In this topic we will report and discuss developments and insights into important companies that are closely associated with the business cycle, with the objective to be able to catch or understand when inflection points in different parts of the economy could start to form.

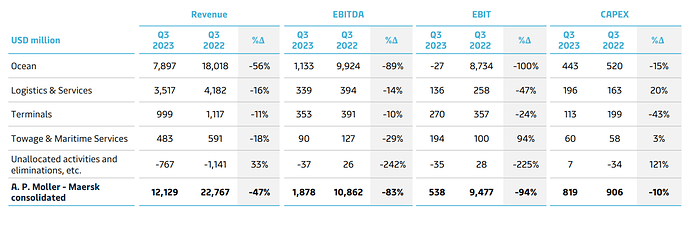

Mærsk, company giving insigns about global trade, has mentioned that their outlook is of a more subdue macroeconomic environment. They already experienced a “collapse” in revenue and profits, and they now expect it to remain kind on stable in these low levels, with pressure on prices especially.

If they are overcapacity, I expect this to translate eventually into closings or layoffs. They are already doing it.

While Q3 volumes increased from Q2, price declines are offsetting this positive effect. But they don’t think an increase in Q3 signals a recovery for now.

The third quarter saw an uptick in volumes in our ocean and Logistics & Services businesses. At the same time, we have seen prices decline across all transportation modes at an accelerated pace, overshadowing the positive impact from higher volumes.

We saw a pickup in volumes in the third quarter, but do not believe that this to be the end of the continued inventory destocking and our volumes outlook generally remains muted. Reflecting on the pickup in Q3 volumes, we narrow our full year guidance container volumes outlook to -2% to -0.5%, a small increase from our previous outlook of -4% to -1%.

They are now expecting a softer demand in coming years, because of this the industry is starting to experience overcapacity, and thus price declines will continue.

The new normal we are now headed into is one of more subdued macroeconomic outlook and thus of soft volume demands for the coming years, prices back in line with historical levels and inflationary pressures on our cost base, especially from energy cost and will also increased geopolitical uncertainty. This outlook is compounded in the shipping front by increasing supply-side risk. Since the summer, we have seen overcapacity across most regions, triggering a new wave of price reductions. At the same time, scrapping and idling of tonnage has not yet picked up. We therefore expect further headwinds as the market conditions in ocean are worsening.

https://investor.maersk.com/static-files/53cae4b1-6458-44d6-b871-9ad9ee20a388

https://seekingalpha.com/article/4647336-p-moller-maersk-s-amkby-q3-2023-earnings-call-transcript

Walmart, has sent a caution sign saying they experienced a different pattern in spending in October to what they have seen during the rest of the year. Their rise in guidance is more due to the Q3 outperformance.

While Wallmart could see some softening, I don’t think it will be that significant, since most of what they sell is for basic needs.

Recently, we’ve experienced a higher degree of variability and weekly performance in between holiday events in the U.S., including seeing a softening in the back half of October, it was off-trend to the rest of the quarter.

Sales during November have turned higher as unseasonal weather abated and we kicked-off holiday events. So sales have been somewhat uneven and this gives us reason to think slightly more cautiously about the consumer versus 90 days ago.

We still expect sales growth to moderate in Q4 versus prior quarters as grocery inflation further normalizes toward historic levels. So we’re encouraged by the increased traffic and share gains we’ve seen and expect them to continue.

They say they could start to experience some deflation, but they welcomed it because of their consumers, and they will try to manage it better than others.

I am not sure I agree with them, deflation could be seen as a positive at first, but eventually if sustained could be way worse than inflation.

We think we may see dry grocery and consumables start to deflate in the coming weeks and months. And so as we look ahead to next year, we could find ourselves in Walmart U.S. with a deflationary environment.

https://seekingalpha.com/article/4652422-walmart-inc-wmt-q3-2024-earnings-call-transcript

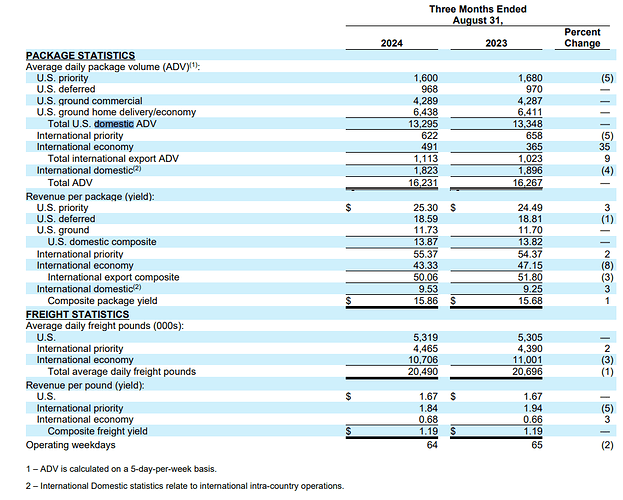

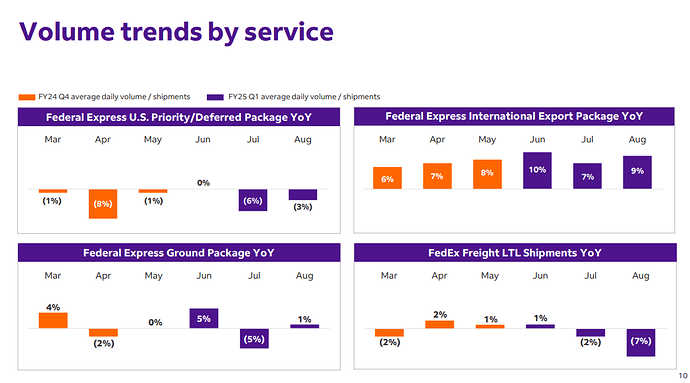

Fedex has also warned of slower demand cutting its revenue forecast for 2024.

Stock is down 10%+ today.

The company said it expects a low-single-digit decline in revenue for the fiscal year, down from a previous forecast for flat sales year over year. Analysts had expected a revenue drop of less than 1% in the current fiscal year, according to LSEG.

In the remainder of [fiscal] 2024, we expect revenue will continue to be pressured by volatile macroeconomic conditions, negatively affecting customer demand for our services across our transportation companies

Looking at the U.S., market conditions remained soft with Q2 demand lower than we anticipated.

The industry has now experienced 10 consecutive quarters of decline in U.S. domestic average daily volume. Additionally, international market pressure continued. Despite this pressure, our Europe and EMEA teams did a great job of growing parcel volume.

We believe that we will see FedEx sequential improvement throughout the back half, but the overall market demand will not change within our fiscal year.

UPS also had disappointing results as Fedex did.

Shares of UPS fell (8%) after the company said revenue declined in the last quarter of 2023 and that it would cut 12,000 jobs this year.

The company said the top line of its U.S. business fell 7.3% in the fourth quarter while volumes fell at a similar rate. Volumes slid even further in its international business, driven primarily by softness in Europe.

“The small package market in the US, excluding Amazon, is expected to grow by less than 1 per cent”, CEO Carol Tome said in a post-earnings call with analysts.

- Revenue fell 7.8% to $24.92 billion, undershooting analyst projections, according to FactSet.

- Profit fell by more than half to $1.61 billion.

- Adjusted per-share earnings, which strip out one-time items, of $2.47 narrowly beat analyst forecasts, according to FactSet.

- UPS expects $92 billion to $94.5 billion in revenue for 2024, with an adjusted operating margin of about 10% to 10.6%. Below analysts’ estimates of US$95.57 billion, according to LSEG data.

UPS Releases 4Q 2023 Earnings

https://www.wsj.com/livecoverage/stock-market-today-dow-jones-earnings-01-30-2024/card/ups-revenue-drops-on-lower-volumes-eUXQn8AMfuSPP46CJEsd?siteid=yhoof2

Q2 Big Retailers’ Insights about Consumer Spending

Consolidated Summary

- While spending has remained resilient, spending patterns have shifted, with consumers becoming more selective and value-conscious.

- Consumers are prioritizing value and stretching their budgets.

- There seems to be a shift towards smaller, essential purchases, with discretionary spending being more cautious.

- Retailers are responding to elevated price sensitivity by reducing prices and increasing promotions.

- So far, aren’t experiencing a weaker consumer overall

- Customers continue to be discerning and choiceful, looking for value to maximize their budgets

- As it relates to value, they are lowering prices. For the quarter, both Walmart U.S. and Sam’s Club U.S. were slightly deflationary overall

- Impact of economic factors like interest rates and uncertainty on consumer spending, particularly in the home improvement sector. More cautious sales outlook is warranted for the year

- Saw engagement the last several quarters in smaller projects. What we saw this most recent quarter is further pressure in larger projects.

- Big ticket comp transactions or those over $1,000 were down 5.8%, compared to the second quarter of last year. This indicates that the decline in consumer spending is more pronounced in high-value transactions.

- Everyone’s expecting rates are going to fall. So, they are deferring those projects.

- Not seeing a lot of trade down in particular, not seeing an increase in OPP (Opening Price Point) penetration

- Pressure on AUR is a matter of lapping. This means that while there was some downward pressure earlier in the year, the pricing environment has stabilized

- Entered the second quarter with an expectation that discretionary spend would remain stable, reflecting a resilient but choiceful consumer. As the quarter progressed, our customer became more discriminating, which we attribute to ongoing macroeconomic uncertainty and an increasingly complex news cycle

- Quarter played out obviously softer than expected. It started to get softer in the middle of the quarter

- Outlook assumes a more discriminating consumer and heightened promotional environment relative to our prior expectations. We believe our range gives us room to address the ongoing uncertainty in the discretionary consumer market

- Consumers continue to focus on value as they work hard to manage their household budgets, and are delaying purchases until the moment of need.

- Encouraged to see discretionary category trends improve for the fourth consecutive quarter

- Taken a measured approach to our forward-looking guidance, and remains ready to respond if the pace of our business turns out to be stronger

- Reduced our prices on about 5,000 frequently purchased items in many markets, and we saw an acceleration in both our unit and dollar sales trends in these businesses.

- Saw a strong customer response to our value proposition, driving comparable store sales growth across our banners.

- With inflation continuing to impact household budgets, we’re seeing more consumers gravitate towards our stores, which offer brand-name merchandise at significantly lower prices compared to traditional retailers

- Ability to drive sales and profitability in the upcoming quarters, as our value-focused model continues to resonate with consumers

- Core consumer state that they feel worse off financially than they were six months ago as higher prices, softer employment levels and increased borrowing costs have negatively impacted low-income consumer sentiment.

- Inflation has continued to negatively impact these households with more than 60% claiming they have had to sacrifice on purchasing basic necessities due to the higher cost of those items, in addition to paying more for expenses such as rent, utilities, and healthcare.

- More of our customers report that they are now resorting to using credit cards for basic household needs and approximately 30% have at least one credit card that has reached its limit.

- Increasing our investment in markdown activity in an effort to support our customers, further drive customer traffic, and improve sales

- Growth was partially offset by declines in our seasonal home and apparel categories

- The three softest comp sales weeks of the quarter were the last week of each of the calendar months. This pattern suggests that our customers are less able to stretch their budgets through the end of the month

FedEx said a weaker industrial economy produced a “challenging” quarter that caused it to trim its outlook for later this year

FedEx, which is often viewed as a bellwether for the economy, reported profits of $892 million, about 24% lower than analysts anticipated for its fiscal first quarter ended Aug. 31. The company also lowered its financial outlook for the fiscal year ahead, projecting earnings per share between $20 and $21 versus its prior range of $20 to $22.

- Results reflect a challenging Q1 demand environment which was weaker than we expected, particularly in the U.S. domestic package market.

- Weakness in the industrial economy pressured our B2B volumes, particularly in the U.S

- Increasing demand for our lower-yielding services and some of this demand increase was driven by a shift in customer preference worldwide from priority to deferred services. The increased demand for lower-yield services hints at cost-cutting measures by businesses and consumers, reflecting broader macroeconomic caution.

- E-commerce continued its reset, showing slight growth in the U.S. as retail sales from online channels climbed.

https://seekingalpha.com/article/4722205-fedex-corporation-fdx-q1-2025-earnings-call-transcript

Hmm slightly more e-commerce is a positive for the likes of Meta. It would be interesting to get a base chart how e-ecommerce developed over time in the U.S in a seperate topic, once you have a lot of time.

In general it would always be great to get quantifications of statements (if available) so it is easier to make sense of them. For example how did the U.S domestic package market and B2B volumes developed y/y? Is it down very little or was there a significant slump

Sure, will add a task about it.

While it would be ideal to find data to support earnings insights, these insights usually have the advantage is that it can give early indications about changes or continuations in trends that official data is not reflecting yet.

It could also happen that there is no data available or that it is not up to date.

Since I have been distrusting government data a lot lately, I think we will need to have a better overview of what companies are actually saying about the economy even if qualifications are difficult.

I assumed that a company like fedex would give us this kind of data themselves either in a quarterly shareholder letter, presentation, 10-q or at least on an annual basis. Aren’t they doing it? (Referring to US domestic package market & their b2b volumes etc.)

Oh sorry, I thought you meant economy-wide numbers.

This is what they report, they report US domestic volumes, but not b2b volumes.

Volumes are essentially flat in the US. They most likely expected some growth already.

Procter & Gamble missed revenue estimates in Q3 and cut its FY outlook.

- EPS: $1.54 vs. $1.52 est

- Revenue: $19.78B vs. $20.15B est

- FY revenue outlook: Flat YoY (+2% to +4% prior)

- FY EPS outlook: +6% to +8% (+10% to +12% prior)

Uncertainty around tariffs, the political environment and other factors resulted in “a more nervous consumer” pulling back in the last two months of the quarter, CFO Andre Schulten said on the company’s call with the media.

“It’s not illogical to see the consumer adopt the ‘wait and see’ attitude, and we saw traffic down at retailers,” Schulten said. “We saw consumers basically looking for value, migrating into online, bigger box retail, into club [retailers].”