December 2024 CPI Expectations

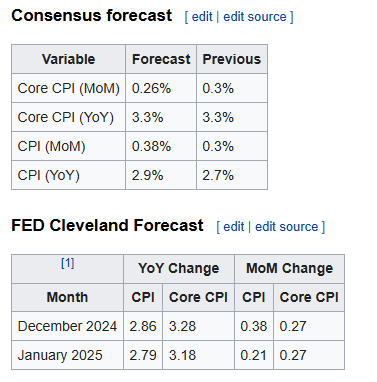

Tomorrow’s CPI is expected to come in on the hotter side, with a projected increase of approximately 0.4% for the headline figure and 0.3% for core CPI.

There is much improvement expected on both metrics on demcember, but January CPI expected to improve a bit.

The risks to the upside remain similar to those outlined in the November 2024 report and continue to outweigh downside risks:

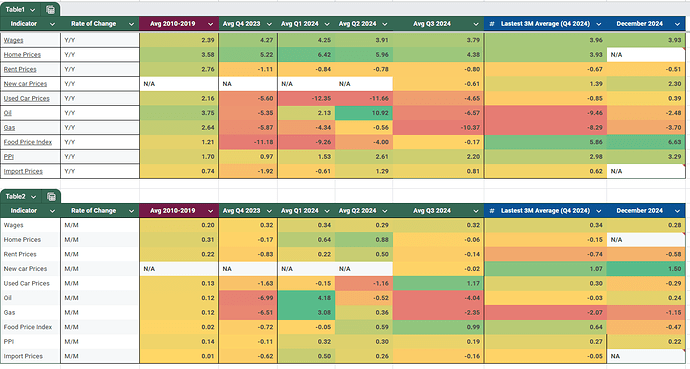

- New car prices surged significantly in the latter part of 2024 and are now approaching their previous peak once again. Used car prices have also shown upward pressure. Both sectors played a key role in goods disinflation until now.

- Food prices, despite a decline in December, have risen sharply year-over-year

- Oil prices, particularly in January, have resumed an increase in prices

- Wage growth remains persistently around the 4% level. Policies on immigration could make this a bigger problem.

- Potential rising tariffs could impact producer price inflation (PPI) and import costs, both of which have already been trending higher recently.

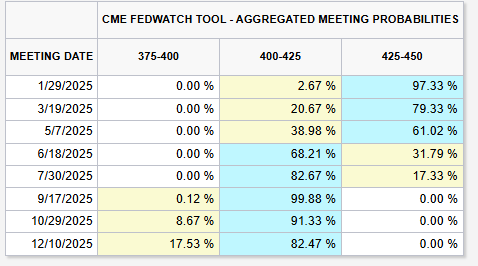

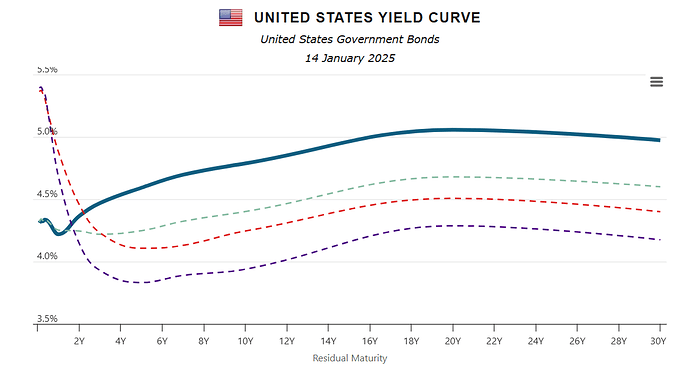

The market is currently pricing only 1 rate cut in 2025, and 10 year yields close to the 5% level, despite today’s PPI coming in cooler than expected.