This topic discusses the upcoming 1&1 Q1 2023 earnings. It contains our earnings outlook and a summary of the results. Here is our Wiki article on the same:

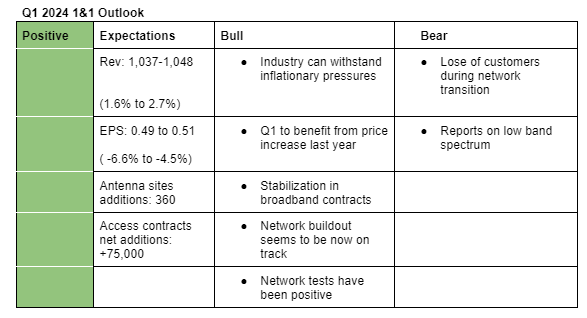

I am positive on 1&1 Q1 2024 results. My guestimates are based on the fact that 1&1 has beaten analysts revenue and EPS estimate by an average of 1.6% and 3.3% respectively in the past four quarters. Here is an explanation of my above bullish and bearish points.

Bullish;

- 1&1 operates in an industry that is essential for most people hence inflationary pressures are unlikely to have an impact on its earnings.

- I expect Q1 2024 results to benefit from price increases initiated in Q2 2023.

- 1&1 said during the recent earnings call that broadband contracts have stabilized.

- 1&1 seems to be now on track in its network buildout as evidenced by its recent announcement that it achieved the 350 antenna sites target.

- Network tests carried out by Teltarif were positive. This reduces the amount of churn during the migration of customers.

Bearish;

-

1&1 said they expect to lose customers that are hard to quantify this year as they transition to their network. Though they said these are low-valued clients, hence expected impact on revenue will be low, we can’t fully know until we see the results.

-

The main agenda among investors will probably be the progress on the network buildout as we have witnessed in the past. Therefore, if management’s comments are in support of recent media reports that the low-band frequencies might go to the old users, investors may react negatively since this will make the network more expensive.

N/B:

Here are the analysts’ expectations:

Revenue (Q1 2024): €1,031.9 million (+1.1% y/y)

EPS (Q1 2024): €0.49 (-7.5% y/y)

Revenue (FY2024): €4,207.1 million (2.7% y/y)

EPS (FY2024): €1.71 (-4.5% y/y)

Good overview.

I agree with your assessment and one further analyst that operating results will be less important this quarter, and everyone will be focused on the large structural changes that come with 1&1 own network and the frequency allocations.

A few more questions about that topic:

Which media reports indicate low-band frequencies might go to the old telco providers?

Did any of 1&1’s German competitors report their numbers already, and if yes, are there further insights into frequency band allocations?

Are the comments you linked about higher network/roaming costs made in comparison of 1&1 operating it’s own network, or would roaming costs also be higher than they are right now and hurt current margins?

1&1 is reporting its earnings earlier than its competitors this time round, but here is what I was able to find;

-

An internal letter from the Federal Network Agency suggests that an extension is likely.

-

The letter details the rules that will govern the extension and is still referred to as a “consultation draft”.

-

The draft rejects a spectrum swap that was being championed by 1&1.

-

Though the draft is considered preliminary, a change of heart by the authority is seen as unlikely [1].

-

In January, the Federal Network Agency hired EY and WIK-Consult GmbH to carry out a study [2] on competitive conditions in the German mobile market.

-

The study established that there was sufficient competition and entry of a fourth MNO will increase such competition.

-

The Federal Network Agency said it will consider the findings of the study in its decision.

-

Deutsche Telekom Chief Executive Timotheus Höttges praised [3] the findings of the study saying it would have a beneficial impact on BNetzA’s decision.

“So I think it’s on a good path now. We are very encouraged by the statements, and I expect that there will be an extension of the use,” he said in their February earnings call.

-

During the recent MWC Barcelona 2024, European Commissioner for Internal Market Thierry Breton said they were working on a White Paper that would eliminate costly auctions across the region [3].

The above reports make me more inclined towards the extension. Though 1&1 has tried hard to justify the need for an inclusive plan by sponsoring studies that come to the same conclusion [4, 5], its rivals such as Telefonica are doing the same and arriving at an opposite conclusion [6]. Therefore, I think BNetzA might decide to go with the findings of its own study. The backing from the European Commission may also give them an upper hand against critics of an extension.

The comments on costs relate to the later point. 1&1 said if they don’t get the low-band frequency, they will have to purchase more roaming than they need today which will be more expensive.

- Buy, €29->€25: Warburg’s analyst, Simon Stippig does not expect any surprises but rather constant progress when 1&1 reports its Q1 results. He also expects constant progress in the construction of its network.

- Neutral, €20: Analyst Ganesha Nagesha of Barclays said network expansion is the main focus and thinks the migration to the Vodafone network and the spectrum auction are the most important events. He wants 1&1 to expand its contract with Vodafone so that it can get access to its NetCo, a significant added value.

Wow, I have to say 1&1 not getting the low-frequency band was not my base case.

I looked up the exact comments of 1&1 during the Q4 2023 earnings call regarding this possibility and impact. Ralph Dommermuth said:

Then you asked what we are doing if we don’t receive any low end frequencies. And I’d say, I’d expect that we will receive them. But of course, there could be an auction and someone may have a better bid than we do. Then we will have to buy more roaming than we do today. Our network is working as operational today without low band frequencies. So where we don’t have coverage for our frequencies, we will have to buy more roaming. And when we are lacking frequencies, we will have to replace them with roaming services.

On the one hand, that’s expensive because roaming costs money. On the other hand we will save the money for purchasing frequencies. So you could now do the math using your spreadsheet and try to calculate when it’s cheaper to remain at roaming and when it’s cheaper to switch to the broadband frequencies.

So if it’s €100,000,000 for example, for roaming, the frequencies will be less expensive and the other way around. So we will have to evaluate or assess that if we do not receive frequencies. But for now, we would expect that we will receive them because it has to be free from discrimination. "

What is your assessment of the overall situation?

Do you know if 1&1 has the contractual guarantee to buy low-frequency frequencies from Vodafone over the full course of their contract and prices for low-frequency only are more or less defined already by the terms of this contract?

Would the BNetzA create an obligation for national roaming like outlined here?

Do you have a link to the source of the internal letter from the Federal Network Agency?

What are analyst or market commentators are saying or thinking about it?

In summary: How much would 1&1 be affected by not getting low-band spectrum? Are enough rules in place that would guarantee them to buy the spectrum and be not at a large disadvantage either from a quality of service and cost perspective?

Discussions on the topic appear mute. I only find one article that seems to touch on it but it requires a subscription [1]. As at October 2023, Fitch expected no spectrum auction in 2025 [2].

I also couldn’t find the link to the internal letter on BNetZa website.

I think there aren’t enough rules at the moment to guarantee sale of frequencies to the likes of 1&1 at favorable terms. But that’s one of the agendas of BNetZa Advisory Board meeting scheduled to be held at the end of September [3].

So far, information on its agreement with Vodafone only relates to national roaming. But they said they are still discussing the agreement, so maybe they would announce it in the full report.

I think even if there would be an extension, BNetZa will come up with mechanisms to please the likes of the Federal Cartel Office [4], the Monopolis Commission [5] and politicians [6] who have been in favor of the fourth MNO. That will possibly be favorable sale terms for frequencies.

From my understanding national roaming comprises all frequency bands and 1&1 might be able to only purchase the frequencies it needs but I am not certain.

So if 1&1 will provide their own high frequencies via their antennas they don’t need to purchase high frequency anymore from Vodafone but only low frequency.

Given the comments from Dommermuth I would assume that only purchasing low frequency is pretty much guaranteed but it remains a risk and we should concentrate on my details during tomorrows report and conference call.

Yeah, their Telefonica roaming agreement provided them with the right to purchase only high-band frequency of 2.6GHz.

“1&1 Drillisch has the possibility to rent frequencies in the amount of 2×10 MHz in the 2.6 GHz band from Telefónica Deutschland on the basis of the commitments given by Telefónica Deutschland as part of the EU merger clearance of the merger with E-Plus. These frequencies will be available until 31 December 2025.”[1]

- Here is an excerpt from the E-plus merger agreement [2]:

" Telefónica will make available to an interested party a package of 2.1 and 2.6. GHz frequencies, mobile sites, national roaming and a passive site sharing, to allow the potential entry to a new competitor in Germany."

Yes, his comments have been signaling that they can get the low frequency from other operators. The question remain at what terms?

- 1&1 Q1 2024 revenue was flat at €1,024.4 million (analysts estimate: €1,031.9 million or +1.1%), dragged down by hardware and other (low-margin business) revenue which fell by 12.8% y/y to €202.5 million, service revenue rose 4.2% y/y to €821.9 million (analysts estimate:€822.3 million), EBITDA was flat at €182.3 million (analysts estimate: 187.2 million)-weighed down by increased network startup cost while EPS came in €0.47 vs analysts estimate of €0.49.

- 1&1 said they closed the quarter with 1,334 antenna sites versus 1,350 guided.

- In Q1, access contracts was flat at 16.30 million (addition of 40k), missing analysts estimate of 12.31 million (addition of 70k), mobile and broadband contracts were flat at 12.29 million and 4.01 million, respectively.

- 1&1 said at the end of March, they had migrated 700,000 customers to their own network and that the migration process is going on well.

- 1&1management maintained its 2024 guidance which includes service revenue of €3.37 billion (analysts estimate: €3.36 billion or +3.6%), EBITDA of €720 million (analysts estimate: €719.6 million or +10.1%) and mobile network startup costs of €-160 million (analysts estimate: -€160.5 million).

In the earnings call;

- 1&1 mentioned a leaked BnetzA internal letter in the yellow press, which mirrors their worst-case scenario (Context: A low-band frequency prolongation without an obligation to provide access for 1&1). They said they are waiting for an official statement.

- They pointed out that if they miss the low-band spectrum, they will make use of national roaming to provide a good indoor coverage which will imply that they will have low traffic (Context: they still guide for close to 50% nationwide coverage by 2030 without the low-band frequency and 60% if they get possession of it) and that impacts their financial performance (due to higher cost of national roaming).

- 1&1 said they experienced a significant migration at the end of March, that their current migration level is 20-40k per day (Context: they approaching optimum level of 50k per day) and that they had migrated around 1 million customers at the end of April.

- They noted that the customer additions during the quarter was impacted by discounts offered by competitors and the migration though the latter’s impact couldn’t have been high due to the low number of migrated customers.

- They said they had 530 base stations (Guided: 600) and 227 active antenna sites (Guided: 200) at the end of March and that they still want to have 3,000 antenna sites at the end of 2024.

- They are guiding for 80-100k net customer additions in Q2 2024 (aided by the tariff changes they made last quarter), which would be above their guided 75k upper point average for each quarter this year (they said in Q4 2023 that they expect to add 200-300k customers in 2024).

Assessment of the earnings

1&1’s operating performance during the quarter was stable though the net customer additions was impacted by the migration. Also, their 2024 outlook and progress on the network buildout and customer migration to own network is positive. The missing piece is the decision of BnetzA on whether to extend the network or not and if to provide obligation for sharing of the low frequencies. The fact that the call focused on the worst case scenario implies that 1&1 may get disadvantaged by the decision.

- Buy, €21.8: Analyst Polo Tang of UBS said 1&1 performed mixed and that the most important driver of price is clarity on the network expansion.

- Underperform: €10.1: “Slow customer growth, high costs – and not a word about the elephant in the room,” analyst Ulrich Rathe of Bernstein wrote. He added that the question is how 1&1 will react if it didn’t get the low frequency.

-

Telefonica expects the spectrum to be extended, O2 Germany CEO Markus Haas didn’t touch on obligation for spectrum sharing.

“In Germany, spectrum extension is the expected scenario.” Telefonica said in their Q1 2024 earnings call.

“According to the EU Commission, the investment gap for #5G and fiber optics across Europe is already 200 billion euros by 2030,” Haas said in a Linkedin post. “A legally secure extension of the frequency usage rights for a maximum of eight years would provide additional necessary expansion impulses to make our country and our economy sustainable in the age of AI.”