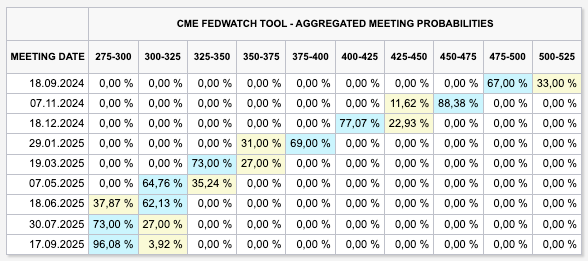

@Magaly Implied interest rate expectations now show that a 50 bps cut in tomorrow’s meeting is more likely with a 67% probability.

In addition, the trajectory of implied rate cuts got significantly more dovish as it prices that interest rates could go back to 270-300 bps within one year.

Did you change your expectation for a 25 bps rate cut to 50 bps or do you maintain that 25 bps is more likely? How would you see the probabilities? What are your expectations on the trajectory of interest rate cuts?

What are the main factors that changed market expectations? Is it a significant downward job revisions and higher full-time unemployment?

I think in the future we should develop models that show our expectations for interest rates and update them as soon as our expectations change, similar to how Aron does it with his updates on company models.