This topic is to discuss PCE data releases and developments during the month that could give us an indication about the FED direction in the coming months.

We track the data here: Personal Consumption Expenditure - InvestmentWiki

This topic is to discuss PCE data releases and developments during the month that could give us an indication about the FED direction in the coming months.

We track the data here: Personal Consumption Expenditure - InvestmentWiki

SI=2%, I=8

Core PCE rose 0.2% in June in-line with Dow Jones estimate, and lower than the 0.3% increase in May.

Year-over-year, core PCE increased 4.1% versus 4.2% estimate, and below 4.6% increase in May.

Headline PCE rose 0.2% in June versus 0.1% in May.

Yearly, headline PCE rose 3%, down from 3.8% increase in May.

Personal income(nominal) rose 0.3% in June versus 0.4% estimate.

Personal spending(nominal) rose 0.5% in-line with estimates.

SI=0%, I=7

Core PCE increased 0.2% in July, in-line with the forecast and same as in June.

Yearly, core PCE rose 4.2% in July, also in-line with the estimate but above the 4.1% increase in June.

Headline PCE grew 0.2% in July, unchanged from June and in-line with the estimate.

Real consumer spending rose 0.6% for the month, above the 0.5% estimate.

I=8

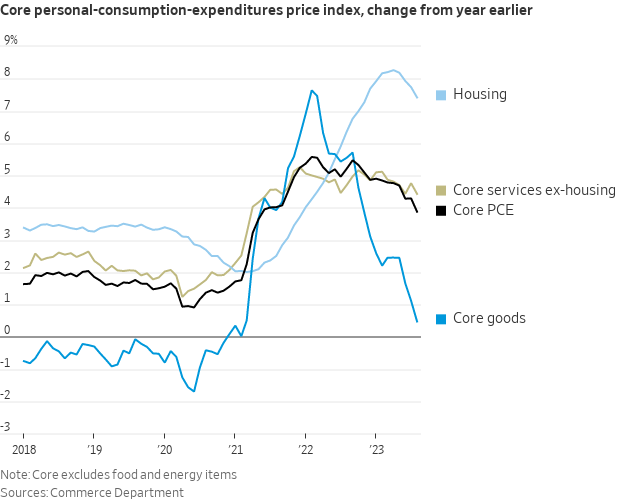

Y/Y Change:

Core goods: +0.5%

Housing: +7.4%

Core services ex-housing: +4.4%

https://twitter.com/NickTimiraos/status/1707763133048107358/photo/1

Core looking good, but headline still uncertain.

Different components, while the y/y is declining nicely, and 3 month trend is not great. Similar to CPI.

I=7

I=7

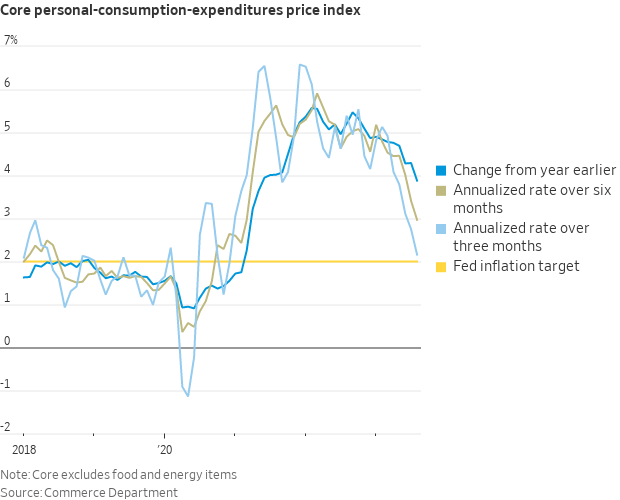

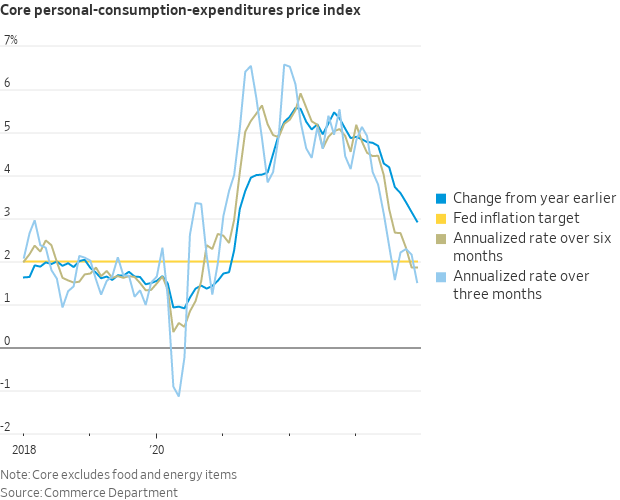

Six months annualized rate for core is now at 1.9%. Rates saying 5.5% are making policy more and more tight each month if inflation comes down.

I sometimes wonder or give some thinking to the possibility that the FED will actually be late to cut rates (will not be the first time), and cause instead some deflation next year due to the fear of a 70-80’s scenario again.

A totally unexpected outcome currently in the markets.

Is a tricky environment currently to know what the right move will be, as the path is not really clear and all scenarios have some possibility still.

For now, is good to see it come down, and spending being still stable. Is probably going to continue to fuel the soft landing narrative and positive sentiment currently.

https://twitter.com/NickTimiraos/status/1738191709370978309/photo/1

I=6

This is the evolution of super core PCE. Currently at 3.3T Y/Y.

At a 6 month annualized rate, core PCE is already at target.

https://twitter.com/NickTimiraos/status/1750874882496217207/photo/1

I=6

The developments for Super core PCE are not the best for January at 0.59% m/m.

Highest m/m since 2021.

Today we also got PCE quarterly data along with the GDP report.

Q1 PCE is significantly higher compared to Q3 2023 numbers.

There is speculation this would mean a hotter-than-expected report for tomorrow’s March report but is difficult to know with certainty since PCE usually has revisions to prior months.

Current expectations are for 0.3% M/M, so between 0.3/0.4% could be possible.

But a soft report (probably with a lower probability) could result in a significant rally tomorrow since expectations are already skewed to be hot.

The quarterly report is not as disaggregated as the monthly one, so we would need to wait until tomorrow for more details. But today’s report showed higher prices on services mostly. Goos continue to be negative, bus much less than before.

https://www.bea.gov/sites/default/files/2024-04/gdp1q24-adv.pdf

I=7

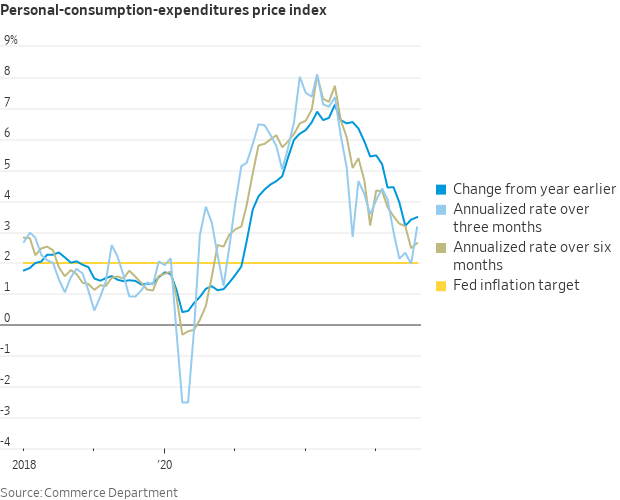

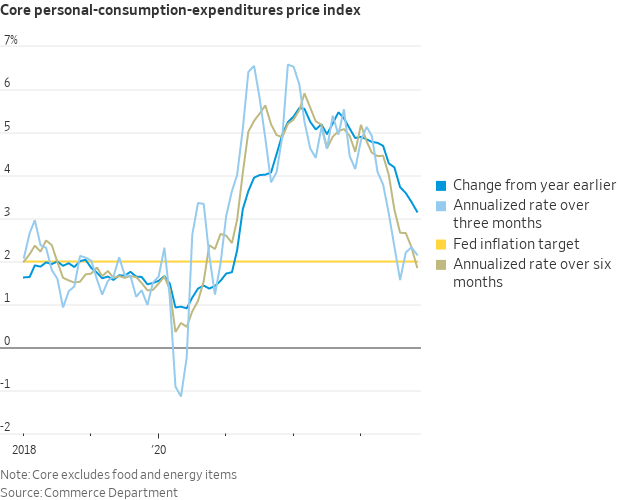

PCE data came in better than feared yesterday.

However, PCE is still showing an upward trend, especially in the last 3 months.

3M ann rates, in a clear uptrend, even goods inflation has had a significant rebound, but still low.

The 6m ann rates uptrend trend is still more muted, but services and super core services are still around ~4% 6m ann, a bit better than the prior month.

Y/Y measures show signs of bottoming at a higher level than the target.

Contributions to PCE

Inflation data: US Economic Data - Google Sheets

I=7