CPI January 2025 Assessment

This is definitely not a good print, but my current thinking (it could change as more data comes out) is that the numbers for January are not as bad as reported, but it does warrant more concerns about a reacceleration:

- It seems residual post-COVID seasonal adjustment issues are distorting early-year data (same as there were after 2009, despite annual updates. Similar inflation scares happened in early 2023 and 2024, which were eventually temporary as the year progressed.

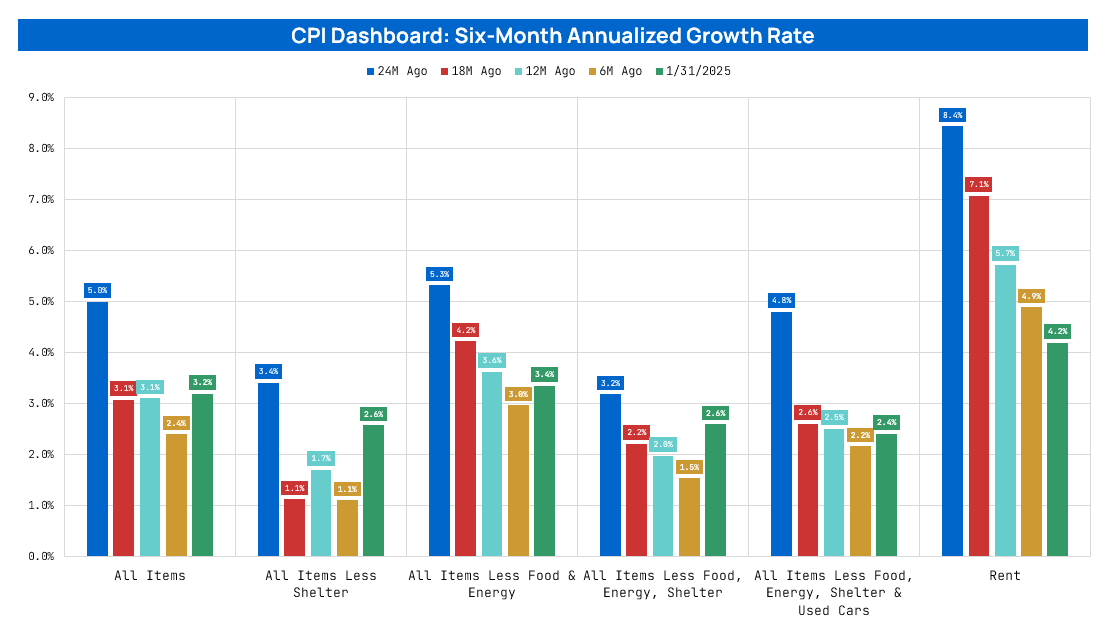

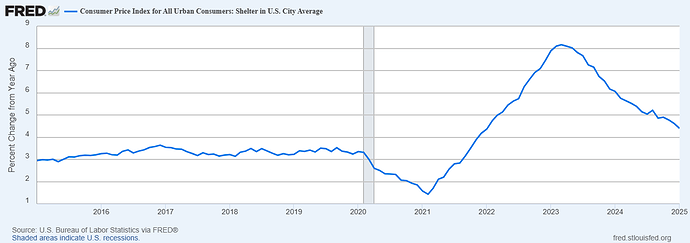

- Shelter made up 30% of headline and 46% of core CPI, however, shelter is poorly measured with a significant lag. Alternative real-time rent data suggests inflation would be much lower with a better methodology. So, is expected shelter to continue disinflating, is just very slow to do so.

- Egg prices are rising due to bird flu, but this should be temporary as the issue resolves eventually.

However, I still think the risks are more tilted to the upside, and these numbers if they continue could become a much bigger problem.

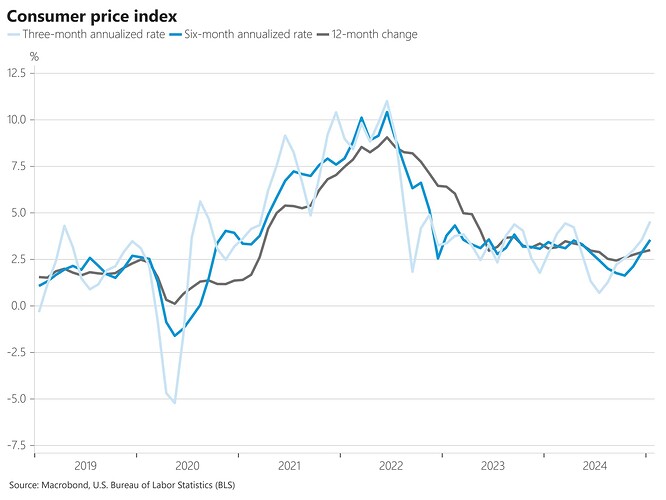

- Headline and core inflation are rising over 3-month, 6-month, and yearly trends, though without a clear trend acceleration.

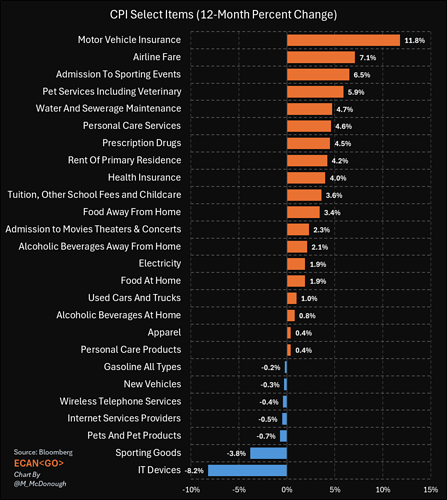

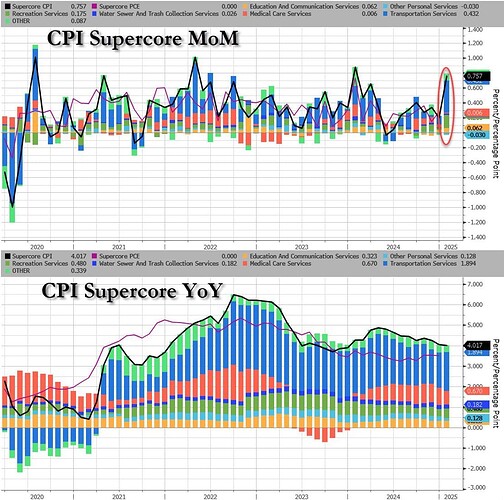

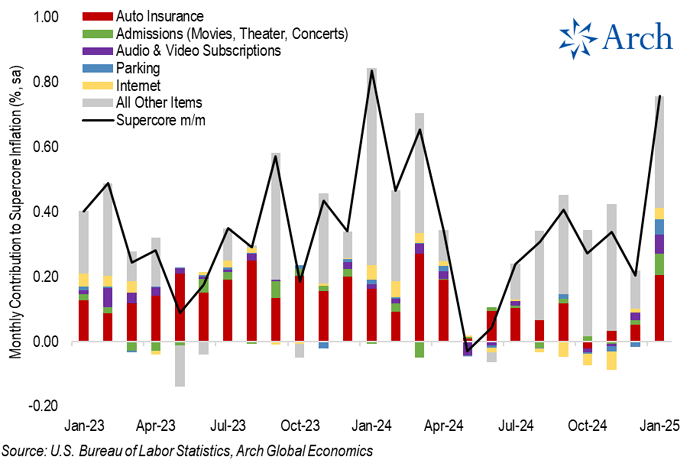

- Super core CPI remains hot despite seasonal distortions. Transportation (vehicle insurance at 12% y/y) inflation appears beyond the Fed’s control currently.

- Wages are holding at ~4% y/y.

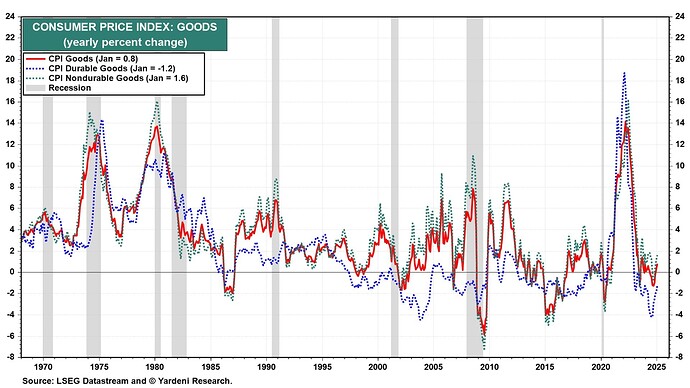

- Core goods are no longer deflating (which helped a lot with disinflation trends) and are beginning to rise again to their normal inflation levels.

- Market-implied inflation expectations are climbing to the highest levels since March 2023, contrary to the Fed’s stance that they remain anchored.

- Some tariffs increasing are inevitable with Trump

All combined, I think today’s data makes rate cuts in the short term very unlikely to happen, though the odds of a hike also remain low IMO.

Higher for longer could in turn create highter likelyhood that credit and treasuries issues in the economy.

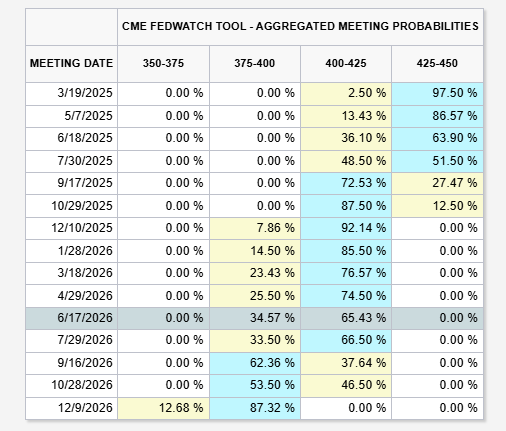

Markets now expect the first 2025 rate cut in September, followed by another only after a year later.

Some details:

All important trends going up (or at least bottoming) for both core and headline inflation

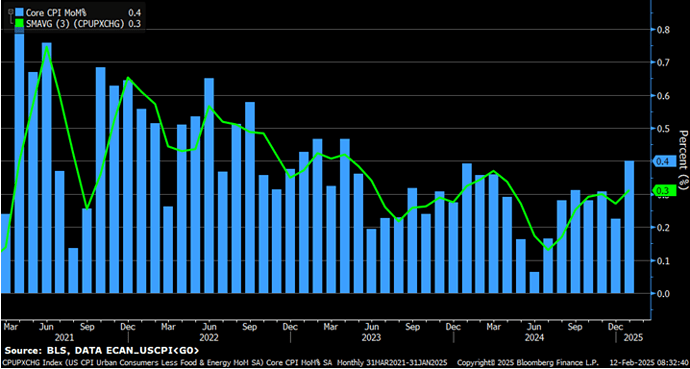

- Core y/y rounded up to 3.3% (3.258% in Jan vs 3.238% in December)

- Core 6m annualized rate ticked up to 3.7% from 3.2%, and the 3m annualized rate was 3.8% (vs 3.1%)

- Headline rate up to 2.99% (vs 2.87% in Dec). The 6M annualized rate was 3.6% (vs. 2.9% in Dec) and the three-month annualized rate was 4.5% (up from 3.5%).

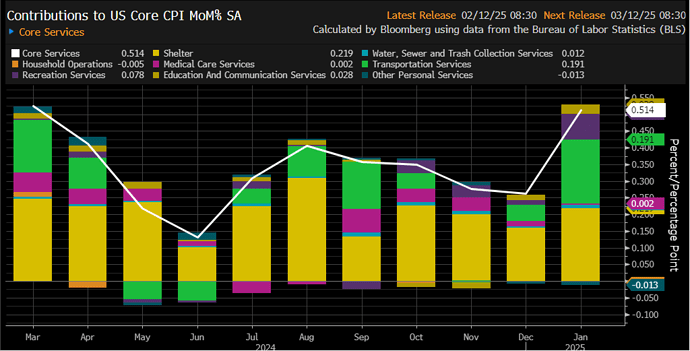

Rise in core CPI was the largest since April 2023, with shelter and transportation having the biggest contribution

Shelter still slowly going down y/y to 4.4% from 4.6% in December 2024.

- Despite lodging away from from increasing 1.4% m/m (2.2% y/y) and contributing to a hotter increase, it still only has a small contribution to CPI (1.3%)

- Rent primary residence and Owners’ equivalent rent are still the biggest issues inside shelter (0.3% m/m, over 4% y/y) due to its poor measure

Super core is the highest since last January, transportation, and recreation are the biggest contributors

Still unclear if there could be some seasonal issues the same as last January

- Vehicle insurance is still the biggest problem in transportation (2% m/m, 12% y/y) with a 20% contribution to January super core.

- Most recreating services went up during the month, with contributions higher than normal

Core good has stopped deflating, and is slowly going back up

Goods were a significant source of disinflation, without this positive contribution and stickiness in services inflation it will become more difficult to see additional progress in inflation