Research about potential impact of tariffs on the US economy

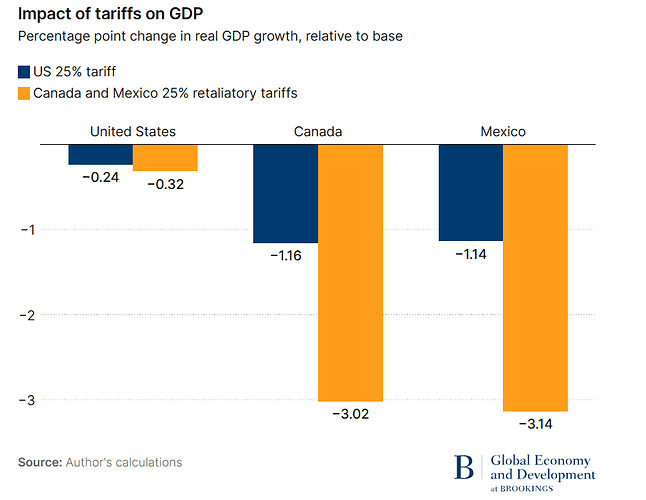

Brookings: The U.S. tariff of 25% on imports from Canada and Mexico is going to reduce U.S. economic growth, reduce jobs, cause wages to fall, and prices to rise, and retaliation by Canada and Mexico will multiply the economic harms across the three countries.

- Analysis doesn’t include China

- The economic impacts are estimated over the medium term (three to five years).

Results:

- Negative Impact on GDP Growth: Without retaliation, U.S. GDP growth may drop by 0.25 points ($45B loss). With retaliation, the decline exceeds 0.3 points ($75B loss)."

-

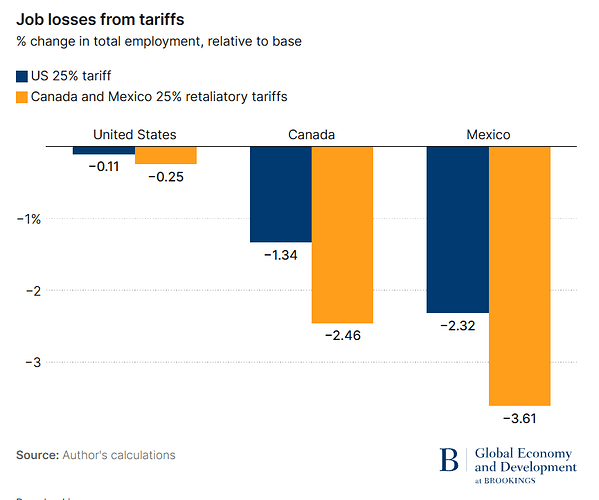

In the U.S., the 25% tariffs are estimated to cause over 177,000 job losses without retaliation, increasing to over 400,000 job losses if Canada and Mexico retaliate.

-

U.S. wages are projected to decline by 0.2% without retaliation and by 0.5% with retaliation.

-

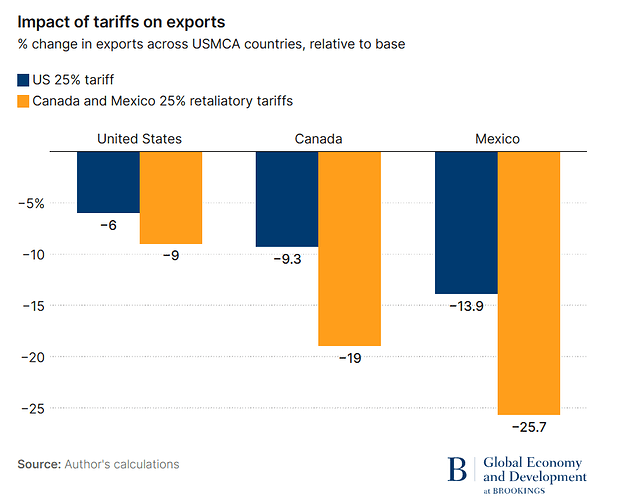

U.S. exports to Canada and Mexico are expected to decline by around 6% with U.S. tariffs and 9% with retaliation.

-

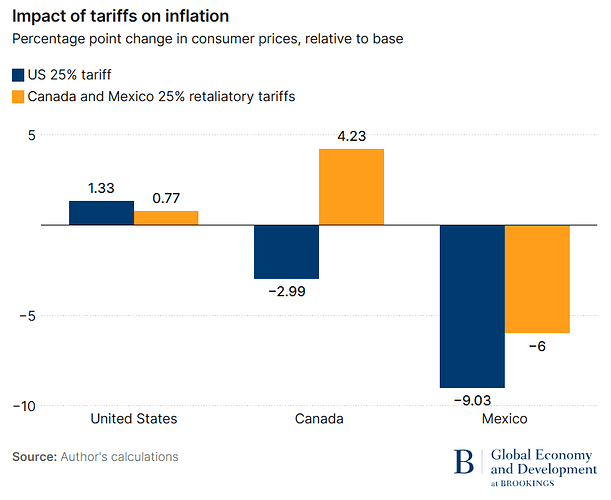

The tariffs are projected to cause inflation to rise in the U.S. by over 1.3 percentage points without retaliation. With retaliation, the inflation increase is estimated to be around 0.8 percentage points due to the greater economic slowdown.

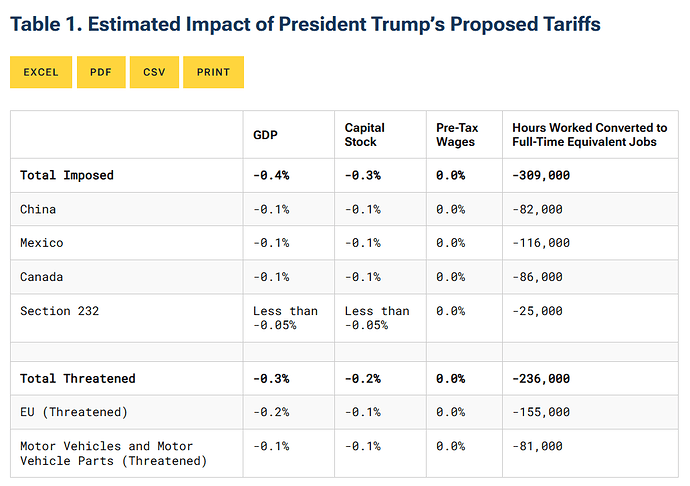

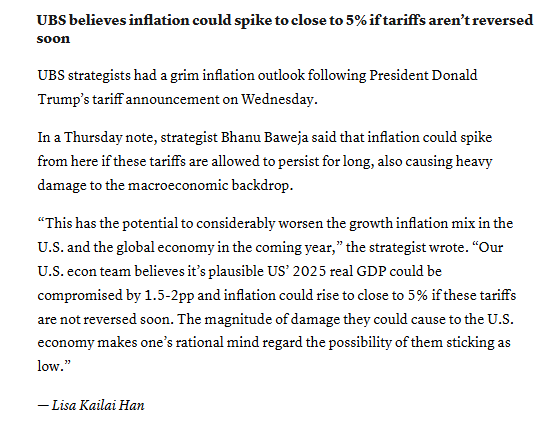

According to Tax Foundation tariffs will weight on GDP Growth and employment for the US instead of the opposite as Trump is declaring

- The average tariff rate on U.S. imports could rise to 8.4% in 2025, the highest since 1946.

- Second Trump administration tariffs now affect more than $1 trillion of imports, and when temporary exemptions for Canada and Mexico expire in April, the tariffs will affect more than $1.4 trillion of imports. (~5% of GDP)

- The after-tax income of American households is projected to decline by 1% on average in 2026 across all income levels:

- Lower-income households are hit harder in relative terms due to higher prices on basic goods.

- The top 1% of earners face a smaller decline of 0.8%, but no group escapes the overall cost burden

- Estimated $2.34 trillion in additional tax revenue over 10 years, but dynamic effects lower revenues as tariffs shrink the economy.

- Academic and governmental studies find that the previous Trump-Biden tariffs have raised prices and reduced output and employment, producing a net negative impact on the US economy.

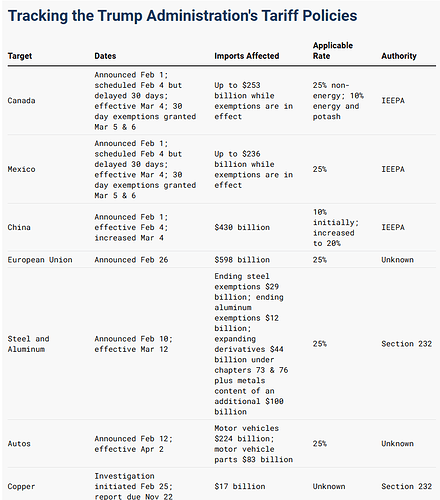

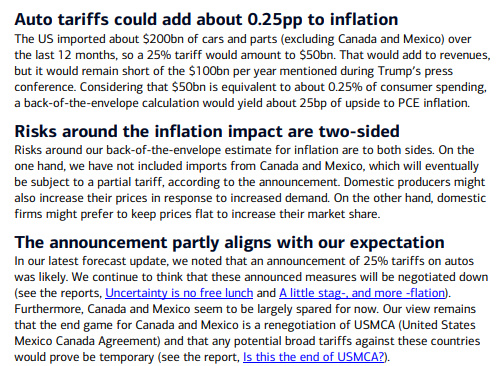

Potential Auto Tariffs Impact On PCE according to BoA. They also think tariffs to Mexico and Canada are likely to be negotiated

BoA says that their “back of the envelope” calculation is the announced auto tariffs would add around 0.25% to PCE inflation, but they continue to expect that “these announced measures will be negotiated down…Our view remains that the end game for Canada and Mexico is a renegotiation of USMCA and that any potential broad tariffs against these countries would prove be temporary.”

Analyst Opinions on Trump Reciprocal Tariffs Impact on the Economy

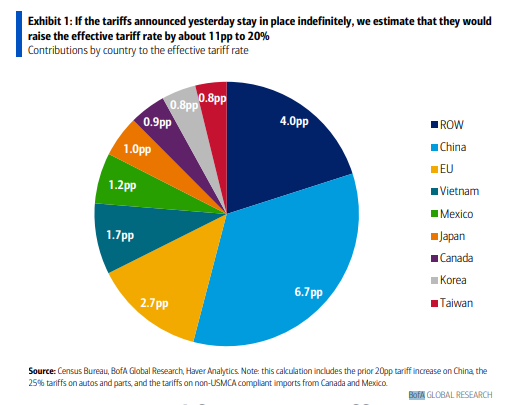

- BoA: tariffs would raise the effective tariff rate by about 11pp to 20%. Think they would add 1- 1.5pp to inflation (the core PCE is currently at 2.8% y/y) and subtract a similar amount from GDP growth over the next couple of quarters.

More details

“As of April 1, the effective US tariff rate (based on all announced measures) stood at around 9%… If the tariffs announced yesterday stay in place indefinitely, we estimate that they would raise the effective tariff rate by about 11pp to 20%. These figures are far larger than what we or markets were expecting. They would push the US much further along the stagflationary path, close to a tipping point where demand collapses under the weight of higher prices.”

“If the tariffs stay in place, we think they would add 1- 1.5pp to inflation (the core PCE is currently at 2.8% y/y) and subtract a similar amount from GDP growth over the next couple of quarters, pushing the economy to the precipice of recession. The drag on growth could last longer than the boost to inflation.”

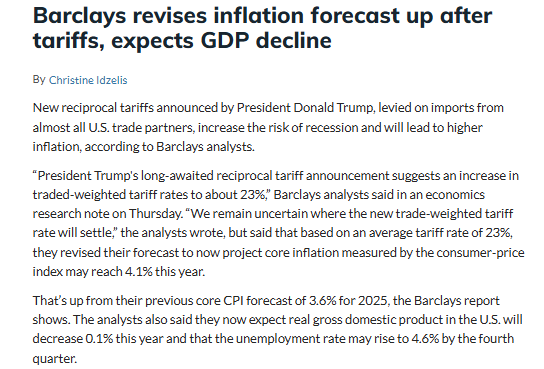

- Barclays: says if tariff rates stay at current levels they see real GDP of -0.1% this yr with the unemployment rate hitting 4.6% and core PCE 4.1%.

- USB: plausible US’ 2025 real GDP could be compromised by 1.5-2pp and inflation could rise to close to 5% if these tariffs are not reversed soon

-

Ed Yardeni: PCE inflation could be between 3-4% rest of the year, with a possible shallow recession later in the year

-

JPM: PCE inflation could increased by 1-1.5% this year, with the economy falling very close or into a recession

-

Tax Foundation: Trump’s tariffs will raise nearly $3.2 trillion in revenue over the next decade and reduce US GDP by 0.8 percent. In 2025, Trump’s tariffs will increase federal tax revenues by $290.4 billion, or 0.95 percent of GDP

- Carlyle Group: effective rate now more in the range of 15%-18%, which is 50%-60% larger in terms of impact than what was expected. The economy is now dealing with a potential 1.5% hit to GDP implicit of tax liabilities.

More details

“Most were anticipating that the effective tariff rate would have gone up by about 10% — so a 1% GDP hit — but it looks like it’s more in the range of 15%-18%, which is 50%-60% larger in terms of impact than what was expected,” Thomas said. “The economy is now dealing with a potential 1.5% hit to GDP implicit of tax liabilities.”

Thomas said it will take “months of hard data” to convince the Federal Reserve that the economic shock is real and a rate cut is appropriate. “If unemployment rises from 4% to 4.5%, we could have the Fed cutting rates by July, September,” he said. “Any cut that they do make will have to be done gingerly. I appreciate it’ll be a more measured response, maybe 50bps in cuts.”

Will continue to edit this, as I encounter more..

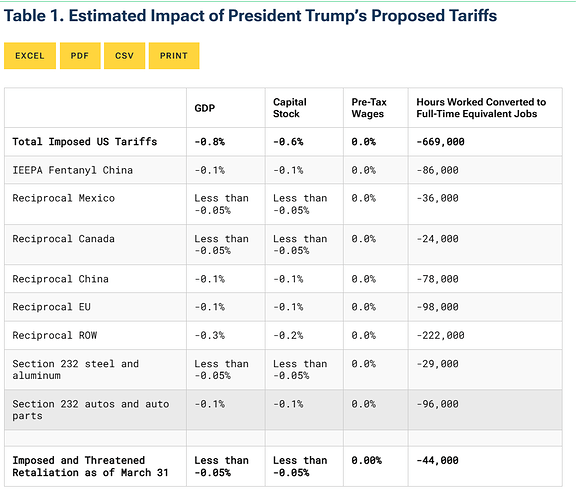

Magaly’s assessment Trump April 2 tariffs Announced

This could changed as more data and analysis start to come out

The overall outlook from analyst estimates, if tariffs remain in place, is

- The economy would fall or be very close to a mild recession

- PCE inflation would increase ~ 1 -2%, close to 4%

- Since prince increase is a one-time effect, the growth consequences would be more long-lasting

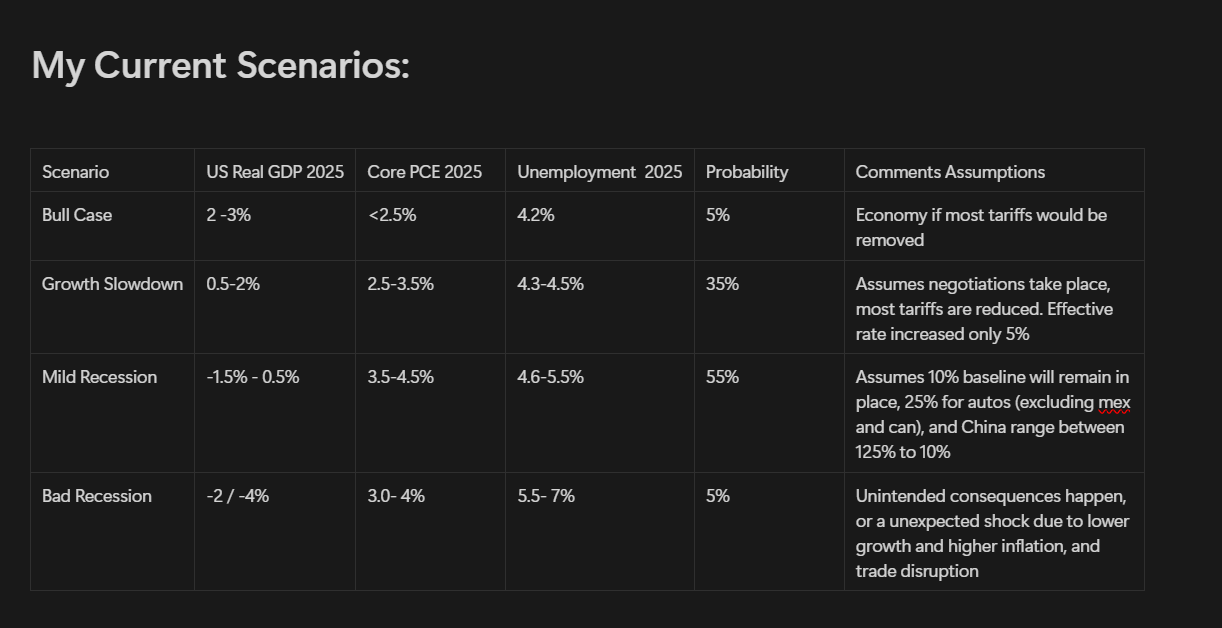

These are my current probabilities (with information as of now and uncertainty), and without taking much into account about other policies as spending cuts or less immigration.

In my opinion, these levels of tariffs increases significantly the risk of experiencing a recession in the next year, these are the arguments:

- A 20% effective rate from 4% as its being estimated on all imports (~4.1 Trillion in 2024) would be a ~$650 billion cost headwind. This is 3.2% of consumer spending, 17% of US corporate profits, and 2.2% of GDP. (my assumptions is consumer and businesses will divide the price increases hit)

- PCE inflation increasing to ~4%, would bring real disposable income close to zero or negative (disposable income currently growing at 4.4% y/y, but slowing), creating an additional headwind to consumer spending. Especially, if uncertainty continues to depress sentiment and increase the consumer saving rate.

- Hit to margins (not all costs expected to be passed to consumers) from importers (small share of total businesses), and from slower spending, but mostly uncertain outlook also expected to continue pausing or completely delaying investment spending.

- If retaliation happens, the economic consequences could be worse, since exports could also be hit with higher tariffs by partners (exports 11% of GDP)

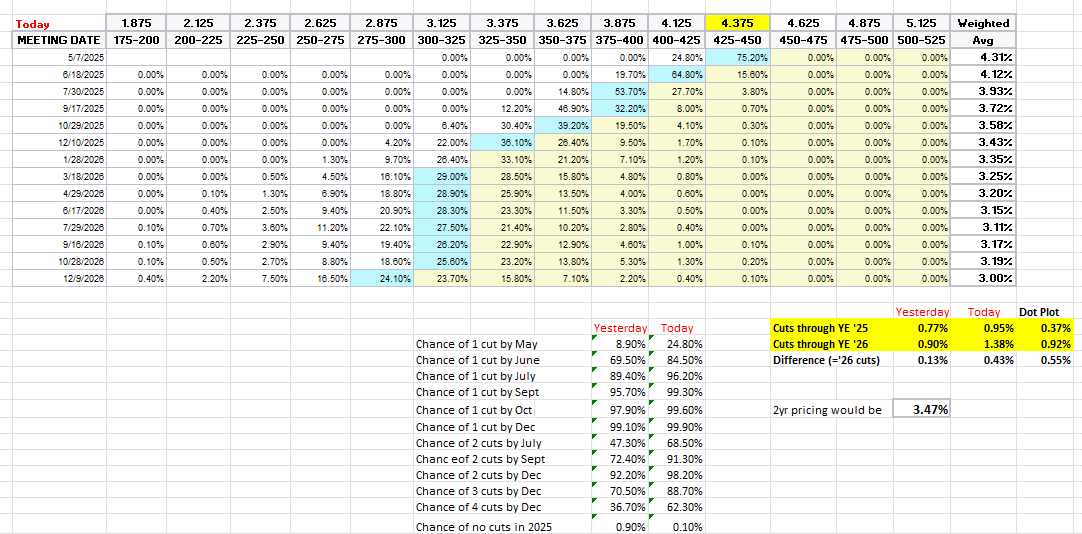

The market is now pricing a 62% probability of four cuts in 2025 (up from 37% yesterday). The cuts are priced in June, July, Oct, and Dec (95bps, up from 77)

- There’s an additional 43bps priced for 2026 (so still over 1.5 cuts), 138bps through Dec '26.

- I think the FED is in a difficult place, the market is more convinced they will focus on weak growth more than inflation (because of 1 one-time price effect only), but I think the FED could be more hesitant to cut if they see inflation increasing beyond 3% again.

- Despite today’s sell-off, the market is still only down by ~12%, IMO the market is still not currently completely pricing a recession or in panic mode (usually 20-30% sell-offs), and bigger sell-off could come if data start to get worse, or no much transaction in negotiations take place.

JPMORGAN: TRUMP TARIFFS WILL PUSH U.S. INTO RECESSION THIS YEAR

JPMorgan now expects the U.S. economy to contract this year, slashing its GDP forecast from +1.3% to -0.3% following Trump’s sweeping tariffs.

Unemployment is projected to rise to 5.3%, with the Fed likely to cut rates at every meeting through January—even as inflation climbs.

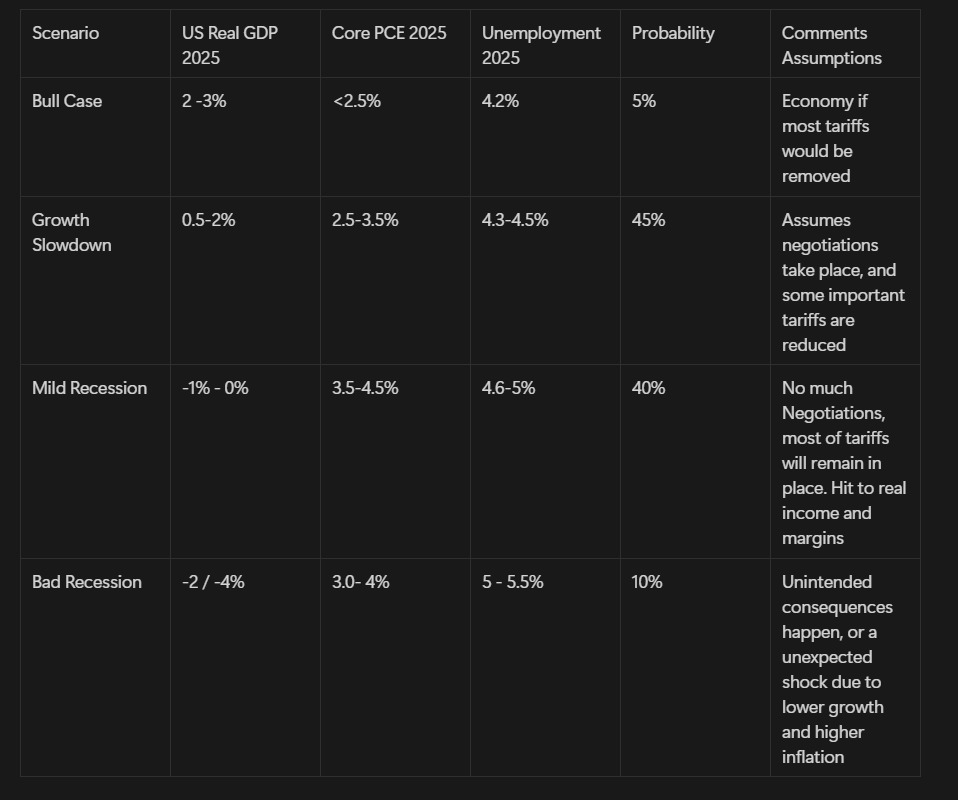

Magaly Assessment Latest Developments with Tariffs as of April 9, 2025.

This was made very fast to have an initial assessment of the situation, it could change with additional data or analyst insights of things I could be missing

While the 90-day pause on reciprocal tariffs seemed good at first, the escalation with China is making the outlook still challenging for the economy, and on top of that there is also still a 10% tariff on all other imports, Hence I am maintaining a mild recession is still the most likely outcome with these conditions, and have actually increased the probability to 55% from 40%.

Model Scenarios: I am about 70% confident about these ranges and probabilities. My lower confidence is that I am still researching what could be the consequences beyond trade from this, but the fact escalation is only with China (for now) lowers the probability for this to turn into something catastrophic.

My arguments and modeling process (which is very simplified, just to get a rough estimate):

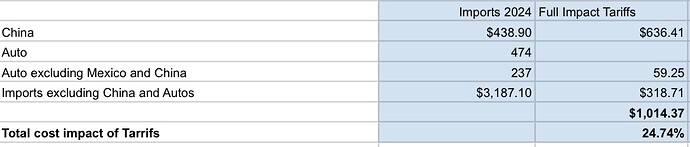

125% tariffs on China, 10% rest of the world, and 25% autos and part (excluding mex and can), means a headwind/cost increase of $926 B (22.5% additional effective rate). This is larger than the $650 before. (This is assuming full impact from 2024 levels)

-

There will be for sure declines in imports from China and Autos, assuming China imports fall by 50% in 2024, autos fall by 25%, and other imports increase by 2.5% (there will be some rerouting from China to other countries, and yuan could devaluate to offset tariffs as it has been happening). It would mean a headwind of $645 B (15.75% additional effective rate)

-

However, I am assuming that the economy has a total cost headwind $741 B (80% of the total, as a worst case). Because even if China’s imports decline, consumers/businesses will have to substitute (domestic/international) at higher prices in most cases, and in some cases, there will be supply constraints in some products due to the US/other countries not having the capacity.

→ This means a total headwind of ~2.5% to GDP, 3.74% of spending, and 21.5% of profits. I have modeled this to be roughly ~ -1.5% real GDP in 2025. -

It seems for now that the 10% baseline for all countries is not negotiable. So I think the likelihood this could be the floor is high (until I found new information than signal otherwise)

-

In a scenario where there is a deal with China and their tariffs also come down to 10% (which seems unlikely to be this low imo). The headwind could still be between $400 and 421 Billion (1.37 - 1.5% of GDP) → a much milder, but still, a recession is likely

-

In any case, even if tariffs only increased by 5% in total, it would still mean a headwind of $205 B (-0.7% of GDP, 1% spending), which is reflected in the growth slowdown scenario.

-

This analysis is for 2025, but in reality, this could extend to 2026, it depends on supply chains and initial inventory from firms (demand has been pulled in some cases) that could mean relatively good data still for some months

Great. I like how detailed and quantitative this is. This is exactly how I think as well (I usually try to estimate scenarios like in the picture below quickly in my head as well when thinking about impacts) but if you calculate them, lead us through everything and go into more depth and detail this is obvs. way better.

I think you could even extend your descriptions here in the Forum a bit or directly share screenshots of the relevant part in the model so it becomes even easier to understand everything and follow along by just reading the Forum.

For example just looking quickly at the model I am not sure how you arrived at the 645billion impact from China and what it assumes, what it is and how it translates into your scenarios (How it translates into inflation, growth, unemployment, earnings etc etc.)

In addition I would be curious about your confidence for some of the assumptions in the model. For example I saw that in all models you just assume a 5% reductions of u.s. exports which might be optimistic (?)

You could also highlight in the model itself which parts are work in progress and which ones are more finished. (E.g. using colors)

Sure, I can do that, obviously, I am just modeling rough estimates on GDP, and that’s why I am using ranges on my table, as I cannot have great confidence in an absolute number due to the complex underlying dynamics of the economy, and because we still don’t even know the final details of anything.

- The $645 billion impact comes from the increased cost after reductions in import volume. I am assuming a 50% reduction in imports from China, a 25% reduction in autos, and a 2.5% increase from other countries (due to rerouting from China). Initially, tariffs will result in some demand destruction.

- I am modeling only a 5% decline in exports, since China accounts for just 4% of total U.S. exports, and other countries have yet to significantly retaliate against the U.S. However, a potential global recession, I haven’t incorporated yet, could further reduce trade volumes ( but affecting both imports and exports). I can address this in the next update.

- For PCE inflation, I’m using a simplified calc (acknowledging the true impact is more complex): consumers absorb 50% of the tariff-related cost increase, or around $325–375 billion. This translates into a 1.62% to 1.82% cost headwind for consumers, potentially pushing PCE inflation up to around 4.5%, which is roughly in line with estimates from other analysts.

- Regarding consumer spending, using current disposable income growth of ~4.4%, offset by the projected 4.5% PCE inflation, implies flat to slightly negative real income growth already. Adding the impact of 2 million additional unemployed workers (assuming a 5.5% unemployment rate and $40,000 average salary) and applying a multiplier of 2, would result in an additional -0.8% drag on household incomes. So, I assumed spending would decline just slightly more than this due to savings patterns. (I will try to refine this more)

- For nonresidential investment, if businesses absorb the other 50% of the tariff costs, it would imply a roughly 10% hit to profits. I assume investment will decline less than that, due to existing project commitments. I’m also using historical recession patterns, though I still need to work on the correlation with profits and investment behavior. This needs more work but is relatively less important than spending

- My estimate for residential investment relies on typical declines observed in past recessions, as I have limited visibility in this sector.

- For government spending, I assumed a slower growth than last year (~3%), due to spending efforts. However, I need to analyze government outlays to make sure spending is indeed declining.

As you see are a lot of assumptions based on my best-informed guesses and knowledge at the time, that’s why I feel more comfortable giving estimates than not.