This topic discusses tomorrow’s Q4 2023 Meta Plattform earnings. It includes our final assessment and decision before the earnings release. We will also summarize the results here. Here is our Wiki article on the same:

Summary of Q1 2024 Tinuiti Digital Ads Benchmark Report:

- Meta ad spend was up 16% y/y in Q1 2024 (Q4 2023:+13%), CPM was flat y/y (Q4 2023: -3%) while impressions rose 15% y/y (Q4 2023:+16%) driven by Reels.

- Facebook ad spend rose 9% y/y (Q4 2023:+8%), impressions fell from growth of 14% in Q4 2023 to 11% in Q1 due to tougher comparisons while CPM fell 2% (Q4 2023:-5%)-the smallest decline in the past seven quarters.

- Instagram ad spend grew by 34% y/y in Q1 (Q4 2023:+27%), CPM rose 6% (Q4 2023:+2%) while impressions rose 27% y/y (Q4 2023:+24%) aided by Reels and Explore.

- TikTok ad spend was up 21% y/y in Q1 (Q4 2023:+64%), driven by a 6% growth in impressions (Q4 2023:+44%) and 15% rise in CPM (Q4 2023:+14%).

- Tinuiti tracks ad spending by Temu on Google Search ads space and according to them, Temu’s

presence faltered in the last three weeks of the quarter.

Assessment

The Tinuiti report suggests continued rebound in ad spend and pricing across Meta Platforms. It’s good to see TikTok’s ad spend and impressions decellerating while that of Instagram are accelerating. It could confirm reports that TikTok is losing ground to Instagram. In Q4 2023, Meta revenue outperformed ad spend in the Tinuiti report by 12%. A similar trend could repeat itself.

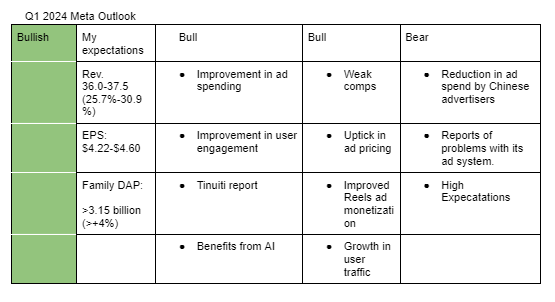

I am bullish on Meta’s Q1 2024 earnings. My estimates are based on positive sentiments on ad spend, improving engagement and tailwind from weak comps.

My positives include;

- Data checks by a number of analysts show that ad spending continued to improve going into Q1 earnings. Additionally, Magna recently revised up their 2024 growth projections for ad spending in U.S.

- Data checks by some analysts indicate that user engagement in Meta Platforms continue to improve.

- The Tinuiti report suggests continued rebound in ad spend and pricing across Meta Platforms.

- Meta continues to make progress with its AI recommendation features. I expect that to have helped it secure more ad spend.

- Meta continues to attract users to its Family of Apps. According to TipRanks, the number of visits to Meta Platforms rose by 43% in Q1 2024.

- Reels monetization continues to trend upwards, helping to boost user engagement in the likes of Instagram.

- Q1 2024 will benefit from weak comps. Q1 2023 revenue had grown by only 2.6%.

- Some advertisers have complained about a rise in the cost of advertising in the platform. I don’t expect this to have caused any significant churn in the quarter but to have benefitted the platform.

Concerning issues are;

- There are reports that Chinese e-commerce advertisers such as Temu started moving ad spend to other countries at the end of 2023 due to regulatory challenges. Data checks also indicate that Temu’s ad spend was highly volatile in Q1.

- Some advertisers have complained that Meta’s ad system is faltering, probably due to the layoffs of a number of engineers last year. However, it’s good that the likes of Temu haven’t noticed the problem.

- Looks like expectations that Meta will report great results for Q1 2024 are high. I think a small miss could lead to a significant drop in the shares, especially since a number of its current developments are long-term.

N/B:

Management Guidance (Revenue): $34.5 billion- $37 billion (20.6%-29.4%)

Analysts’ Estimate (Revenue): $36.1 billion (+26.1%)

Here are the Q1 2024 numbers:

- Revenue rose by 27% y/y to $36.46 billion, in-line with management’supper guidance and above analysts’ estimate of $36.14 billion.

- Earnings per share was $4.71 versus analysts’ estimate of $4.31 while operating margin rose to 38% from 25% a year ago.

- The average Family daily active people (DAP) rose 7% y/y to 3.24 billion (analysts’ estimate: 3.21 billion).

- Meta is guiding Q2 2024 revenue in the range of $36.5-39 billion (analysts’ estimate: $38.2 billion or +25.9% y/y), updating its 2024 total expenses to a range of $96-99 billion from $94-99 billion due to higher infrastracture and legal costs and 2024 capex to a range of $35-40 billion from $30-37 billion due to continued scale up in its AI infrastracture.

In the earnings call,

-

Zuckerberg said they will significantly invest on AI in the coming years and that his main focus this year and next year is on Meta AI.

“And this leads me to believe that we should invest significantly more over the coming years to build even more advanced models and the largest scale AI services in the world,” he said.

“But I’d say that’s the main thing that I’m focused on for this year and probably a lot of next year is growing that product and the other AI products and the engagement around them.”

-

CFO Susan Li said growth in spend among Chinese advertisers remained strong in Q1, driven by online commerce and gaming. She didn’t give outlook but said “they are lapping periods of increasingly strong demand over the course of 2024 given the recovery of China-based advertisers in 2023 from their prior pandemic-driven headwinds.”

-

Overall, their advertising and recommendation systems continue to track on well with revenue flowing through Advantage+ Shopping and Advantage+ App Campaigns having doubled since last year.

-

They said Reels now make up 50% of time spent on Instagram and that it continues to a positive contributor to overall revenue.

Summary

Assessment of the earnings

Q1 2024 results came in more than expected though Q2 guidance was below estimates. The company didn’t give any specific reasons for the guidance other than that it was lapping periods of strong demand. But given that growth rate expectations for Q2 have been high, I don’t think the small miss is a major concern. Looks like the market didn’t like the fact that Meta is going to invest significantly on Meta AI. I saw that the shares dropped from $430 to around $410 on Zuckerberg’s comments on Meta AI investments. In general, I am positive on Meta AI. Not just its AI monetization opportunities but also due to the possibilty that it will boost engagement on the sites. My first tests on Meta AI are promising.

-

Buy, $588->$550: Stifel said Meta reported solid Q1 but Q2 revenue outlook was below consensus, believes the shares were under pressure due to upward revisions to 2024 expenses and capex

-

Buy, $590->$550: Ronald Josey of Citi said the main debate coming out of the earnings is likely to be around Meta’s multi-year investments on AI and believes it is operating on a position of strenght.

-

Buy, $535->$480: JP Morgan believes that Meta can become the leading AI company in the world, says Q1 revenue and Q2 outlook was a bit lower than expected.

-

Buy, $555->$475: KeyBanc is more concerned on 2025 EPS and free cash flow but sees Meta as a normalized 10%-plus grower despite its AI investment cycle remaining an overhang.

-

Buy, $525->500: Baird said investors were caught offguard by higher capex outlook, exacerbated by softer Q2 guidance but thinks the reactions were overdone.

-

Buy, $600->$570: RBC said it would be buying Meta shares due to improved conversions in its core business and expansion of its moat through AI.

-

Buy, $575: Mizuho said the biggest surprise was that Meta will be in an AI investment cycle for long, added that its long-term fundamentals remained unchanged.

I=6

- Google’s advertising revenue rose by 13% y/y to $61.66 billion, exceeding analysts’ estimate of $60.18 billion.

- YouTube ads rose 20.9% y/y to $8.09 billion, above analysts’ estimate of $7.71 billion.

- Alphabet said they will purchase an additional $70 billion shares and pay the first cash divident of $0.20 per share.

- Alphabet stock jumped 12% following the results.

I=5

- Snap’s revenue rose by 21% to $1.195 billion in Q1 2024, exceeding analysts’ estimate of $1.12 billion.

- It reported global daily active users of 422 million, that was above analysts’ estimate of 420 million.

- Snap is guiding Q2 revenue in the range of $1,225 million to $1,255 million (+15%-18%), above analysts estimate of $1.22 billion.

- In their investor letter, Snap said revenue growth was driven by improvements in their advertising platform as well as demand for their direct-response advertising solutions.

-

In the earnings call, CFO Ruth Porat echoed statement by Meta that spend by APAC retailers was strong in Q1 and that they will begin lapping periods of strong demand from Q2.

“Results in our advertising business in Q1 continued to reflect strength and spend from APAC-based retailers, a trend that began in the second quarter of 2023 and continued through Q1, which means we will begin lapping that impact in the second quarter,” she said.

-

Porat noted that capex will remain high for the rest of the year.

“With respect to CapEx, our reported CapEx in the first quarter was $12 billion, once again driven overwhelmingly by investment in our technical infrastructure with the largest component for servers followed by data centres,” she said. “The significant year-on-year growth in CapEx in recent quarters reflects our confidence in the opportunities offered by AI across our business.”

“We do expect the quarterly CapEx throughout the year to be roughly at or above the $12 billion cash CapEx we had here in Q1.”

-

Analysts forecasted capex of $10 billion in Q1.

-

They saw an increasing contribution of AI to their Google Cloud revenue.

-

Some of their AI integrations include search overviews on the main search results page and Circle to Search which enables users to circle an image or object in a video and get an AI overview with lens.

https://seekingalpha.com/article/4686483-alphabet-inc-goog-q1-2024-earnings-call-transcript

-

Microsoft said they expect capex to increase materially in Q4 compared to Q3 due to continued demand for their AI services.

“We expect capital expenditures to increase materially on a sequential basis driven by cloud and AI infrastructure investments,” CFO Amy Hood said in the earnings call. “We continue to bring capacity online as we scale our AI investments with growing demand. Currently, near-term AI demand is a bit higher than our available capacity.”

-

Microsoft said its AI services contributed 7 points to Azure growth and that the number of Azure AI customers continues to grow alongside average spend.

-

Microsoft like Meta AI also offers open source models while its Azure OpenAI service is widely used.

“We offer the most diverse selection of AI accelerators, including the latest from NVIDIA, AMD, as well as our own first-party silicon. Our AI innovation continues to build on our strategic partnership with OpenAI. More than 65% of the Fortune 500 now use Azure OpenAI Service. We also continue to innovate and partner broadly to bring customers the best selection of frontier models and open source models, LLMs and SLMs. With Phi-3, which we announced earlier this week, we offer the most capable and cost-effective SLM available,” CEO Satya Nadella noted.

-

Some of the AI integrations include Cosmos DB and Microsoft Fabric.

“Over half of our Azure AI customers also use our data and analytics tools. Customers are building intelligent applications running on Azure, PostgreSQL and Cosmos DB with deep integrations with Azure AI. TomTom is a great example. They’ve used Cosmos DB along with Azure Open AI service to build their own immersive in-car infotainment system.”

“Fabric now has over 11,000 paid customers, including leaders in every industry from ABB, EDP, Energy Transfer to Equinor, Foot Locker, ITOCHU and Lumen, and we are seeing increased usage intensity. Fabric is seamlessly integrated with Azure AI Studio, meaning customers can run models against enterprise data that’s consolidated in Fabric’s multi-cloud data lake, OneLake. And Power BI, which is also natively integrated with Fabric provides business users with AI-powered insights. We now have over 350,000 paid customers.”

-

They are also using AI to accelerate growth in LinkedIn Premium.

https://seekingalpha.com/article/4686499-microsoft-corporation-msft-q3-2024-earnings-call-transcript