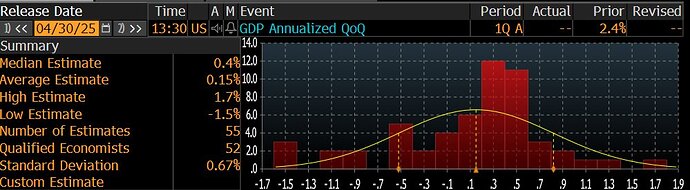

Q1 2025 GDP is expected to come in at 0.4% Q/Q SAAR

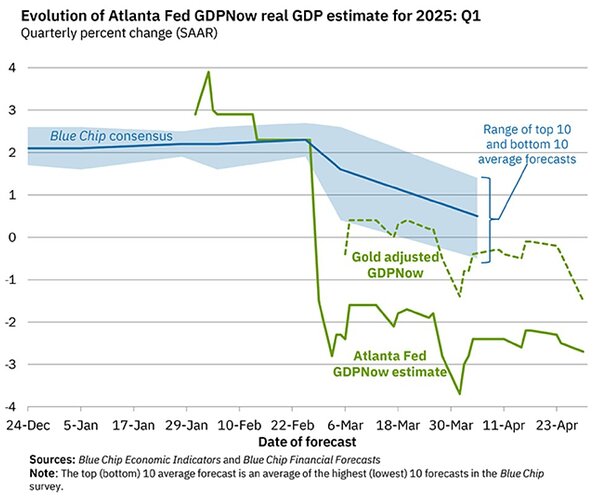

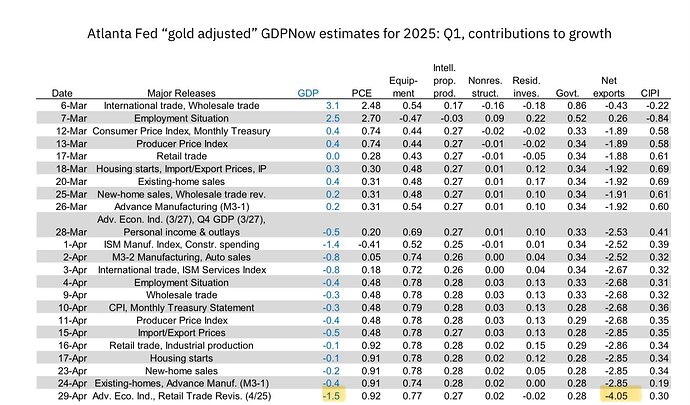

Majority of the weakness is expected to come from net exports, due to pull forward imports from consumers. However, consumer spending is also expected to be much more modest than Q4 2024.

I think there is a high change (~50- 60%) that this could be a negative print of ~1% negative Q/Q SAAR, which could create a more a more negative market reaction, but not extremely negative since there are already some analyst expecting this to be the case also.

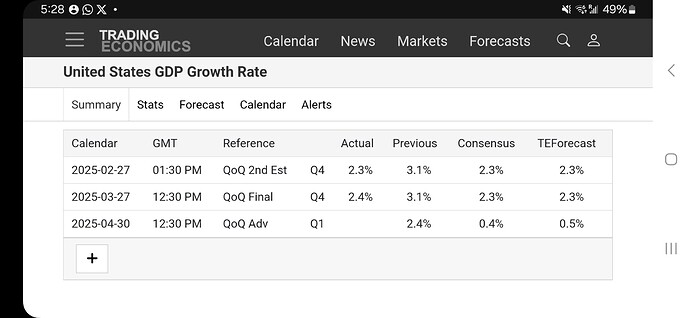

Some analyst expectations:

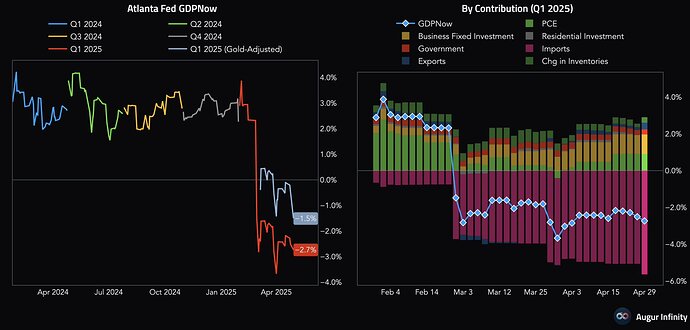

- Atlanta FED is expecting a -1.5% Q/Q SAAR (adjusting for gold imports)

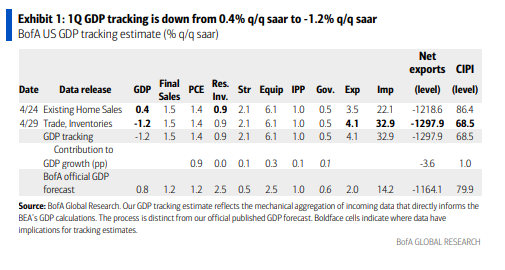

- BoA is expecting a 1.2% Q/Q SAAR decline following the increased in trade deficits from yesterday, but says domestic sales stable at 1.5%.

More Details

Also negative now is BoA whose 1Q GDP tracker falls a huge -1.6% to -1.2% Q/Q SAAR following the trade deficit. Unlike the Atlanta Fed, the model was also expecting a larger inventory build which also subtracted from the estimate (it was an addition for the Atlanta Fed).

That said, they reiterate, in line with the Week Ahead commentary this weekend, that increasing imports is not a sign of economic weakness. “[T]he trade deficit mechanically weighs on GDP tracking, imports are a net zero for GDP from an accounting perspective. They get subtracted out of net exports, but get added into one of the other components of GDP like inventories. But inventories are susceptible to measurement issues which is likely why we are tracking a low contribution from 1Q inventories. But this poses an upside risk to 2Q GDP (or 1Q GDP could get revised up) when inventories finally account for this import surge.”

“For now, despite the negative 1Q GDP print, we would recommend investors focus on indicators that reflect the underlying momentum in the economy, keeping aside the more volatile components like trade and inventories: Final domestic sales (GDP ex trade and inventories) is tracking at a stable 1.5%, in line with modest consumer spending in the quarter.”

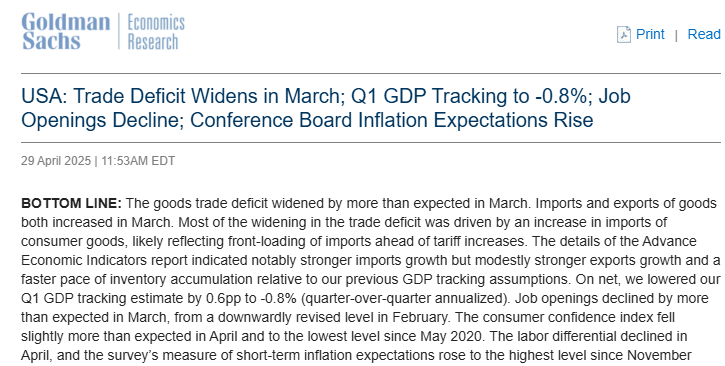

- Goldman Sachs is expecting a -0.8% Q/Q SAAR, following the larger than expected goods trade deficit

- Jefferies at -0.2%, BNP Paribas at -0.6%, and JPM -1.5% Q/Q SAAR