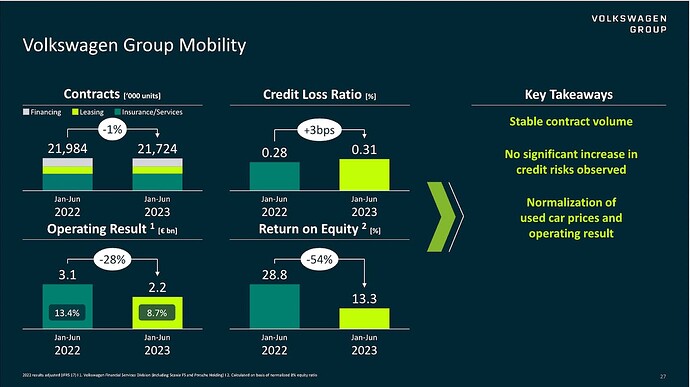

Regarding Volkswagen Financial Services, CFO Arno Antlitz said in the prepared remarks, “At Financial Services, we saw an overall stable contract volume, slightly lower financing contracts were compensated by more leasing and insurance contracts. Credit loss ratio remained stable at the prior year level despite the worsened macroeconomic environment.”

-

Volkswagen entered into a partnership deal with Xpeng, a tech leader in Chinese EV, to produce two new EVs for Chinese market by 2026. The deal is expected to reduce production and procurement cost for the two companies by up to 20%.

-

Volkswagen Chinese company, Tech Co, will produce NEVs based on MEB platform for the Chinese market next year.

-

Oliver Blume acknowledged the complexity of the business, but expects complexity to reduce as they transition to EVs. They also plan to significantly reduce the number of models in the lon-run.

-

Oliver said that Volkswagen is different from Tesla in that its products are individualized, which is expected to drive higher loyalty and profit margin.

-

To ensure they meet their targets, Volkswagen plans to adapt management compensation to the targets and ensure competition between the brands.

-

CFO Arno said, “Volkswagen Group is more under pressure in the current pricing environment in China.” That’s why they lowered their deliveries outlook for 2023 from around 9.5 million to 9 to 9.5 million.