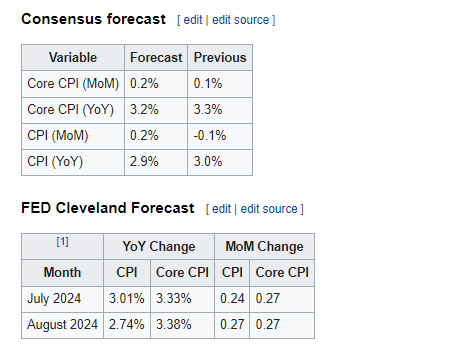

July 2024 CPI Expectations

Another soft report is expected for July 2024, above June numbers on a m/m basis, but the Y/Y trend is expected to continue to decline.

Given the current economic slowdown, it’s likely that inflationary pressures will continue to ease in the coming months. Unless there are any new disruptions to the supply chain or energy markets.

Most subcategories also had a soft July, except for used cars and housing prices.

- Wage growth had a soft report in July reaching 3.6%, getting to levels close to pre-pandemic.

- Gasoline had another decline of -3.15% m/m, while oil had an increase of 7.5% m/m. Gasoline has a higher weight in CPI.

- Food index declined -0.2% m/m in July

- Supply chain index remains stable. However, shipping rates remain elevated due to Middle East conflicts.

- Housing prices increased 0.9% m/m during July, and remain ~6% Y/Y

- Rents increased by 0.2% m/m, down 0.8% y/y.

- Used car prices increased 2.8% m/m in July (-4.8% Y/Y), while new car average transaction prices remained mostly unchanged during the month and -0.2 Y/Y (final numbers not available yet).

- Import prices remained unchanged during June and 1.58% Y/Y.

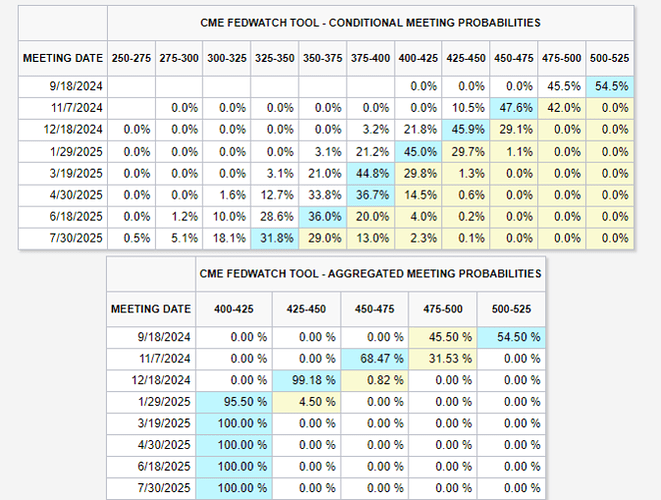

The market is currently pricing 100 bps of cuts in 2024.

For September, the market remains undecided between a 25 basis point cut or a 50 basis point cut, with 25bps having a slight higher probability.