Assetment CPI Report December 2024

Similar to labor market report, this CPI release doesn’t necessarily changes the broader trends on inflation, it seems that it remains sticky, with upside risks still present

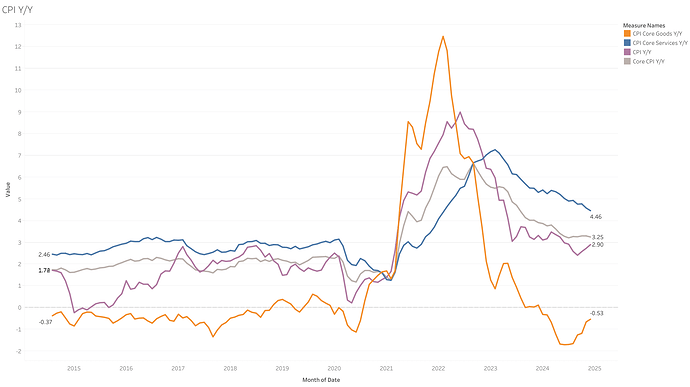

- Core CPI declined only slightly by 0.05% to 3.25% year-over-year (0.23% m/m vs. 0.26% expected). It continues to be elevated and above the Federal Reserve’s target, without much improvement in all 2024 (Dec 2023 Core CPI: 3.91%).

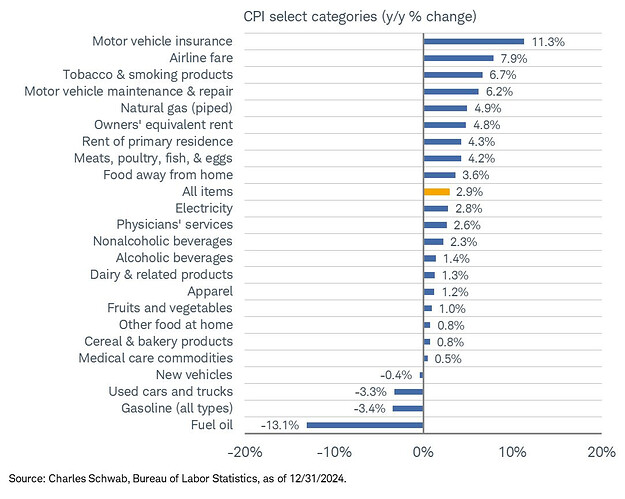

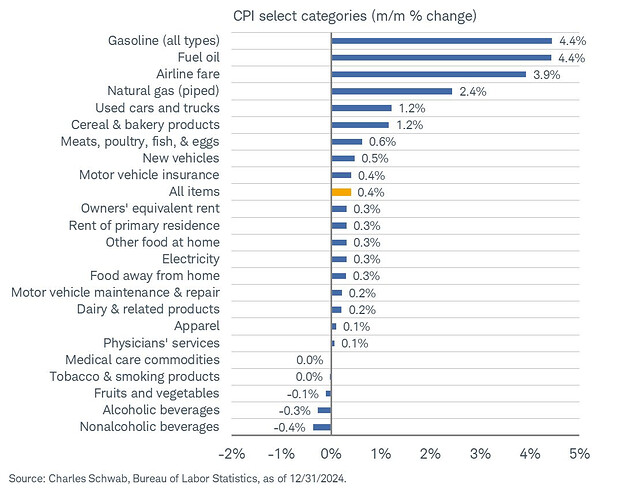

- Headline CPI reached its highest level since July, driven by a resurgence in energy and food prices.

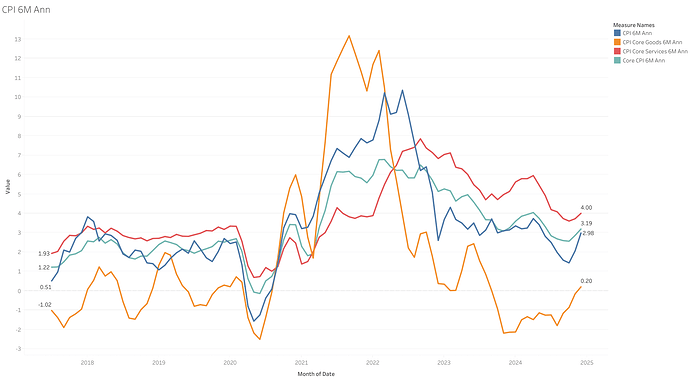

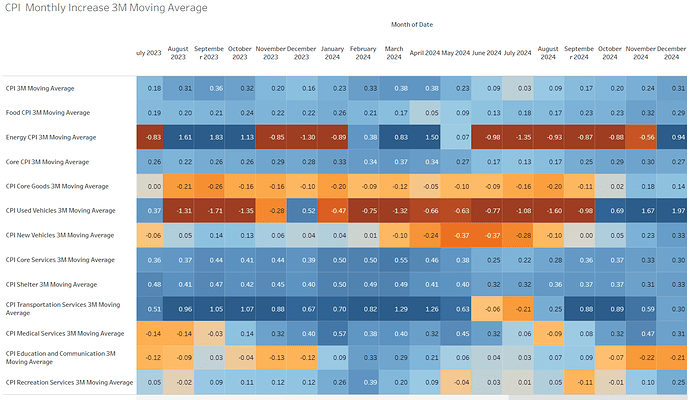

- Notably, many key components are currently above the 0.3% monthly increase on a 3-month moving average basis.

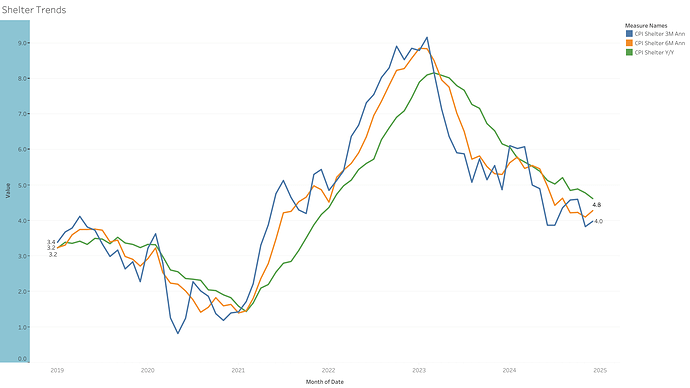

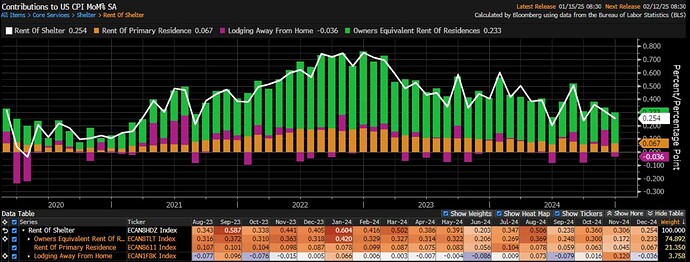

- A positive takeaway is that the shelter component remains on a gradual downtrend, however at a very slow pace. Additionally, super-core inflation registered its softest reading since July.

I think this report is just a relief to the markets, which could have expected even worse-than-forecasts numbers

In my view, this is an encouraging development, but it’s not enough for me to dismiss inflation concerns entirely. Consistent progress across multiple reports is needed to confidently conclude that inflation risks are very low, especially with potential headwinds with the coming administration.

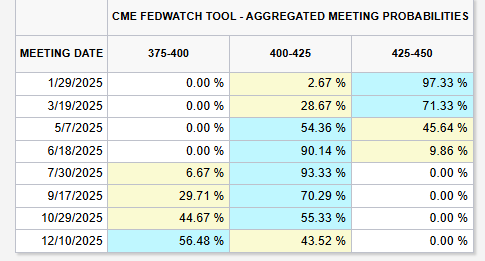

After the CPI reports market are currently slightly pricing two rate cuts for 2025 again, with the first one in May. And 10-year yields declined to 4.66%

Core CPI sticky in the 3.2-3.3% range since June 2024. Headline highest since July

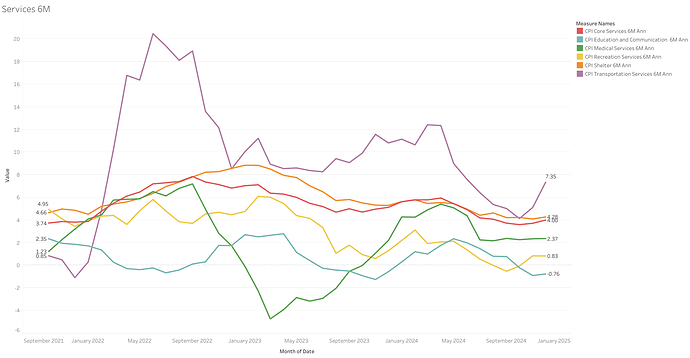

The 3m moving average monthly reading has increased for most key components since the very low readings of June/July

Shelter CPI monthly increase slowed to 0.26% m/m, but it has been volatile in recent months, so still uncertain this is a sustained softening.

- However, December improvement came from hotels, not rents related CPI. They increased from 0.2% m/m in November to 0.3% in December

Energy had a significant contribution in December CPI after having a very modest contribution most of 2024

- Energy accounted for over forty percent of the monthly CPI increase

- Gas online prices added 14bps in Dec vs just under 2bps in Nov.

- Food has also increased its contribution lately

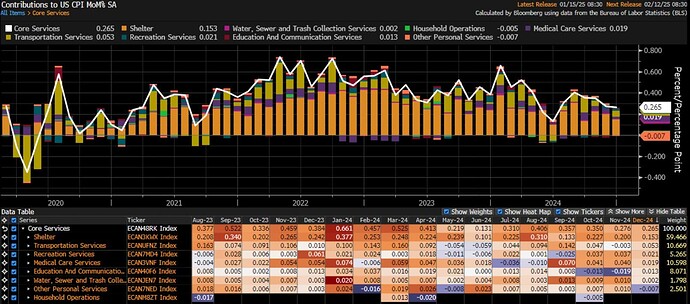

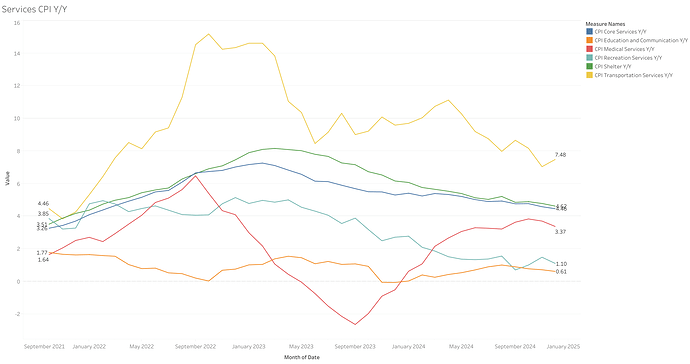

Core Services remained mostly unchanged at 0.26 m/m vs 0.27% in November. Y/Y continues to improve along with shelter CPI

- Other than shelter, transportation continues to be elevated at 7.5% y/y (0.5 m/m).

Sources:

Tableau

Google Sheets