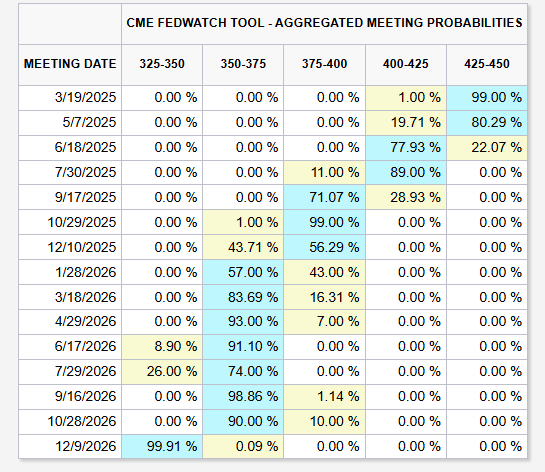

March 2025 FED Meeting Expectations

- FED is expected to keep interest rates unchanged with a 99% probability according to market pricing

The first 2025 cut in June and the second one in September - FED expected to continue QT without changes at the March meeting, with expectations it might end around mid-2025, but there’s uncertainty due to debt-ceiling concerns.

- Reserves are expected to be at $3.125 trillion by the end of the QT process, compared with $3.3 trillion now, while the level of the Fed’s reverse repo facility, a proxy of excess liquidity, is estimated to be $125 billion.

- Reserves are expected to be at $3.125 trillion by the end of the QT process, compared with $3.3 trillion now, while the level of the Fed’s reverse repo facility, a proxy of excess liquidity, is estimated to be $125 billion.

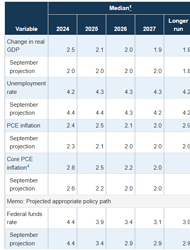

Tomorrow we also get new FED projections, there are expectations for the FED to most likely keep cuts at only 2 in 2025 despite recent growth concerns due to the equal upside risks to inflation due to Trump tariffs.

- Analysts expect a mild economic downgrade, with GDP forecasts reduced and inflation estimates revised upward.

It seems likely to me we will these revisions on their economic projections since this is also the current trend most economists are reporting on their forecasts.

As a reminder the FED projected two cuts in 2025 to get to 3.9%, and 2 more in 2026 to 3.4%.

Any up or down revision will most likely mean a market reaction since the market’s current pricing is more o less in line with December projections.