Yes, it makes sense, Russell companies are the ones with more debt and with a large percentage unprofitable (~40%)

I also heard there is a lot of short covering on the Rusell today that helped with the big move.

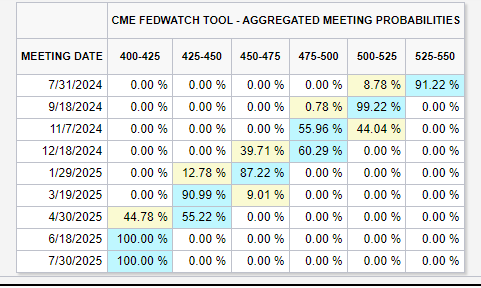

The probability of a rate cut in September jumped to almost 100%, and now expecting the other 1 in November (not sure the FED would cut close to the election, thought)

However, I still don’t know what 25bps cuts are going to do to help the economy that seems to be cooling faster or these companies, but I still think based on recent data they should start soon if they don’t want to be extremely late or make a mistake.

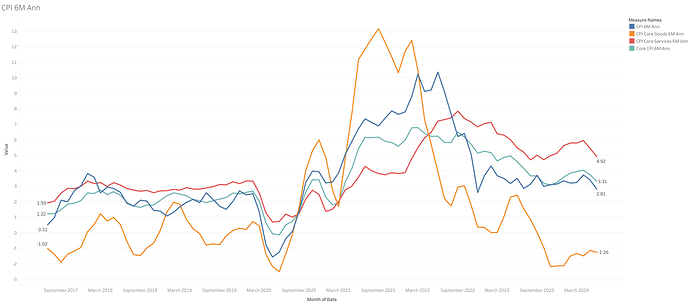

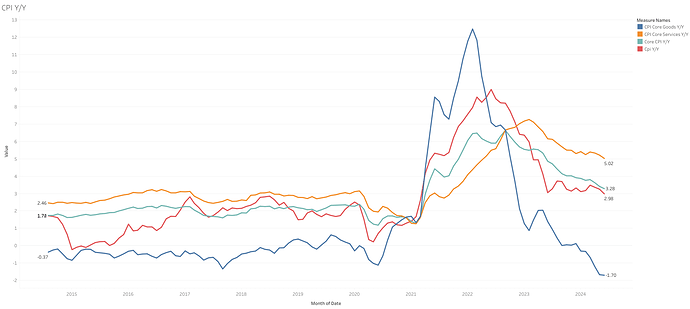

Rapid falling inflation could also be a signal of a cooling economy.

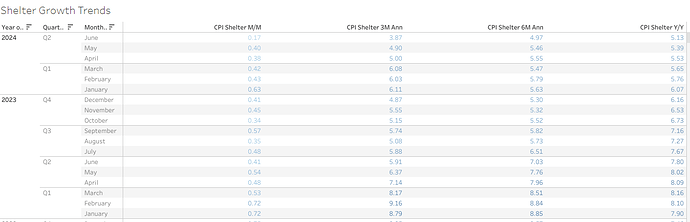

Shelter is not down, it still increased by 0.2%, but the rate of increase has cooled, from 0.5% monthly increase on average in Q1 2024 to 0.31% in Q2 2024.

All growth trends got better during the quarter too.

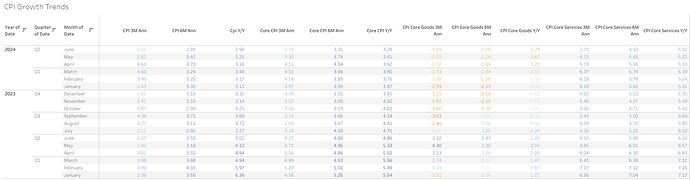

All components rate of increased cooled in Q2 2024, except for goods, but they are still deflating.

- CPI monthly average rate of increase was 0.09 in Q2 2024 vs 0.38 in Q1.

- Core CPI monthly average rate of increase was 0.17 in Q2 2024 vs 0.37 in Q1.

- Core Goods CPI monthly average rate of increase was -0.09 in Q2 2024 vs -0.12 in Q1.

- Core Services CPI monthly average rate of increase was 0.25 in Q2 2024 vs 0.55 in Q1.

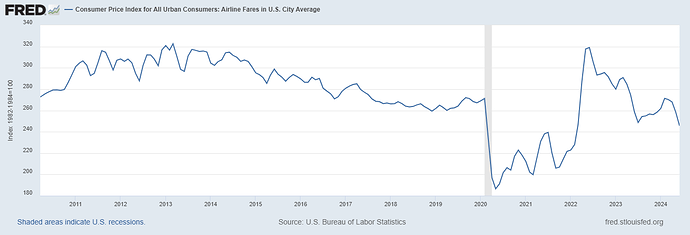

Transportation has been one of the big contributors to supercore negative readings, this mostly due to airline fares falling.

Vehicle insurance had a 0.9% m/m increase again.