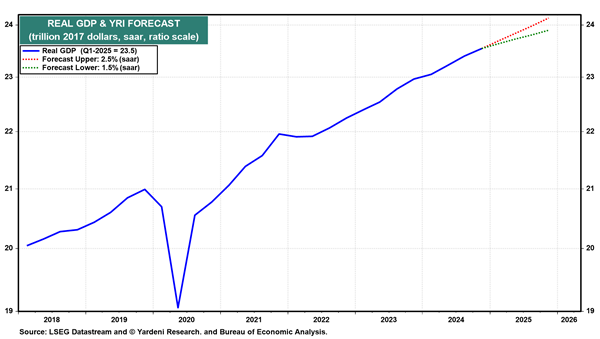

ED Yardeni on latest tariffs news: PCE inflation could increase to 3-4% rest of the year, which could cause a consumer-led slowdown. FED wont be able to step in due to inflation

“We’ve recently warned that Trump’s Reign of Tariffs is very likely to boost inflation over the rest of the year, depressing overall consumer sentiment, real wages, and consumer spending. Rising goods prices could boost the PCED inflation rate from 2.0%-3.0% currently to 3.0%-4.0% over the rest of this year (chart). If the result is a consumer-led slowdown later this year (after a short auto-buying binge), the Fed won’t be able to help by easing monetary policy if inflation remains well above its 2.0% target. The result could be 6-12 months of stagflation.”

“We hope that many of the reciprocal tariff rates will be negotiated down throughout the year. We expect that the 10% tariff floor plus some additional tariffs on key countries like China will still exist by year-end. That suggests at least $300 billion in annual tariff revenues, or maybe $600 billion if the average rate is closer to 20% (chart). That will dent the federal budget deficit, but will remain below the government’s net interest payments, which will likely exceed $1 trillion this year.”

https://x.com/neilksethi/status/1907812651754721354