November 7 FED Meeting Assessment

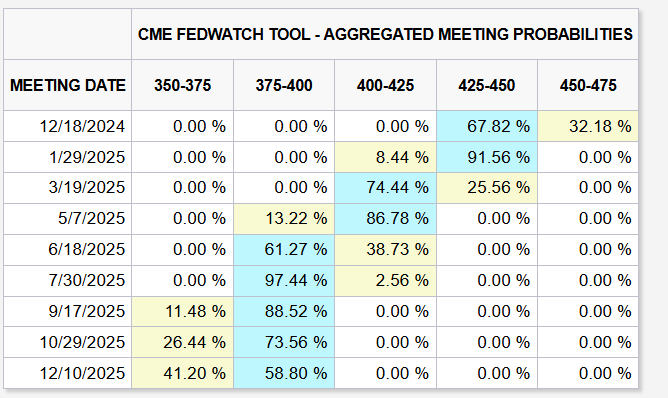

Todays conference gave me the feeling that the December rate cut is not assured at this point. And if the economy maintains its resilient performance, the pace of rate cuts in 2025 may slow accordingly.

This outlook arises from the ongoing uncertainty around the neutral rate level, with the possibility that it may be higher than previously estimated. However, Powell emphasized that the risks of overtightening versus under-tightening are currently balanced.

The market appears to have interpreted the message similarly, as the odds of a December cut and additional rate cuts in 2025 have slightly decreased

Notes:

Trump Presidency

- Powell clarified that the Fed does not expect immediate policy effects from the incoming administration. While fiscal policy changes, can influence economic outcomes, the Fed will consider these impacts once the specifics become available.

- Powell emphasized that, legally, the President does not have the authority to remove the Fed Chair.

Inflation

- Recent inflation data came in slightly higher than anticipated. Anticipate some bumps in inflation ahead, though the trend remains downward.

- This is not an overheated economy. Much of the inflation observed this year represents “catch-up” inflation in housing rather than ongoing pressures.

- Current renter inflation data reflects a lag from prior conditions. Newly signed leases are showing low inflation, which will gradually appear in broader measures.

- Despite increases in break-even inflation rates, Powell did not observe significant de-anchoring of long-term inflation expectations, indicating continued confidence in inflation moving toward the 2% target.

Labor Market

- Average monthly job gains over the past three months stand at 104,000, a marked slowdown from earlier in the year. The labor market is currently slightly weaker than pre-pandemic.

- Powell indicated that the Fed is keen on maintaining a strong labor market while avoiding unnecessary cooling that could weaken economic activity.

- Current wage increases are now roughly in line with inflation at 2%, assuming productivity gains remain strong.

Long-term yields and rates

- Powell attributes higher Treasury yields since September to stronger growth expectations and reduced recession risks, rather than heightened inflation expectations.

- As the Fed approaches neutral territory, the pace of rate cuts could slow, a consideration that is only now starting to take shape.

- The Fed remains flexible and will adjust its view on the pace and endpoint for rate changes as the economic outlook evolves.

Fiscal Deficits

- Powell acknowledged the unsustainable path of U.S. fiscal policy, with deficits increasing despite full employment.

- Fed views high and rising debt levels as ultimately a longer-term threat to economic stability. However, he reiterated that fiscal policy is beyond the Fed’s direct control and urged responsible management.