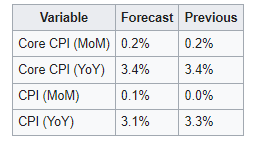

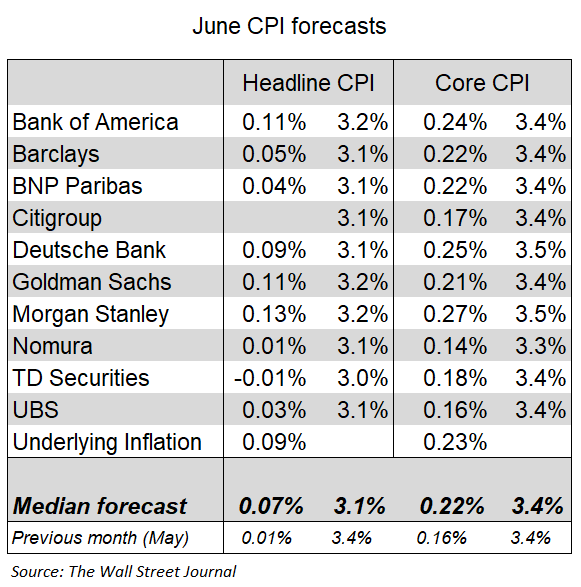

June CPI expectations

Another soft increase expected for June, the softer headline reading is again due to the decline in gasoline prices during the month.

Some insights during the month, most of them lower readings than in May:

- Wages were on line with estimates in June, with a 0.3 m/m increase (vs 04% in May), in line with the average increase of the past few quarters.

- Gasoline had a decline of -4.12% m/m (vs -0.23 in May), while oil had an increase of 3.2% m/m (-6.12% in May). However, gasoline has a higher weight in CPI (3.6 vs 0.08)

- Food index was unchanged during the month (vs 0.9% in May)

- Supply chain index remains stable.

- Housing prices increased 1.17% m/m during April (1.30% in March), reaching 6.29% Y/Y. Rents in june increased by 0.4% m/m (vs 0.5% in May), down 0.7% y/y.

- Used car prices continued to decline in June being down -0.6% m/m equal to May, while new car average transaction prices increased ~0.5% m/m (unchanged in May).

- Import prices had a decline of 0.6% m/m in June 2024, and are still slightly up now 1% y/y

- Producer price index fell 0.2% in May versus growth of 0.5% in April and against expectations for a 0.1% increase

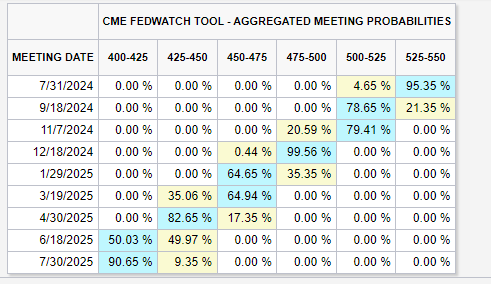

The market is still expecting with higher confidence 2 rate cuts in 2024, despite the FED projections for only 1 cut.