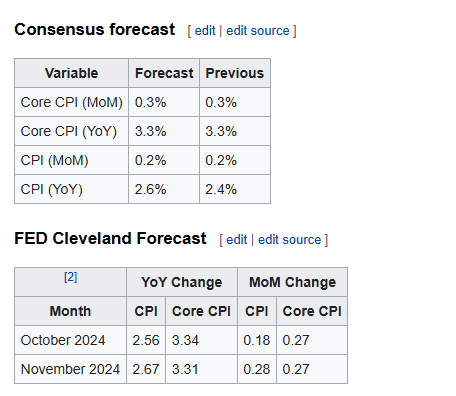

The October 2024 CPI expectations indicate minimal progress in inflation compared to September.

According to projections from the Cleveland Federal Reserve, this stickiness is expected to persist into November as well.

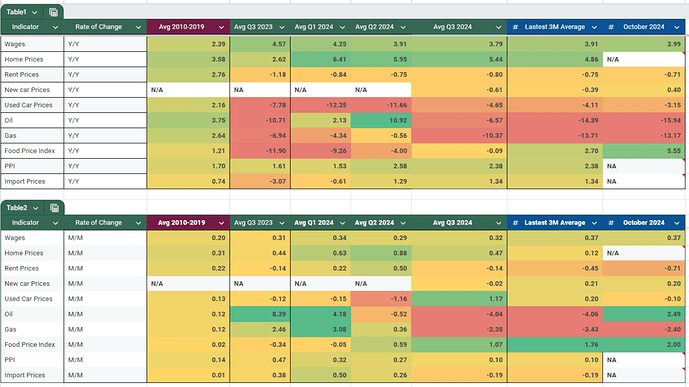

In my view, the potential for significant upside risk in this report remains limited. Wage growth remains persistently sticky, and rising food prices are the only notable factors posing an immediate risk.

- Wages remain persistently sticky at around 4%, despite noticeable current weakness in job openings and hiring activity.

- Food prices have risen sharply over the past two months, now standing at over 5% year-over-year.

- Home prices have shown a more moderate increase recently, while rent prices remain negative year-over-year. This trend suggests we may continue to see further moderation in the shelter CPI going forward.

- New and used car prices have stabilized in recent months, though they continue to exhibit a downward trend.

- Although oil prices saw a slight increase in October, it remains significantly negative year-over-year, same as gasoline prices

- PPI, import prices, and supply chains remain stable, which could support continued low inflation in goods CPI. However, it’s worth noting that potential policy changes under Trump could shift this dynamic in the near future.