Analyst Opinions on Trump Reciprocal Tariffs Impact on the Economy

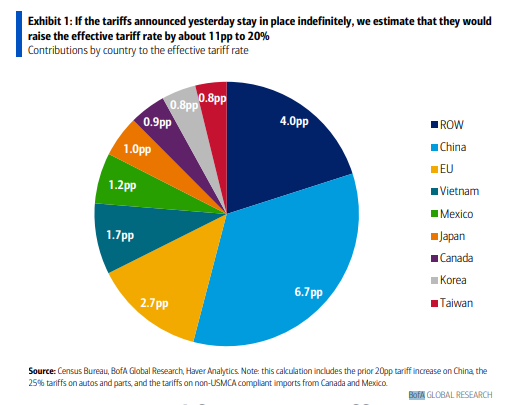

- BoA: tariffs would raise the effective tariff rate by about 11pp to 20%. Think they would add 1- 1.5pp to inflation (the core PCE is currently at 2.8% y/y) and subtract a similar amount from GDP growth over the next couple of quarters.

More details

“As of April 1, the effective US tariff rate (based on all announced measures) stood at around 9%… If the tariffs announced yesterday stay in place indefinitely, we estimate that they would raise the effective tariff rate by about 11pp to 20%. These figures are far larger than what we or markets were expecting. They would push the US much further along the stagflationary path, close to a tipping point where demand collapses under the weight of higher prices.”

“If the tariffs stay in place, we think they would add 1- 1.5pp to inflation (the core PCE is currently at 2.8% y/y) and subtract a similar amount from GDP growth over the next couple of quarters, pushing the economy to the precipice of recession. The drag on growth could last longer than the boost to inflation.”

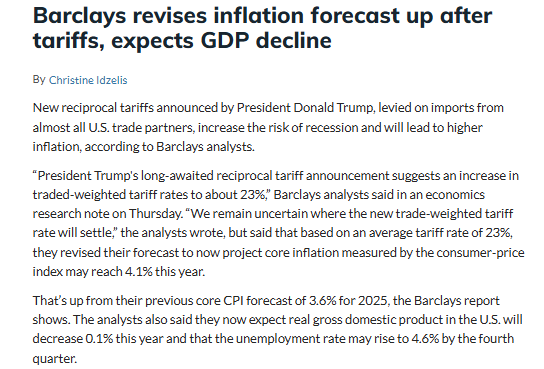

- Barclays: says if tariff rates stay at current levels they see real GDP of -0.1% this yr with the unemployment rate hitting 4.6% and core PCE 4.1%.

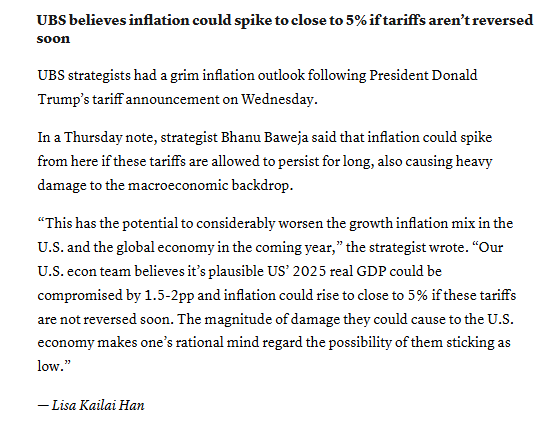

- USB: plausible US’ 2025 real GDP could be compromised by 1.5-2pp and inflation could rise to close to 5% if these tariffs are not reversed soon

-

Ed Yardeni: PCE inflation could be between 3-4% rest of the year, with a possible shallow recession later in the year

-

JPM: PCE inflation could increased by 1-1.5% this year, with the economy falling very close or into a recession

-

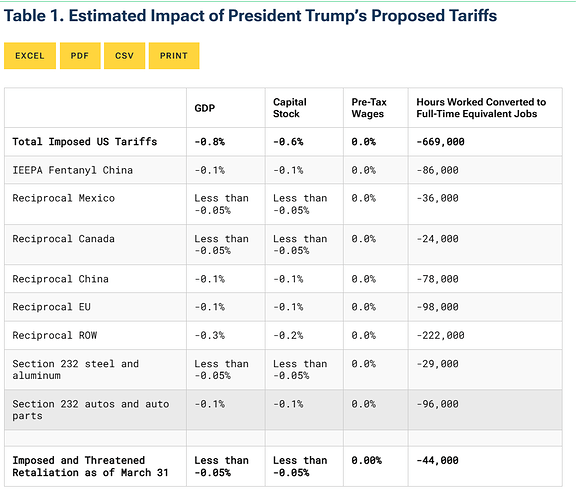

Tax Foundation: Trump’s tariffs will raise nearly $3.2 trillion in revenue over the next decade and reduce US GDP by 0.8 percent. In 2025, Trump’s tariffs will increase federal tax revenues by $290.4 billion, or 0.95 percent of GDP

- Carlyle Group: effective rate now more in the range of 15%-18%, which is 50%-60% larger in terms of impact than what was expected. The economy is now dealing with a potential 1.5% hit to GDP implicit of tax liabilities.

More details

“Most were anticipating that the effective tariff rate would have gone up by about 10% — so a 1% GDP hit — but it looks like it’s more in the range of 15%-18%, which is 50%-60% larger in terms of impact than what was expected,” Thomas said. “The economy is now dealing with a potential 1.5% hit to GDP implicit of tax liabilities.”

Thomas said it will take “months of hard data” to convince the Federal Reserve that the economic shock is real and a rate cut is appropriate. “If unemployment rises from 4% to 4.5%, we could have the Fed cutting rates by July, September,” he said. “Any cut that they do make will have to be done gingerly. I appreciate it’ll be a more measured response, maybe 50bps in cuts.”

Will continue to edit this, as I encounter more..