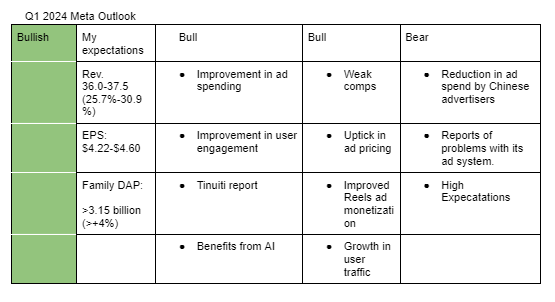

I am bullish on Meta’s Q1 2024 earnings. My estimates are based on positive sentiments on ad spend, improving engagement and tailwind from weak comps.

My positives include;

- Data checks by a number of analysts show that ad spending continued to improve going into Q1 earnings. Additionally, Magna recently revised up their 2024 growth projections for ad spending in U.S.

- Data checks by some analysts indicate that user engagement in Meta Platforms continue to improve.

- The Tinuiti report suggests continued rebound in ad spend and pricing across Meta Platforms.

- Meta continues to make progress with its AI recommendation features. I expect that to have helped it secure more ad spend.

- Meta continues to attract users to its Family of Apps. According to TipRanks, the number of visits to Meta Platforms rose by 43% in Q1 2024.

- Reels monetization continues to trend upwards, helping to boost user engagement in the likes of Instagram.

- Q1 2024 will benefit from weak comps. Q1 2023 revenue had grown by only 2.6%.

- Some advertisers have complained about a rise in the cost of advertising in the platform. I don’t expect this to have caused any significant churn in the quarter but to have benefitted the platform.

Concerning issues are;

- There are reports that Chinese e-commerce advertisers such as Temu started moving ad spend to other countries at the end of 2023 due to regulatory challenges. Data checks also indicate that Temu’s ad spend was highly volatile in Q1.

- Some advertisers have complained that Meta’s ad system is faltering, probably due to the layoffs of a number of engineers last year. However, it’s good that the likes of Temu haven’t noticed the problem.

- Looks like expectations that Meta will report great results for Q1 2024 are high. I think a small miss could lead to a significant drop in the shares, especially since a number of its current developments are long-term.

N/B:

Management Guidance (Revenue): $34.5 billion- $37 billion (20.6%-29.4%)

Analysts’ Estimate (Revenue): $36.1 billion (+26.1%)