Main article: Housing Market: Germany - InvestmentWiki

Some real estate insights from Germany (will continue to add more if a found them):

- Prices could be stabilizing, but at the same time could be only because of low volume. A forced increase in supply could put additional pressure.

Compared with the previous quarter, Q1 2023, prices for apartments decline by 0.3 percent. Single-family house prices increase 2.3 percent, while multi-family house prices increase 1.8 percent.

Compared with the previous-year quarter, Q2 2022, all housing segments are still down sharply. Apartment prices are down 9.9 percent in comparison, single-family house prices are down 10.5 percent, and multi-family house prices are down 20.9 percent.

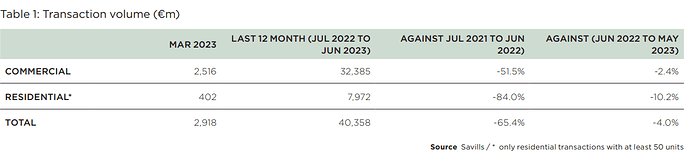

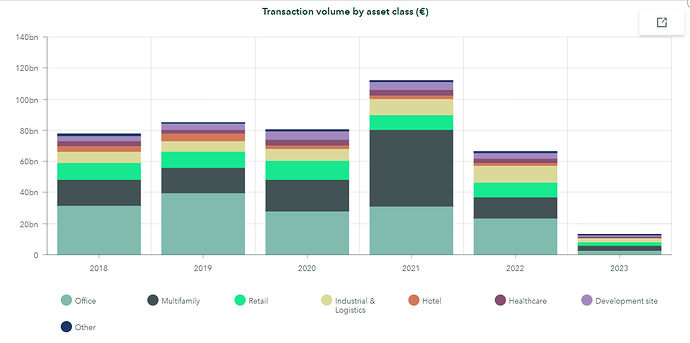

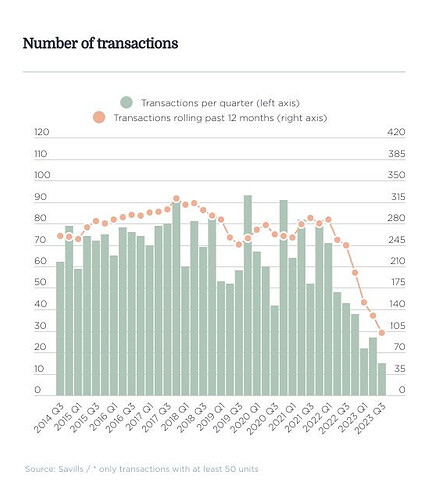

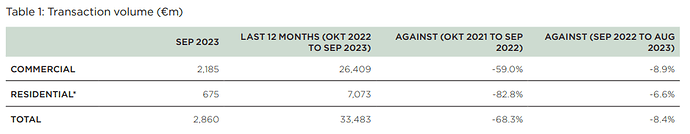

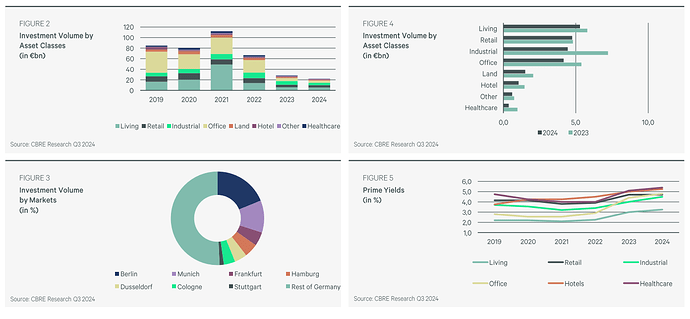

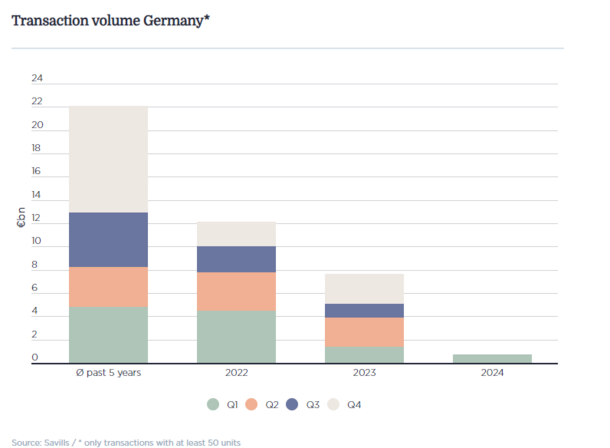

- Investment transaction volumes continued to be low Q2 2023.

Activity on the German real estate investment market stabilized in the 2nd quarter of the year but remained exceptionally low. For the 1st half of 2023, the transaction volume totaled approx. €13.3bn. This is about two-thirds less than in the same period of the previous year and at the same time the lowest turnover of a 1st half-year since 2011.

.

- Other source with similar results:

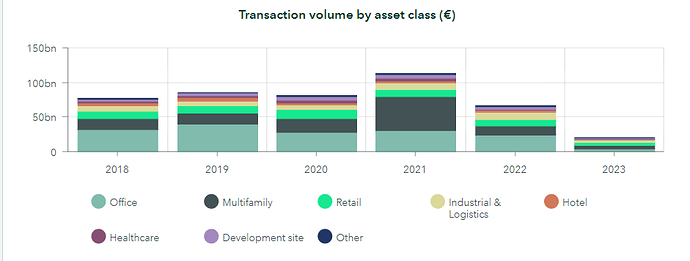

We are now setting our 2023 forecast for the transaction volume at €40 billion. This would roughly correspond to the 2012 result and would be around 47 per cent below the 10-year average.

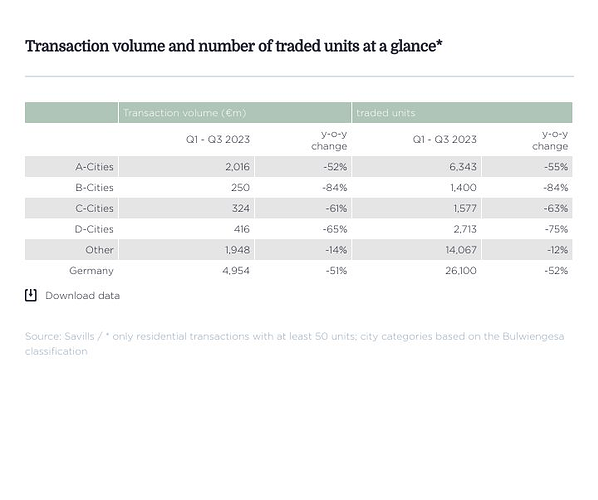

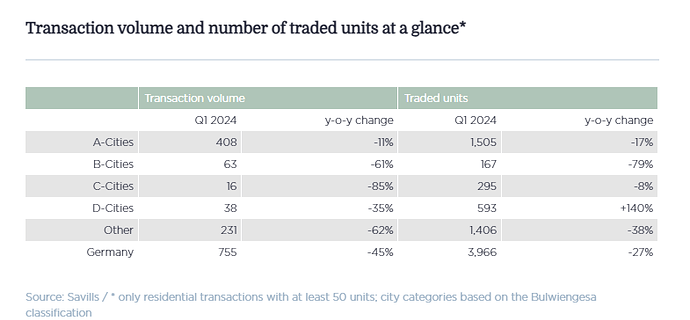

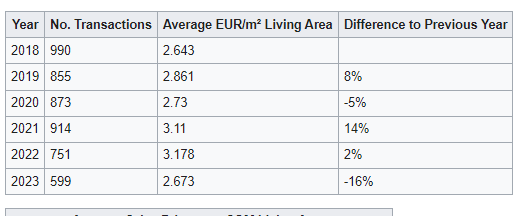

- Residential market also with very low volume

Residential transaction volume (more than 50 units) amounted to approximately €3.1bn in the first half of 2023 – more than 60% less than in the same period of the previous year, with the second quarter being the weakest in terms of sales since 2011. The outlook to the end of 2023 is very subdued: Transaction volumes will be well below the long-term averages of €15.8bn (5 years) and €14.7bn (10 years)

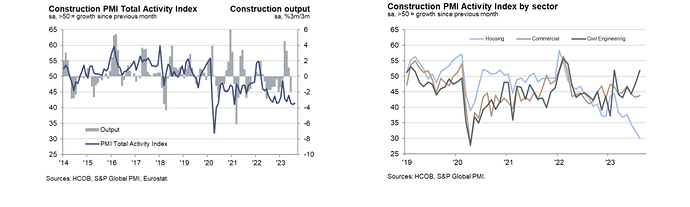

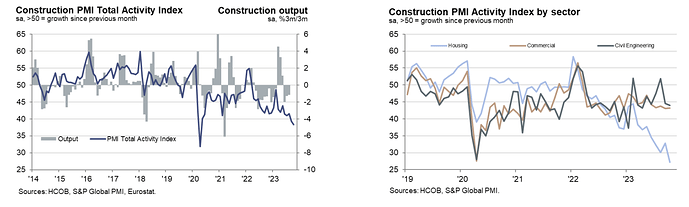

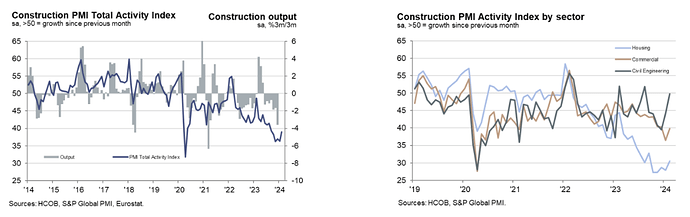

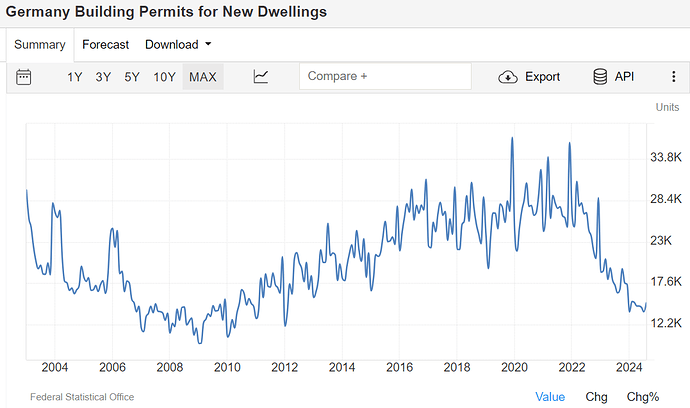

- Building Permits and construction activity still in contraction.

A deepening decline in housing activity continued to weigh heavily on the German construction sector midway through the third quarter, according to the latest HCOB PMI survey compiled by S&P Global, with work on residential building projects falling to the greatest extent in 13-and-a-half years as rising interest rates took their toll. Building companies remained in retrenchment mode, making notable cuts to both employment and purchasing activity.

“In August, construction work kept on plummeting at a fast pace, primarily due to a sharp decline in house building. The dismal condition of this sector can be traced back to a blend of higher interest rates, real income erosion from inflation, and needless bureaucratic obstacles. It’s not just that the government’s goal of 400,000 residential units won’t be achieved this year. It also seems like Germany will fall considerably short of the roughly 290,000 units that were constructed last year.

Expectations among companies point to a much weaker activity level in twelve months’ time, which fits to the continued sharp decrease of new orders and the fact that material buying has been trimmed down more rapidly.

The overall miserable environment is causing input prices to decline more rapidly. In the same vein, subcontractor rates have increased again at a softer rate, continuing a trend that has been underway since the middle of last year.

The construction sector is scaling back its workforce at a less rapid rate than its overall activity. The reason could be the consistently tight labour market we’ve had so far which is now adjusting to a somewhat more equilibrated level.

https://www.pmi.spglobal.com/Public/Home/PressRelease/568af51d33f74f07aaf31b5dd352b3d3

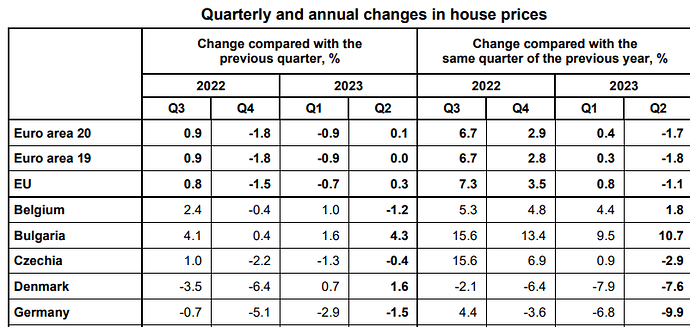

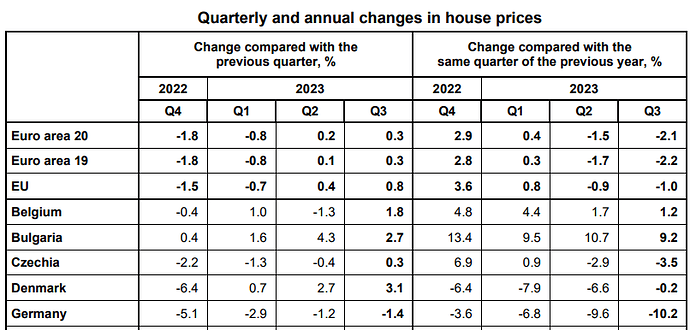

Germany house prices have declined almost 10% in q2 2023. The worst decline in all of Europe.

https://ec.europa.eu/eurostat/documents/2995521/17603068/2-03102023-AP-EN.pdf/8df23f89-bdbe-305f-5f6e-f70262fadf71?version=1.0&t=1696319418354

-

In the first three quarters of 2023, residential property in Germany was traded for almost €5.0bn. This was 51% less than in the same period of the previous year.

-

In Q3, registered a transaction volume of €1.0bn and just 15 transactions - the lowest number of transactions in a quarter since we began monitoring the market in 2009. In the year to date, around 26,100 apartments have changed hands (down 52% year-on-year).

-

The transaction volume at the end of the year is likely to be well below €10bn – this would be the lowest transaction volume since 2011. Due to the favorable fundamentals and significantly rising rents, the residential investment market is likely to pick up again sooner or later.

The German real estate investment market delivered a transaction volume of €20.97bn in the first three quarters of 2023.

In the third quarter, investments of €7.8bn flowed into German real estate, reflecting an increase of 28% compared with the second quarter of 2023 but marking a decline of 53% versus the third quarter of 2022.

Outlook:

- Not expecting a year-end rally, anticipate a transaction volume of €25bn for the full year 2023. And currently estimate €32.5bn for 2024.

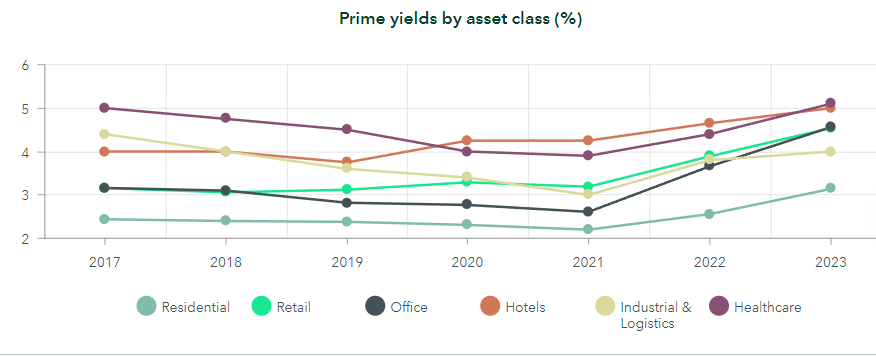

- Repricing continuing to make headway in the market, however, and that, prompted by the increase in financing costs and also by the significantly higher returns on alternative investment products in the capital market, players are moving closer to a new equilibrium – that said, we definitely anticipate yields rising further.

- Refinancing is imminent for numerous real estate loans, with the result that insolvencies, distressed positions, and fire sales will create ample investment opportunities.

https://arcgiscenter.cbre.eu/portal/apps/storymaps/collections/0ab0cfcadd014d7b94f28b7341e5a625?item=1

Additional source:

- In the third quarter of 2023, commercial and residential properties changed hands for around €6.7bn in just over 200 transactions. Both figures thus roughly correspond to the comparative values

from the two previous quarters. - Prime yields, on the other hand, increased in all segments, mostly by 20 to 30 basis points in Q3

- The transaction volume for the first three quarters of the current year, at approx. €21.2bn, is around 60% below the previous year’s level and the prime yields of the main property uses have risen by an average of almost 1 percentage point within a year and even by almost 1.5 percentage points since their low point in Q1 2022.

https://pdf.euro.savills.co.uk/germany-research/2023/market-in-minutes-investment-market-germany-q3-2023.pdf

Germany’s Construction Sector continues to be in a clear recession. Especially the residential sector.

The HCOB Germany Construction PMI Total Activity Index – a seasonally adjusted index tracking changes in total industry activity – remained on a downward trajectory at the start of the fourth quarter. At 38.3 in October, down from 39.3 in September, the index recorded its lowest reading for three-and-a-half years

Things continue to go from bad to worse in Germany’s construction sector. The housing sector is the epicentre of the downturn, nosediving at a breakneck speed. Meanwhile, civil engineering and commercial building activity are stuck in a similar rut as last month. As a result, the total industry activity index for construction has plummeted even further below 40.

It is particularly worrying that new orders again fell faster than the month before, indicating that we have not reached the bottom yet in terms of activity. The sharp declines in purchases and jobs are just adding to this bleak scenario

“It looks like construction companies are not finding much solace in the thought that interest rates might be peaking. The Future Activity Index is sounding the alarm for a big downturn in the next year, even though it’s up slightly from last month. While there are indeed some downside risks, overall, we would expect to have left the bottom behind us in 12 months from now.”

https://www.pmi.spglobal.com/Public/Home/PressRelease/e5a64ea6dda14e61b211a7f90ef8d228

Germany housing prices declined another -1.4% in Q3, and are now -10.2% year over year.

https://ec.europa.eu/eurostat/documents/2995521/18288283/2-10012024-AP-EN.pdf/ef5d6132-4a40-f0f0-78fa-8229ca6ba385

Summary German Housing Market as of April 2024:

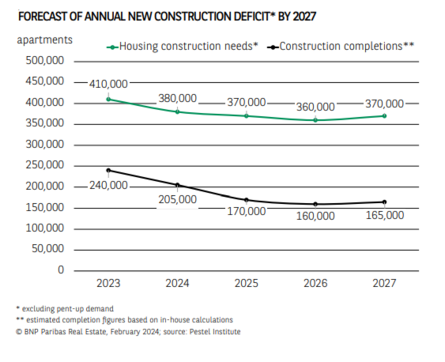

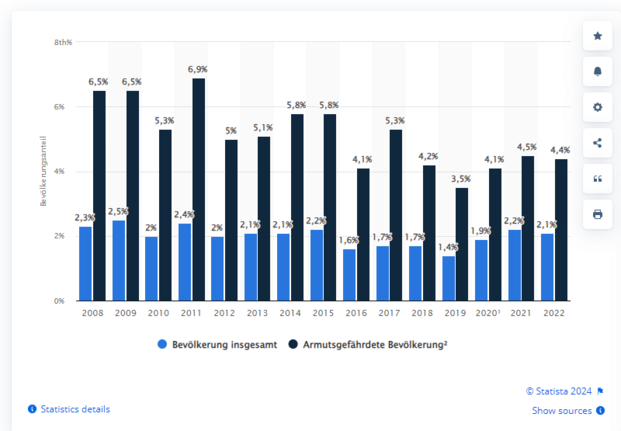

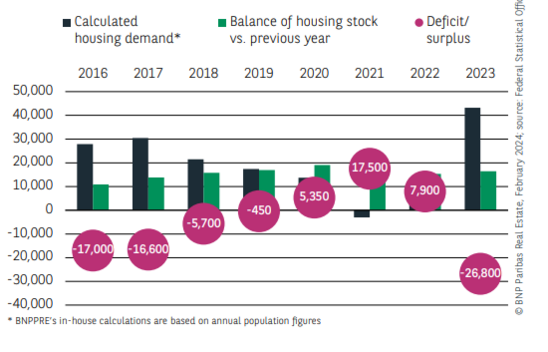

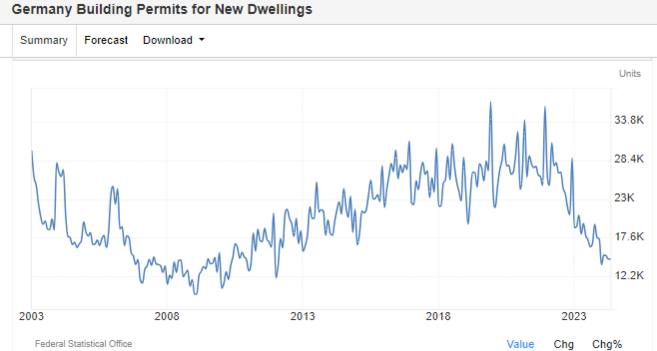

The biggest trend currently in Germany is the significant shortage of housing units accumulating, this is because of the deep recession going on in the residential construction activity due to higher rates and higher construction costs.

This while continues to be a significant headwind to the German Economy, it will at the same time be supportive of increasing rents in coming years since demand, especially due to immigration, is expected to continue, which could benefit some of the real estate companies.

National Level

Supply

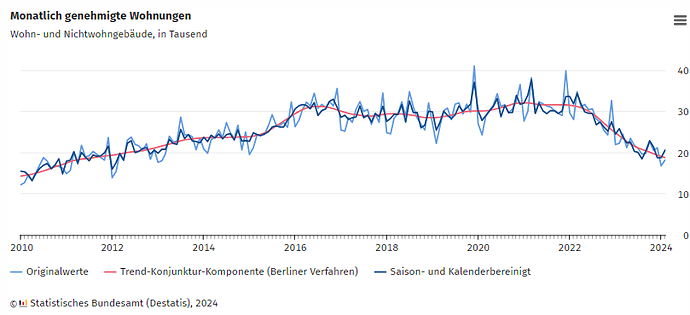

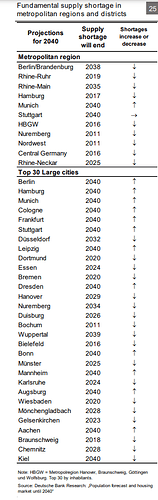

There is currently a housing shortage in Germany. In 2023 shortage could be around 700,000 units, the largest deficit in 20 years.

-

From the government’s perspective, around 400,000 new apartments per year are needed to combat this situation.

-

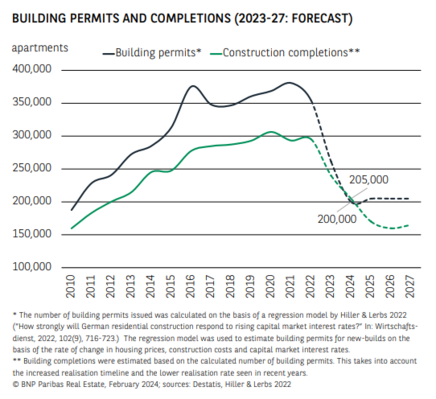

In 2023, only 260,000 building permits were issued, -26.6%Y/Y, and below the 400,000 the government target.

-

And in 2024, building permits continue to trend down, -24.9%Y/Y between January and February.

-

The construction PMI is also evidence of the issues, with residential construction in deep recession territory.

-

According to PNB Paribas, the shortage will continue as building permits and completions will remain low, and the construction deficit could grow to over 1 million units by 2027.

Demand

Transaction volume for residential volumes continues to be very low compared to history. But demand is expected to rise, as birth deficit is likely to be more than offset by immigration.

-

In Q1 2024, residential properties in Germany were traded for around €755m. This was around 60% less than the quarterly average of the previous year and even 86% less than the quarterly average of the last five years

-

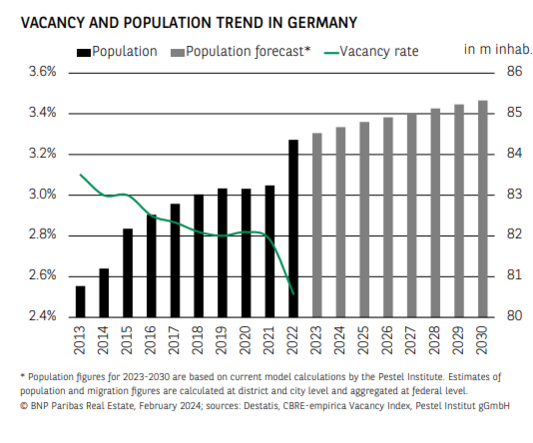

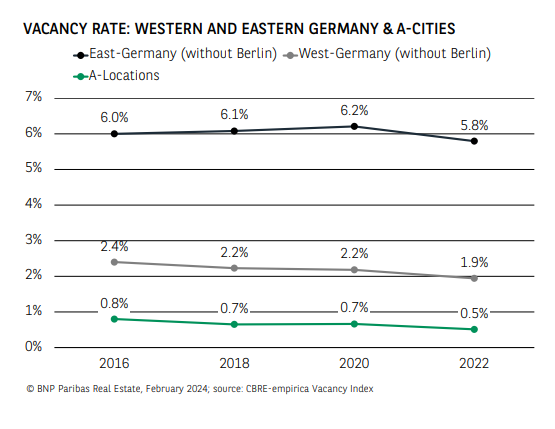

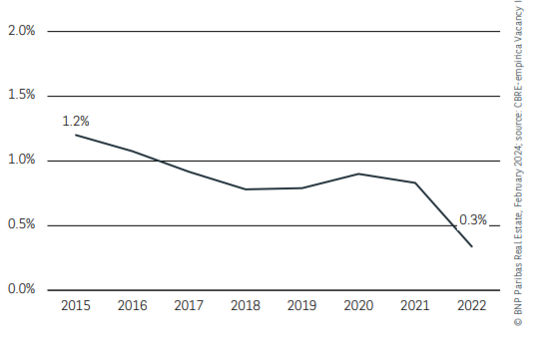

Due to the housing shortage mentioned above, vacancy rates are reaching very low levels, especially in the top seven cities. (Data as of 2022)

This is expected to continue to support rising rents in the coming years.

-

The vacancy rate in all of Germany’s top 7 cities is well below the 3% mark, which is considered the minimum fluctuation reserve for a functioning housing market

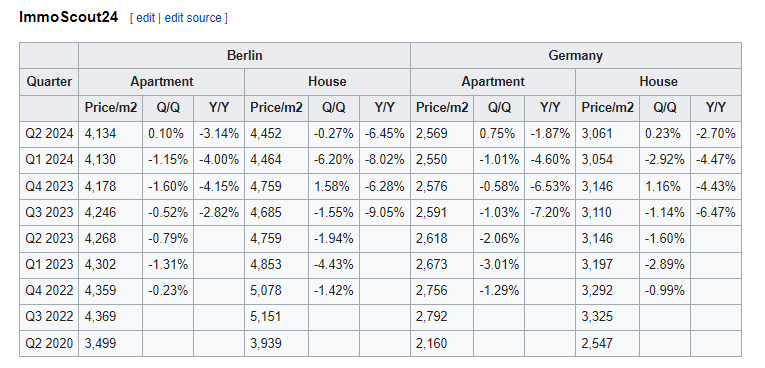

Prices

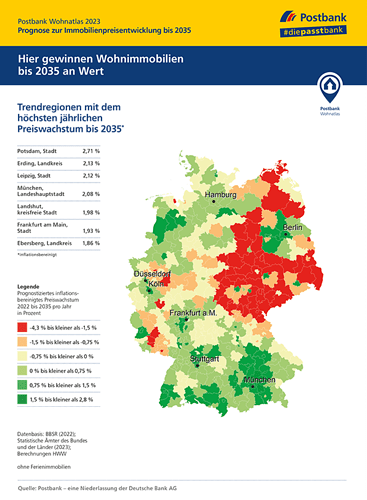

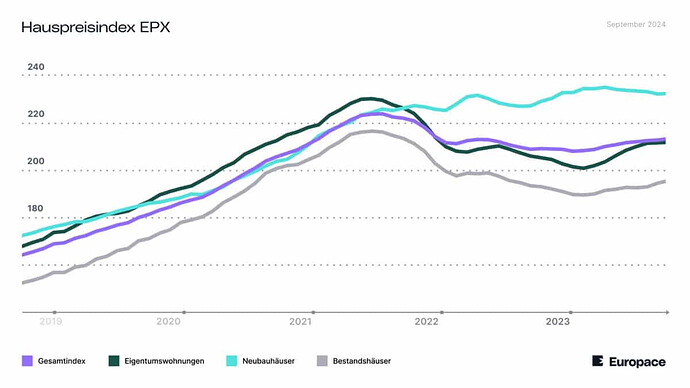

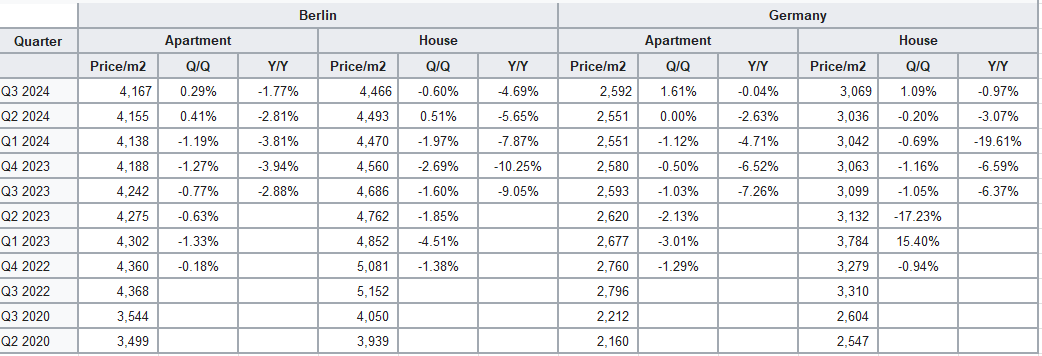

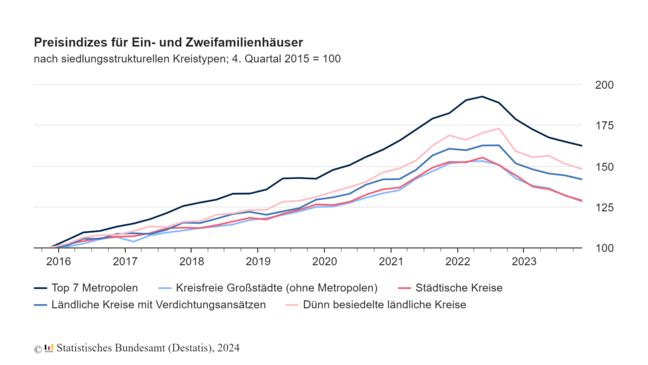

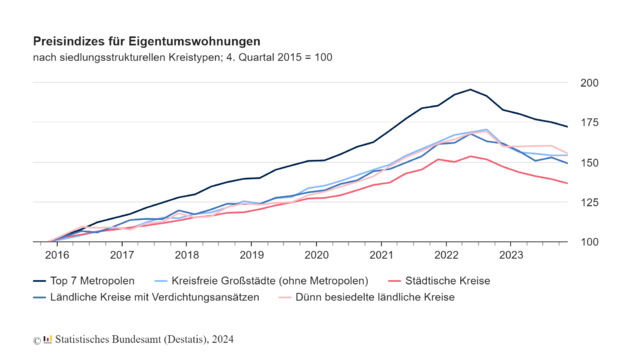

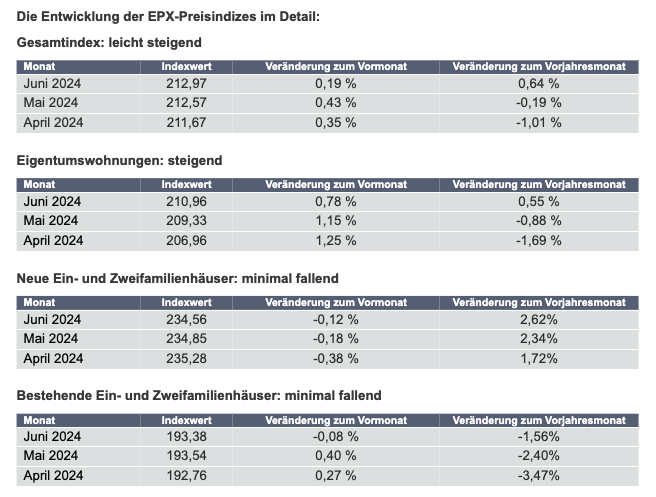

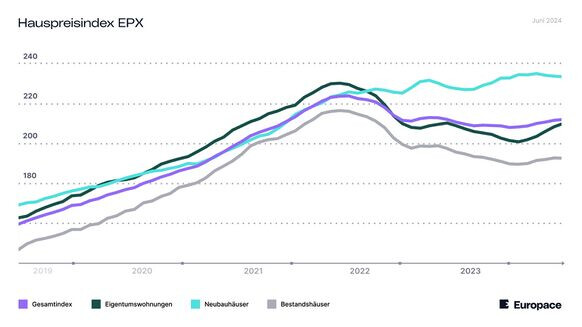

Prices have gained some upside momentum in Q1 2024, after seeing a significant decline in 2023.

-

On average in 2023, residential property prices fell by 8.4% compared to 2022. This was the largest year-on-year decline since the time series began in 2000 and the first decline since 2007.

-

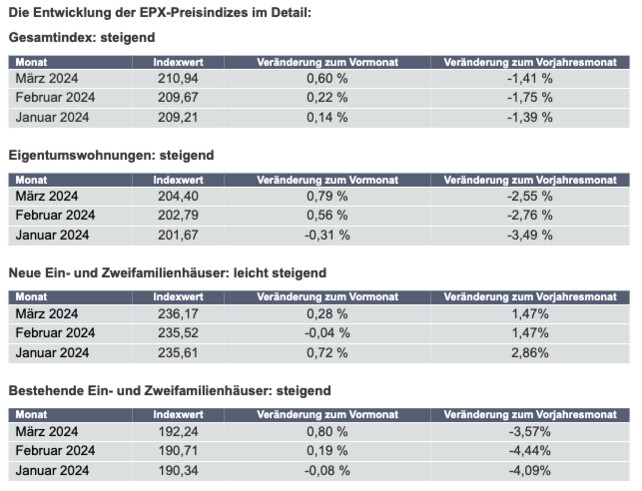

In Q1 2024, according to the EPX Index, prices have been slowly increasing again.

-

Forecasts for 2024 are mostly expecting a flat to slightly down market, with a 10% decline the worst outcome (see wiki section for more details). Long-term prices are still expected to be slightly up in most cities.

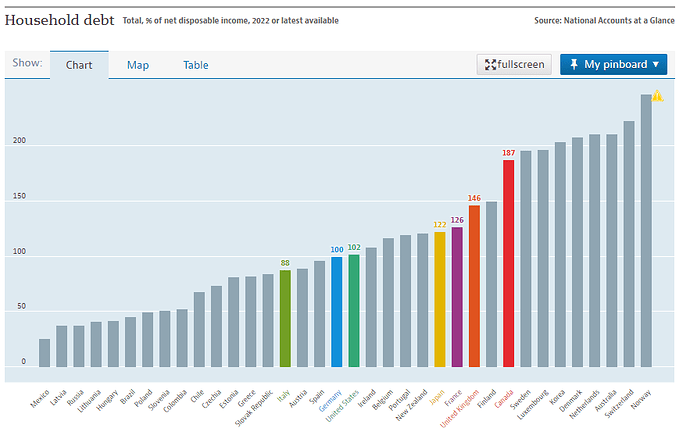

Delinquencies

As of 2022, delinquencies remained low. (Still searching for 2023 data)

According to Fitch, there not should be significant risks coming from refinancing needs.

- Taking into account typical loan amortization so far, monthly due amounts after refinancing next year should remain broadly unchanged for an average German mortgage originated in 2012-2013.

- Data from Europace indicates that the share of mortgages with fixed terms of five years or less is very low, and decreased from 2018, so only a small proportion of refinancing borrowers in 2024-2025 should be affected.

- Expect broadly stable mortgage performance, and forecast delinquency rates to rise to 0.5% in 2024 from 0.4% in 2023, before reverting to slightly lower levels in 2025. Expect 10-year fixed mortgage rates to decline slightly from 4% this year to 3.75% in 2024 and 3.5% in 2025.

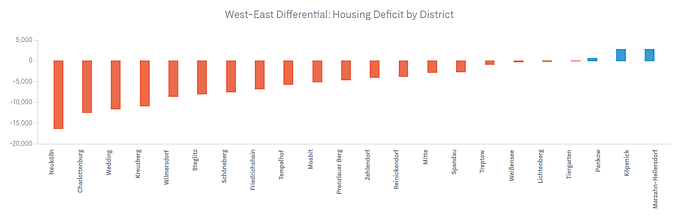

Berlin

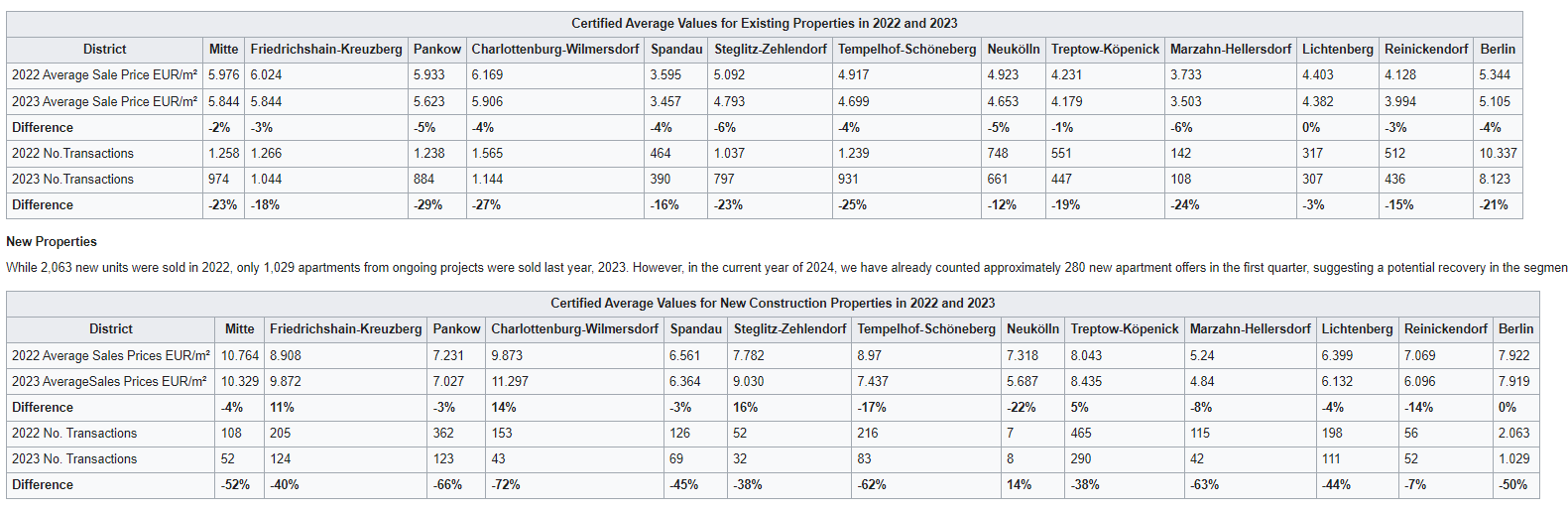

Berlin is showing the same trends as at a national level, with a housing shortage/deficit due to low construction activity., and vacancies reaching extremely low levels.

It has affected rents that have risen significantly in recent years and is expected to continue increasing.

According to GUTHMAN, the total housing deficit could be approximately 112,000 units with a decreasing pressure from west to east.

Prices

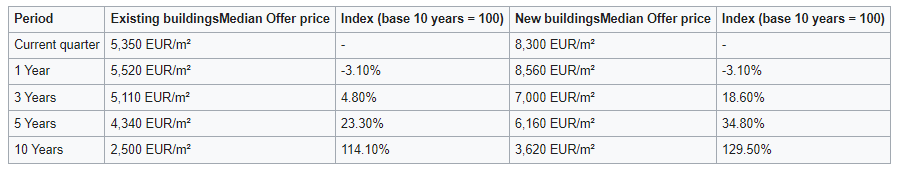

- Developments over the past twelve months stands at -3% percent. Shorter observation periods reveal a shallower price decline, with a slight increase over the last three months.

- Recent sales, previously down by 21 percent, are picking up again. Buyers are taking advantage of the low prices to secure profitable deals. Despite an average marketing period of 21 weeks, high-end lofts and penthouses are slower to sell compared to apartments.

- The apartment block market, which has experienced a greater depreciation, is also gaining momentum. In the first quarter of 2024, the number of listings and closings increased, with both multipliers and square meter prices dropping

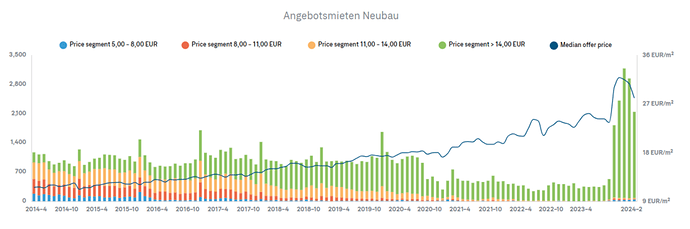

Rents

The rental market situation remains tense. Current market dynamics and the interest rate environment continue to put pressure on the already limited supply. Rising financing costs and higher equity requirements make purchasing a home more expensive, leading to increased demand in the rental sector.

-

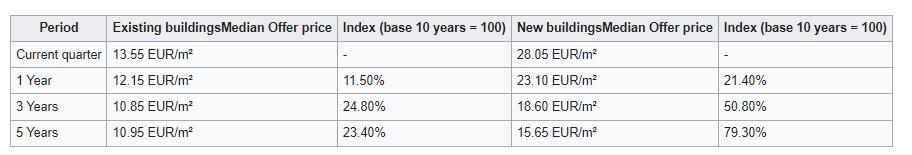

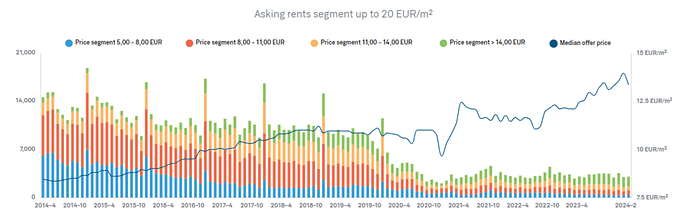

In the standard rental market below 20 EUR/m², average rent in the current quarter is 13.55 EUR/m² .

-

PNB Paribas, expect higher rent to continue: In light of the fact that Berlin remains highly attractive combined with the significantly intensifying housing shortage and the drop in the number of completions, we can expect rent prices to continue their steep rise short to medium term.

- Condominium purchase prices are expected to stabilize in 2024*.

Good overview of some of the most important elements.

The most surprising to me is the low risk coming from refinancing because I always assumed it would be significantly higher without investing time into researching it.

Do you have an indication about the total amount of those residential mortgages (esp. to natural persons) and the amount that need to be refinanced in each of the coming years?

I want to compare potential sell pressure to transaction volumes, given my initial assumption that a part of people who would need to pay 2-3% additional interest on their mortgages would be inclined to sell instead of refinancing as paying rent can be cheaper in a scenario like that instead of owning. (esp. if the mortgage is high compared to the value of their property)

Additionally, I think that with rising costs of living, interest, and maintenance, some homeowners might be forced to sell at one point, further contributing to increasing sell pressure. At one point, this could turn into a panic with banks not extending mortgages and foreclosing properties leading to more rapidly declining prices in an illiquid market in which almost no one has the money to buy. (Valuation compared what people earn are very high)

Of course, such a worst-case scenario is hypothetical, but I want to make sure that we are not missing any dangers because the market is so calm.

Depending on the size of those mortgages a panik to sell without buyers could even create a risk to the banking system.

When calculating the number of transactions based on an average of 180,000 EUR per traded apartment and a trading volume of 7.9 billion EUR in 2023, we only had around 44,000 transactions.

That is only around 1 transaction for 2,000 persons in Germany. This number looks very low as this means at this rate only 1 of 25 people will ever have bought an apartment in their lifetime (2,000/80years) and the volume in 2024 is again significantly lower.

I am also optimistic about rent prices in Germany as the population is growing with immigration, but I remain a bit concerned about valuations because few people appear to have the money to buy at current valuations and interest levels.

I did not find data about maturities or financing needs for Germany. I don’t think is available, at least not for free. Not even the Fitch assessment offers the data.

I will try to find out about total mortgage debt, but European data about this has been more obscure too. So, I am not sure how disaggregated it can be.

And I think you are misinterpreting transaction data. This is only investment transaction volumes and, not total home sales (transactions of at least 50 units).

I will try to find again if there is a total home sales data available but I haven’t until now. Investment transaction volume is what most firms report.

Just giving an update here:

I have tried to find data for mortgages and home sales, and have been kind of unsuccessful for now.

Central Bank only have this data available for mortgages, which for some reason don’t include a total mortgage debt indicator: Housing loans to households / Mortgage loans secured by residential real estate | Deutsche Bundesbank

They also have the German Panel on Household Finances (PHF), but is only available by request for formal research projects.

-

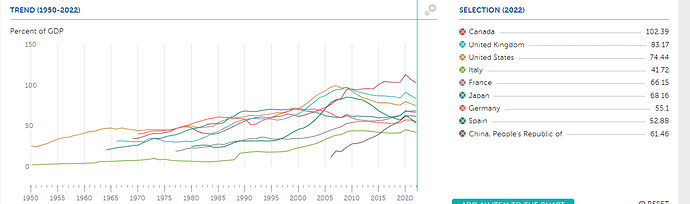

The IMF only has a household debt to GDP measure (does not disaggregate by type), which is 55% for Germany as of 2022, has been declining since 2000. Relatively better than other advanced countries.

-

OECD has a household debt to GDP ratio measure, Germany has a 100% as of 2022.

No data was found on maturities, unfortunately.

Home sales seem that it isn’t an indicator produced by German official sources. Housing - German Federal Statistical Office

Even ECB home sale data don’t include Germany.

I will keep this in mind if additional data is found later on.

Q2 2024: Residential real estate prices are stabilizing. Construction activity continues at extremely low levels

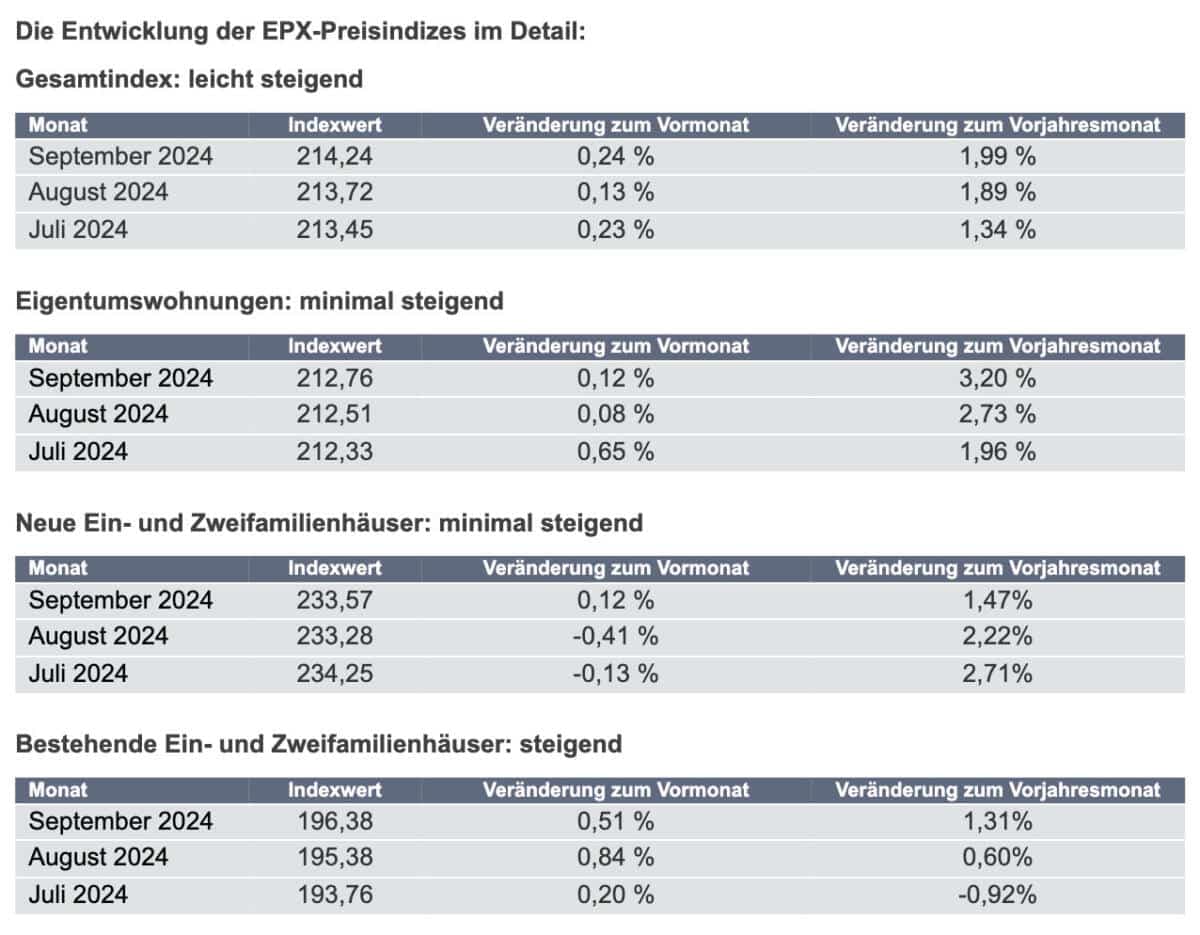

Prices continued to increase during the quarter ~0.96% Q/Q , and started to show a positive y/y trend.

“ The prices for condominiums continue to rise, while real estate prices for existing houses and new buildings remain stable with minimal price declines ,” explains Stefan Münter, Co-CEO and board member of Europace, explaining the house price index. “ The bottom has long been reached and we continue to see a clearly high demand for real estate. We expect prices to rise in the coming months and see a slow shift from a buyer’s market to a seller’s market. The feasibility is unlikely to improve and the supply will decrease again in the future. It is therefore essential to keep a close eye on the economic conditions and to react flexibly to changes ,” adds Münter.

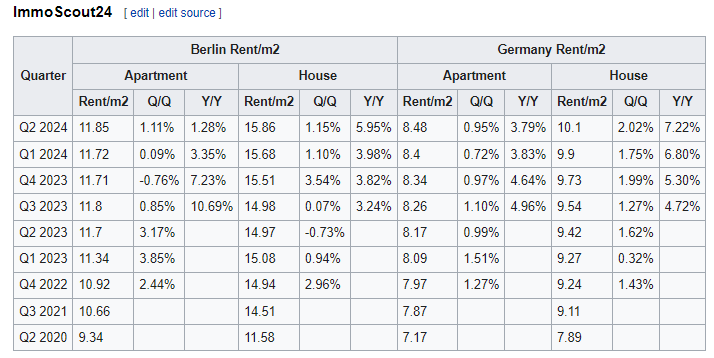

Data from Immoscour24 shows average Berlin prices also remained mostly flat during the quarter.

Rent prices also continued to increase during the quarter in Berlin, and nationally, according to Immoscout24

Rents are expected to remain high or even rise further due to tight supply and an exacerbating housing shortage, driven by the current and anticipated low levels of building permits and housing completions.

- From January to May 2024, 71,400 new apartments were approved, 24.0% or 22,600 apartments fewer than in the same period last year.

- According to the Ifo Institute, approximately 210,000 new residential dwellings will be completed in 2024, dropping to around 175,000 in 2025. Including other completions, only about 200,000 housing units will be built in 2025, falling short of the German government’s target of 400,000 units.

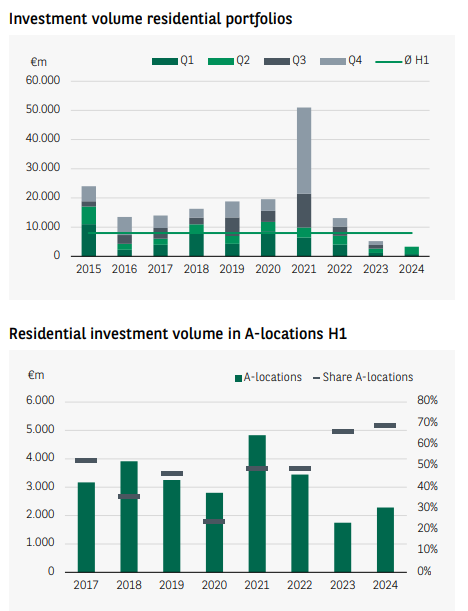

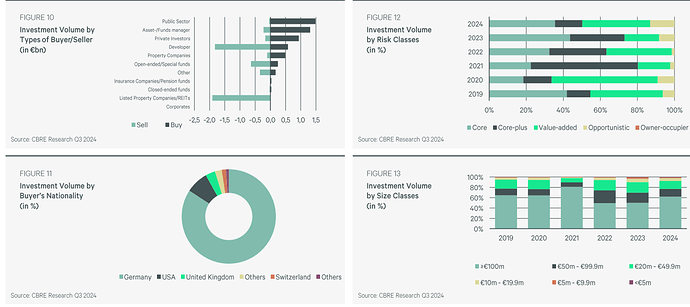

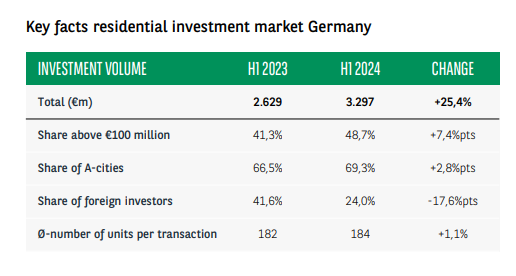

The transaction investment volume increased significantly compared to the previous year.

- Across Germany, €3.3 billion was invested in larger residential portfolios (30 residential units or more) in the past six months. This exceeded the half-year result of the previous year by 25%, although the long-term average was undercut by 59%.

Do we have an update for Q3 2024 for the German real estate market yet? I saw that Vonovia stock was falling a bit and wondered if there was any reason for it or if there were any worsening developments in the real estate market. Given that Vonovias stock price will be a key factor when it comes to the offer that Dt. Wohnen shareholders will receive short term developments of last quarter and the coming quarter will be important.

It does not seem to be due to additional weakness in the real estate market, from everything I have checked the market in Q3 2024 remained weak compared to historical levels but is stable, and showing early signs of slow recovery.

Is expected to remain stable for the rest of the year, though the recovery is expected to be slow since the German economy is not yet in a good place.

The normalization is expected to continue, especially as the ECB does additional rate cuts, real estate becomes more attractive.

Prices seem to be stabilizing and even increasing in recent quarters, in both Berlin and Germany.

- Overall, the overall EPX index recorded a cost increase of 0.24 percent and reached 214.24 points in September 2024. Compared to the same period last year, prices increased by 1.99 percent.

- Data from Immoscout24 confirms a similar trend in prices in last 2 quaters, however still negative y/y

Investment transaction volumes remain low and volatile, but year-to-date are up y/y, which means demand/supply is starting to balance more.

- German investment market reached €22.2 billion in the first nine months of 2024, up 9% YoY.

- Q3 2024 saw a 6% decline compared to Q2 2024.

- Total 2024 volume is expected at ~€33 billion, implying ~€11 billion in Q4.

- Residential investments (50+ units) totaled €5.3 billion in the first nine months of 2024, up 16% YoY.

- Prime yields stabilized at 3.40% in the top 7 cities, though yields on existing properties continue to rise.

- 2024 outlook is more optimistic compared to mid-year projections. The combination of portfolio adjustments and closing of refinancing gaps suggests that transaction volume could reach around €8 billion for the year.

What remains extremely weak without clear signs of recovery is the construction activity, however this will support rent increases going forward due to the housing shortage and population increase.

- From January to August 2024, 141,900 apartments were approved, down 19.3% (33,900 fewer) compared to the same period in 2023. These results include building permits for apartments in new residential and non-residential buildings as well as for new apartments in existing buildings.

- From January to August 2024, 116,800 new apartments for residential were approved, 21.2% or 31,400 fewer than in the same period last year.

According to Immoscout24 rent prices continued to significantly increase in Q3 2024

Very good overview thank you. What are the sources of the two tables linked? I think one is here in the Wiki the other one is from Immoscout?

Both are for Immoscout24, they offer both prices and rents. I have linked both of the wiki tables in the original post which are coming from the data from Immoscout.

I=3

- The German coalition government recently extended the rent control law (Mietpreisbremse) which was introduced in 2015 as a temporary measure to curb a large increase in rent.

- Mietpreisbremse curbs rent increases at 10% above the local comparative rates.

According to Deutsche Bank the German housing market is likely to stabilize and experience modest growth, driven by supply shortages, easing interest rates, and more regulatory clarity

Rents are likely to reflect ongoing supply shortages, supporting sustained rental growth of 3% annually. Expect all price indices to show a bottoming out or rising prices again in Q3 at the latest.

- Stronger wage growth and inflation above the target rate could also boost rental growth in the coming years.

- Rents may also rise due to more frequent index-linked leases, which are likely to be agreed more frequently due to current market conditions and recent inflation increases.

- Proportion of short-term rentals and furnished rentals is increasing in large cities and conurbations.

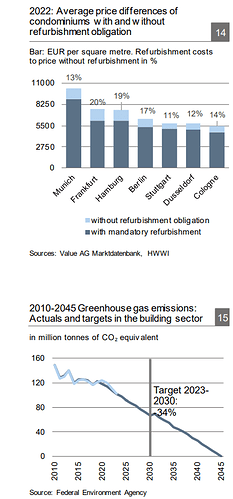

CO2 emissions in 2022/2023 have fallen more than expected which could lessen regulatory mandates

A significant portion of refurbishment costs is likely already priced in. If energy and CO2 consumption/ continues to decline, even without a major increase in renewable energy for existing buildings, this could prompt revisions to the Heating Act and the 65% target.

- Newer properties have held their value better compared to older homes, partly due to the environmental refurbishment obligations placed on less energy-efficient buildings

- Report highlights ongoing innovation in construction materials and smart-home technologies that could further reduce emissions and energy consumption, potentially reshaping future regulatory demands

- By 2030, emissions only need to fall by a cumulative 34%, i.e. around 5% p.a., which is less than in 2022 and 2023. This is undoubtedly still a major challenge.

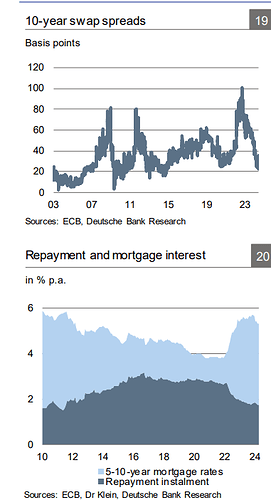

The mortgage market has shown signs of recovery in 2024, with rates expected to stabilize at around 3.8%

- 10-year swap rates and 10-year Bund yields fell almost steadily from over 90 bp in the winter of 2022/23 to the current historical average of around 30 bp.

- 5-10-year mortgage rates fell from almost 4% in Q4 2024 to 3.6% in Q2

2024 - Credit growth shifted up a gear again. It increased by 12% in Q1 compared to the previous quarter and reached its highest level since Q3 2022 with more than EUR 44 billion in new lending business.

- Repayment rate fell from 2.7% before the interest rate shock to 1.7% in May 2024, the lowest value since 2011.This means that interest and repayment in a classic annuity loan fell from 5.8% at the end of 2023 to 5.3% in 2024.

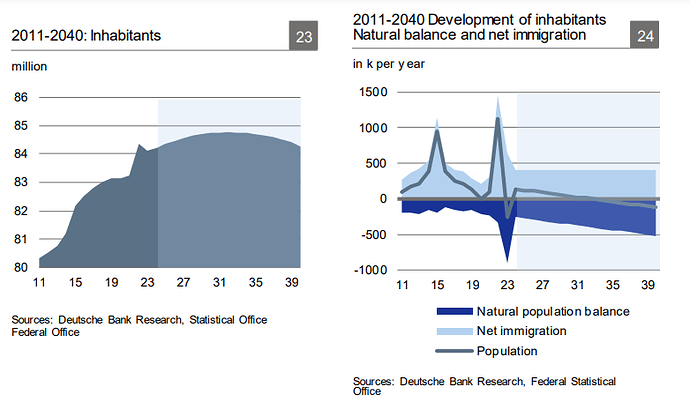

As a result of immigration and natural development, the population initially rises to 85.4 million inhabitants by 2032. The population subsequently decreases and falls below 85 million again for the first time in 2040.

- Average household size fell from 2.3 people in the 1990s to around 2 people in 2023. Expect a further decline to below 1.9 people in 2040.

- As a result, projection shows that demand for housing will increase from 42.9 million to 45.5 million homes between now and 2040.

While on a national level, the shortage is not apparent, this varies by region, with some top cities experiencing significant storage that is not expected to end soon

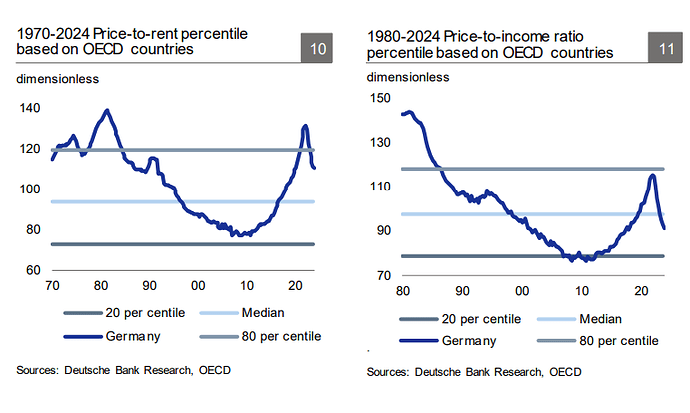

Affordability indices returning to the historical average

These national indices do neither reflect the bottlenecks in the large cities nor the relatively relaxed fundamental situation in regions with a weak infrastructure