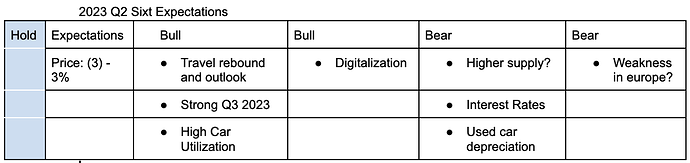

This topic centers on Sixt Q2 2023 earnings expectations and results.

While we are seeing positive signals in Q2 and Q3 2023 for Sixt our medium-term outlook is mixed and we are not changing the position. Over the long run Sixt especially its preferred stock trades at attractive levels. Q3 needs to be observed closely as it is the most important quarter of the year.

Travel

We are seeing a strong rebound in travel after covid with more industry growth projected in 2024 and beyond.

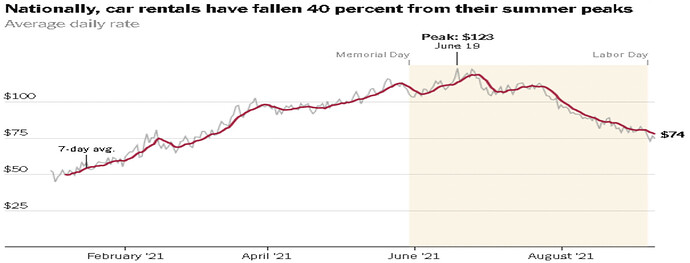

Rental prices

Rental car prices dropped from their 2021 highs as more rental cars came online. Revenues per day (RPD) stands at approx. $61 for Hertz and $70 for Avis. Both companies want to be conservative on fleet growth and achieve high utilization levels with high RPDs which is positive for Sixt.

Interest and Depreciation

Interest costs for car rental companies as well as depreciation are increasing. This is caused by falling used car prices.

Europe

There are signs of weakness in Europe like lower airfare prices. We need more research into this topic.

Mindmap

A mindmap draft of arguments can be found here.

Longterm

Longterm we are seeing potential opportunities in electric vehicles, autonomous driving, long-term rental mobility offerings, and opportunities in new markets including the USA. Areas to observe include the performance of Sixt’s CEO after the succession and the potential effects of climate change.

I=10

-

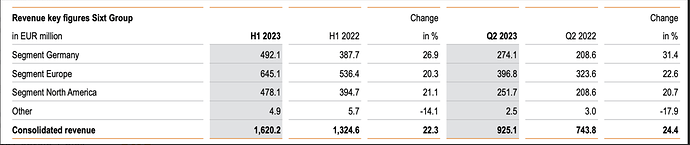

Revenue grew by 24.4% y/y to EUR 925.1 million, above analysts estimate of EUR 874 million(+17.5%), EBT was 131.9 million euros versus analysts estimate of 130 million and rental fleet(excluding franchises) grew 24.6% y/y to 166,300.

-

Sixt Co-CEO Alexander Sixt maintained the company’s FY23 EBT outlook of EUR 430 to 550 million and said, “The current uncertain macroeconomic situation for Europe, especially for Germany, may influence the course of the second half of the year and we are therefore also cautious with regard to our fleet purchasing for 2024.”

-

Germany has been their strongest revenue segment.

-

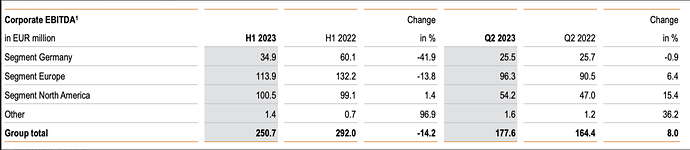

But segment Germany saw deterioration in EBITDA due to a mix of higher depreciation and interest costs.

SIXT achieves best ever second quarter | Corporate - EQS News

Sixt:Quarterly Results/2023 Q2 - InvestmentWiki

SI=0%, I=5

-

Jefferies maintained buy rating on Sixt with a price target of 145 euros.

-

Analyst Constantin Hesse said the company reported strong results and confirmed outlook as expected.

https://www.finanzen.ch/analyse/sixt-se-st-buy-902711 -

Baader Bank also maintained buy rating on Sixt with a price target of 140 euros.

-

Analyst Christian Obst said Sixt had a record quarter with key data exceeding consensus estimates.

https://www.finanzen.ch/analyse/sixt-se-st-add-902708